- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyphenylene Sulfide Market Size & Share Report, 2030GVR Report cover

![Polyphenylene Sulfide Market Size, Share & Trends Report]()

Polyphenylene Sulfide Market Size, Share & Trends Analysis Report By Type (Linear PPS, Cured PPS, Branched PPS), By Application (Automotive, Electrical & Electronics, Industrial, Coatings, Others), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: 978-1-68038-044-6

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Bulk Chemicals

Report Overview

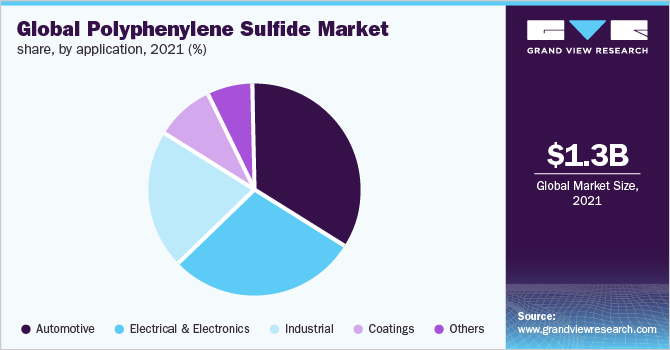

The global polyphenylene sulfide market size was valued at USD 1,299.29 million in 2021 and anticipated to expand at a compound annual growth rate (CAGR) of 8.8% from 2022 to 2030. Rise in product consumption in coatings applications owing to the properties of PPS including chemical & heat resistance along with good electronic properties is likely to boost the market in the forecast period.

Polyphenylene Sulfide (PPS) are widely used for coil formers, bobbins, relay components, slurry coatings, high-temperature air filters, specialty membranes, terminal blocks, and packaging. High chemical and abrasion resistance, mechanical strength, and dimensional stability are some of the characteristics that PPS possesses. The high melting point and low viscosity index, along with its lightweight nature, make it easier to cast into the desired shapes. PPS finds extensive application across various industries, such as automotive, electrical and electronics, coatings, and industrial. The aforementioned factors are likely to create demand for PPS in the forecast period.

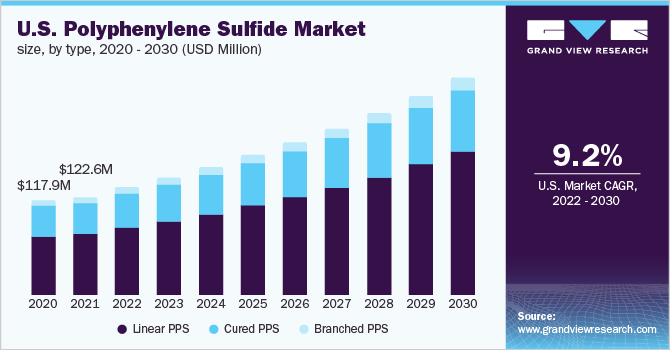

The Polyphenylene Sulfide (PPS) market in the U.S. is projected to witness significant growth over the coming years owing to the rise in production of automotive. The availability of well-trained machinists, automobile engineers, and other skilled laborers, along with the increasing automobile demand, is driving investments in the U.S. automotive industry. According to the U.S. Bureau of Economic Analysis, the automotive industry contributed USD 13.33 billion, in terms of export sales, to the U.S. economy in September 2022. In addition, the presence of prominent automobile manufacturers, such as Ford Motor Company, General Motors, Chrysler LLC, and Stellantis N.V., is anticipated to propel the growth of the automotive industry in the country, thereby augmenting the demand for polyphenylene sulfide products.

The U.S. enjoys several advantages in the evolving field of flexible electronics technology. It has the best and largest system of research universities across the globe, most of which are presently engaged in research and development projects with themes related to flexible electronics. Electronics development in the U.S. defense has fostered a high-technology flexible electronics industry for the production of products such as sockets, switches, lamp sockets, microwave parts, and others. However, for flexible electronics, in which government funding appears to be an essential driver in nascent-stage industrial developments, the U.S., seems to be being outspent by European & Asian governments.

Several key companies have initiated strategic moves such as joint ventures, mergers & acquisitions, and new product development to expand their market presence in the global market. In the past few years, the joint venture is an integral part of the polyphenylene sulfide industry that allows market players to strengthen their market position globally. For instance, in April 2022, SABIC launched a compound named LNP™ THERMOCOMP™ OFC08V. It is a polyphenylene sulfide products for plastic dipole antennas used in 5G base stations that can be processed easily and performs effectively in terms of chemical properties plating. The material makes it suitable to produce lightweight and affordable all-plastic antenna designs to support the development of 5G infrastructure. Besides, it is also employed for antenna elements of 5G base stations and other electrical & electronic applications.

