- Home

- »

- Consumer F&B

- »

-

Global Probiotic Drink Market Size, Share, Report, 2020-2027GVR Report cover

![Probiotic Drink Market Size, Share & Trends Report]()

Probiotic Drink Market Size, Share & Trends Analysis Report By Product (Dairy-based, Plant-based), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-201-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Consumer Goods

Report Overview

The global probiotic drink market size was valued at USD 13.65 billion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 6.1% from 2020 to 2027. The growing demand for functional beverages worldwide to improve digestive health is supporting the growth of the market over the years. Consumers are increasingly getting aware of the product and understanding its importance for their gut wellness. Furthermore, the rising health awareness among the consumers, especially young consumers, has fueled the demand for the product across the globe. Moreover, the availability of ready-to-drink products for on-the-go consumption has prompted the growth of the market.

Probiotic drink help maintain a healthy balance of stomach bacteria, leading to several health benefits, including digestive health, weight loss, and immune function. Regular consumption of the drinks improves bowel movement and nutrient absorption. Furthermore, these drinks promote mental health as several studies have proven that mood and mental health are linked with gut health. Thus, the product helps reducing depression, anxiety, obsessive-compulsive disorder (OCD), and autism. In addition, the products may boost the immune system by promoting the production of natural antibodies in the human body.

The increasing awareness about the health benefits of the product has been fueling its adoption among the consumers. As per a survey conducted by Kerry Group, more than 75% of the consumers in the U.S. and over 50% of consumers worldwide are aware of the digestive health benefits associated with the product. Google searches for “microbiome” increased by 267% from 2014 to 2019. Thus, the demand for probiotic drink has been rising with the growing health consciousness among consumers.

The manufacturers of probiotic drinks have been introducing innovative products with different flavors and attractive packaging. However, choosing a substantial strain can be challenging for the manufacturers as performance levels vary with the other strains. Lactobacillus and Bifidobacterium are the most common strains used for the production of these products. Though, Bacillus is also gaining traction among the producers as it can be utilized in most extreme production processes.

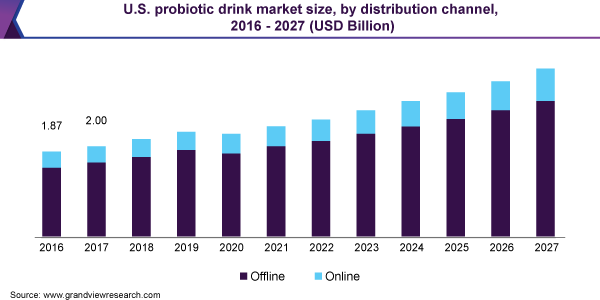

Distribution Channel Insights

The offline channel segment led the market and accounted for more than 85.0% of the global revenue in 2019. Supermarkets, hypermarkets, and convenience stores are the key offline distribution channels in the market. The increased shelf space in the physical stores, including supermarkets, convenience stores, grocery stores, health food stores, and pharmacies, has boosted the sales of these beverages over the world.

Online channel is expected to expand at the fastest CAGR of 6.7% from 2020 to 2027. The increasing number of online retailers who offer competitive pricing, easy payment options, and hassle-free delivery is fostering the segment growth. In addition, the growth can be attributed to the increasing experience and dependency of the younger generation on the internet and e-commerce. Furthermore, the high penetration of smartphones among the middle-class population across the globe is expected to boost the sales of these drinks via online platforms over the coming years.

Product Insights

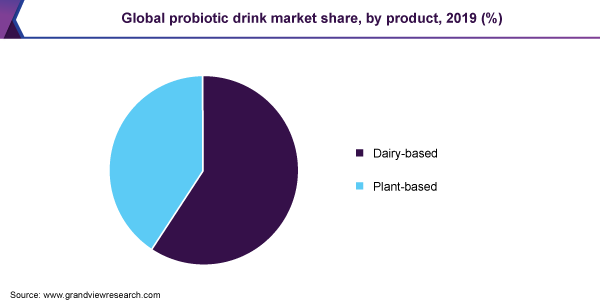

Dairy-based products held the largest revenue share of more than 55.0% in 2019. Traditionally, probiotic drinks are associated with fermented dairy drinks or yogurt-based drinks as probiotics are very compatible with dairy products. Some of the traditional or regional dairy-based drinks are gaining popularity across the globe. For instance, Kefir, a fermented milk drink, traditionally consumed in Europe, is gaining popularity over the world. As reported by Food & Drink International in February 2020, Tesco plc, an international supermarket, has witnessed a demand growth of 400% for Kefir in the U.K. in the last 18 months. Key manufacturers including Yakult Honsha Co., Ltd., Danone S.A., and GCMMF (Amul) offer a range of milk-based products.

