- Home

- »

- Medical Devices

- »

-

Prosthetic Liners Market Size, Industry Report, 2019-2026GVR Report cover

![Prosthetic Liners Market Size, Share & Trends Report]()

Prosthetic Liners Market Size, Share & Trends Analysis Report By Material (TPE, Silicone), By Application (Upper Extremity, Lower Extremity), By End Use, By Region, And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-681-3

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Healthcare

Industry Insights

The global prosthetic liners market size was estimated at USD 246.47 million in 2018 and is anticipated to expand at a CAGR of 5.1% over the forecast period. Rising adoption of the prosthesis to rehabilitate amputees is expected to drive the growth. These products are used as a protective cover on a residual limb to prevent skin abrasions and to reduce bone pressure in the prosthesis. They are also used for improving socket suspensions in prosthetics.

The introduction of advanced materials for liner manufacturing is attributed to the high adoption of the product by prosthetists. The new products have features such as anatomical shaping, antibacterial shields and additives, and the textile outer layer that makes them easy to apply. These features are anticipated to fuel the demand for prosthetic liners.

Moreover, favorable reimbursement policies are projected to propel the market growth. For instance, Medicare Part B or medical insurance in the U.S. provides coverage to prosthetic devices required to replace a body function or body part when applied by a Medicare registered healthcare provider or supplier. Such favorable government reimbursement policies are expected to fuel the adoption of prosthetic liners over the forecast period.

The market is driven by the high prevalence of orthopedic conditions that need prosthesis coupled with the rising willingness of the patients to spend on premium products. An upsurge in the geriatric population prone to various lifestyle-related diseases and disorders is another major factor fueling the demand for prosthetic liners.

Furthermore, leading companies operating in the prosthetic liners market engage in strategic collaborations to develop new products, which in turn is anticipated to create lucrative growth opportunities in near future. For instance, in October 2018, Quorum Prosthetics introduced Quatro Compression Socket made of silicone suitable for different designs. The product acts as an interface between the residual limb and the socket. Such initiatives by the leading companies are projected to further foster market growth.

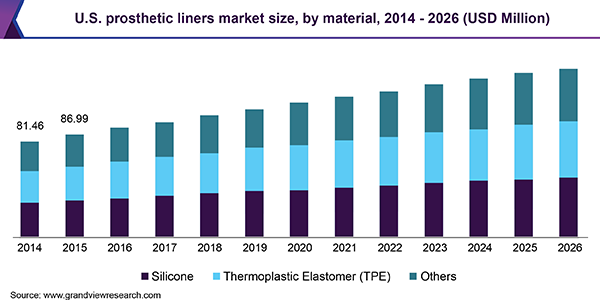

Material Insights

Silicone held the largest market share in 2018 owing to the benefits associated with the usage of this material. Silicone prosthetic liners are durable and easy to clean. They are easy to use and can provide better comfort for all activity levels, which in turn is projected to drive the demand from active amputees. Product innovation is projected to further fuel segment growth. For instance, Össur recently introduced a new soft silicone product called Iceross Comfort Locking liner with the silken inner surface with ample cushioning for added comfort.

The growth is driven by various factors including increasing incidence of orthopedic injuries, the introduction of advanced materials such as Thermoplastic Elastomer (TPE), and polyurethane among others for manufacturing liners, and improving healthcare infrastructure in developing countries. Also, rising awareness among patients regarding the advantages of prosthetic liners has resulted in increased product adoption.

Application Insights

Upper extremity held the dominant market share of above 55.0% in 2018. The liner enables rapid and painless recovery, which is expected to bode well for market growth. Ottobock Silicone Arm Liner with Chemical Vapor Deposition (CVD) coating made of silicone and the custom-made socket has anti-friction properties which make wearing it easy. Such innovations are anticipated to bode well for segment growth.

The lower extremity liner segment is projected to register the fastest CAGR over the forecast period. These liners are mostly used for patients with uncharacteristic residual limb outlines. These offer a tailored solution, with customized gel profiles for a comfortable fit. Such advantages are anticipated to provide lucrative growth opportunities in near future.

