- Home

- »

- Next Generation Technologies

- »

-

Global Public Safety And Security Market Size Report, 2025GVR Report cover

![Public Safety And Security Market Size, Share & Trends Report]()

Public Safety And Security Market Size, Share & Trends Analysis Report By Service (Professional, Managed), By Solution, By Application (Homeland Security, Critical Infrastructure Security), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-138-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Technology

Industry Insights

The global public safety and security market size was valued at USD 318.2 billion in 2018. It is expected to reach USD 812.6 billion by 2025, growing at a CAGR of 14.8% from 2019 to 2025 owing to the exponential increase in terrorist attacks and criminal activities worldwide. Furthermore, the growing adoption of Internet of Things (IoT) as part of smart city initiatives is also anticipated to drive the market over the forecast period. Increasing investments by governments for the upgradation and modernization of legacy systems to improve operational performance and reduce associated costs is also expected to accelerate the adoption of these solutions over the forecast period.

Citizens and corporates are facing continuous threats of cyber-attacks, natural and man-made disasters, and terrorism. This is expected to increase the demand and drive the deployment of public safety and security solutions worldwide. In the rapidly evolving global security scenario, governments are emphasizing on advanced solutions to improve and strengthen the existing information technology infrastructure and security systems. These factors are anticipated to boost the adoption of public safety and security solutions by governments across the world.

There has been a growing demand for public safety and security solutions in countries where there is high level of civil unrest. Also, the threat of attack on public utilities and critical infrastructure projects such as power generation plants, highway network, and water reservoirs has emerged as a significant factor driving the adoption of public safety and security solutions. The increasing occurrences of natural disasters such as cyclones, floods, hurricanes, tornadoes, and earthquakes is also a crucial factor driving the deployment of critical communication networks and emergency and disaster management solutions worldwide.

The geographical expansion of business operations by Multinational Companies (MNCs) in the Asia Pacific region, particularly in emerging economies such as China, India, and Philippines are anticipated to drive the economic growth and financial markets in the region, thereby making them potential targets for terrorists and cyber criminals. According to the recent Internet Security Threat Report (ISTR) released by Symantec Corporation, U.S., China, and India were the countries in which the highest number of cyber threats were detected. These factors are expected to drive the adoption of public safety and security solutions by the governments over the forecast period.

As the technological environment continues to evolve, legacy information technology systems are unable to effectively deal with the emerging threats. The major challenges impacting the adoption of advanced public safety and security solutions include substantial investments for designing and deploying technologically advanced IoT devices and a high-speed communication and surveillance network. The high cost of modernization of legacy IT infrastructure, lack of experienced workforce, and integration issues are also restricting the market growth. Furthermore, data security concerns and stringent regulations such as the General Data Protection Regulation (GDPR) in Europe are also impacting the growth of the market by restricting the collection and storage of citizens’ personal data.

Service Insights

Based on service, the market has been further segmented into professional services and managed services. The professional services segment dominated the market in 2018 owing to the high demand of design and deployment of new public safety and security network as part of digital transformation initiatives. Governments are aggressively focusing on improving the legacy public safety and security systems by installing advanced biometric systems and authentication, C2/C4ISR, and surveillance systems. However, the managed services segment is anticipated to emerge as the fastest-growing segment over the forecast period owing to the growing popularity and adoption of Public Safety as a Service (PSaaS) model.

PSaaS can be easily implemented on-demand as part of smart city initiatives without requiring a high capital investment in information technology assets or extensive technical expertise. Furthermore, the ‘as-a-service’ approach to security has enabled governments to overcome the challenges and proactively respond to emergency situations using a data-driven approach. For instance, SOMA Global LLC offers a cloud-based public safety platform via the PSaaS model. These factors will play a key role in driving the growth of managed services over the forecast period.

Solution Insights

Based on solution, the market has been further segmented into biometric security and authentication system, critical communication network, C2/C4ISR system, surveillance system, screening and scanning system, emergency and disaster management, cybersecurity, public address and general alarm, and backup and recovery system. The critical communication network segment dominated the market in 2018 owing to the rapidly increasing demand for the deployment of high-speed wireless and broadband communication networks worldwide. Furthermore, the increasing adoption of critical communication network for emergency and disaster management in emerging economies of the Asia Pacific region is anticipated to drive the public safety and security market growth over the forecast period.

The increasing deployment of Long-Term Evolution (LTE) is a crucial component of critical communications. The LTE technology, with its wide-scale commercial deployment, offers an excellent opportunity to meet public safety and security requirements. For instance, the ability of LTE to support a wide range of services such as real-time communication and high bandwidth data provides law enforcement and disaster management agencies with unprecedented capabilities to enhance public safety in a cost-effective manner. However, emergency and disaster management is anticipated to emerge as the fastest-growing segment over the forecast period owing to the increasing focus of governments to deploy mechanisms to deal with natural calamities.

