- Home

- »

- Next Generation Technologies

- »

-

Professional Services Automation Software Market Report 2030GVR Report cover

![Professional Services Automation Software Market Size, Share, & Trends Report]()

Professional Services Automation Software Market Size, Share, & Trends Analysis Report By Component, By Solution, By Services, By Deployment, By Enterprise Size, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-790-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

Market Size & Trends

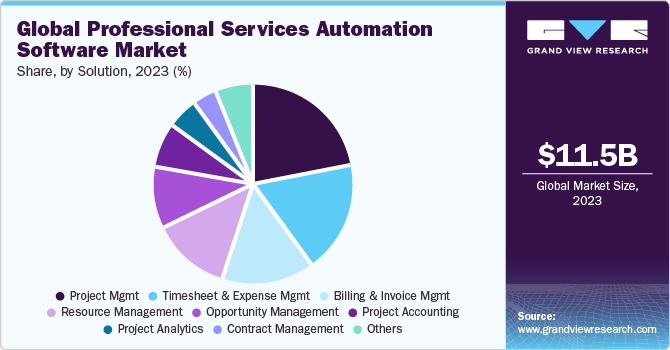

The global professional services automation software market size was valued at USD 11.52 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 11.9% from 2023 to 2030. Shifting various organizations' focus on digitizing business operations for improvement in operational visibility and business process efficiency is anticipated to drive Professional Services Automation (PSA) software across the globe. Furthermore, PSA's various advantages, such as enriched customer experience, revenue leakage reduction, and enhanced forecasting capability, are accelerating the sale of PSA solutions.

Moreover, professional services in SaaS companies are witnessing notable growth due to the sector's unique operational requirements. PSA software plays a pivotal role in optimizing project management, resource allocation, and overall efficiency, contributing to the success and sustainability of SaaS businesses.

The COVID-19 pandemic positively affected the professional services automation software market owing to a surge in remote working practices and hybrid projects. The companies adopted PSA software across their business models for balancing integrated project delivery, higher project profitability, and efficient project resource utilization amid the pandemic. Professional services automation software’s fundamental functions are project management, resource allocation, invoice & expense management, and automated billing.

This software also plays a vital role in profit margin expansion, automating various time-consuming tasks, and establishing robust communication between internal stakeholders of the business, supporting market growth. Additionally, PSA solutions create a unified platform enabling teams to efficiently collaborate and complete the given task or projects in minimum time. Most governments focus on digitalizing their economic operations, which is anticipated to create robust market opportunities for professional services automation software. Various governments, such as Canada, India, Germany, and Saudi Arabia, are supporting regional market players to accelerate economic growth.

For instance, in March 2022, the Government of Canada established Canada Digital Adoption Program (CDAP) with an investment of USD 4 billion to assist small and medium-sized enterprises (SMEs) in adopting digital technologies. Under this program, the SMEs will receive USD 2,400 microgrant to cover the costs related to their e-commerce business such as social media advertising, website development, and other automated web actions. The rising implementation of professional services automation software across the globe encourages industry participants to invest in R&D activities for innovations and increase their brand value.

Market players such as NetSuite OpenAir, Inc., ProductDossier Solutions, and Microsoft Corporation are highly emphasizing expanding their consumer base to accelerate their market revenue. For instance, in March 2022, ProductDossier Solutions announced that it had signed an agreement with multiple companies to implement its flagship professional services automation software TouchBase. The company’s new customer base includes Tiger Analytics, Aujas Cyber Security, Hical Technologies, and Tata Communications. Lack of awareness and high implementation costs of professional services automation software are two main factors challenging the market growth.

The company needs to spend significantly on training sessions for the employees after the implementation of this software across organizations, contributing to high operational costs. Furthermore, evolving digital threats pose an immense threat to cloud-integrated PSA solutions. These digital threats can manipulate the data, steal it, and affect the overall business processes, hampering industry statistics. Industry players are partnering with digital security firms to improve their software capability to defend against evolving digital threats.

