- Home

- »

- Advanced Interior Materials

- »

-

Polyester Hot Melt Adhesives Market Size Report, 2020-2027GVR Report cover

![Polyester Hot Melt Adhesives Market Size, Share & Trends Report]()

Polyester Hot Melt Adhesives Market Size, Share & Trends Analysis Report By Application (Packaging, Textiles & Fabrics, Automotive, Electrical & Electronics), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: 978-1-68038-605-9

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Advanced Materials

Report Overview

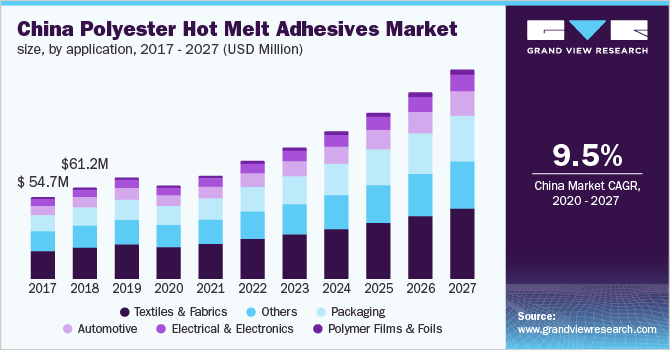

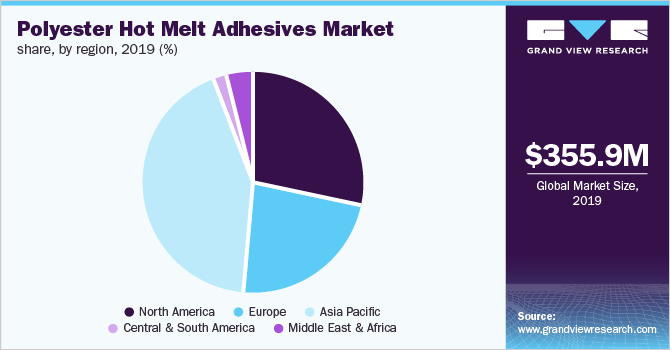

The global polyester hot melt adhesives market size was valued at USD 355.9 million in 2019. It is expected to expand at a compound annual growth rate (CAGR) of 8.7%, in terms of revenue, from 2020 to 2027. Growing demand from the packaging industry is projected to drive market growth. The packaging application segment is projected to remain the fastest-growing segment over the forecast period. Need to support flexible packaging demand in the food and beverage sector and increasing demand from online businesses such as e-commerce, and food deliveries are projected to contribute to the demand for polyester hot melt adhesives. Advancements in packaging materials and technologies have been boosting the demand for corrugated packaging for food and beverages.

The increased usage of corrugated packaging in non-durable products is mainly due to their cost-effective and environment-friendly properties. Medicine, food, consumer durables, rubber, and petroleum are the predominant end users of corrugated packaging materials. The textile sector is projected to remain a key contributing sector in the growth of the U.S. polyester hot melt adhesive market. As per the National Council of Textile Organizations (NCTO), the revenue of the textile sector in the country increased to USD 76.8 billion in 2018 from USD 73 billion in 2017. Home furnishings, fabrics, yarns, carpets, and other non-apparel products accounted for over 60% of revenue in 2018.

The U.S. textile industry is highly dependent on imports from Asian countries such as China, Vietnam, Bangladesh, and India. These countries have witnessed a considerable amount of disruptions across the value chain during the ongoing COVID-19 pandemic.

This has resulted in manufacturers working at low production capacities and ultimately decline in exports and production during the first 3 quarters of 2020. For instance, in April 2020, The Shanghai New Union Textra Import and Export Co. reported a massive decline in new orders for textile exporters. This is likely to result in a slump of around 50% in profits in FY 2020.

Polyester Hot Melt Adhesives Market Trends

The global polyester hot melt adhesives market is projected to grow on account of rapid advancements in the packaging industry across the world over the long term. The rapid growth experienced by the market can be attributed to increasing demand from the packaging, textile, and automotive industries. The growing requirement for flexible packaging from industries like food & beverage along with the rising trend of takeaway food deliveries is projected to contribute to the demand for polyester hot melt adhesives market over the coming years.

The market growth is rising on account of increasing consumer demand for paper packaging and packaged foods & beverages. These primarily include dairy products, frozen foods such as meat and fish, bread and vegetables, ready-to-eat foods, and cake mixes. The increasing demand for these products is projected to assist in increasing production capacity, thereby favoring the demand for adhesives in food packaging. Polyester hot melt adhesives are used in the paper & packaging industry on account of their high strength, low density, low odor, and their ability to operate at a wider temperature range.

Pharmaceutical packaging is one of the major potential end-use industries of the polyester hot melt adhesives market. Advances in biotechnology are anticipated to boost the demand for various pharmaceutical packaging products such as parenteral vials and pre-fillable syringes. These factors are projected to have a positive impact on the polyester hot melt adhesives market in the long run.

Textiles and fabrics end-use industry witnessed significant growth in 2019 in the polyester hot melt adhesives market. Polyester resins find prominence in yarns and fabrics including textiles and footwear industries. Textile applications include carpets, apparel assembly, and interlinings. Web-form, powder, and film hot melts cater to a wide range of textile segments. Footwear hot melts are expected to gain penetration in Europe and Asia owing to the large number of sporting events conducted in India, Bangladesh, and England.

Ethylene-vinyl acetate (EVA) is one of the popular materials used in the production of hot melt adhesives. The adhesion and mechanical cohesion properties of the material make it suitable for use in adhesive products. The material is highly flexible and is also compatible with numerous additives and polymers. Also, it has an excellent cost-to-performance ratio and is easy to process. EVA has marked its presence in various industries such as footwear, solar panels, and packaging.