The plant-based product segment is expected to witness the fastest growth over the forecast period. Over the past few years, the demand for plant-based drinks, including probiotic fruit and vegetable juices, is increasing significantly. The increasing number of lactose-intolerant people and growing concerns over animal cruelty in the food and beverage industry have been driving the segment.

Companies such as KeVita (PepsiCo), Goodbelly (NextFoods), and Harmless Harvest offer exclusively plant-based probiotic drinks. Kombucha tea is one of the most trending beverages, which has been gaining traction among consumers. In April 2020, Neuro, a beverage company, introduced probiotic kombucha tea, Probucha. This product is a carbonated drink flavored with lemon and ginger and cultured with Bacillus subtilis bacteria.

Regional Insights

The Asia Pacific accounted for the largest share of more than 40.0% in 2019. China, Japan, and India are the key markets in the region. According to the International Probiotics Association (IPA), China is one of the most important markets for probiotics in the world. Producers and suppliers have been witnessing a significant increase in sales in the nation. Yogurt-based probiotic drinks are significantly prevalent in the region.

Central and South America is expected to expand at the fastest CAGR of 7.2% from 2020 to 2027. The functional beverage market is one of the fastest-growing markets in the region. As of 2019, Brazil contributed more than half of the sales in the region. Furthermore, increasing middle-class population, rising health concerns, and expanding availability of the probiotic drinks are expected to fuel the demand for the product in the region in the upcoming years.

Key Companies & Market Share Insights

The industry is characterized by intense competition on account of the presence of major market players. Manufacturers have been introducing new flavors, attractive packaging, and organic ingredients to gain a competitive advantage over others. In November 2017, AliveBiome, a U.K.-based food, and beverage specialist company, launched a new probiotic beverage that offers live bacteria, botanicals, and vitamins. This probiotic drink is available in citrus and raspberry flavors and packaged in 375ml bottles. Similarly, in July 2020, Chobani, LLC. launched a new plant-based organic beverage made with fermented fruit juice and oats. These beverages are available in vanilla, mixed berry vanilla, banana cream, and strawberry cream flavors. Some prominent players in the global probiotic drink market include:

-

Yakult Honsha Co., Ltd.

-

Danone S.A.

-

GCMMF (Amul)

-

PepsiCo

-

NextFoods

-

Harmless Harvest

-

Bio-K Plus International Inc.

-

Fonterra Co-operative Group

-

Lifeway Foods, Inc.

-

Nestle SA

-

Chobani, LLC

Probiotic Drink Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 13.38 billion

Revenue forecast in 2027

USD 21.95 billion

Growth Rate

CAGR of 6.1% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; Japan; Brazil; South Africa

Key companies profiled

Yakult Honsha Co., Ltd.; Danone S.A.; GCMMF (Amul); PepsiCo; NextFoods; Harmless Harvest; Bio-K Plus International Inc.; Fonterra Co-operative Group; Lifeway Foods, Inc.; Nestle SA; Chobani, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global probiotic drink market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Dairy-based

-

Plant-based

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global probiotic drink market size was estimated at USD 13.65 billion in 2019 and is expected to reach USD 13.38 billion in 2020.

b. The global probiotic drink market is expected to grow at a compound annual growth rate of 6.1% from 2020 to 2027 to reach USD 21.95 billion by 2027.

b. Asia Pacific dominated the probiotic drink market with a share of over 40% in 2019. This is attributable to rising health concerns coupled with the increasing middle-class population in the region.

b. Some key players operating in the probiotic drink market include Yakult Honsha Co., Ltd., Danone S.A., GCMMF (Amul), PepsiCo, NextFoods, Harmless Harvest, Bio-K Plus International Inc., Fonterra Co-operative Group, Lifeway Foods, Inc., and Nestle SA.

b. Key factors that are driving the probiotic drink market growth include growing demand for functional beverages, rising health awareness among the consumers, and the availability of ready-to-drink products across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."