- Home

- »

- Homecare & Decor

- »

-

Playroom Furniture Market Size & Share, Industry Report, 2019-2025GVR Report cover

![Playroom Furniture Market Size, Share & Trends Report]()

Playroom Furniture Market Size, Share & Trends Analysis Report By Raw Material (Wood, Polymer), By Product (Chair, Cabinets), By Application, By Distribution Channel, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-401-7

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Consumer Goods

Industry Insights

The global playroom furniture market size was valued at USD 3.0 billion in 2018. Growing focus on holistic child development has been acting as a catalyst to the market growth. Increasing requirement for a comfortable and dedicated place for kids to have fun without interfering with the rest of the house, along with learning, has grabbed parents, teaches, and caretakers’ attention.

The need for a properly planned playroom has been concretized with growing awareness about the role-playing in the growth of children. It helps in improving the intellectual, physical, and emotional health of the kids. Additionally, toys can create clutter in the rest of the house if kids do not have dedicated space and organizers for keeping and playing with it.

Most playrooms are designed to include furniture, which is brightly painted to entice the interest of the kids. Playroom furniture is designed to fit in a particular pattern, which should keep the kid interested. Bright colors such as red, green, blue, pink, and violet seem to be preferred more over light pastel colors. A trend for designing this furniture according to a certain theme can also be observed in some of the houses.

For instance, the room, along with fixtures, is often designed to look like a railway compartment or a car. This helps in making the kids interested in spending time in that room. Shifting trend towards decorating the room, along with its equipment in the theme of superheroes, has been gaining acceptance among the children.

Over the past few years, the furniture manufacturers have been modifying the designs to make sure that kids find themselves inseparable from these. It has been observed that the prime objective driving the manufacturers towards the evolution of the products is safety. Manufacturers are designing these products so that they not only impress the children but are also considered safer to use. Furthermore, these products are unbreakable and lightweight so that the kids are not hurt.

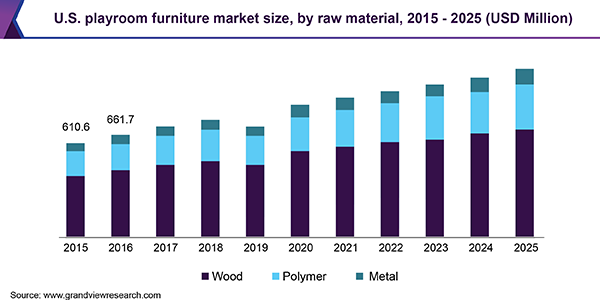

Raw Material Insights

The wood segment contributed more than 55.0% share in the global revenue in 2018. This growth is attributed to the excellent strength and durability characteristics of some varieties of wood including oak, maple, cherry, pine, and cedar. Along with strength and durability, these types of products have the absence or less content of toxic agents. Furthermore, these products are painted in vibrant colors to hold kid’s interest.

The polymer segment is expected to register the fastest CAGR of 5.8% from 2019 to 2025. Polymers are comparatively cheaper than both woods as well as metal. Their lightweight feature offers safety to kids. Additionally, these products are unbreakable and thus are suitable for rough and tough fun games. Most of these products come in the preposition of separate pieces and can be reassembled with little effort, which makes it highly suitable while shifting or storing things in a smaller place. Additionally, the furniture comes with a very long life as their quality is not affected by the changing climate and weather conditions.

Product Insights

Chairs contributed more than 30.0% share of the global revenue in 2018. Sitting units in general dominated the number in a playroom. These products are developed from materials including polymer, wood, and metal, which are present in much larger numbers as per their counterparts in pre-nurseries and child daycare centers. Kids prefer sitting on these products rather than on the floor. Many times, according to the weather conditions, these can be stuffed with fabric, cotton, and foam for long comfortable sitting hours.

Cabinets are expected to register the fastest CAGR of 5.8% from 2019 to 2025. These products come in myriads of other forms such as drawers, organizers, storage, and display units. Cabinets have become a must to sort the huge clutter of toys in the playroom. A trend of including display units that are higher above the kid’s reach has also been noticed, which include toys that visually appeal the kid but are fragile for them to play with.