EVA copolymers find extensive use in packaging films and hot-melt adhesives. EVA copolymers are used as a base polymer for hot melt adhesives. The use of EVA hot melt adhesives in non-structural applications includes film laminates, carpet backing, textile bonding, and structural assembly applications such as woodworking. EVA gains prominence in major applications including films, extrusion coating, injection molding, and compounding. Growing EVA hot melt demand is anticipated to hinder polyester hot melt adhesives market growth over the next eight years.

Application Insights

The textiles and fabrics application segment held the largest revenue share of over 30% in 2019. Adhesives used in textiles ensure effective and durable bonds even for high water-repellent textiles pre-treated with hydrophobic polymers. The increasing need for breathability and water resistance properties, e.g. in the footwear industry, requires innovative technologies. The rising textile industry in emerging economies such as China and India is anticipated to augment product demand over the next eight years.

The textiles and fabrics application segment is likely to witness a decline of 8.8% in terms of revenue amid the COVID-19 pandemic. Numerous textile companies in China and India were operating at low production capacities from March to May 2020. However, the industry has started gaining its momentum in the second quarter of 2020 on account of increasing orders from vendors.

The interior design is an important decision criterion for purchasing a car. Bonding technology for lamination processes helps to ensure pleasant and soft surfaces in textile applications. Furthermore, the application of adhesive assists market vendors to meet the customer requirement and ensure technical specifications. Large volume production, particularly in North America and Asia Pacific, is projected to drive the automotive sector around the world.

Regional Insights

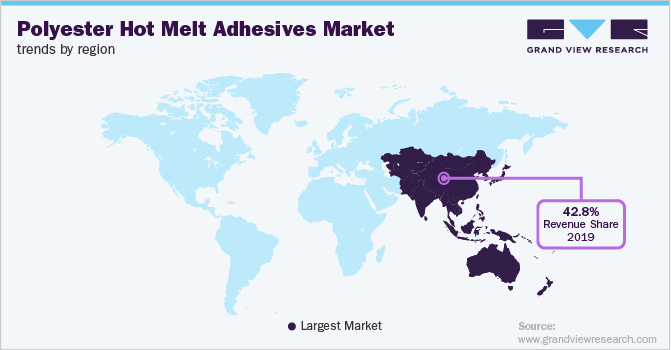

The market in Asia Pacific is projected to grow at the highest growth rate over the forecast period owing to the increasing number of adhesive producers and manufacturing operations in the country. The production of adhesive products is rising in the region, on account of growing awareness about health standards and the demand for large volumes of adhesives for various packaging and textile applications. The region is characterized by the presence of a gigantic food & beverage industry and thus it is a key element in the economic development of the region.

Furthermore, rising disposable income and the growing urban population in countries like China and India are anticipated to boost the demand for processed food, which is anticipated to benefit market growth. China is characterized by the presence of key automotive players including Chery, Beijing Automotive Group, and Guangzhou Automobile in addition to being the manufacturing base of international players such as Toyota, Ford, and Honda among others. Such factors are expected to lead to production growth in the automobile industry, which, in turn, is expected to drive the demand for polyester hot melt adhesive in the country over the coming years.

Key Companies & Market Share Insights

The global polyester hot melt adhesives market is fragmented in nature with the presence of various key players such as HB Fuller, Arkema Group, Sika AG, and 3M as well as a few small and medium regional players operating in different parts of the world. The international companies face strong competition from each other as well as from the local players who have solid distribution channels and internal knowledge for local supply chains.

The market belongs to a niche category and no recent merger and acquisitions have been observed in the recent past. However, with strong and consistent demand, in the long run, some of the key adhesive manufacturers are equipped with all the resources to acquire small and medium-sized businesses. Some prominent players in the global polyester hot melt adhesives market include:

-

Bostik

-

H.B. Fuller

-

3M

-

Avery Dennison Corporation

-

Dow Inc.

-

Sika AG

Polyester Hot Melt Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 325.0 million

Revenue forecast in 2027

USD 695.1 million

Growth Rate

CAGR of 8.7% from 2020 to 2027

Base year for estimation

2019

Actual estimates/Historic data

2016 - 2018

Forecast period

2020 - 2027

Quantitative Units

Revenue in USD Million, volume in kilotons, and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; South Korea; Brazil

Key companies profiled

Bostik; H.B. Fuller; 3M; Avery Dennison Corporation; Dow Inc.; Sika AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Polyester Hot Melt Adhesives Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For this study, Grand View Research has segmented the global polyester hot melt adhesives market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Packaging

-

Textiles & fabrics

-

Automotive

-

Electrical & electronics

-

Polymer films & foils

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global polyester hot melt adhesives market size was estimated at USD 355.9 million in 2019 and is expected to reach USD 325.0 million in 2020.

b. The polyester hot melt adhesives market is expected to grow at a compound annual growth rate of 8.7% from 2020 to 2027 to reach USD 695.1 million by 2027.

b. Textiles & fabrics dominated the polyester hot melt adhesives market with a revenue share of 33.9% in 2019, owing to the growing middle-class population and change in lifestyle.

b. Some of the key players operating in the polyester hot melt adhesives market include Bostik, H.B. Fuller, 3M, Avery Dennison Corporation, Dow Inc. and Sika AG.

b. The key factors that are driving the polyester hot melt adhesives market include growing packaging, and textile & fabric industries and increasing usage of products for lamination applications in the automotive sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."