- Home

- »

- Water & Sludge Treatment

- »

-

Primary Water And Wastewater Treatment Equipment Market Report 2030GVR Report cover

![Primary Water And Wastewater Treatment Equipment Market Size, Share & Trends Report]()

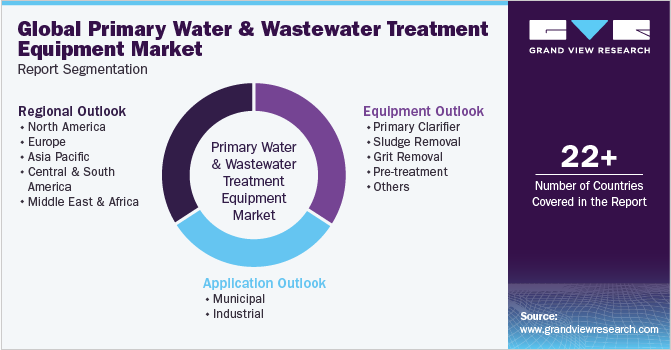

Primary Water And Wastewater Treatment Equipment Market Size, Share & Trends Analysis Report By Equipment (Primary Clarifier, Sludge Removal, Grit Removal), By Application (Municipal, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-818-3

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Report Overview

The global primary water and wastewater treatment equipment market size was estimated at USD 12.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.9% from 2023 to 2030. Rising demand for clean water has resulted in augmenting the number of water and sludge treatment plants globally, thereby driving the growth of the market. Primary water & wastewater treatment involves the separation of floating materials and heavy solids from effluent. The slurry is passed through several tanks and filters that separate water from contaminants. Low operating costs and high market visibility of the process are expected to play a crucial role in increasing the application scope of primary treatment over the forecast period.

According to the U.S. EPA, over 23,000 to 75,000 sanitary sewers overflow every year in the U.S., thereby augmenting the number of new users connected to the centralized treatment systems. The increasing number of users is expected to boost the demand for the construction of new slurry treatment plants or upgradation of existing plants, driving demand for primary water & wastewater treatment equipment in the country.

The dumping of untreated slurry into water bodies from houses, municipal facilities, and industries pollutes the water, endangering the environment as well as human and animal life. As a result, governments throughout the world have enacted strict laws and guidelines for the management of wastewater in the municipal and industrial sectors, which is predicted to stimulate market expansion.

Primary wastewater treatment includes the removal of large solids from sewage using physical techniques such as sedimentation, skimming, and screening. During the primary treatment process, around 65% of the grease & oil, over 50% to 70% of the total suspended solids (TSS), and 25% to 35% of the biochemical oxygen demand (BOD) are removed.

Several governments have implemented stringent regulations related to wastewater discharge for industrial and municipal sectors, which is expected to boost the primary water & wastewater treatment equipment market growth. Key governmental authorities such as the U.S. EPA, Central Pollution Control Board (CPCB), and European Environment Agency (EEA) play vital roles in preventing water pollution and improving the quality of the water environment.

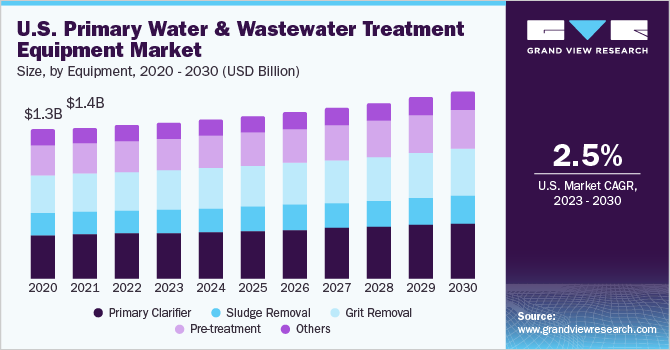

Equipment Insights

The primary clarifier segment led the market and accounted for more than 28.9% of the global revenue share in 2022 on account of the equipment’s ability to remove around 25% of the total BOD, 40% to 60% of the suspended solids, and 90% to 95% of the settleable solids in the wastewater. The adoption of primary clarifiers in the paper mills aids in removing the fiber from the waste streams aids in augmenting the demand.

Pre-treatment equipment majorly includes screening products such as bar screens, waterfall screens, coarse screens, trash racks, and others used for removing oil and grease in the wastewater. The demand for pre-treatment equipment is anticipated to witness growth due to its ability to lower the operating costs of the sludge management plants, reducing the risk of impairing the plant equipment in further stages.

Grit removal equipment is estimated to witness a CAGR of 3.8% from 2023 to 2030 in terms of revenue, owing to its ability to remove cinder, gravel, sand, coffee grounds, seeds, bone chips, and large organic particles such as food waste. Factors such as grit characteristics, the quantity of grit, space requirements, organic contents, cost, and removal efficiency are taken into consideration prior to the selection of grit removal systems.