Market Concentration & Characteristics

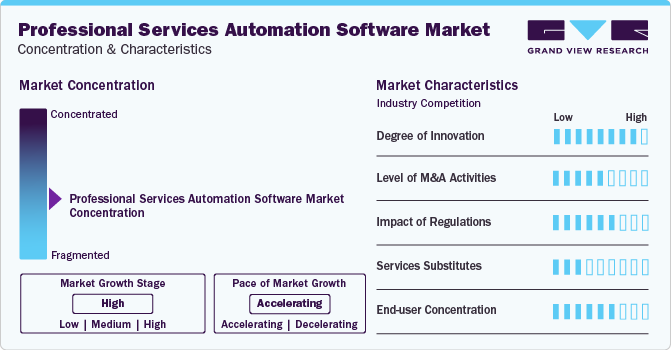

The growth of the professional services automation software market is high, and the growth’s pace is accelerating. Professional services automation (PSA) software is designed to assist businesses in managing and automating various business processes, including resource planning, HCM, and financial management. Thus, organizations are significantly adopting PSA software for automating resource management, expense management, billing & invoicing, contact management, and other business processes.

Businesses are actively investing in adopting PSA software, which is helping companies in reducing manual administrative work that causes errors and additional time in completing processes that can be used for more valuable tasks and better client engagement. Further, PSA software also assists businesses in improving transparency across their sales, administration, planning, and budgeting processes with real-time visibility about the ongoing backlogs and projects on hold. Based on this data information, businesses can make calculated decisions related to monthly revenue, labor costs, and hours of work, among others.

The market is witnessing a high level of merger and acquisition (M&A) activity by major players. For instance, in August 2023, IBM Corporation, an AI, automation, and cloud solution provider, announced the acquisition of Apptio Inc., a professional services automation software provider. IBM Corporation aimed to assist businesses by providing simplified, automated, and integrated solutions amidst the rising investments by businesses in IT investments, increased workloads, and growing applications across public and private clouds. Thus, with the help of this acquisition IBM Corporation will help businesses in automated processes, improve operations, optimize their IT spending, and drive greater financial returns.

Governments and local authorities are taking significant initiatives to drive the growth of software industries, thereby encouraging companies to invest in their region and countries, provide employment opportunities to locals, develop innovative solutions, and increase their regional customer base. For instance, the Indian government has launched a series of initiatives under the Digital India Scheme, such as establishing Centres of Entrepreneurship and Software Technology Parks along with providing sector-specific incentives to boost the growth of the software market in the country.

The software solutions provided by professional services automation businesses do not have any direct substitutes. Moreover, the rising demand for industry-specific PSA solutions has led to a significant rise in the competition. The availability of differentiated and customized solutions and the unavailability of alternatives contribute to the low threat of substitutes for the market.

The application of professional services automation software is spread across various companies and verticals, including consulting firms, technology companies, architecture and construction companies, audit and accounting firms, and legal services firms. Services organizations demand collaboration among various team members and departments for driving successful projects and automating business processes. Thus, it ensures greater visibility across the projects and their status and establishes effective communication among the various departments, including resource planning, HCM, finance, sales, accounting, and service delivery.

Application Insights

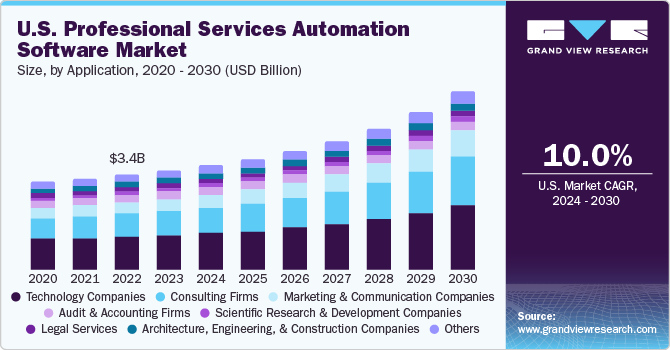

The technology companies segment acquired a higher market share which is valued at USD 4,966.7 million in 2022. Technology solutions providers use PSA solutions in their development process to decrease their solutions’ time to market and establish a transparent business model. Various PSA solution providers for technological companies are emphasizing mergers and collaborations to improve their PSA service offering to target a larger potential audience. For instance, in April 2021, Kohlberg Kravis Roberts & Co. (KKR) backed Exact and acquired Gripp, a professional services automation solution provider. Gripp's strong client network in the Netherlands, Belgium, Luxembourg, and Spain will assist Exact in improving its market share in Europe’s PSA market.