Application Insights

The residential segment contributed a share of more than 60.0% in 2018. The application of playroom furniture is increasing in residences owing to rising awareness among parents regarding understanding the kid’s needs. The millennials have been continuously addressing the need of their kids for spaces that are dedicated to playing. Further, urban residential places are mostly too cluttered to have a playground. Therefore, an equipped playroom has been preferred owing to the kid’s safety inside the house in comparison to the external environment.

The commercial segment is expected to expand at the fastest CAGR of 5.5% from 2019 to 2025. In the majority of the developing economies including India, China, and Brazil, it has been observed that the parents are employed and they spend most hours of the day away from their kids. In such situations, the kids are admitted to kindergartens, pre-nursery, and daycare canters at a very early age. These places are themed and designed differently according to a different group of kids and their interests.

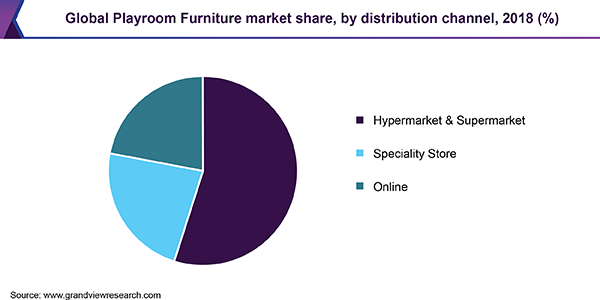

Distribution Channel Insights

Hypermarket and supermarket accounted for the largest share of exceeding 50.0% in 2018 as people in developing countries including China, India, and Bangladesh largely rely upon shopping for these physically. Furthermore, people enjoy shopping in physical stores for instant verification, availability, ease of comparison, and huge reliance. In addition, the majority of daycare centers, kindergartens, and pre-nurseries prefer signing contracts so that a customized set of furniture is made available as per the requirements.

Online sales are expected to witness the fastest growth as a result of increasing penetration of smartphone users at a global level who prefer e-commerce portals for any purchases. These channels also provide value-added services including cash-on-delivery, discounted prices, and cash-back. Additionally, manufacturers including IKEA have developed their in-house e-commerce platforms in order to extend the playroom furniture market hold through offering products in discounted prices and aftersales support.

Regional Insights

North America was the largest market, accounting for 30.8% share of the global revenue in 2018. The increased importance of daycare services in corporate offices of the U.S. and Canada as a result of the increment in the number of the female workforce at a domestic level is expected to promote the utility of playroom furniture among kids over the next few years. Additionally, the rising popularity of lightweight materials in the furniture industry of the U.S. as a result of shifting consumer inclination towards comfort is expected to open new avenues for the key industry participants.

Asia Pacific is expected to be the fastest-growing market, expanding at a CAGR of 6.0% from 2019 to 2025. Manufacturers from India, Japan, and China have been making efficient products with the least expense. Unavailability of playgrounds in these countries owing to a large population has generated a need for the playroom in every house. Moreover, the trend of kids getting admitted to pre-nursery, kindergarten, and daycare in emerging economies including China and India as a result of expansion in middle-class income groups has increased the demand for these in the cities.

Playroom Furniture Market Share Insights

Some of the key players are American Signature, Ashley Furniture Industries, Berkshire Hathaway Furniture, Herman Miller, HNI, IKEA, Kids Furniture World, Kids Zone Furniture, Rooms To Go, Steelcase, TJX, and Williams-Sonoma. The market is driven by continuous product renovations and the inclusion of features that make the product suitable and interesting for kids of different age groups. A class of urban population has been keen on products, which are strong, handy, and luxurious to keep in the playrooms.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Million & CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S., Germany, U.K., China, India, Brazil, and UAE

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global playroom furniture market report on the basis of raw material, product, application, distribution channel, and region:

-

Raw Material Outlook (Revenue, USD Million, 2015 - 2025)

-

Wood

-

Polymer

-

Metal

-

-

Product Outlook (Revenue, USD Million, 2015 - 2025)

-

Table

-

Chair

-

Cabinets

-

Others

-

-

Application Outlook (Revenue, USD Million, 2015 - 2025)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Specialty Store

-

Hypermarket & Supermarket

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

India

-

China

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."