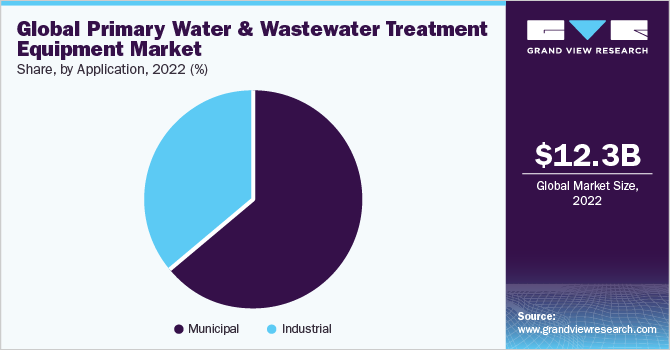

Application Insights

The municipal application segment led the market and accounted for 64.1% of the global revenue share in 2022. Factors such as growing residential construction, an increasing number of rural households switching to public sewers, rapid urbanization, and population growth are anticipated to drive demand for primary water & wastewater treatment equipment in the municipal sector.

Increasing federal funding in the wastewater management sector under the Clean Water State Revolving Fund (CWSRF) program in the U.S. is expected to drive the demand for wastewater management systems. This, in turn, is expected to have a positive impact on the primary water & wastewater treatment equipment market in the country.

Industrial applications include significant sectors such as food & beverage, chemical, pharmaceutical, pulp & paper, and oil & gas. Factors such as the presence of stringent regulations regarding sludge discharge and growing investments in various industries are expected to drive the demand for primary water & wastewater treatment equipment in the industrial sector over the forecast period.

The industrial application segment is anticipated to witness a CAGR of 4.4% in North America from 2023 to 2030 in terms of revenue. The effluent from the paper & pulp industry is characterized by high levels of suspended solids, BOD & COD from the digestion process, and chlorinated organic products from the bleaching process. Increasing the adoption of primary wastewater treatment equipment in the paper & pulp industry is expected to drive growth.

Regional Insights

The Asia Pacific dominated the market and accounted for 34.6% share of global revenue in 2022 on account of the presence of a strong consumer base in the region. The strong consumer base has led to a significant surge in demand for primary water & wastewater treatment equipment. Furthermore, improving economic conditions, a rising population, and the presence of one of the most important manufacturing sectors are expected to complement growth.

The demand for primary water & wastewater treatment equipment in India is estimated to witness growth owing to the increasing demand for more reliable supplies of municipal and industrial water. Furthermore, positive developments in the country’s economic conditions are likely to augment the growth of the primary water & wastewater treatment equipment market.

The robust presence of oil & gas reserves in Argentina, Brazil, Columbia, and Venezuela is expected to have a positive impact on the market growth in Central & South America. Furthermore, airport expansions and the development of large-scale commercial structures, especially in Brazil and Columbia, are anticipated to drive the demand for primary water & wastewater treatment equipment over the forecast period.

The demand for primary water & wastewater treatment equipment in Canada was valued at USD 352.5 billion in 2022. The presence of a supportive environment for business growth and proximity to the U.S., which are creating strong growth potential for equipment suppliers and manufacturers, is anticipated to impact the country’s market growth positively.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including mergers, product developments, new joint ventures, geographical expansions, and acquisitions to cater to the changing technological requirements and enhance market penetration across various applications such as municipal and industrial. For instance, in February 2023, Evoqua Water Technologies completed the acquisition of an industrial water treatment service division from Kemco Systems. This acquisition will help the company to expand its aftermarket services in the North America market while strengthening the company’s capability to support and serve its industrial customers. Some prominent players in the global primary water and wastewater treatment equipment market include:

-

Xylem, Inc.

-

Pentair plc.

-

Evoqua Water Technologies LLC

-

Aquatech International LLC

-

Ecolab Inc.

-

DuPont

-

Calgon Carbon Corporation

-

Toshiba Water Solutions Private Limited (TOSHIBA CORPORATION)

-

Veolia Group

-

Ecologix Environmental Systems, LLC

-

Parkson Corporation

-

Lenntech B.V.

-

Samco Technologies, Inc.

-

Koch Membrane Systems, Inc.

-

General Electric

-

Ovivo

Primary Water And Waste Water Treatment Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.6 billion

Revenue forecast in 2030

USD 16.7 billion

Growth rate

CAGR of 3.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Norway; Finland; China; India; Japan; Australia; South Korea; Brazil; Argentina; Venezuela; Saudi Arabia; UAE; Egypt

Key companies profiled

Veolia Group; Ecolab Inc.; Evoqua Water Technologies LLC; Pentair plc; Toshiba Water Solutions Private Limited; Xylem, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Primary Water And Wastewater Treatment Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and analyzes the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global primary water and wastewater treatment equipment market report based on equipment, application, and region:

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Primary Clarifier

-

Sludge Removal

-

Grit Removal

-

Pre-treatment

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Municipal

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Norway

-

Finland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

Venezuela

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global primary water and wastewater treatment equipment market size was estimated at USD 12.3 billion in 2022 and is expected to reach USD 12.6 billion in 2023.

b. The global primary water and wastewater treatment equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.9% from 2023 to 2030 and reach USD 16.7 billion by 2030.

Which region accounted for the largest primary water & waste water treatment equipment market share?b. Asia Pacific dominated the primary water and wastewater treatment equipment market with a revenue share of 34.6% in 2022. The region has a large population that requires access to clean and safe water, which has led to a high demand for primary water and wastewater treatment equipment.

b. Some of the key players operating in the primary water and wastewater treatment equipment market include Veolia Group, Ecolab Inc., Evoqua Water Technologies LLC, Pentair plc, Toshiba Water Solutions Private Limited, Xylem, Inc.

b. The key factors that are driving the primary water and wastewater treatment equipment market include the growing population, increasing water scarcity, rising industrialization, and government regulations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."