- Home

- »

- Beauty & Personal Care

- »

-

Global Probiotic Cosmetic Products Market Report, 2020-2027GVR Report cover

![Probiotic Cosmetic Products Market Size, Share & Trends Report]()

Probiotic Cosmetic Products Market Size, Share & Trends Analysis Report By Product (Skin, Hair Care), By Distribution Channel (Hypermarket & Supermarket, E-commerce), By Region (APAC, North America), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-272-8

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Consumer Goods

Report Overview

The global probiotic cosmetic products market size was valued at USD 252.5 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2020 to 2027. With the growing acceptance as a dietary supplement, probiotics have a high demand in the cosmetics segment, which is driving the market growth. Probiotic cosmetic products are useful to all skin types and can help reduce acne, rosacea, eczema, and chronic inflammation. Growing awareness about probiotic as a beneficial element and concerns regarding skin problems, such as acne, damaged skin, breakouts, eczema, rosacea flares, and psoriasis, is the key factor driving the market growth. Moreover, consumers are willing to pay a premium price for product ingredients that are proven to work for skin nourishment due to growing consciousness about physical appearance and skincare routine.

Citing these trends, many cosmetics companies are launching various products that are probiotic in nature. For instance, in January 2020, AIME skincare supplement and wellness brand launched its first probiotic-based skincare–The Simple Skin. The product range consists of probiotic skincare routine for all types of skin–The Simple Cleanser, The Simple Serum, and The Simple Cream. Many brands have realized the existence of white space in the product offering and have been addressing the market gap either through new product development or through strategic acquisition.

For instance, in October 2017, Kerry Group–a nutrition and food giant–acquired probiotic technology firm and a key player Ganeden for product portfolio expansion and to cater to a larger consumer base. In addition, most of the companies in the market have been investing in small-sized skincare businesses or startups to innovate new products and expand their current portfolio. For instance, in January 2018, Unilever invested in microbiome brand–Gallinee, by acquiring a minority stake in it. The investment is the inaugural foray into microbiome-based skincare products by Unilever group.

The Coronavirus pandemic has impacted the skincare industry severely. Store closures, stay-home policy, and lockdown measures implemented by governments across the globe have resulted in a drastic decrease in sales. One of the key observations during the pandemic is that the consumer sentiment has shifted more toward basic necessities and basic skincare routines, thereby decreasing the probiotic product demand. Also, the ongoing circumstance has goaded consumers to step back and opt for mass skincare products, which are considerably cheap and widely available across all stores.

Product Insights

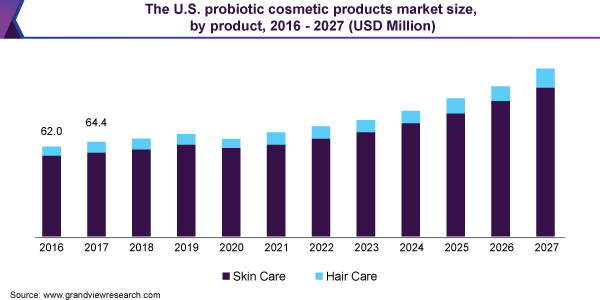

The skin care segment led the market and accounted for more than 90% share of the global revenue in 2019. Probiotics used as a relief ingredient against skin problems, such as acne, blemishes, wrinkles, and others, is the key factor driving the segment growth. Growing awareness regarding the clinically tested products and the efficacy of probiotics cosmetics adds to the segment growth. In addition, rising demand for products that will have minimal to no side effects is estimated to boost product demand in the segment.

Manufacturers have been expanding their product portfolio and bringing probiotics to the main counter shelves. For instance, in November 2019, a new startup focusing on skin microbiome launched its first beauty and cosmetics range, Naked Papaya Gentle Enzyme Face Cleanser, Supermello Hydrating Gel-Cream Moisturizer, Pimple Potion Retinal + Salicylic Acne Treatment, and the turmeric-spiked Self Reflect Probiotic Moisturizing Sunscreen. These products contain Kinbiome, a plant-based pre-probiotic, which is derived from the fermentation of lactobacillus.

The hair care segment is anticipated to register the fastest CAGR from 2020 to 2027. Growing concerns regarding hair quality, rough scalp, and hair fall align with the segment growth. Consumers have been using hair dyes, hair serums, and several other solutions to treat such issues. Product launches in this space have been a prominent factor for segment growth. For instance, in June 2019, Tela Beauty Organics by Philip Pelusi launched Probiotic scalp scrub, which is an addition to the Life Force Probiotic Haircare Collection. This scrub is used as a pre-shampoo treatment and has a blending system of probiotics.

