- Home

- »

- Biotechnology

- »

-

Preparative And Process Chromatography Market Report, 2030GVR Report cover

![Preparative And Process Chromatography Market Size, Share & Trends Report]()

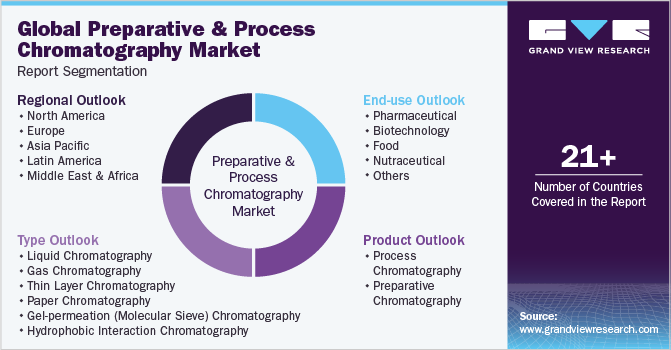

Preparative And Process Chromatography Market Size, Share & Trends Analysis Report By Product (Process Chromatography, Preparative Chromatography), By End-use (Food, Nutraceutical), By Type, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-789-6

- Number of Pages: 184

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global preparative and process chromatography market size was estimated at USD 9.5 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.08% over the forecast period. The growth of this market is driven by the rising demand and approval of monoclonal antibodies in the pharmaceutical and biotechnology sectors. In addition, the market is driven by the expanding biopharmaceutical industry, the demand for advanced purification techniques, and the need for more efficient and cost-effective processes. Technological advancements and the development of innovative chromatography products are expected to boost market growth. For instance, in October 2021, CEM launched the prodigy preparative high-performance liquid chromatography (HPLC) system.

The system offers an elevated temperature capability, resulting in enhanced resolution and separation capabilities. The COVID-19 pandemic had a favorable impact on the market owing to the high demand for COVID-19 vaccines and treatment medications. Similarly, the pharmaceutical and biotechnology industries are likely to experience significant growth in the future driven by the emerging production and demand for preparative and process chromatography. The separation process and preparative chromatography can be employed in the analysis of materials for the manufacturing of the coronavirus vaccine.

A chromatography system is a scientific technique used for isolating specific components from sample mixtures. Analytical and preparative chromatography systems are widely employed in qualitative and quantitative methods to analyze biotechnological, pharmaceutical, and other components. The market for chromatography systems is experiencing growth due to various factors, including the increasing demand for insulin and omega-3 fatty acids, rising concerns related to food quality & safety, and the growing geriatric population. Moreover, ongoing research paradigms focusing on the separation and analysis of monoclonal antibodies using mild reverse-phase chromatography are expected to drive research in this market.

Companies are actively involved in developing flexible and robust platforms for the continuous production of monoclonal antibody products, leading to an increased demand for quality control measures. The market is experiencing growth due to the high demand for preparative techniques, technological advancements in chromatography, and the large-scale integration of liquid chromatographic techniques in downstream processing. Affinity chromatography has emerged as a pivotal tool to purify proteins as it is based on highly specific interactions occurring between the protein of interest and an immobilized ligand.

The Downstream Process (DSP) or the product purification process is one of the costliest aspects of modern bioprocess protocols, particularly with respect to proteins. Hence, in these cases, chromatography serves as a crucial tool at all stages of DSP, from early initial capture to the final polishing or finishing steps. Preparative techniques have gained wide acceptance for the purification of APIs and the key drivers associated with this expanding acceptance include improved throughput, cost-effectiveness, and purity. These techniques offer the users sufficient material volume at the desired quality for the initiation of clinical and preclinical trials. This, in turn, opens alternative routes for commercialization with minimum time invested in product development.

Product Insights

The product segment is divided into process/analytical chromatography and preparative chromatography. Process chromatography held the largest share of 59.03% in 2022. These methods are commonly employed in industry to purify a variety of biomolecules. They're designed for large-scale biopharmaceutical manufacturing and process scale-up. The segment is primarily driven by pharmaceutical companies' increased usage of automated systems. Preparative chromatography is expected to register the highest CAGR during the forecast period owing to precise results. Chromatography has become a standard laboratory process for a variety of industries due to continuous developments in technology and methodology.

