- Home

- »

- Biotechnology

- »

-

Protein Purification And Isolation Market Size Report, 2030GVR Report cover

![Protein Purification And Isolation Market Size, Share & Trends Report]()

Protein Purification And Isolation Market Size, Share & Trends Analysis Report By Product (Instruments, Consumables), By Technology, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-881-7

- Number of Pages: 135

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Market Size & Trends

The global protein purification and isolation market was valued at USD 8.44 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.86% from 2023 to 2030. Growing research in the areas of pharmaceutical and biotechnology for the development of novel drugs drives the demand for protein purification and isolation. Furthermore, rising investments in R&D by pharmaceutical manufacturers are projected to drive market growth. The unexpected outbreak of the COVID-19 pandemic prompted the implementation of lockdown rules across the globe, causing delays in protein purification and isolation import and export. The pandemic also lowered the availability of funds from private investors and governments around the world. Purification and isolation of proteins refer to a set of procedures for isolating a specific protein from a complicated combination of cells, organisms, or tissues.

Protein research requires these techniques to separate, concentrate, stabilize, and eliminate contaminants including endotoxins, viruses, and nucleic acid. They involve determining material and maintaining a purification table to track the enzyme's development. They are mostly used to classify a protein's function, structure, and interactions. Affinity chromatography, immunoprecipitation, proteomics, and enzyme assay are some of the regularly utilized methods of protein purification and separation. Over the pandemic, the disruption in the process had a negative impact on the protein purification & isolation market, but increased government funding for R&D is enabling the market to recover, and the market is expected to grow during the forecast period.

Governments are increasingly investing in R&D and undertaking initiatives that promote the development and growth of pharmaceutical and biotechnology markets. They also provided added benefits via tax incentives, grants, and investment-friendly regulations among others. Pharmaceutical is a highly lucrative industry for protein purification and isolation solutions owing to significant investments for the development of biomarker specific molecules. Precise isolation of proteins with a significant amount of purified substrate is a vital component of the preclinical drug development phase.

Ongoing technological advancements further drive the market for protein purification and isolation solutions. Magnetic and protein beads and ligand tagging systems are increasingly preferred over traditional methods such as agarose beads and other resins. Furthermore, the rising usage of automated analyzers is projected to drive the demand for purification and isolation solutions.

The rising significance of discovering novel ligands, such as protein-based therapeutic compounds, is a major factor driving market expansion. Additionally, rising demand for purification kits in rapid screen tests, a shift towards technologically advanced instrumentation for protein purification, growth of the proteomics market, and increasing R&D in pharmaceutical and biotechnological fields are expected to propel protein purification and isolation market forward. However, instruments that result in a reduced acceptance rate and the difficulty of maintaining purification kits that fit all proposes are market restraints, and high tool costs are a hurdle for market growth. In addition, the protein purification and isolation industry are benefiting from untapped growth markets and protein therapies.

Product Insights

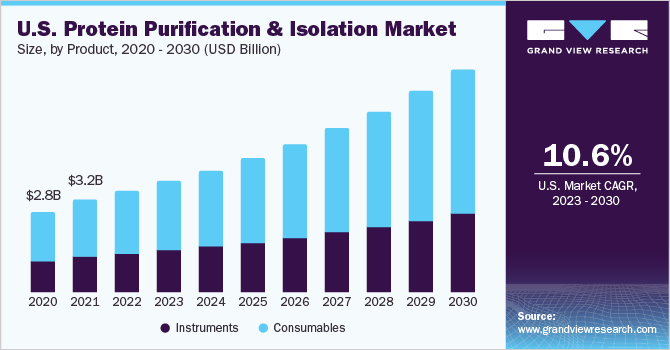

Based on products, the market is categorized into consumables and instruments. The consumables segment dominated the market in 2022 with a share of 61.39%. Columns, reagents, kits, resins, and magnetic beads are the most commonly used consumables. In 2022, the kits segment dominated the consumables product segment as they are convenient and offer several benefits. For instance, they can be effectively used for the isolation of GST-tagged protein from the crude or cleared lysate.

The instruments segment is projected to witness a CAGR of 9.76% over the forecast period due to the development of accurate, sensitive, and portable instruments. Furthermore, the growth of the instruments segment can be attributed to the high usage and a rise in the commercialization of advanced equipment for protein analysis that ensure precise results.

Technology Insights

Chromatography was the largest revenue-generating segment in 2022 and held a market share of 29.16%. Chromatography is one of the most accurate and sensitive techniques for the isolation and purification of proteins when compared to its counterparts. Various companies are hence focusing on commercializing new products based on this technology in order to expand their product portfolio.

For instance, in 2018, Bio-Rad commercialized ChromLab Software, a novel software for the purification of proteins using NGC chromatography systems. The various types of chromatography techniques available make them suitable for a range of applications, further driving the segment growth.

Application Insights

Protein-protein interaction was the largest revenue-generating application segment in 2022 with a share of 32.17% and is projected to witness substantial growth over the forecast period. High adoption of these techniques for deriving highly purified proteins and an increasing number of studies based on structural protein is contributing to the segment growth.

The drug screening segment is estimated to witness the highest CAGR of 11.61% from 2023 to 2030. It is extensively used for discovering innovative drugs with different applications. Drug screening comprises the development of drugs with higher efficacy than conventional drugs as well as fewer side effects. Moreover, increasing R&D investments by manufacturers for the screening of novel drugs through structure-based studies and protein-protein interaction is projected to drive the segment growth.

