- Home

- »

- Plastics, Polymers & Resins

- »

-

Point of Purchase Packaging Market Size, Share, Industry Report, 2025GVR Report cover

![Point Of Purchase Packaging Market Size, Share & Trends Report]()

Point Of Purchase Packaging Market Size, Share & Trends Analysis Report By Product (Pallet Display, Floor Display, Counter Display), By Material, By End Use, By Application, By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-158-0

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Bulk Chemicals

Industry Insights

The global point of purchase packaging market size was estimated at USD 11.0 billion in 2018 and is projected to witness a CAGR of 5.6% during the forecast period. This is attributed to the growing organized retail market in emerging economies and the rising need for cost-effective marketing tools.

The presence of multiple marketing channels such as television, digital, and newspaper advertisement as well as billboards are available. However, advertising does not convert a potential customer into a buyer instantly. In the retail market, nearly 70% of the buying decisions are made in the store. This indicates that the store environment majorly affects the buying process. As a result, brand and store owners focus extensively on the product display.

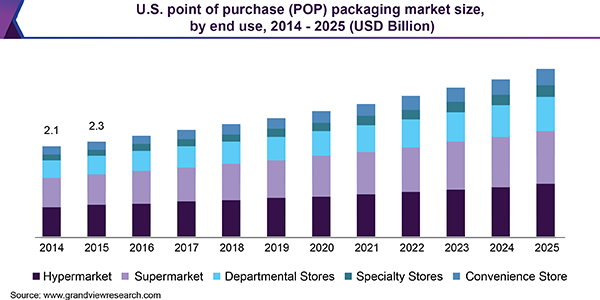

The U.S. market for point of purchase packaging is propelled by the presence of a large number of retail stores. Over 31% of the top 250 retail stores are present in the U.S. which contributes to an estimated 46% of retail sales. The U.S. market for point of purchase packaging witnessed an increase to over USD 2.50 billion in 2018 and is expected to exhibit a CAGR of nearly 6% during the forecast period.

The point of purchase packaging solutions offers specific and customized target marketing. Marketing messages can be modified according to the store or region and according to customer preferences. Moreover, assessment of the effectiveness of point of purchase packaging regarding the store, region, and consumer segment is easier when compared to the assessment of the effectiveness of TV and other advertisement strategies.

Point of purchase packaging units are effective channels and are being increasingly adopted owing to properties such as reusability coupled with a growing emphasis on optimization in marketing on account of growing competition. Moreover, the use of recyclable material to produce these packaging solutions target the consumers who are inclined towards the use of environment-friendly products, thus, boosting the product demand in turn.

The point of purchase packaging demand is expected to experience friction owing to the growing e-commerce industry, which is expected to grow on account of technological advancement and higher consumer adoption rates. Traditional hypermarket giants such as Walmart, D-mart, and Tesco have also started e-commerce services on account of growing acceptance of these channels, which is expected to affect product demand.

End-use Insights

Small companies or small convenience store owners adopt the point of purchase packaging solutions as the cost of these products is much lower when compared with traditional advertising modes. Besides, the point of purchase packaging solutions delivers marketing messages accurately with the product presented in an attached point of purchase packaging. Point of purchase packaging also helps retail owners in clearing old product inventory as these displays receive continuous attention from customers owing to their unique designs.

Hypermarkets frequently experience high consumer footfall owing to their large size and variety of products offered. This creates market opportunities for brand managers to deliver a marketing message. The point of purchase packaging solutions is the chief tool for sending marketing communications. On account of their unique and bright designs, these displays catch customer attention, thus, playing a crucial part in the purchase decision process.

The convenience stores' end-user segment is expected to expand at the highest CAGR in the future years owing to the increasing preference of customers for convenience stores to supermarkets for regular purchases. Tesco, a hypermarket chain in the U.K. has been establishing 150 convenience stores in different locations in Europe per year owing to rising consumer footfall at these stores.

Product Insights

Pallet display and floor display are widely used product segment in the point of the purchase packaging market. In 2018, pallet display was the prominent product segment, with a market share of over 28.0% in terms of revenue. It is normally available with interior support structures to fill the inner part of large pallet for better product positioning. A range of products can be assembled in a pallet display using various methods such as chimney and alternating stacking.

In the pursuit of larger profit margins and slashed stocking labor, pallet displays have emerged as a widespread packing solution over the past few years. Growing adoption of pallet displays at point of sale globally can be credited to the rising popularity of pallet skirts that form a crucial part of the pallet. A key driving factor increasing the demand for floor displays is the scope of advertising and printing in these displays owing to the availability of a large surface area.

Counter displays can be produced using numerous materials such as cardboard, metal, and Plexiglas. These displays can take the form of acrylic displays, candy racks, glass display cases, hat displays, multi-purpose merchandisers, basket displays, counter easels, paper racks, and greeting card displays.