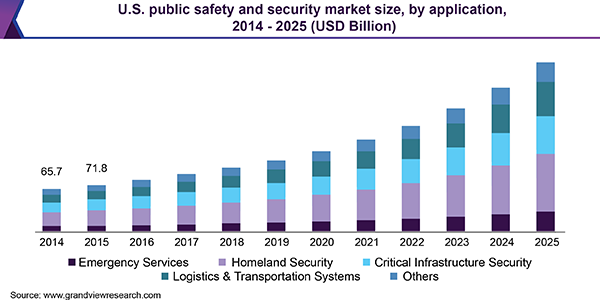

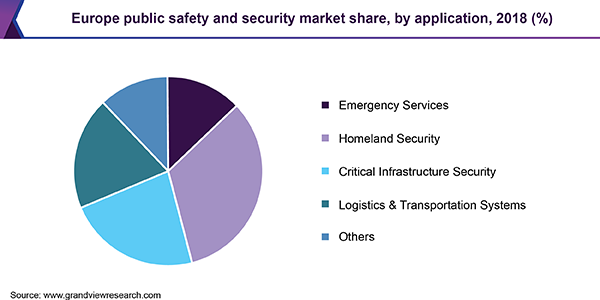

Application Insights

Based on application, the market has been further segmented into emergency services, homeland security, critical infrastructure security, logistics and transportation systems, and others. The homeland security segment dominated the market in 2018 owing to the increasing number of government initiatives to improve safety and security. For instance, the National Infrastructure Protection Plan (NIPP) in U.S. is a formal directive issued by the U.S. Department of Homeland Security (DHS) to combine Critical Infrastructure and Key Resource (CIKR) protection efforts in U.S. The NIPP outlines the government and private sector participation for protecting the CIKR assets and locations across 16 sectors. The implementation of NIPP is expected to drive the deployment of public safety and security solutions to manage risks.

The logistics and transportation systems segment is expected to witness the highest growth over the forecast period. This growth is attributed to the rapidly growing adoption of technologically advanced public security and safety solutions and modernization of the existing infrastructure to manage and enhance the security of the transit systems. Furthermore, the deployment of Intelligent Transportation Systems as part of smart city initiatives worldwide is expected to drive the segment growth over the forecast period.

Regional Insights

The North American region dominated the global market in 2018. High government investments in improving the existing public safety and security infrastructure to tackle terrorism and illegal immigration is anticipated to drive the market growth over the forecast period. North America is also home to several leading public safety and security solutions providers such as General Dynamics; Harris Corporation; and Cisco Systems, Inc.. The governments in the North American region are also early adopters of emerging technologies for internal urban applications.

The Asia Pacific region is projected to emerge as the fastest-growing regional market. Rapid urbanization, increasing crime rates, illegal immigration, and cross-border terrorism have emerged as the key factors driving the deployment of public safety and security solutions in the Asia Pacific region. Hence, governments across the region are investing in improving their surveillance and communication systems. Furthermore, the growing number of smart city projects in emerging economies such as India and China is also anticipated to drive the market growth over the forecast period.

Public Safety and Security Market Share Insights

Key industry players operating in the market include Atos; Ericsson; ESRI; SAP SE; NEC Corporation; Cisco Systems, Inc.; Harris Corporation; Genetec; General Dynamics; and Huawei Technologies Co., Ltd.. These market players are working on offering advanced public safety and security solutions to improve the capabilities of the governments to effectively manage emergencies. Companies such as General Dynamics; Harris Corporation; and Cisco Systems, Inc. have strong research and development teams working on developing cutting edge technology systems. Many of the providers of public safety and security solutions are also involved in the design and manufacturing of weapon systems for the armed forces.

In addition, some of the solution providers, such as Harris Corporation and General Dynamics are closely working with government agencies to offer public safety and security solutions. For instance, in 2019, Harris Corporation delivered 9,000 advanced public safety radios to the U.S. Department of Homeland Security’s Customs and Border Protection (CBP), the country’s primary border control organization. The XL-200P radio was specifically designed in line with public safety experts to meet the performance requirements and operational needs of the DHS.

Report Scope

Report Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD billion and CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, U.K., Germany, India, Japan, China, and Brazil

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global public safety and security market report based on service, solution, application, and region:

-

Service Outlook (Revenue, USD Billion, 2014 - 2025)

-

Professional Services

-

Managed Services

-

-

Solution Outlook (Revenue, USD Billion, 2014 - 2025)

-

Biometric Security & Authentication System

-

Critical Communication Network

-

C2/C4ISR System

-

Surveillance System

-

Screening & Scanning System

-

Emergency & Disaster Management

-

Cybersecurity

-

Public Address & General Alarm

-

Backup & Recovery System

-

-

Application Outlook (Revenue, USD Billion, 2014 - 2025)

-

Emergency Services

-

Homeland Security

-

Critical Infrastructure Security

-

Logistics & Transportation Systems

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2014 - 2025)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."