- Home

- »

- IT Services & Applications

- »

-

Property Management Software Market Size Report, 2030GVR Report cover

![Property Management Software Market Size, Share & Trends Report]()

Property Management Software Market Size, Share & Trends Analysis Report By Deployment (Cloud, On-premise), By Solution (Software, Services), By Application (Residential, Commercial), By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-053-5

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

The global property management software market size was valued at USD 4,473.3 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2023 to 2030. The market is expected to notice a cumulative surge in demand for Property Management Software (PMS) owing to escalating demand for web-based services, including software as a service (SaaS) by PMS providers. SaaS-enabled PMS allows managing daily operations, including building maintenance, accounting, and tenant tracking. The software provides a centralized platform to view all the properties and enables supervision of other property-related operations, such as maintenance tasks and addressing tenants' requirements. It mainly offers online document storage and sharing, financial reporting, electronic lease agreements, accounting capabilities, online maintenance tracking, and integrated banking, among other applications.

In recent years, PMS solutions have shifted from manual to automatic management. The automated PMS solutions have improved the property management software system, thereby diminished human errors and allowing property managers to assign tasks efficiently to avoid interruptions in service. An automatic PMS helps reduce the time taken to respond to complaints and grievances from tenants or owners. Also, it simplifies property management procedures by facilitating rent collection processes, lowering communication gaps, tracking finances, and storing and leasing documents and contracts, among others.

Whereas, in traditional ways of property management, the data is documented manually using Notepad, Microsoft Excel, or other spreadsheets, which makes the process slow, inefficient, and prone to errors. Also, landlords either manage their estate themselves or hire third-party property managers, which involves more workforce and time investment. Thus, property management software was formed to evade human errors and streamline work through automation. The easy availability of property management software has automated and simplified the work of owners and estate managers. Moreover, PMS solutions and computer record-keeping have significantly augmented the productivity of hospitality industries by updating and centralizing multiple computers and device records. Also, PMS solutions can be customized as required by the hotel and hospitality industries to further enhance ease of operations, including check-in and check-out, hotel inventory supply management, bookings automation, Point of Sale (POS) integration, food and beverage costing, security and room locks, and reporting of Key Performance Indicators (KPI).

Moreover, the advent of cloud technology is one of the key advances in the software industry. Cloud technology has significantly changed the way software applications are operated and provided to end-users. This shift has allowed software developers to concentrate on the technology feature of software while outsourcing the management feature to cloud service companies. SaaS software enables multifamily property management enterprises to efficiently integrate PMS across the portfolio. SaaS platforms facilitate property managers to incorporate advanced payment solutions with their PMS solutions for efficient and steady transactions.

COVID-19 Impact on the Property Management Software Market

In the wake of the COVID-19 outbreak, there has been a significant disturbance in most industries worldwide. While a few industries underwent a contraction in their productions and businesses, others encountered severe consequences, such as the shutdown of businesses and movement restrictions. However, during the pandemic, the real estate industry experienced both a surge and a decline. In the initial pandemic phases (Q1 & Q2), property managers, real estate companies, and property owners were primarily concerned with keeping visitors and tenants safe and adhering to governmental laws and regulations. As a result, it decreased real estate property sales. The pandemic allowed property managers to introduce and use new automation tools like AI-enabled PMS. The management tool enabled by AI collects the data via Wi-Fi and automatically responds to leads, reducing operational risks and improving customer service.

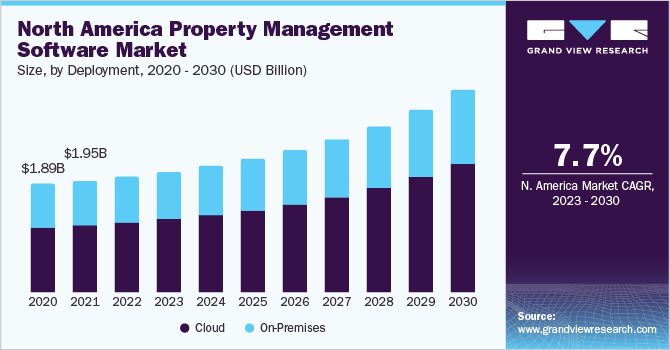

Deployment Insights

The cloud segment accounted for the largest revenue share of 60.3% in 2022 and is expected to continue its dominance over the forecast period. This is attributable to the growing adoption of cloud deployment among various end-users, including property managers, housing associations, and corporate occupiers, among others. Factors such as scalability, cost-effectiveness, ease of use, and fewer tenant disputes are encouraging small, medium, and large enterprises to shift toward cloud-based property management solutions. Also, cloud-based PMS software offers a backup facility and seamless data integration, which helps in preventing data loss. Besides, it also saves property managers indirect costs of money recovery as well as direct costs included in automating a labor-intensive procedure.