Material Insights

Paper was the leading material segment in the market in 2018. The material provides retailers with the option of presenting products economically. The paper segment is driven by increased consumption of materials made from paper such as paperboard in retail stores, globally. The paper material segment is expected to witness the fourth-highest CAGR from 2019 to 2025.

Paperboard is an extremely versatile raw material that can be customized according to the requirements of various retail displays. Also, the material offers better printing attributes and accommodates to the advertising requirements of brands in retail stores. Packaging foam is a part of the protective packaging category and is used for the packing/display of a product that requires shielding. These are generally used in combination with other materials to enhance the overall appeal of retail displays.

On the other hand, plastic, which can be used as single material in point of purchase packaging solutions, is likely to register the highest CAGR during the forecast period. Plastic materials are generally chosen for counter displays in a retail store owing to the availability of significant surface area for promotion/ decoration via painting and printing. Counter displays that are produced using plastic materials are made from various types of plastics, including acrylic, polycarbonate, high impact polystyrene (PS), and expanded PVC.

Application Insights

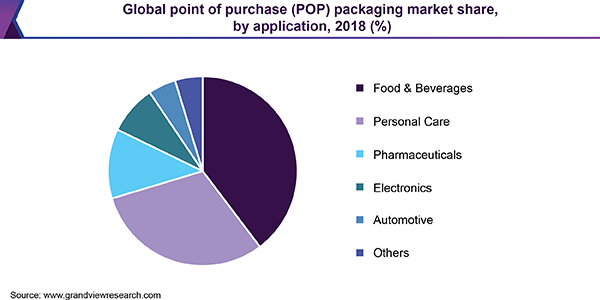

Food and beverage is the chief application segment in the market. Although brands and retailers gain from impulse buying behavior of consumers, the use of point of purchase solutions further heightens the impulsive buying practices in these stores, while shielding displayed products from damage.

In the pharmaceutical industry, a variety of products displayed in pharmacies or drugstores extends from medicines and orthopedic products to dietary care products and other health care aids. Most drug stores and pharmacies have low storage space. Therefore, point of purchase solutions in these stores offer effective floor usage in limited space available.

The point of purchase solutions for personal care products focuses more on the appeal of the entire display than that of the function of packaging. As personal care products are generally expensive, advertising and promotion play an important role in elevating the retail sales of these products. The personal care application segment is expected to exhibit the third-highest growth rate during the forecast period.

Regional Insights

The market for point of purchase packaging in Europe is driven by the shift in the demographic transition towards the geriatric population in countries such as Germany and Belgium, which is characterized by the rising number of single households. This has prompted retailers and brand owners to innovate their advertising displays across the retail space to increase the appeal of products, thereby, increasing the adoption of point of purchase displays as promotional and advertising tools.

In 2018, the U.S. government initiated a dramatic transformation in its trade policy, to cut the trade deficit. The policy is based on a review of current trade associations and the application of trade costs. The U.S. withdrew from the Trans-Pacific Partnership (TPP), levied tariffs on the imports of aluminum and steel from the European Union (EU), Mexico, and Canada, and levied a significant array of tariffs on imports from China.

Also, the U.S. finished a renegotiation of the North American Free Trade Agreement (NAFTA). Finally, the U.S. threatened to levy tariffs on all imports about the automotive industry. North America market is expected to witness the second-highest growth on account of the presence of a large number of retail stores and increasing investments in the retail industry.

Point of Purchase Packaging Market Share Insights

The market is consolidated and is characterized by the presence of both domestic and international players. The market participants compete principally based on product differentiation and services offered.

Key industry participants include International Paper, Menasha Packaging Company, LLC; Smurfit Kappa Display; DS Smith; Sonoco Products Company; Georgia-Pacific LLC; WestRock Company; Felbro, Inc.; and FFR Merchandising. These players dominate the market by offering innovative packaging solutions coupled with rapid expansion on a global scale.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Million & CAGR from 2019 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Region Scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, U.K., France, China, India, Japan, Brazil, Saudi Arabia

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country-level and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global point of purchase packaging market report based on the product, material, end-use, application, and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Counter display

-

Floor display

-

Gravity free display

-

Pallet display

-

Sidekick display

-

Dump bin displays

-

Clip Strip Displays

-

-

Material Outlook (Revenue, USD Million, 2014 - 2025)

-

Paper

-

Foam

-

Plastic

-

Glass

-

Metal

-

-

End-use Outlook (Revenue, USD Million, 2014 - 2025)

-

Hypermarket

-

Supermarket

-

Departmental stores

-

Specialty stores

-

Convenience Store

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Food & Beverages

-

Personal care

-

Pharmaceuticals

-

Electronics

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."