- Home

- »

- Advanced Interior Materials

- »

-

Pre Painted Metal Market Size, Share, Industry Growth Report, 2025GVR Report cover

![Pre-Painted Metal Market Size, Share & Trends Report]()

Pre-Painted Metal Market Size, Share & Trends Analysis Report By Product (Steel, Aluminum), By Application (Construction, Transportation, Consumer Electronics), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-161-0

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Advanced Materials

Industry Insights

The global pre-painted metal market size was USD 13.3 billion in 2018 and is anticipated to witness a CAGR of 11.2% from 2019 to 2025. The growth of the construction industry in emerging economies of Asia Pacific is expected to generate significant demand for pre-painted metal in the form of sheets and coils on account of increased corrosion resistance.

Pre-painted metal sheets provide a combination of high strength, formability, and joint-ability along with excellent corrosion resistance. Hence, they are the most preferred materials in the construction industry, particularly in roofing and walls. Moreover, the advantages of the product such as the relative durability of the coating and recyclability make them suitable in various other applications such as automotive, consumer electronics, HVAC, and furniture. Its ability to get into almost any shape, excellent weathering resistance for superior longevity, availability in numerous colors, and no environmental pollution, make it suitable in both exterior and interior construction applications.

Increasing construction spending along with infrastructure development in various countries is anticipated to drive the market for pre-painted metal over the coming years. Central and South America plan to invest USD 4.5 trillion in infrastructure development by 2028. This is likely to drive the market for pre-painted metal over the coming years.

Pre-painted metal is produced using a coil coating process which includes cleaning, heating, and coating tools and equipment. The high maintenance cost of these tools and equipment increases the cost of the manufacturing process, resulting in high prices of pre-painted metal. Thus, consumers prefer home appliances that require fiber or plastic for fabrication that are less expensive than pre-painted metal. This is anticipated to hamper market growth over the coming years.

Product Insights

On the basis of product, the pre-painted metal market is segmented as steel and aluminum. Steel accounted for more than 76.3% of the market revenue share in 2018 owing to its greater resistance to drying out, warping, and cracking in comparison to aluminum. Also, its lightweight advantage further increases its usage, especially during renovation, as it is easy to install.

Aluminum is the fastest-growing segment owing to its properties such as lightweight and high strength as compared to steel. It is used in outdoor architectural applications such as facades as it is weather, UV, and seawater resistant. The only disadvantage of pre-painted aluminum is that it costs more than twice of raw aluminum.

Application Insights

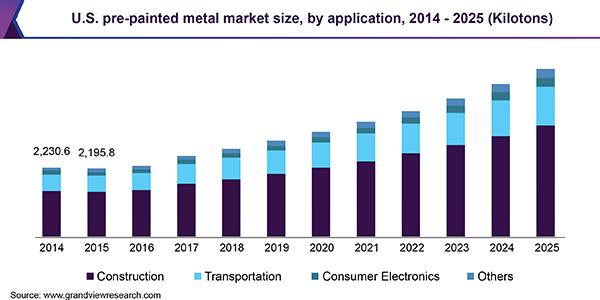

Pre-painted metal is used in a variety of applications including construction, transportation, consumer electronics, and others. Construction was the largest segment accounting for a revenue share of nearly 40.6% in 2018. Increasing investment in infrastructure development is anticipated to drive the market for pre-painted metal over the coming years. It is used in gutters, partitions, roofing structures, facades, cladding systems, ceiling systems, and a variety of ancillary components.

In the transportation sector, pre-painted metal is used for manufacturing electric vehicles. It is also used in components such as body-in-white of cars, oil filter caps, and wiper blade assemblies, thus providing a high-quality base for customized automotive paint coatings. According to the International Energy Agency, the global sales of electric vehicles are anticipated to reach 23 million by 2030, which in turn is expected to propel product demand over the coming years.

The consumer electronics segment is anticipated to witness a CAGR of 6.8% in terms of volume from 2019 to 2025. The growth is attributable to increasing demand for refrigerators, freezers, washing machines, toasters, and DVD players. According to India Brand Equity Foundation, sales of the appliance and consumer electronics in India are anticipated to reach USD 48.37 billion by 2022. This is likely to boost the utilization of pre-painted metal over the coming years.

Regional Insights

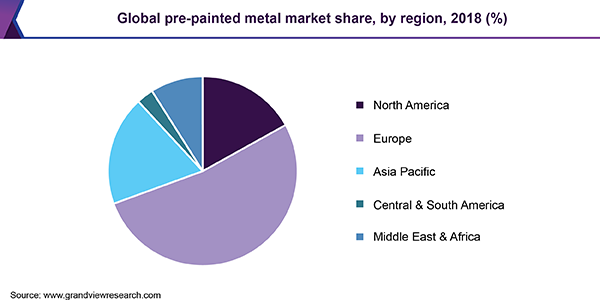

The Asia Pacific was the second largest segment accounting for a revenue share of 33.0% in 2018 owing to a rise in construction and transportation industries. Rapid urbanization along with increasing disposable income in countries such as China and India is anticipated to drive demand for residential, commercial, and industrial infrastructure. Low-interest rates on housing loans in these countries are further expected to boost the construction industry in the region.

Low labor costs and favorable FDI norms in the Asia Pacific are encouraging automotive OEMs to shift or expand their production base in China, India, and Japan. Increasing production of automobiles in these countries is likely to increase the utilization of pre-painted metal over the coming years.

North America is expected to exhibit a CAGR of 9.2% in terms of volume over the coming years. The growth is attributable to rising infrastructural developments and a rise in automotive production in the region. In North America, the number of new or upgraded continuous coil painting lines is increasing rapidly to serve these end-use industries. The U.S. government initiative such as the Zero Emission Vehicle (ZEV) program is likely to drive demand for lightweight vehicles in the country, which in turn is likely to fuel the automotive industry growth. This is anticipated to drive the product demand over the coming years.

Europe is among the fastest-growing segments in the market for pre-painted metal owing to the established automotive industry and the growing construction industry. According to Euroconstruct, the construction output in the region grew by 3.1% in 2018 and is expected to witness moderate growth over the coming years. This is likely to propel market growth over the coming years.

Pre Painted Metal Market Share Insights

Key market players including ArcelorMittal, Tata BlueScope Steel, Haomei, SSAB, Nippon Steel Corporation, UNICOIL, MMK Group, Impol, and NLMK are adopting strategies such as capacity expansion and mergers and acquisitions to enhance their market share and meet the growing demand from potential customers.

For instance, In July 2019, ArcelorMittal Dofasco (Canada) announced to invest in a project to modernize the hot strip mill. In the project, the company plans to replace three end-of-life coilers with state-of-the-art coilers and runout tables. The project is expected to be completed by 2021.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Volume in Kilotons, Revenue in USD Million, and CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, Russia, Turkey, China, India, Japan, and Brazil

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country-level and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global pre-painted metal market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Steel

-

Aluminum

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Construction

-

Transportation

-

Consumer electronics

-

Other applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."