End-use Insights

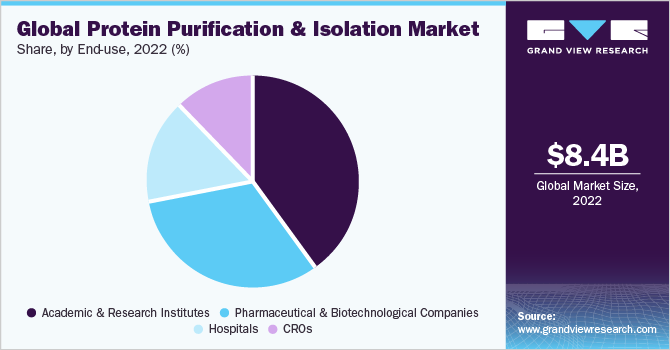

On the basis of end-use, the market for protein purification and isolation has been segmented into academic and research institutes, hospitals, contract research organizations (CROs), and pharmaceutical and biotechnological companies. Academic and research institutes held the largest share of 40.26% in 2022. Growing research initiatives in academic institutes for structural and functional proteomics, detailed kinetic analysis, and protein-protein interaction are some of the factors contributing to the demand for protein purification and isolation solutions.

On the other hand, CROs are estimated to witness a CAGR of 11.35% over the forecast periodowing to the rise in the number of preclinical trials outsourced by drug development companies and significant R&D investments associated with it. These organizations conduct more precise R&D functions for the pharmaceutical industry, along with offering a range of services for clinical trial activities, further driving the segment growth over the forecast period.

Regional Insights

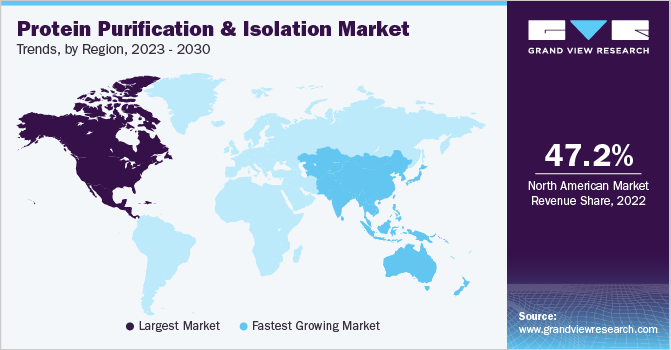

On the basis of region, the market for protein purification and isolation is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. North America was the largest revenue-generating region and accounted for 47.20% market share in 2022. North America dominated the market owing to high funding for life science research, established research infrastructure, and the presence of key players. Furthermore, the rise in biopharmaceutical drug development is estimated to drive the growth of the regional market over the forecast period.

Asia Pacific is estimated to witness the fastest CAGR of 11.83% over the forecast period. Initiatives undertaken by governments of developing countries such as India and China for the development of healthcare infrastructure is estimated to drive the demand for protein purification and isolation solutions in this region. Moreover, these governments are providing funds for the development of novel purification and isolation methods.

Key Companies & Market Share Insights

Market players are adopting various strategies such as product development, geographic expansion, mergers, acquisitions, and collaborations to increase their market share. For instance, in March 2023, Waters Corporation launched its Alliance iS next-generation HPLC system that offers enhanced error detection and troubleshooting mechanisms to streamline the workflows for chromatography applications, such as protein purification, among others.Some prominent players in the global protein purification and isolation market include:

-

Thermo Fisher Scientific, Inc.

-

Merck KGaA

-

QIAGEN N.V

-

Bio-Rad Laboratories, Inc.

-

Agilent Technologies

-

GE Healthcare

-

Promega Corporation

-

Norgen Biotek Corp.

-

Abcam plc

-

Danaher

Protein Purification And Isolation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.28 billion

Revenue forecast in 2030

USD 19.08 billion

Growth rate

CAGR of 10.86% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; Colombia; Peru; Chile; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; QIAGEN N.V; Bio-Rad Laboratories, Inc.; Agilent Technologies; GE Healthcare; Promega Corporation; Norgen Biotek Corp.; Abcam plc; Danaher

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Purification And Isolation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global protein purification and isolation market report on the basis of product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables

-

Kits

-

Reagents

-

Columns

-

Magnetic Beads

-

Resins

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Ultrafiltration

-

Precipitation

-

Chromatography

-

Ion Exchange Chromatography

-

Affinity Chromatography

-

Reversed-phase Chromatography

-

Size Exclusion Chromatography

-

Hydrophobic Interaction Chromatography

-

-

Electrophoresis

-

Gel Electrophoresis

-

Isoelectric Focusing

-

Capillary Electrophoresis

-

-

Western Blotting

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Screening

-

Biomarker Discovery

-

Protein-protein Interaction Studies

-

Diagnostics

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic And Research Institutes

-

Hospitals

-

Pharmaceutical And Biotechnological Companies

-

CROs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Peru

-

Chile

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global protein purification and isolation market size was estimated at USD 8.44 billion in 2022 and is expected to reach USD 9.28 billion in 2023.

b. The global protein purification and isolation market is expected to witness a compound annual growth rate of 10.86% from 2023 to 2030 to reach USD 19.08 billion in 2030.

b. Based on technology, chromatography segment held the largest share of 29.16% in 2022, owing to the increasing focus of various companies on commercializing new products based on this technology in order to expand their product portfolio.

b. Some key players operating in the protein purification and isolation market include Thermo Fisher Scientific, Inc.; Merck KGaA; QIAGEN N.V; Bio-Rad Laboratories, Inc.; Agilent Technologies; GE Healthcare; Promega Corporation; Norgen Biotek Corp.; Abcam plc; Danaher

b. Key factors driving the protein purification and isolation market growth include increase in investment in pharmaceutical and biotechnological R&D, growing need for more accurate and rapid purification kits, and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."