- Home

- »

- Pharmaceuticals

- »

-

Postmenopausal Osteoporosis Treatment Market Size ReportGVR Report cover

![Postmenopausal Osteoporosis Treatment Market Size, Share & Trends Report]()

Postmenopausal Osteoporosis Treatment Market Size, Share & Trends Analysis Report By Drug Type (Bisphosphonates, Vitamin D3), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-065-0

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global postmenopausal osteoporosis treatment market size was valued at USD 9.12 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. Sedentary lifestyles and unhealthy eating & drinking patterns that have an effect on women’s menstrual cycles increasing their risk of the disease. Moreover, growing elderly population is also driving market demand. In addition, several key companies are working on postmenopausal osteoporosis treatments. Teva Pharmaceutical is one of the companies with drug candidates that are in the most advanced stage, which is phase III. For the treatment of individuals with postmenopausal osteoporosis, Teva Pharmaceutical is developing TVB-009, a Denosumab biosimilar. Clinical trials for TVB-009, a RANK ligand inhibitor, are ongoing in phase3.

Another primary factor driving the market is the increase in disease burden among postmenopausal women. Osteoporosis risk rises and bone loss accelerates significantly during menopause. According to recent studies, osteoporosis affects roughly 1 in 10 women over the age of 60 years globally and can cause up to 20% of bone loss during these stages. According to the International Menopause Society (IMS), 1 in 3 women over 50 years of age describe fractures brought on by osteoporosis. In addition, due to the COVID-19 pandemic’s interruption of fracture liaison services, the market for osteoporosis treatments suffered. Moreover, to stop the virus from spreading during the pandemic, hospitals as well as private health centers postponed non-emergency procedures & office visits.

This had an additional negative impact on the industry. The unmet need among patients includes limited numbers of novel remedies; however, key companies are actively engaged in R&D of novel products thereby addressing the unmet need. The industry is expected to grow faster than average during the forecast period as a result of growing expenditures in research and development efforts to create a precise myelofibrosis therapy. Rapid technological development and continuing clinical trials both support business expansion. The business is also growing as a result of other factors like an improved healthcare sector, reimbursement policies, supportive government initiatives, busy lifestyles, and shifting dietary patterns.

Government and private groups are making active efforts to increase public awareness of social conditions and support market expansion. The days of October 18 and October 20 are set aside each year as World Menopause Day & World Osteoporosis Days, respectively, to raise awareness about the challenges involved in treating postmenopausal osteoporosis symptoms and disease management. Furthermore, in January 2021, the Asia Pacific Consortium on Osteoporosis (APCO) introduced pan-Asia Pacific clinical practice guidelines for disease screening, diagnosis, and management. The market is being driven by all of the aforementioned factors, which are raising awareness about the condition.

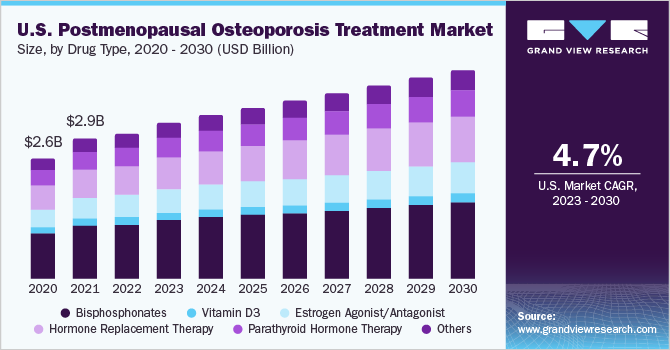

Drug Type Insights

The bisphosphonates segment held the largest revenue share of 37.7% in 2022. As the first line of therapy for osteoporosis, bisphosphonates dominate the market. In addition, bisphosphonate-containing medications reduce bone loss by reducing osteoclast activity and by enhancing bone structure & density. Furthermore, the introduction of new products with greater effectiveness is accelerating market expansion. Some of the prominent drugs include Actonel (risedronate) and Fosamax (alendronate), which are taken daily and monthly, respectively. The easy availability of these drugs is anticipated to propel the market growth.

Hormone replacement therapy is the fastest-growing sub-segment in the market. Due to rising adoption of hormone replacement therapy products and an increase in the prevalence of growth hormone deficiency in major countries, there is an increase of market demand for therapeutic areas that are safe and effective in comparison to others while posing minimum risks. Furthermore, the parathyroid hormone aids in promoting the growth of new bone-forming cells, making it a popular treatment option for patients with numerous fractures. In addition, manufacturers have introduced biosimilar versions of Forteo for the treatment of osteoporosis, which are also anticipated to support the market development over the forecast period.