Type Insights

Linear PPS dominated the global polyphenylene sulfide (PPS) market and accounted for more than 58% of the total market share, in terms of revenue, in 2021. The growing demand for PPS products in automotive and electrical & electronics applications for the production of connectors, sockets, relays & switches, bobbins & coils, electronic packaging, and encapsulated devices owing to their properties such as temperature resistant, high mechanical stress, and corrosion resistance is expected to propel the linear polyphenylene sulfide (PPS) market globally over the coming years.

Linear PPS is used to manufacture filter bags for industrial sector such as fire stations and duct chambers. They are highly resistant to acidic environment and high temperature that makes it suitable for the usage in high coal-fired power plants. Additionally, they are comparatively cheaper than other fibers such as Polytetrafluoroethylene (PTFE), aramid, and polyamides. With stringent regulations levied from particular matter emissions from power plants, the demand for PPS has increased for various applications including automotive and coatings.

Furthermore, branched polyphenylene sulfide (PPS) is used heavily in various other applications including electronics, coatings, and industrial. Growth in use of polyphenylene sulfide in engine parts, routers, piston pins, transmission components, and cooling system is driving the market growth. Branched polyphenylene sulfide (PPS) provide immense strength at a comparatively lesser dimension. The strong electromechanical properties of branched PPS make it one of the most suitable candidates for the advanced plastics family.

Application Insights

Automotive dominated the application segment in the global polyphenylene sulfide (PPS) market and accounted for more than 34% of the total market share, in terms of revenue, in 2021. PPS is primarily used in coatings to prevent corrosion on ferrous parts in the chemical and construction industries. Slurry coating, electrostatic coating on cold or hot surfaces, powder flocking, and fluidized bed coating are some methods that can be used to apply polyphenylene sulfide coatings. The enhancement in coating processes in developing countries such as U.S., China, and Brazil is expected to boost the PPS market in coating application.

PPS finds wide application in the electrical and electronics industry, especially in appliances. Electrical appliances include circuit breakers, relays, fans & blowers, heat exchangers, and connectors. Electronic applications include switches, circuit breakers, connectors, CD/DVD optical pickup components, HDTV & projection light engine housing, and inkjet cartridges. The robust manufacturing base of electronics products in Europe is expected to drive the PPS market over the forecast period.

Moreover, the growing demand for lightweight cars in order to improve their efficiency and reduce emissions has resulted in the need to replace heavy metal parts with lighter polymers. PPS is commonly used in automotive application due to its superior properties including stiffness, creep resistance, temperature resistance, and strength. Top automotive manufacturers such as TATA, Maruti Suzuki, Toyota Kirloskar Motor, Mahindra & Mahindra Ltd., Hyundai Motor Company, and Mercedes-Benz AG have been using PPS for their engine components to reduce weight and improve overall stability.

Regional Insights

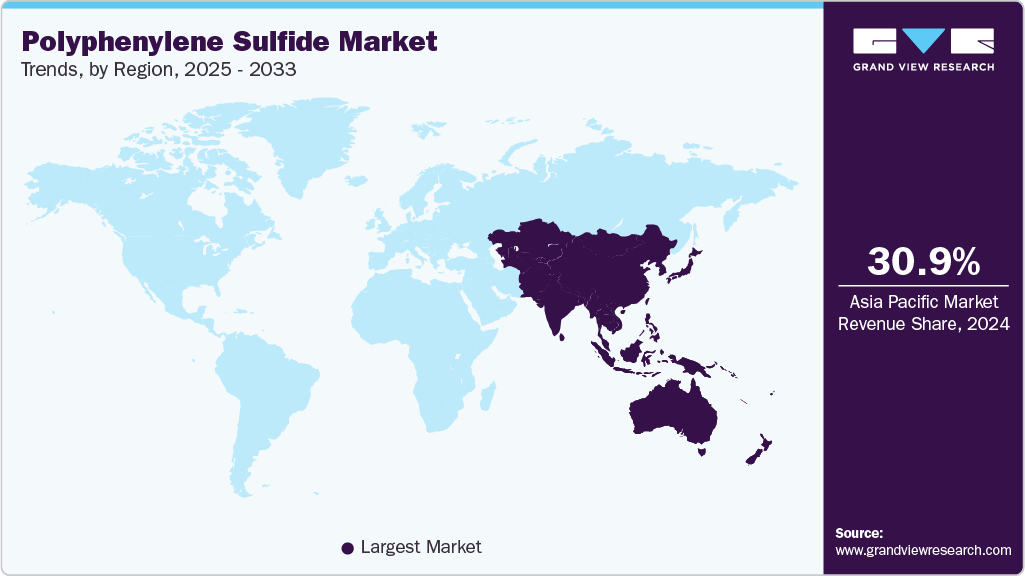

Asia Pacific dominated the PPS market in 2021 and accounted for more than 30% of the overall market revenue share. The market growth for automotive industry in China is mainly due to the urbanization along with high demand for Sedans and UVs. The presence of manufacturing facilities with latest technology advancements polyphenylene sulfide market growth in the region. High production rate in the region is creating a positive scenario in the overall PPS market.

