- Home

- »

- Clinical Diagnostics

- »

-

Primary Care POC Diagnostics Market Size Report, 2030GVR Report cover

![Primary Care POC Diagnostics Market Size, Share & Trends Report]()

Primary Care POC Diagnostics Market Size, Share & Trends Analysis Report By Product (Glucose Testing, Lipid Testing, Drug Abuse Testing), By End-use (Pharmacy & Retail Clinics, Physician Office), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-333-1

- Number of Pages: 192

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Market Size & Trends

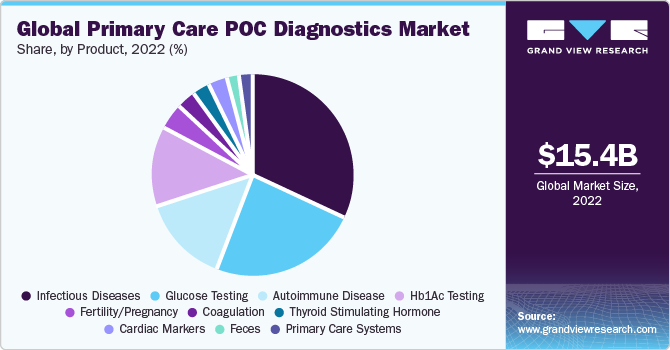

The global primary care POC diagnostics market size was valued at USD 15.40 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. The rapid evolution of point-of-care testing (POCT) holds enormous potential for the growth of both primary and secondary care settings. Rapidly increasing healthcare expenditure within secondary and tertiary care has driven the attention of healthcare communities toward primary care settings. These expenditure issues can be curbed to a great extent at the primary care stage through routine screening of patients with early symptoms. As a result, the market will likely receive a major boost.

Companies within the market are undertaking continuous efforts for the advancement of POC products concerning their portability and ease of use. This is mainly to ensure effective and unrestricted usage of POC devices at primary care levels and in remote settings with no/minimal laboratory infrastructure. In the current scenario, POCT is successfully implemented for disease diagnosis in outpatient settings, which include non-practice clinics, urgent care, and physician’s offices and clinics. In February 2023, Siemens Healthineers announced a strategic partnership with Unilabs, via which Unilabs will acquire 400 laboratory analyzers, including hemostasis and immunoassay, for laboratory infrastructure improvements, thus facilitating better patient service.

Demand for POC technologies from primary care physicians is likely to grow significantly over the years. This is due to a paradigm shift in diagnostics from centralized labs towards practitioners’ offices, which would open new revenue streams for various end users and significantly improve profit margins. Higher adoption of POC testing in primary care is observed in remote locations and relatively densely populated regions where telehealth services are being actively considered to improve patient convenience. The decentralization of primary care services in several markets worldwide has become a common trend as it helps reduce the use of antibiotics and offers rapid results. This is expected to drive the adoption of POCT in the market.

Growing usage of POCT in primary care settings can also be attributed to the ease of usage associated with these devices in out-of-hospital laboratory settings. Also, medical and non-medical personnel can use these devices with minimum training.

Product Insights

POCT devices and products include primary care systems, feces testing, Hb1Ac testing, decentralized clinical chemistry, cardiac markers, hematology, fertility, lipid testing, cancer marker, urinalysis, coagulation, drug abuse testing, glucose testing, blood gas/electrolytes, thyroid-stimulating hormone, infectious diseases, and ambulatory chemistry. The rising availability of these devices, ongoing studies on their usage, and continuous technological advancements are expected to drive the primary care POC diagnostics market.

The infectious disease segment held the largest market share at 26.4% in 2022, owing to the increased prevalence of infectious diseases, demand for quick and precise diagnosis, and the growing awareness of the benefits of POC testing. According to the World Health Organization (WHO), approximately 354 million people globally are hepatitis B or C positive, and diagnosis and treatment are unavailable. The WHO aims to control and reduce new infections by 90% and deaths by 65% by 2030.

In July 2022, Werfen received the Food and Drug Administration (FDA) approval for the POCT ROTEM sigma Thromboelastometry System featuring real-time, quick, and actionable results. ROTEM sigma also provides clinicians with a visual assessment of clot stability and firmness, hemostasis optimization, and blood loss minimization.