The marketing and communication companies’ segment is expected to expand at a CAGR of 13.9% through 2030. This segment is anticipated to register the highest CAGR through 2030. PSA solutions developers are launching their new PSA innovations in the market for various communications & marketing applications is anticipated to drive the segment growth in the forecast period. For instance, in April 2019, Upland Software introduced the Upland Professional Services Automation solution equipped with Upland WorkCenter to provide key performance indicators (KPIs) information in one unified dashboard. This Upland Professional Services Automation software is a cloud-based solution that provides insights through its pre-integrated data analytics tools and assists in critical decision-making in marketing.

Deployment Insights

Professional services automation on-premise software deployment accounted significant market share of around 52.5% in 2022. On-premise PSA solutions offer robust data security & privacy and are less vulnerable to digital threats, driving the segment growth. Moreover, on-premise, PSA solutions can perform their work and provide safe access to the data even if the internet connection is interrupted due to its local data storage system. Market players are participating in various exhibitions to advertise their on-premise PSA solutions to improve their brand identity. For instance, in October 2021, work & portfolio management solutions provider Plainview, Inc. showcased its latest professional services automation on-premise software at Technology & Services World (TSW) 2021 in Las Vegas, Nevada, organized by Technology & Services Industry Association (TSIA).

The cloud segment is expected to register a CAGR of 14.7% from 2023 to 2030. Cloud-based PSA solutions provide various benefits such as quick deployment, support for remote work management, unlimited storage capacity, and reduced Total Cost of Ownership (TCO) & CAPEX costs, driving the segment growth. Industry participants such as Kimble Applications, Projector PSA, and SAP SE are emphasizing establishing strategic partnerships to improve their cloud-based professional services automation software portfolio. For instance, in November 2021, cloud-based PSA solution provider Kimble Applications collaborated with professional cloud platform service company Infor in delivering professional services automation software with improved financial solutions to its clients through cloud integration.

Enterprise Size Insights

The large enterprise segment held the largest market share of around 58.5% in 2022. These enterprises are major consumers of professional services automation solutions due to low operating costs, enhanced consumer experience, better team collaboration, and reduced workforce costs. These large enterprises majorly sign a long-term partnership with professional services automation software providers to optimize the software costs and enable their employees to become familiar quickly with the PSA solutions. The market players are establishing strategic partnerships to improve their service offerings and attract large enterprises. For instance, in March 2022, Nividous Software Solutions collaborated with Damco Solutions to streamline core and non-core business processes of various industries using intelligent automation processes.

Small and medium-sized enterprises (SMEs) are expected to register a substantial CAGR of 13.6% through 2030 owing to flexible pricing options offered by professional services automation software vendors and strengthening their business operations to compete with larger firms. Integration of professional services automation software in SMEs assists companies in improving the consumer experience, reducing products & services’ time to market, and boosting employee productivity. Emerging startups and SMEs are focusing on establishing a strategic partnership with key market players for the adoption of professional services automation software. For instance, in November 2019, the software company Aptivio Inc. collaborated with Oracle Corporation to automate sales processes using Oracle professional services automation software and a cloud platform.

Solution Insights

The project management segment is anticipated to dominate the market with a share of more than 25% through 2030. Professional services automation software usage in project management solutions is rapidly increasing owing to their various benefits, such as reducing overhead costs, faster completion, and efficient team management. Industry participants are unveiling their PSA software solutions to help clients in efficient project management. For instance, in July 2021, Logic Software Inc. introduced a professional services automation platform, Birdview PSA, equipped with analytical tools to assist clients in managing each project stage and improve the project's overall profitability. BirdView PSA helps in various project lifecycle stages such as planning, execution, delivery, development, control & monitoring, project accounting, and optimization.