Besides, an increase in the incidence of lower extremities is projected to drive the segment growth. According to an article published by the National Center for Biotechnology Information (NCBI) in 2017, it was reported that approximately 52.4% out of 435 lower-limb amputees reported falling at least once in a year, and around 39.5% reported falling two or more times leading to injuries demanding lower extremity prosthetic liners.

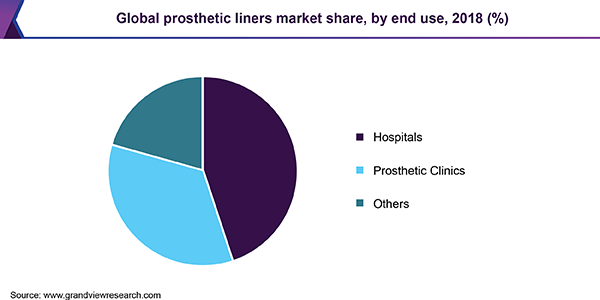

End-Use Insights

In 2018, hospitals accounted for the largest market share in terms of revenue. The segment is driven by an increased number of orthopedic surgeries performed in these facilities. Hospitals have skilled healthcare professionals and technologically advanced systems contributing to a large number of orthopedic procedures carried out in these settings. Furthermore, the tie-ups of hospitals with various companies to develop advanced surgical procedures are projected to propel the segment growth. Additionally, an increasing number of hospitals carrying out orthopedic and prosthetic surgeries worldwide coupled with the rising adoption of advanced appliances is expected to fuel the growth.

The Center for Limb Loss and Mobility (CLiMB) in the U.S., Seattle is a research group focused on helping veterans who are disabled or experience leg and/or foot loss, by enhancing their ability to move around. Moreover, the center aims to reduce the frequency of limb loss and functional activities by identifying diseases that result in impaired limb function and by increasingly introducing state-of-the-art technologies. The rising number of such research centers involved in enhancing the functional activities of amputees is projected to drive the market growth.

Regional Insights

North America held the dominant market share and was valued at USD 115.08 million in 2018. The growth is attributed to the presence of leading players such as Willow Wood Global LLC, ALPS South LLC, and other such well-established players in the region. The companies adopt various strategies such as mergers, acquisitions, collaborations, and new product launches to maintain their dominance. For instance, in June 2019, DW Healthcare Partners (DWHP) bought a majority stake in WillowWood Global LLC, to strengthen its prosthetic product portfolio. The deal will support the latter's ability to develop prosthetic products in near future. Such partnerships are expected to positively impact growth.

The Asia Pacific is anticipated to witness robust growth owing to increasing government initiatives, rehabilitation services for amputees, and improving healthcare infrastructure. Moreover, factors such as advancements in diagnostic technologies and the adoption of sophisticated healthcare facilities are anticipated to fuel the growth. Increasing collaborations between governments and local market players and research centers for developing innovative products are anticipated to further propel the market. Increasing awareness about the advantages of prosthetic liners for improving the quality of life is projected to drive the demand from developing countries such as India and China.

Prosthetic Liners Market Share Insights

The market is competitive with the presence of many large and small players. Some of the key players include Zimmer Biomet Holdings, Inc.; Blathford Inc.; Ottobock Healthcare GmbH; Fillauer LLC; and Willow Wood Company. Market leaders focus on the development of cost-effective, durable, and user-friendly products to gain a competitive edge.

Companies are collaborating to develop more sophisticated and advanced devices. For instance, in April 2016, Coapt and WillowWood worked on a new advanced liner technology designed to add comfort and support to existing upper extremity prosthetic devices to provide users with new and beneficial technologies. Such strategic partnerships are contributing significantly to the growth of the market for prosthetic liners.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2026

Market representation

Revenue in USD Million and CAGR from 2019 to 2026

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Germany, U.K., France, Italy, Spain, Russia, Japan, China, India, South Korea, Australia, Singapore, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2026. For this study, Grand View Research has segmented the global prosthetic liners market report based on material, application, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2014 - 2026)

-

Silicone

-

Thermoplastic Elastomer (TPE)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2014 - 2026)

-

Upper Extremity

-

Lower Extremity

-

-

End-Use Outlook (Revenue, USD Million, 2014 - 2026)

-

Hospitals

-

Prosthetic Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2026)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."