The cancer marker segment is expected to grow at the fastest CAGR of 9.73% over the forecast period. The key drivers include the growing prevalence of cancer, rising demand for screening cancer, technological advancements, and supportive government initiatives and policies. According to the Centers for Disease Control and Prevention, 1.6 million new cancer cases were registered, and 602,347 deaths occurred due to cancer in 2020. 403 in 100,000 reported new cancer cases, and 144 of them died.

Glucose testing is a major segment of the market. The adoption of self-testing glucose devices plays an important role in controlling glycemic levels regularly, which, in turn, is anticipated to provide positive health outcomes, especially among people with diabetes.

Lipid testing products are expected to witness strong growth over the forecast period. Commercial availability of several Clinical Laboratory Improvement Amendments of 1988 (CLIA)-waived POC lipid testing products in the market is likely to drive the segment considerably. F. Hoffmann-La Roche Ltd.’s Accutrend Plus system is a significant example of such testing products, which can be effectively employed in physicians’ offices and clinics. Ongoing research studies and support from funding agencies are also expected to boost the segment throughout the forecast period.

Regional Insights

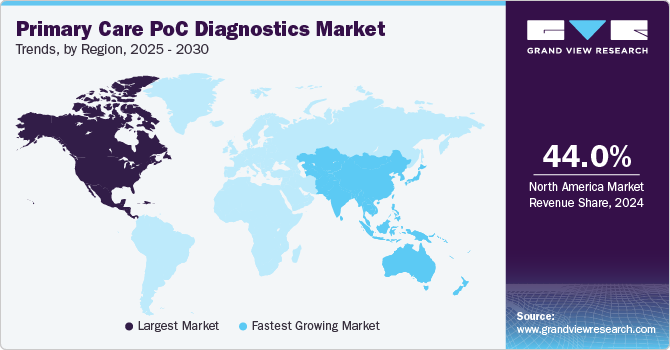

North America held the largest share of 43.2% in 2022, owing to a substantial number of primary care settings in the U.S. that employ POC products. The presence of major players in the country offering products and services for primary settings has also attributed to the large share of this regional market. The Centers for Medicare & Medicaid Services is urging healthcare providers to initiate patient engagement programs. This, along with the availability of funding for R&D in healthcare by universities and academia, is driving the market.

The North American market is relatively more developed compared to the rest of the world, and this can be attributed to the availability of numerous advanced and innovative POC diagnostic solutions. Growing demand for these solutions in primary home healthcare and assisted healthcare settings is also a key growth driver. The introduction of advanced healthcare solutions such as EHR, digitalization, and telemedicine also works in the market’s favor.

However, Asia Pacific is expected to emerge as a lucrative regional market and is slated to exhibit a stronger growth rate of 8.2% CAGR compared to other regions over the forecast period. This can be attributed to an increasing number of firms capitalizing on untapped potential in the region. Moreover, growing awareness among the population about early disease diagnoses to improve patient survival rates is expected to spur the market in the Asia Pacific.

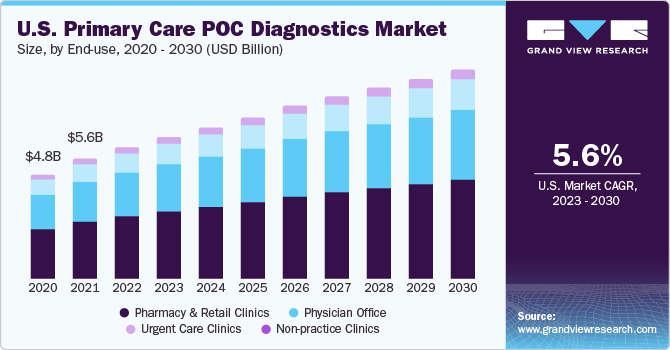

End Use Insights

A global rise in POCT owing to easy and quick results has radically improved workflow and patient care at physicians’ offices. These tests, supported by the expertise of doctors in quickly assessing the situation and making important medical decisions, deliver improved clinical outcomes. POCT also aids in performing complex tests with low sample volumes compared to those performed in laboratories. Thus, factors such as consumer demand for easy, stress-free, and less time-consuming tests are likely to boost the market for primary care POC diagnostics in physicians’ offices.