The business analytics segment is expected to register a CAGR of 14.0% through 2030. Shifting various companies' focus toward making data-driven decision-makings for profitable business outcomes is anticipated to drive segment growth. Companies such as Dynatrace, Inc. and Salesforce, Inc. are focusing on introducing their new products to attract potential business clients and improve their market share. For instance, in October 2022, Dynatrace, Inc., a software Intelligence Company, launched Grail core technology for its Dynatrace software intelligence platform to power log management and analytics. With this new technology, the data and its security can be monitored more efficiently through multi-cloud environments.

Regional Insights

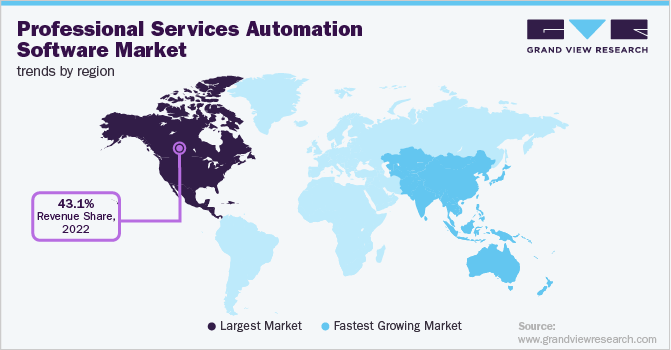

North America held the highest market share of USD 4,651.8 million, which is 43.1% market share in 2022. Integration of advanced technologies such as Artificial Intelligence (AI) & Machine Learning (ML) and new solution introduction by market players are creating positive traction for PSA solutions in North America. Furthermore, the presence of established market players such as Appirio, Inc., Salesforce, Inc., Oracle Corporation, Upland Software, and NetSuite OpenAir, Inc. in the region is further driving the market growth.

Market players are launching new products to achieve higher profitability and increase their customer base in this potential region. For instance, in December 2022, Salesforce, Inc. introduced Automation Everywhere Bundle to accelerate automation across any system and end-to-end workflow orchestration using AI and embed data technology.

Europe Professional Services Automation Software Market

Europe's professional services automation software market was estimated to hold a market share of approx. 23% in 2022 in the global market. The growth of the professional services automation software market can be attributed to companies expanding their operations to Europe, which has enabled customers access to advanced automation software solutions for professional services. For instance, in August 2023, after announcing the opening of a new hub in Amsterdam, the Dutch capital, Ofi has now extended its services throughout the Benelux region and the wider European market. Amsterdam is the seventh office for Ofi globally. Bogotá, Quito, Santiago, Sao Paolo, Mexico City, and New Orleans are the locations of further offices. The company employs more than 100 consultants.

U.K. Professional Services Automation Software Market

The U.K. professional services automation software market is expected to register a growth rate of around 12% over the forecast period ending in 2030. The growth of the professional services automation software market in the U.K. can be attributed to factors such as increasing partnerships in the region undertaken by various companies operating in the country. For instance, in May 2023, Pro2col and Coviant Software collaborated to launch Diplomat MFT in the U.K. and other European markets. With this new cooperation, Pro2col will take the lead in increasing the exposure and reach of Diplomat MFT throughout Europe and the U.K., drawing on the solid knowledge that the firm has built over two fruitful decades of operation.

Germany Professional Services Automation Software Market

Throughout the projection period ending in 2030, the German professional services automation software market is expected to develop at a CAGR of more than 12%. A number of factors, including increased automation and digitalization, better internet infrastructure, the need for mobility, the requirement for real-time project visibility, and the growing popularity of cloud-based solutions, have contributed to the expansion of the professional services automation software market.

France Professional Services Automation Software Market

France's professional services automation software market was estimated to grow significantly over the forecast period. The growth of the professional services automation software market in France can be attributed to factors such as quick deployment, remote work management capability, unlimited storage capacity, and reduced TCO and CAPEX costs, among others.