The on-premise deployment segment is expected to register considerable growth over the forecast period. This is attributable to the associated benefits, including ownership and control over hardware and a high level of data security than cloud-based PMS software. Also, on-premise PMS offers customization as per business or user needs. The benefits mentioned above of on-premises deployment contribute to the growth of the segment over the forecast period.

Solution Insights

The software segment accounted for the largest revenue share of 61.9% in 2022 and is anticipated to continue its dominance over the forecast period. The COVID-19 pandemic accelerated digital transformation, prompting property management businesses to adopt streamlined solutions for centralized operations. Robust software platforms are essential due to the increasing complexities of property management, providing automation, data analytics, and remote access capabilities. This growth is further fueled by property managers' recognition of software's competitive advantages, driving investments to enhance tenant experiences, occupancy rates, and resource allocation.

The services segment accounted for a revenue share of 38.1% in 2022 and is expected to witness the fastest CAGR of 8.6% over the forecast period. This is attributable to the increasing need for specialized expertise in managing complex property tasks. Service providers offer tailored solutions for legal compliance, tenant relations, marketing, and strategic planning, addressing the multifaceted nature of property management. This segment not only provides industry insights and a human touch but also enhances software platforms through training, customer support, and customization, contributing significantly to its remarkable growth.

End-user Insights

The property managers/ agents segment accounted for the largest revenue share of 37.4% in 2022. This is attributable to rising commercial and residential properties worldwide. Also, PMS helps property managers and agents to have track of all the properties along with necessary maintenance work. Thus, this evolving trend of workplace mobility is propelling market growth.

The housing associations segment accounted for a revenue share of 30.4% in 2022 and is expected to witness considerable growth over the forecast period. This is attributable to a few challenges faced by apartments and townships, including receiving payments, leasing agreements, and tracking tenants, among others. However, all these challenges have compelled market players to provide solutions for inspections, tracking payments, transparent and comprehensive reporting, and maintenance. Affordable housing using PMS allocates accurate rent payments depending on the amount paid by the tenant compared to government payment.

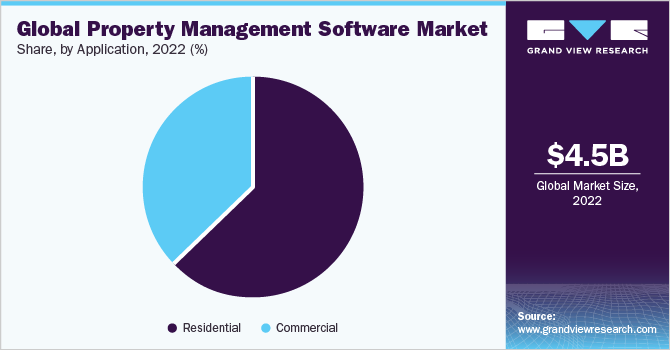

Application Insights

The residential segment accounted for the largest market share of 65.7% in 2022 and is expected to continue its dominance over the forecast period. This is attributable to increasing investments in real estate. The residential segment is further distributed into sub-segments, namely multi-family housing/ apartments, single-family housing, and others. The commercial segment is expected to register considerable growth over the forecast period.

The growing commercial sector across the globe is one of the major factors propelling market demand. The rising cyber risk management, growing disposable income, and changing consumption technologies, among others, are other factors expected to fuel investments in the commercial sector, thus driving the PMS market growth. Moreover, the commercial segment comprises various sub-segments, namely retail spaces, office spaces, hotels, and others. PMS has become an essential tool in the hotel management industry. It helps in handling the interface of numerous departments within a hotel to manage the estate or land effectively. Also, it helps in automating hotel operations such as guest bookings, guest details, materials management, online reservations, food and beverage costing, point of sale, accounts receivable, HR and payroll, maintenance management, sales and marketing, quality management, and other amenities.

Regional Insights

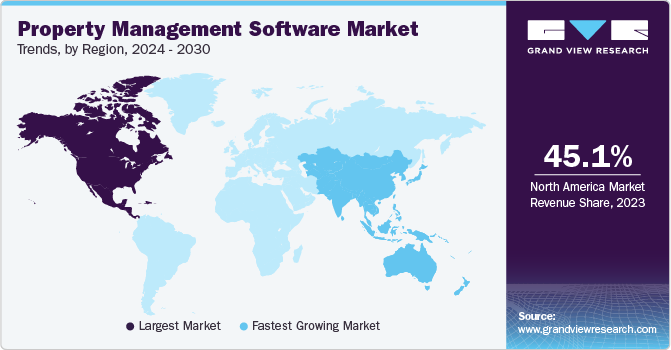

North America region accounted for the largest revenue share of 45.2% in 2022. This is attributable to the presence of prominent players in the region, including AppFolio, Inc.; Entrata, Inc.; MRI Software LLC; and Yardi Systems Inc. The U.S. dominates the region, owing to an increasing number of hotel spaces in the country. Europe accounted for the second-largest market share in 2022. The growth can be attributed to the rising presence of a considerable number of residential and commercial buildings, along with a high degree of digitalization in the region.