The pharmacy and retail clinics segment dominated the market with a 46.9% share in 2022 and is also expected to witness the fastest growth of 7% CAGR over the forecast period. An increase in the number of people covered under healthcare plans has reduced healthcare costs and improved access to healthcare. This has led to the availability of POC testing at pharmacies. In the last five years, the number of pharmacists performing laboratory tests such as cholesterol screening and glycosylated hemoglobin (A1C) has increased. Moreover, more patients prefer to undergo testing for acute and chronic diseases at pharmacies, thus providing the segment with lucrative growth opportunities. In May 2020, Roche Diagnostics launched the digital diagnostic solution v-TAC to enable clinicians to test patients for blood gas in a relatively simpler, painless, and less invasive venous method.

The physician office segment held the second largest segment at 22.8%, a result of the growing usage of POC testing devices by physicians to improve patient satisfaction and care and the rising prevalence of chronic and infectious diseases requiring frequent diagnosis, monitoring, and treatment.

Key Companies & Market Share Insights

Partnerships and agreements are a major trend observed in the market. Market players are drafting agreements with prominent emerging participants to establish co-ownership in IP and to gain key licenses and sub-licenses from various universities for foundation IP rights. Companies are also engaged in collaborations with major players to develop new product lines and enhance their market presence. For instance, in April 2023 bioMerieux and Oxford Nanopore announced a strategic partnership to develop novel infectious disease diagnostic solutions.

In June 2022, Roche Diagnostics launched BenchMark ULTRA PLUS cancer diagnostic tissue staining system featuring optimized workflow, higher diagnosis efficiency, and environmental sustainability.

Key Primary Care POC Diagnostics Companies:

- Roche Diagnostics

- BD Biosciences

- Danaher Corporation

- Abbott Laboratories

- Instrumentation Laboratory

- bioMerieux

- Siemens Healthcare

- Quidel Corporation

Primary Care POC Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.79 billion

Revenue forecast in 2030

USD 26.17 billion

Growth rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Roche Diagnostics; BD Biosciences; Danaher Corporation; Abbott Laboratories; Instrumentation Laboratory; bioMerieux; Siemens Healthcare; Quidel Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Primary Care POC Diagnostics Market Report Segmentation

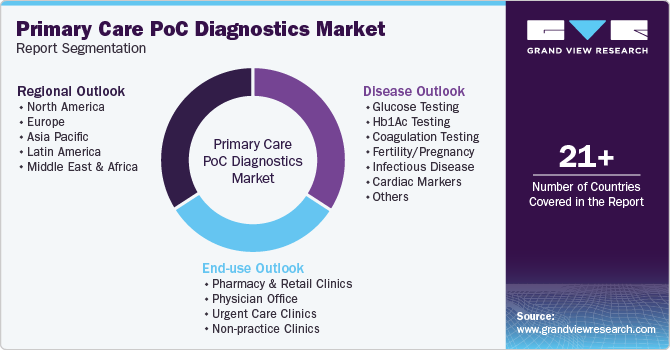

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global primary care POC diagnostics market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Glucose Testing

-

Hb1Ac Testing

-

Autoimmune Disease

-

Coagulation

-

Fertility

-

Infectious Diseases

-

Cardiac Markers

-

Thyroid Stimulating Hormone

-

Hematology

-

Primary Care Systems

-

Decentralized Clinical Chemistry

-

Feces

-

Lipid Testing

-

Cancer Marker

-

Blood Gas/Electrolytes

-

Ambulatory Chemistry

-

Drug Abuse Testing

-

Urinalysis

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacy & Retail Clinics

-

Physician Office

-

Urgent Care Clinics

-

Non-practice Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global primary care POC diagnostics market size was estimated at USD 15.3 billion in 2022 and is expected to reach USD 16.7 billion in 2023.

b. The global primary care POC diagnostics market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 26.1 billion by 2030.

b. Pharmacy & retail clinics dominated the primary care POC diagnostics market with a share of 46.9% in 2022. This is attributed to an increase in the number of people covered under healthcare plans, which has resulted in improved availability of point-of-care testing at pharmacies.

b. Some key players operating in the primary care POC diagnostics market include Roche Diagnostics, BD Biosciences, Danaher Corporation, Abbott Laboratories, Instrumentation Laboratory, bioMerieux, Siemens Healthcare, and Quidel Corporation.

b. Key factors that are driving the market growth include rapidly increasing healthcare expenditure within secondary & tertiary care and companies ensuring effective as well as unrestricted usage of point of care devices at primary care levels.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."