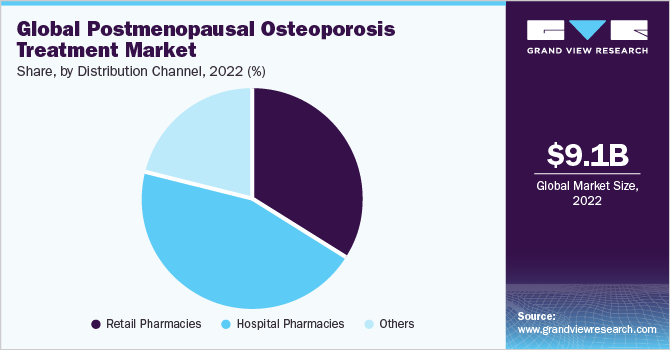

Distribution Channel Insights

On the basis of distribution channel segment, the industry has been further categorized into hospital pharmacies, retail pharmacies, others. The retail pharmacy distribution channel segment accounted for the largest share of 34.52% of the overall revenue in 2022. This attributed to factors such as patient’s high compatibility with retail pharmacies owing to prolong treatment period, increased collaboration with orthopedic centers that aid in the management of osteoporosis, and others.

Moreover, due to online drug purchases and a major emphasis on the part of the companies to strengthen their distribution channel, other distribution channels, such as online pharmacies, are expected to boost growth. It is anticipated that consumer demand for osteoporosis therapy will increase in the coming years due to the rising patient population and further boost the market growth.

Regional Insights

North America accounted for the largest share of 37.55% of the overall revenue in 2022 owing to factors, such as well-developed healthcare infrastructure, the strong presence of several industry players, a high rate of accurate diagnosis & effective treatment, higher patient compliance, and a large patient population. In North America, the U.S. makes the largest contribution. In 2021, the Centers for Disease Control & Prevention (CDC) reported that 18.8% of women aged 50 years or above had osteoporosis. Due to sedentary lifestyles or unhealthy eating and drinking habits, the prevalence is predicted to rise even further. The National Osteoporosis Foundation estimates that by 2030, 71 million Americans will be affected by low bone mass.

Asia Pacific is expected to grow at a lucrative rate during the forecasted period. With an increase in the number of elderly patients with osteoporosis, more people are using the new drug to address the condition. The region's highest CAGR is anticipated to be gained in China and India, two economically developing nations that are regarded as significant contributors to healthcare spending. Due to improved healthcare infrastructure, increased public awareness, and other factors, the markets in Latin America and Middle East and Africa are still in their nascent stages.

Key Companies & Market Share Insights

The continuous demand for postmenopausal osteoporosis treatment by multiple end-users has created numerous market opportunities for major players to capitalize on. For instance, in July 2022, Chugai Pharma China Co., Ltd., a division of Chugai Pharmaceutical Co., Ltd., introduced Edirol (eldecalcitol) in China after it had received approval by the China National Medical Products Administration (NMPA) to treat postmenopausal osteoporosis. Some of the prominent players in the global postmenopausal osteoporosis treatment market include:

-

Teva Pharmaceuticals Industries Ltd.

-

Pfizer Inc.

-

Merck & Co.

-

Novartis AG

-

Eli Lilly and Company

-

AbbVie (Allergan plc.)

-

Cipla Inc.

-

Amgen Inc.

-

F. Hoffmann-La Roche Ltd.

Postmenopausal Osteoporosis Treatment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.84 billion

Revenue forecast in 2030

USD 13.70 billion

Growth rate

CAGR of 5.22% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drugs type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Teva Pharmaceuticals Industries Ltd.; Pfizer Inc.; Merck & Co.; Novartis AG; Eli Lilly and Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Postmenopausal Osteoporosis Treatment Market Report Segmentation

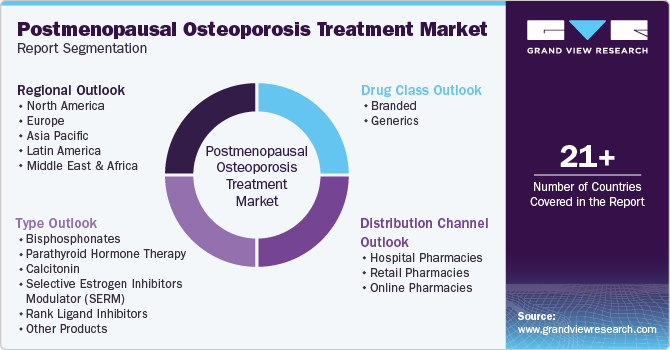

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the postmenopausal osteoporosis treatment market based on drug type, distribution channel, and region:

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bisphosphonates

-

Vitamin D3

-

Estrogen Agonist/Antagonist

-

Hormone Replacement Therapy

-

Parathyroid Hormone Therapy

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global postmenopausal osteoporosis treatment market size was estimated at USD 9.12 billion in 2022 and is expected to reach USD 9.84 billion in 2023.

b. The global postmenopausal osteoporosis treatment market is expected to grow at a compound annual growth rate of 5.22% from 2022 to 2030 to reach USD 13.70 billion by 2030.

b. North America dominated the market for postmenopausal osteoporosis treatment and accounted for the largest revenue share in 2022.

b. Some of the key market players include Teva Pharmaceuticals Industries Ltd., Pfizer Inc., Merck & Co., Novartis AG, Eli Lilly and Company and others.

b. Key factors that are driving the postmenopausal osteoporosis treatment market growth include robust late-stage product pipeline, and increase in disease burden among postmenopausal women due to the growing elderly population, and lifestyle shifts such as sedentary behavior, heavy drinking, and unhealthful eating patterns.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."