The most dependable method of isolating and purifying vast amounts of extremely valuable compounds is preparative chromatography. Implementing single-use technology is considered a cost-effective solution in terms of labor, costs, capital, and materials. Presently, there are various disposable chromatography column systems conforming to current good manufacturing practices, which are readily accessible for preparative and process chromatography. Single-use batch chromatography systems, such as single-use/disposable chromatography columns and membrane products, are expected to grow in popularity in the bioprocessing industry.

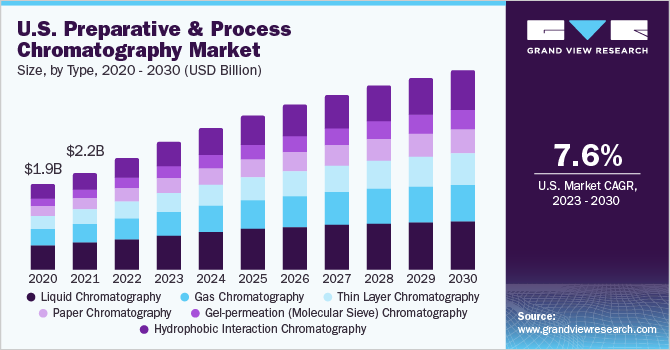

Type Insights

On the basis of types, themarket is further divided into liquid chromatography, gas chromatography, thin-layer chromatography, paper chromatography, gel-permeation chromatography, and hydrophobic interaction chromatography. The liquid chromatography segment accounted for the largest share of 27.3% in 2022 owing to the widespread application across several industries. Bioactive compounds are isolated from a variety of sources using different variations of this approach. Liquid chromatography plays a critical function in guaranteeing product quality during the production process.

As a result, the rapidly expanding pharmaceutical and specialty chemicals sectors have demonstrated tremendous interest in this area, resulting in significant growth. The hydrophobic interaction chromatography segment is expected to witness the fastest growth rate of 10.22% over the estimated period. As this technique has demonstrated its advantages in analyzing protein unfolding & folding and isolating complex proteins, it is being widely used in the protein research field. In the near future, the rising demand for monoclonal antibodies in oncology is expected to promote the utilization of this approach.

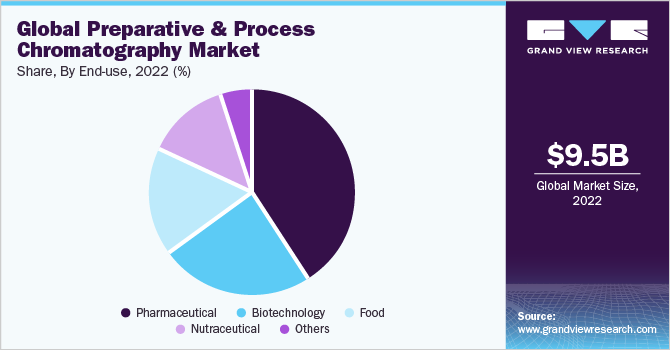

End-use Insights

On the basis of end-uses, the market has been segmented into pharmaceuticals, biotechnology, food, nutraceuticals, and others. The pharmaceutical segment accounted for the largest share of 41.12% in 2022 owing to the high usage of preparative and process chromatography in drug safety assessment. The demand for the development of an effective vaccine against the novel coronavirus in a reduced timeframe has led to the introduction of unique vaccine strategies, such as viral vector-based vaccines, nucleic acid-based vaccines, and virus-like particle vaccines.

As a result of the situation and its scope, the need to commercialize and provide access to the most productive, versatile, and novel bioprocessing equipment is anticipated to grow. This is likely to strengthen the pool of companies involved in preparative and process chromatography, promoting market growth even more.The food segment is expected to grow significantly over the forecast owing to growing concerns. Furthermore, the presence of a strict regulatory framework for the food industry has resulted in effective food product monitoring. Furthermore, the growing global food business has resulted in arise in the adoption of these quality assurance approaches.

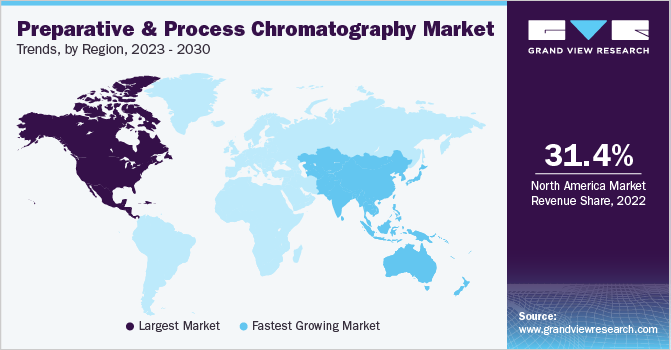

Regional Insights

On the basis of geographies, the global market has been further categorized into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa. In 2022, North America dominated the global market with the highest share of 31.43% of the overall revenue, followed by Europe. The regional market growth has been driven by the presence of a large number of significant competitors, as well as increased R&D programs for disease management.

