- Home

- »

- Clinical Diagnostics

- »

-

qPCR Instruments Market Size, Share & Trends Report, 2030GVR Report cover

![qPCR Instruments Market Size, Share & Trends Report]()

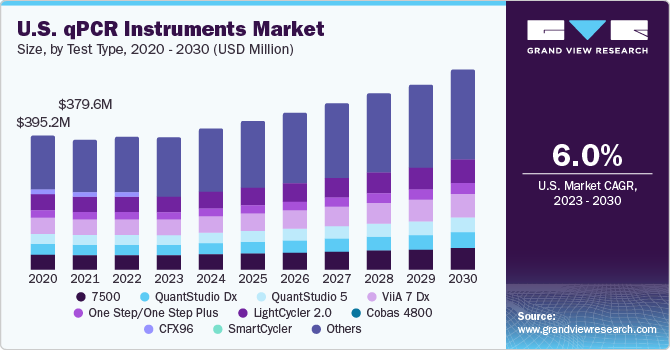

qPCR Instruments Market Size, Share & Trends Analysis Report By Test Type (7500, QuantStudio Dx, QuantStudio 5, ViiA 7 Dx, One Step/One Step Plus, LightCycler 2.0, Cobas 4800, CFX96, SmartCycler), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-339-3

- Number of Pages: 109

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

qPCR Instruments Market Size & Trends

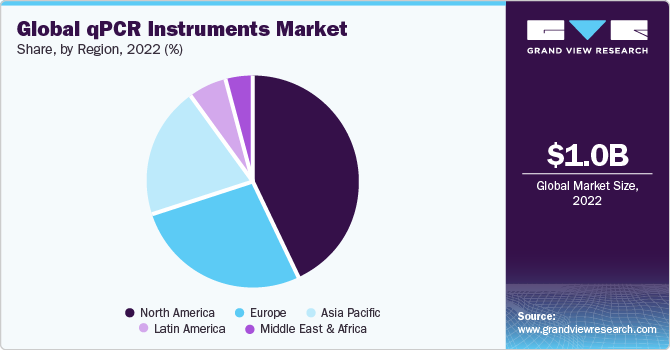

The global qPCR instruments market size was valued at USD 1.0 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.0% from 2023 to 2030. The growing prevalence of diseases, technological advancements, and increasing demand for qPCR instruments are anticipated to drive the market over the forecast period. qPCR is a highly sensitive and specific technique for detecting and quantifying nucleic acids, making it ideal for diagnosing infectious diseases. The increasing incidence of infectious diseases, such as HIV, malaria, and tuberculosis, drives the demand for qPCR instruments. Governments worldwide are increasing funding for research and development in qPCR. This funding is helping to drive innovation in qPCR technology and increasing the availability of qPCR instruments to researchers and clinicians.

The launch of new products is expected to change certain market dynamics as it can increase the threat of internal substitution. Furthermore, increasing consumers' preference for updated and advanced products creates a demand for technologically advanced products. For instance, Bio-Rad Laboratories, Inc, a big company that makes tools for studying life and diagnosing diseases, has made a new CFX Duet Real-Time PCR System. This tool helps scientists with tests that look at tiny bits of genetic material. The CFX Duet can measure how much of certain things are in a sample. It's like using a special microscope to count how many of these things are there. This tool is good at doing two tests at once and can also check if proteins are working properly. People can easily set up their experiments and see the results using special software that comes with the tool.

In addition, the prevalence of chronic diseases, infectious diseases, and genetic disorders, such as Alzheimer's, Turner syndrome, and Parkinson's, has increased rapidly, which is expected to fuel market growth. For instance, according to the Alzheimer's Association, more than 6 million individuals in the U.S. are impacted by Alzheimer's disease, and this figure could climb to almost 13 million by 2050. Roughly 1 in every 3 seniors passes away with Alzheimer's or another kind of dementia, more than the combined deaths from breast and prostate cancer. In 2023, the cost of Alzheimer's and other dementias to the nation will reach USD 345 billion, possibly increasing to nearly USD 1 trillion by 2050. Over 11 million Americans offer unpaid care to people with Alzheimer's or other dementias. In 2022, these unpaid caregivers contributed around 18 billion hours of care, valued at roughly USD 339.5 billion. The risk of developing Alzheimer's by age 45 is 1 in 5 for women and 1 in 10 for men. Regrettably, only 4 out of 10 Americans would promptly seek medical assistance for early memory or cognitive issues. Encouragingly, 7 out of 10 Americans are expected to prefer to know early if they have Alzheimer's disease, as it could enable earlier treatment. From 2020 to 2030, an additional 1.2 million direct care workers will be necessary to support the rising number of individuals living with dementia. This workforce shortage is the largest in the U.S.

Increasing adoption of qPCR technologies is expected to propel this market growth. The adoption of qPCR techniques is increasing owing to their accuracy, automation, precise results, real-time quantification, and sensitivity. qPCR offers a wide range of input nucleic acids, making it an effective and useful technology in research applications.

The increased frequency of infectious diseases like malaria, HIV, and hepatitis, as well as genetic disorders like cancer and syndromes, are likely to drive the real-time PCR market forward. The usage of clinical diagnostic tests is expected to expand owing to the rising prevalence of genetic diseases worldwide and the established usefulness of qPCR analysis in estimating and detecting disease-causing bacteria. As a result, the qPCR market is expected to grow substantially in the forecast period. For instance, according to the World Health Organization (WHO), in 2021, almost 50% of the global population faced the risk of malaria. During that year, around 247 million cases of malaria were estimated worldwide. The estimated count of malaria-related deaths reached 619,000 in 2021.