The polyphenylene sulfide (PPS) market players are expected to operate at large operating margins to create future expansions depending on the growing demand. For instance, in September 2021, Solvay SA announced the installment of new plant for the production of thermoplastic composites in Greenville at South Carolina site. The product line includes high-performance polymers including PVDF, PPS and PEEK.

The automobile industry in Germany is one of the biggest industries in the country and produces more than 6 million vehicles including commercial and passenger vehicles every year. In 2021, the German automotive industry accounted for more than 28% of the total Europe automobile market share. The growing automotive industry owing to the rising population in Germany is expected to propel the market growth in the forecast period.

Furthermore, the presence of various PPS manufacturing facilities in the top countries including U.S. and Canada is anticipated to create demand for PPS in various applications including automotive, electrical & electronics. Additionally, the rising consumer awareness of environmentally friendly materials and new technological developments in the region is positively impacting the PPS market.

Key Companies & Market Share Insights

The key players operating in the polyphenylene sulfide (PPS) market include DIC CORPORATION, Solvay S.A., Lion Idemitsu Composites Co., Ltd, Toray Industries, Inc., Tosoh Corporation, and others owing to the presence of top regional players. Due to the increasing demand for the production of polyphenylene sulfide (PPS) for various applications including flexible printed circuits and specialty fabricated products, key manufacturers are developing new polymers for the production of polyphenylene sulfide (PPS).

The key global companies are expected to develop their polymer offerings to North America, Asia Pacific, the Middle East & Africa, and Central & South America, owing to the market demand in these regions given the expansion of the PPS market. Some of the prominent players operating in the global polyphenylene sulfide market are:

-

DIC CORPORATION

-

Solvay S.A.

-

Lion Idemitsu Composites Co., Ltd

-

Toray Industries, Inc.

-

Tosoh Corporation

-

SK chemicals

-

Chengdu Letian Plastics Co., Ltd.

-

Celanese Corporation

-

TEIJIN LIMITED

-

SABIC

-

Zhejiang NHU Co., Ltd.

-

LG Chem

-

RTP Company

-

Ensinger

-

Polyplastics Co., Ltd.

Polyphenylene Sulfide Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1,413.46 million

Revenue forecast in 2030

USD 2,767.32 million

Growth Rate

CAGR of 8.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in Tons, Revenue in USD Million, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Japan; India; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

DIC CORPORATION; Solvay S.A.; Lion Idemitsu Composites Co., Ltd; Toray Industries, Inc.; Tosoh Corporation; SK Chemicals; Chengdu Letian Plastics Co., Ltd.; Celanese Corporation; TEIJIN LIMITED; SABIC; Zhejiang NHU Co., Ltd.; LG Chem; RTP Company; Ensinger; Polyplastics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyphenylene Sulfide Market Segmentation

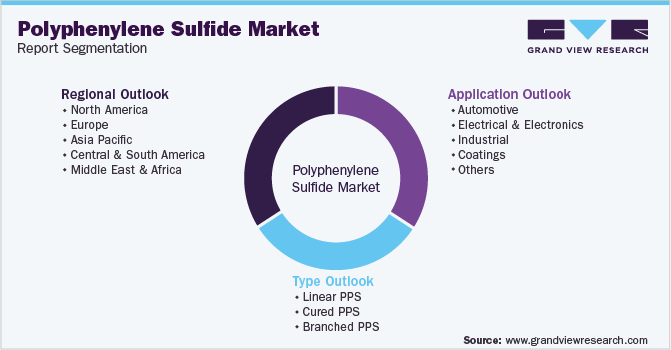

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyphenylene sulfide market report based on type, application, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Linear PPS

-

Cured PPS

-

Branched PPS

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

Industrial

-

Coatings

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polyphenylene sulfide market size was estimated at USD 1,299.29 million in 2021 and is expected to reach USD 2,767.32 million in 2022.

b. The global polyphenylene sulfide market is expected to grow at a compound annual growth rate of 8.8% from 2022 to 2030 to reach USD 2,767.32 million by 2030.

b. The automotive segment dominated the polyphenylene sulfide market with a share of 34% in 2021. Increasing requirements of weight reduction in cars to improve their efficiency and to reduce emissions has resulted in the need to replace heavy metal parts with lighter polymers.

b. Some key players operating in the polyphenylene sulfide market include Toray Industries, SK Chemicals, Solvay, Kureha Corporation, DIC, and Polyplastics Co., Ltd.

b. Key factors that are driving the market growth include increasing demand from various sectors including automotive, electronics, industrial, and aerospace.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."