R&D spending by key players drives regional market growth. On the other hand, the Asia Pacific region is expected to register the fastest growth rate over the forecast period. The developing pharmaceutical and biotechnology sectors support the expected growth. The regional market growth is driven by the presence of countries like China and India. Furthermore, the rising geriatric population in the region is expected to fuel market growth.

Key Companies & Market Share Insights

Companies engaged in the development of innovative products are expected to intensify the market competition. The key players are focused on continuous innovations and launching products to retain and acquire market share. Moreover, the companies are developing products as per the global demands, along with the integration of advanced technologies in the product. For instance, in August 2020, the new Thermo Scientific Dionex Easion ion chromatographic system was launched by Thermo Fisher Scientific for water analysis. This product support reduces the total cost of maintenance and ownership. In November 2020, Shimadzu Corporation launched the “Advanced i-Series” HPLC. This is an improved flagship LC model to support remote work. Some prominent players in the global preparative and process chromatography market include:

-

GE Healthcare

-

Danaher Corp.

-

Merck KGaA

-

Bio-Rad Laboratories Inc.

-

Thermo Fisher Scientific Inc.

-

Shimadzu Corp.

-

Agilent Technologies

-

Waters Corp.

-

Novasep Holding S.A.S

Preparative And Process Chromatography Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 11.01 billion

Revenue forecast in 2030

USD 19.04 billion

Growth rate

CAGR of 9.08% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Danaher Corp.; Merck KGaA; Bio-Rad Laboratories Inc.; Thermo Fisher Scientific Inc.; Shimadzu Corp.; Agilent Technologies; Waters Corporation; Novasep Holding S.A.S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Preparative And Process Chromatography Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the preparative and process chromatography market report on the basis of product, type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Process Chromatography

-

System

-

Multi Use Batch Chromatography Systems

-

Single-Use Batch Chromatography Systems

-

Continuous Chromatography Systems

-

-

Consumables

-

Reagents

-

Resins

-

Affinity Resins

-

Ion-exchange Resins

-

Size-exclusion Resins

-

Hydrophobic Interaction Resins

-

Reversed Phase Resins

-

Mixed mode/Multi-mode Resins

-

-

Columns

-

Prepacked Columns

-

Automated Columns

-

Manual Columns

-

-

-

Service

-

-

Preparative Chromatography

-

System

-

Semi-Preparative Chromatography Systems

-

Other Chromatography Systems

-

-

Consumables

-

Reagents

-

Resins

-

Affinity Resins

-

Affinity Resins

-

Ion-exchange Resins

-

Size-exclusion Resins

-

Hydrophobic Interaction Resins

-

Reversed Phase Resins

-

Mixed-mode/Multi-mode Resins

-

-

-

Columns

-

Prepacked Columns

-

Empty Columns

-

-

Service

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Chromatography

-

HPLC

-

Flash/Column Chromatography

-

Ion-exchange chromatography

-

Size-exclusion chromatography

-

Affinity chromatography

-

-

Gas Chromatography

-

Thin Layer Chromatography

-

Paper Chromatography

-

Gel-permeation (Molecular Sieve) Chromatography

-

Hydrophobic Interaction Chromatography

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Biotechnology

-

Food

-

Nutraceutical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include increasing investments by the government to enhance R&D, growing use of chromatography techniques in the food and nutraceuticals industry, and increasing demand for biopharmaceutical products.

b. The global preparative and process chromatography market size was estimated at USD 9.5 billion in 2022 and is expected to reach USD 11.01 billion in 2023.

b. The global preparative and process chromatography market is expected to grow at a compound annual growth rate of 9.08% from 2023 to 2030 to reach USD 19.04 billion by 2030.

b. North America dominated the preparative & process chromatography market with a share of 31.43% in 2022. This is attributable to the rise in major strategic mergers and acquisitions undertaken by key market players.

b. Some of the key players operating in the preparative and process chromatography market include GE Healthcare, Pall Corporation, Merck KGaA, Bio Rad Laboratories, Thermo Fisher Scientific Inc., Shimadzu Corporation, Agilent Technologies, Waters Corporation, Novasep Holding S.A.S, and Chiral Technologies, Inc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."