Distribution Channel Insights

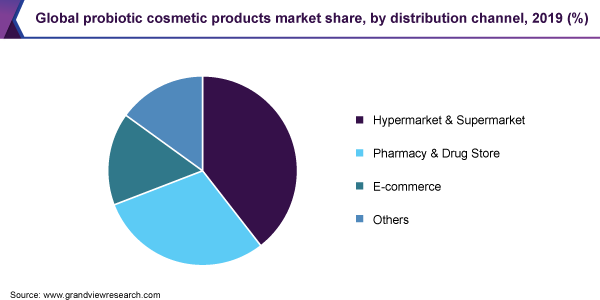

Hypermarket & supermarket dominated the market and accounted for over 39% share of global revenue in 2019. Brick and mortar stores including hypermarkets and supermarkets have been considering providing more shelf space to probiotic cosmetic products, which is driving the segment growth. Many big retailers, such as Sephora and Ulta Beauty, have been contributing to generating offline experience for customers. Sephora has a separate category for cosmetic range featuring probiotics and other supplements.

E-commerce is expected to be the fastest-growing distribution channel segment over the forecast period. The rising popularity of e-commerce channels is likely to lead to considerable growth prospects for the market. Factors, such as wider distribution network, increase in internet penetration, availability of a wide range of products, and low operating expenses, have been enticing both established and new companies to rely on this distribution channel. Online channels, such as Amazon.com, Sephora.com, Nykaa, and skinstore.com, are some of the major e-retailers of probiotic cosmetic products across the globe.

Regional Insights

North America region dominated the market in 2019 and accounted for over 34% of the global revenue share. Growing concerns regarding acne and various skin diseases are driving the probiotics cosmetics demand in the region. Prospective manufacturers have been focusing on product innovation to secure a foothold in the market. For instance, in April 2020, Estee Lauder launched Futurist Hydra Rescue Moisturizing Makeup SPF45 infused with Ion Charged Water, plus probiotic technology and chia-seed extract helping in skin hydration and natural glow.

Asia Pacific is expected to be the fastest-growing regional market over the forecast period. Factors, such as rising awareness about following healthy skin routines, product innovations, and the need for a long-term solution to skin problems, are expected to drive the regional market. Local and regional brands have been expanding their product portfolio and launching new products; for instance, in December 2019, Lotus Herbals launched a new brand called PROBITE with a premium probiotic skincare range, which includes products, such as Illuminating Radiance Crème, Illuminating Radiance Night Crème, Illuminating Radiance Sleeping Mask, Illuminating Radiance Serum + Crème, Illuminating Radiance Exfoliator, and Illuminating Radiance Cleansing Foam.

Key Companies & Market Share Insights

Key market players focus on strategies, such as innovation, new product launches, and mergers & acquisitions, to enhance their market position. For instance, in January 2017, L’Oreal announced the acquisition of three companies, CeraVe, AcneFree, and Ambi, from Valeant Pharmaceuticals International. The acquisition complemented the skincare division of L’Oréal and it would help the company to proliferate its revenues gradually. Some of the key players operating in the global probiotic cosmetic products market are:

-

Esse Skincare

-

Estee Lauder Companies, Inc.

-

Aurelia Skincare Ltd.

-

L’oreal S.A.

-

Tula Life, Inc.

-

Eminence Organic Skincare

-

Unilever

-

LaFlore Probiotic Skincare

-

Glowbiotics, Inc.

-

The Clorox Co.

Probiotic Cosmetic Products Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 242.7 million

Revenue forecast in 2027

USD 418.1 million

Growth Rate

CAGR of 6.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Germany, U.K.; France; China; India; Brazil

Key companies profiled

Esse Skincare; Estee Lauder Companies, Inc.; Aurelia Skincare Ltd.; L’oreal S.A.; Tula Life, Inc.; Eminence Organic Skincare; Unilever; LaFlore Probiotic Skincare; Glowbiotics, Inc.; The Clorox Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global probiotic cosmetic products market report on the basis of product, distribution channel, and region:

-

Product outlook (Revenue, USD Million, 2016 - 2027)

-

Skin care

-

Hair care

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Hypermarket & Supermarket

-

Pharmacy & Drug Store

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global probiotic cosmetic products market size was estimated at USD 252.5 million in 2019 and is expected to reach USD 242.7 million in 2020.

b. The global probiotic cosmetic products market is expected to grow at a compound annual growth rate of 6.5% from 2020 to 2027 to reach USD 418.1 million by 2027.

b. North America dominated the probiotic cosmetic products market with a share of 34.2% in 2019. The growing inclination of the people towards regular skincare routine and concerns regarding acne, skin diseases are some of the key driving factors for the growth of probiotic cosmetics in the region.

b. Some key players operating in the probiotic cosmetic products market include ESSE SKINCARE, Estee Lauder Companies, Inc., Aurelia Skincare Ltd., L’Oreal S.A., Tula Life, Inc., EMINENCE ORGANIC SKINCARE, LaFlore Probiotic Skincare, GLOWBIOTICS Inc., Unilever, and The Clorox Co.

b. Key factors that are driving the probiotic cosmetic products market growth include growing awareness about probiotics as a beneficial element and concerns regarding skin problems such as acne, damaged skin.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."