Asia Pacific Professional Services Automation Software Market

Asia Pacific's professional services automation software market is anticipated to register the highest CAGR of around 14.0% through 2030 owing to increasing digitalization and emerging professional services automation startups in the region. The rising adoption of online service delivery and cloud integrations are playing a vital role in contributing to industry growth. Regional key players are focusing on expanding their professional services automation solutions portfolio and strengthening their R&D operations. For instance, in November 2022, an IT company, Wipro Limited introduced Wipro Data Intelligence Suite, to allow its clients an end-to-end automated cloud migration.

China Professional Services Automation Software Market

China's professional services automation software market was estimated to grow at the fastest rate of around 17% over the forecast period. The growth of the professional services automation software market in China can be attributed to increased partnerships/collaborations among key companies in the market. For instance, in December 2023, Salesforce and Alibaba Cloud announced a significant integration of Salesforce's Sales Cloud, Service Cloud, and Platform. With effect from December 18, 2023, this calculated action would fundamentally alter the business environment for international corporations operating in China's mainland.

India Professional Services Automation Software Market

India's professional services automation software market was estimated to be valued at USD 257 million in 2022. The growth of the professional services automation software market in India can be attributed to businesses increasingly digitalizing and automating their processes, increased demand for automation services and reduction in overall costs, and growing need for scalable and flexible professional services automation solutions.

Japan Professional Services Automation Software Market

Japan's professional services automation software market was estimated to be valued at USD 632.3 million in 2022. The growth of the professional services automation software market in Japan can be attributed to expansion activities carried out by the companies operating in the market. For instance, in May 2023, Swimlane announced the launch of its latest office in Tokyo, Japan, as well as the availability of Swimlane Turbine throughout the Asia-Pacific Japan (APJ) area. The implementation demonstrates Swimlane's expansion and commitment to enabling partners and clients in Japan to use automation outside of the SOC and establish a system of record for security operations.

Middle East & Africa Professional Services Automation Software Market

Middle East & Africa professional services automation software market was expected to hold a market share of approx. 5.5% in 2022 in the global professional services automation software market. The growth of the professional services automation software market in the Middle East & Africa can be attributed to expansion activities carried out by some of the key companies operating in the region. For instance, in November 2023, OnviSource declared its intention to enter the thriving African market strategically. In OnviSource's quest to offer contact center and enterprise solutions to an even wider global audience, this momentous step represents a critical turning point. With an increasing focus on providing outstanding customer experiences, Africa has become a hotspot for outsourcing, and OnviSource is well-positioned to be a key player in accomplishing this objective. The company's debut in the African market coincides with a rise in the sophistication and quantity of contact center and BPO services.

Saudi Arabia Professional Services Automation Software Market

Saudi Arabia’s professional services automation software market was expected to witness significant growth in the market during the forecast period. The growth of the professional services automation software market in Saudi Arabia can be attributed to factors such as increased demand for AI in operational efficiency, growing need for automation services, reduction in overall costs, availability of cloud-based PSA solutions, and time tracking and access to historical and real-time data capability.

Key Professional Services Automation Software Market Company Insights

Some of the key players operating in the market include Microsoft Corporation, SAP SE, and Oracle Corporation.

-

Microsoft Corporation offers PSA software to support the existing legacy system and tools to help businesses manage client engagements across the entire project lifecycle. The PSA software offered by the company centralizes various critical operations to manage better, adjust, and pivot professional business operations such as financial planning, project management, resource management, and expense management.

-

SAP SE is a technology software and service provider that helps professional service providers manage projects, finances, resources, and operations more effectively. Thus, it helps minimize risk, boost customer satisfaction, enhance operational processes, and utilize resources more effectively.

-

PROJECTOR PSA, BMC Software, Inc., and NetSuite OpenAir, Inc. are some of the emerging market participants in the professional services automation software market.

-

PROJECTOR PSA is a project accounting software company that empowers service companies to focus on project accounting and revenue recognition. Further, the software also customizes expense and time approval workflows, automates email requests for missing timesheets, and triggers notifications for pending approval and reviews.

-

NetSuite OpenAir, Inc. is a professional services automation software company that helps businesses in budgeting, forecasting, staffing, and billing operations. The software also automates professional services companies’ processes across the entire project lifecycle.