The WHO African Region carried an unequal burden of the global malaria impact. In 2021, this Region accounted for 95% of malaria cases and 96% of malaria-related deaths. Among these, about 80% of the fatalities were among children under 5 years old.

Among many other technological developments in the medical business, nucleic acid detection-based techniques have become speedy and reliable for viral detection. The qualitative PCR approach, characterized by high sensitivity, quick detection, and specificity, is regarded as the "gold standard" for virus detection. In many nations, research funding is used to assist the COVID-19 treatment, which is anticipated to offer lucrative expansion opportunities. For instance, Bio-Rad Laboratories, Inc launched Digital droplet PCR (ddPCR). It is a technique to amplify and quantify nucleic acids in individual droplets. This makes it possible to detect very small amounts of nucleic acids and to quantify them accurately. ddPCR is also very fast and can be used to analyze multiple samples simultaneously.

Test Type Insights

The GeneXpert segment accounted for the largest revenue share of 21.67% in 2022. This is attributed to its increased adoption rate during the SARS-CoV-2 pandemic to detect infections. This system provides 24/7 testing accuracy, workflow flexibility, and user-friendly designs. They offer multiple tests on a single, scalable, and consolidated workstation. Key features of this system include high adjustability, touchscreen, increased accumulator capacity, expanded conveyor and loading zone, expanded test shuttle, and self-containment. It also has a faster, quieter, and more robust robotic gantry. For instance, GeneXpert Edge was launched by Cepheid, a portable, battery-operated molecular diagnostic instrument. It is designed for use in point-of-care (POC) settings, such as clinics and hospitals. GeneXpert Edge can be used to run a variety of molecular diagnostic tests, including tests for tuberculosis (TB), HIV, and malaria. GeneXpert Edge is easy to use and can be operated by non-technical staff. GeneXpert Edge results are available in as little as 80 minutes, which can help to improve patient outcomes.

The Rotor-Gene Q 5Plex HRM System segment is expected to grow at the fastest CAGR of 8.8% during the forecast period owing to the factors such as Rotor-Gene Q 5Plex HRM System can deliver results in as little as 90 minutes, which is faster than many other qPCR instruments. This makes it ideal for applications requiring rapid diagnosis, such as infectious diseases. Rotor-Gene Q 5Plex HRM System is easy to use and can be operated by laboratory technicians without prior experience with qPCR instruments. This makes it a good choice for laboratories looking for an easy-to-use instrument.

Regional Insights

North America dominated the global qPCR instruments market and accounted for the largest revenue share of 42.73% in 2022. The growth of this region is attributed to the growing regulatory support and increasing launches of novel products. Compared to other regions, the large number of instruments installed in North America demonstrates its high diagnostic capacity. However, it reduces the opportunity for the installation of new instruments.

Asia Pacific is expected to grow at the fastest CAGR of 8.9% over the forecast period. The major untapped opportunities in the form of unmet medical needs, increasing initiatives for scientific research, and positive economic growth are primary growth drivers of this market. According to the International Monetary Fund, despite tightening monetary policies, domestic demand in Asia has remained robust, while external demand for technology goods and other exports from the region has been weakening. The growth forecast for Asia and the Pacific in the current year has been revised to 4.6%, a rise from the 3.8% recorded in 2022. This represents a 0.3% increase compared to the projections outlined in the October World Economic Outlook (WEO).

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of the market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. For instance, in November 2020, Streck announced the launch of its novel qPCR instrument Zulu RT which can be used to perform four experiments simultaneously and independently. The greater flexibility of this instrument was expected to help capture a share of the market.

Key qPCR Instruments Companies:

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Danaher

- QIAGEN

- Agilent Technologies, Inc.

- Abbott

- BIOMÉRIEUX

- Quantabio

- Azure Biosystems Inc.

- Bio Molecular Systems

qPCR Instruments Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.02 billion

Revenue forecast in 2030

USD 1.64 billion

Growth Rate

CAGR of 7.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK,; Germany; France; Italy; Spain; Denmark; Sweden,; Norway; China; Japan,; India; Australia,; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Danaher; QIAGEN; Agilent Technologies, Inc.; Abbott; BIOMÉRIEUX; Quantabio; Azure Biosystems Inc.; Bio Molecular Systems

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global qPCR Instruments Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global qPCR instruments market on the basis of test type, and region:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

7500

-

QuantStudio Dx

-

QuantStudio 5

-

ViiA 7 Dx

-

One Step/One Step Plus

-

LightCycler 2.0

-

Cobas 4800

-

CFX96

-

SmartCycler

-

GeneXpert

-

Rotor-Gene Q 5Plex HRM System

-

Rotor-Gene Q

-

BIOFIRE FILMARRAY SYSTEMS

-

BMS Mic System

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global qPCR instruments market size was estimated at USD 1.0 billion in 2022 and is expected to reach USD 1.02 billion in 2023.

b. The global qPCR instruments market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 1.64 billion by 2030.

b. North America dominated the global qPCR instruments market with a share of 42.73% in 2022. This is attributable to growing regulatory support and increasing launches of novel products. The large number of instruments installed in North America, as compared to other regions, demonstrates its high diagnostic capacity.

b. Some key players operating in the global qPCR instruments market include Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Danaher Corporation, Qiagen, Agilent Technologies, Inc., Abbott, bioMérieux SA, Quantabio, Azure Biosystems, Inc., BioMolecular Systems.

b. Key factors that are driving the qPCR instruments market growth include the growing prevalence of diseases, technological advancements, increasing demand for qPCR instruments, and increased focus on diagnostics attributed to the spread of COVID-19.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."