The Asia Pacific region is expected to emerge as the fastest-growing region, registering a CAGR of 9.6% from 2023 to 2030. This is attributable to the rapidly evolving infrastructure, coupled with accessibility for collecting and maintaining property information and escalating demand for improved data administration in the region. Furthermore, factors such as government regulations, increasing population, rising cloud-based solutions, and outsourcing services are a few significant factors supporting the market growth in the region. Besides, technological advancements such as machine learning, data analytics, and voice command to enhance the capability of PMS are anticipated to boost the adoption of property management software in the region.

Key Companies & Market Share Insights

The property management software market is highly fragmented and has the presence of several key market players. Some prominent players in the market include AppFolio, Inc.; CoreLogic; Entrata, Inc.; InnQuest Software; IQware Inc.; MRI Software LLC; RealPage, Inc.; REI Master; and Yardi Systems Inc; among others. These players are adopting strategies such as product/solution launches, partnerships and collaborations, and mergers & acquisitions to gain a competitive edge.

For instance, in April 2020, Yardi Systems Inc. announced its launch of new functional updates for its Yardi Breeze property management software amid COVID-19. The new features include credit and debit cards, online lease documents, customer relationship management, and PayNearMe. These features helped property managers, tenants, vendors, and owners stay connected on a single platform working remotely due to social distancing measures during the COVID-19 crisis. Similarly, in July 2023, Entrata, Inc. announced the acquisition of Rent Dynamics, a prominent resident rent reporting and financial resources provider. This initiative allowed Entrata, Inc. to expand its offerings and strengthen its position in the property management industry, providing additional valuable services related to rent reporting and financial management for residents. Some of the prominent players operating in the global property management software market include:

-

AppFolio, Inc.

-

Console Australia Pty Ltd

-

CoreLogic; Entrata, Inc.

-

MRI Software LLC

-

RealPage, Inc.

-

REI Master

-

Yardi Systems Inc.

-

Zillow Group, Inc.

-

ManageCasa

Property Management Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4,671.5 million

Revenue forecast in 2030

USD 8,041.0 million

Growth Rate

CAGR of 8.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Deployment, solution, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; China; India; Japan; Brazil; Mexico

Key companies profiled

AppFolio, Inc.; Console Australia Pty Ltd; CoreLogic; Entrata, Inc.; MRI Software LLC; RealPage, Inc.; REI Master; Yardi Systems Inc.; Zillow Group, Inc.; ManageCasa

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Property Management Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global property management software market report on the basis of deployment, application, end-user, and region:

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Rental Listings Management

-

Applicant Management

-

Reporting & Analytics

-

Maintenance Activities Management

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Residential Outlook (Revenue, USD Million, 2017 - 2030)

-

Multi-family Housing/ Apartments

-

Single-family Housing

-

Others

-

-

-

Commercial

-

Commercial Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail Spaces

-

Office Spaces

-

Hotels

-

Others

-

-

-

-

End-User Outlook (Revenue, USD Million, 2017 - 2030)

-

Housing Associations

-

Property Managers/ Agents

-

Property Investors

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Canada

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global property management software market size was estimated at USD 4.47 billion in 2022 and is expected to reach USD 4.67 billion in 2023.

b. The global property management software market is expected to grow at a compound annual growth rate of 8.1% from 2023 to 2030 to reach USD 8.04 billion by 2030.

b. North America dominated the property management software market with a share of 45.2% in 2022. This is attributable to the increasing number of hotel spaces in the U.S. and the presence of prominent players in the region, including AppFolio, Inc., Buildium, Entrata, Inc., MRI Software LLC, and Yardi Systems Inc.

b. Some key players operating in the property management software market include AppFolio, Inc., Buildium, Console, CORELOGIC, Entrata, Inc., MRI Software LLC, RealPage, Inc., and Yardi Systems Inc.

b. Key factors that are driving the property management software market growth include escalating demand for web-based services including Software as a Service (SaaS) by property management software providers, increasing investments in real estate, and a rise in the demand for transparency in property management.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."