Key Professional Services Automation Software Companies:

The following are the leading companies in the professional services automation software market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these professional services automation software companies are analyzed to map the supply network.

- Autotask Corporation

- Atlassian

- BMC Software, Inc.

- ConnectWise, Inc.

- Deltek, Inc.

- FinancialForce.com

- Kimble Apps

- Klient, Inc,

- Microsoft Corporation

- NetSuite OpenAir, Inc.

- Oracle Corporation

- Planview

- PROJECTOR PSA

- SAP SE

- Upland Software, Inc.

- Workday, Inc.

- Comp15

Recent Developments

-

In April 2023,Workday, Inc. a financial management, HCM, and student information system software company partnered with Dayshape, a resource management software solution company, to provide strategic assistance to professional services businessesin the areas of resource management. Thus, it is expected to drive better planning, estimation, enhance performance management, and greater profitability.

-

In May 2023, Deltek, Inc., a professional services automation software provider announced the acquisition of Replicon, a unified time tracking software that brings together finance, human resource, and project delivery on a single platform. Thus, acquisition is aimed at enhancing Deltek, Inc.’s portfolio of enterprise software, professional service automation, and information solutions for project-based businesses.

-

In July 2023, Klient, Inc, a professional services automation platform announced strategic partnership with Sage Intacct a cloud-based accounting and financial management software provider to revolutionize the operational and financial operations of businesses. The integration among professional services automation and accounting solutions will establish data flows accurately and effortlessly and from one platform to the others, Thus, helps in eliminating the error-prone and time-consuming process of manual data entry.

Professional Services Automation Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.52 billion

Revenue forecast in 2030

USD 25.25 billion

Growth Rate

CAGR of 11.9% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, Solutions, Services, Deployment, Enterprise Size, Application, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, U.K., Germany, Italy, France, China, Japan, India, Singapore, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, and South Africa

Key companies profiled

Autotask Corporation; Atlassian; BMC Software, Inc.; ConnectWise, Inc.; Deltek, Inc.; FinancialForce.com; Kimble Apps; Klient, Inc; Microsoft Corporation; NetSuite OpenAir, Inc.; Oracle Corporation; Planview; PROJECTOR PSA; SAP SE; Upland Software, Inc.; and Workday, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Professional Services Automation Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global professional services automation software market report based on component, solutions, services, deployment, enterprise size, application, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Services

-

-

Solutions Outlook (Revenue, USD Billion, 2018 - 2030)

-

Project Management

-

Project Accounting

-

Billing & Invoice Management

-

Resource Management

-

Timesheet & Expense Management

-

Project Analytics

-

Opportunity Management

-

Contract Management

-

Others (Knowledge Management and Others)

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

System Integration Services

-

Consulting

-

Training and Support

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consulting Firms

-

Marketing and Communication Companies

-

Technology Companies

-

Architecture, Engineering, and Construction Companies

-

Audit and Accounting Firms

-

Scientific Research and Development Companies

-

Legal Services

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Singapore

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

UAE

-

Frequently Asked Questions About This Report

b. The global professional service automation software market size was estimated at USD 10,796.7 million in 2022 and is expected to reach USD 11.52 billion in 2023.

b. The global professional service automation software market is expected to witness a compound annual growth rate of 11.9% from 2023 to 2030 to reach USD 25.25 billion by 2030.

b. The large enterprise segment accounted for the largest PSA software market share in 2022 with a share of more than 55% in 2022. These enterprises are major consumers of professional services automation solutions due to enhanced consumer experience, reduced workforce costs, better team collaboration, and low operating costs.

b. Autotask Corporation, BMC Software, Inc., ConnectWise, Inc., Deltek, Inc., FinancialForce.com, Kimble Apps, Microsoft Corporation, NetSuite OpenAir, Inc., Oracle Corporation and Planview are some of the major industry players in this domain.

b. An increasing need for operational efficiency in professional services firms is expected to propel the PSA software market over the forecast period. In addition, the increasing sprawl of cloud deployment is also aiding market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."