- Home

- »

- Pharmaceuticals

- »

-

Rare Diseases Treatment Market Size, Share Report, 2030GVR Report cover

![Rare Diseases Treatment Market Size, Share & Trends Report]()

Rare Diseases Treatment Market Size, Share & Trends Analysis Report By Therapeutic Area (Cancer, Musculoskeletal Conditions), By Route of Administration, By Drug Type, By Distribution Channel, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-965-6

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

The global rare diseases treatment market size was valued at USD 119.6 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12.8% from 2022 to 2030. The presence of a strong product pipeline and the imminent launches are expected to fuel market growth. According to Pharmaceutical Research and Manufacturers of America, there were around 791 potential orphan drug candidates under clinical trials for the treatment of rare diseases in 2021. Among all clinical orphan drugs, 168 were for rare cancers, 120 for rare blood cancers, 192 for genetic disorders, 56 for neurological disorders, 54 for blood disorders, 51 for autoimmune diseases, and 36 for infectious diseases.

In addition, around 26 novel orphan drugs were approved for the treatment of rare diseases by the Center for Drug Evaluation and Research (CDER) in 2021. Some of the approved products were Lumakras, Scemblix, Welireg, Amondys 4, Bylvay, Welireg, Cytalux, Besremi, Empaveli, Evkeeza, Exkivity, fexinidazole, and Zynlonta, among others. Therefore, increasing approval and launch of new orphan drugs are anticipated to boost industry growth.

A multidisciplinary approach with innovative proposals for the development of novel SMA drugs to fulfill the unmet needs in rare disease treatment is projected to fuel industry growth. For instance, in June 2021, the European expert group on orphan drug incentives unveiled a set of policy proposals to fulfill unmet medical needs in rare diseases. This policy proposal includes revision of EMA pharma strategy and regulations related to orphan drugs to foster R&D investment in orphan drugs. Along with this, basic research on patient access, challenges in clinical development, and regulatory approval procedures are key points highlighted in policy proposals. Such favorable government initiatives may support the industry growth during the forecast period.

However, the market growth could be hampered by the high cost associated with the research and development of pipeline candidates used for the treatment of rare diseases, which, in turn, contributes to the rise in drug prices. This can be attributed to factors such as the increased capital for conducting clinical trials through contract research organizations (CROs) and the risk of drug failure during the clinical trials.

Therapeutic Area Insights

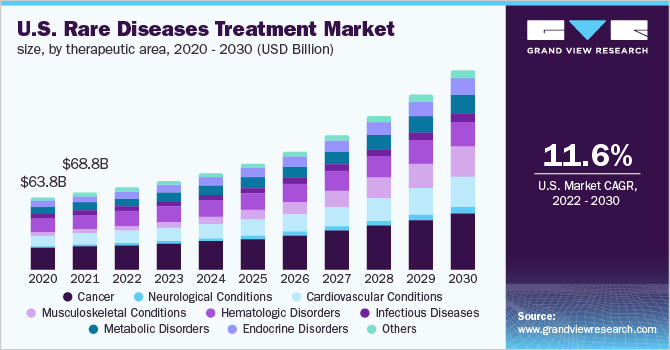

Cancer dominated the market in 2021 with a revenue share of over 25.0%. This dominance can be attributed to the high prevalence and recurrence rate of rare cancer indications. According to the American Cancer Society, the estimated incidence of esophageal cancer, chronic myeloid leukemia, and anal cancer was found to be 19,260, 9,110, and 9,090 respectively in the U.S. in 2021. Based on the therapeutic area, the global market is segmented into cancer, neurological conditions, cardiovascular conditions, musculoskeletal conditions, hematologic disorders, infectious diseases, metabolic disorders, endocrine disorders, and others.

Musculoskeletal condition is expected to be the fastest-growing segment during the projection period due to the increasing prevalence of this condition and new product approvals for its treatment. For instance, in March 2020, NS Pharma’s VILTEPSO candidate was approved in Japan for the treatment of patients with Duchenne muscular dystrophy (DMD). It was granted the SAKIGAKE designation by the healthcare body of Japan. This approval is also expected to boost segment growth. Osteogenesis imperfecta, achondroplasia, and fibrous dysplasia are some of the rare musculoskeletal conditions found in patients.

Route Of Administration Insights

The injectable segment dominated the market with a revenue share of over 50.0% in 2021 and is expected to witness significant growth during the forecast period. This can be attributed to the launch of novel injectables for the treatment of rare diseases. For instance, in February 2021, the U.S. FDA approved Sarepta Therapeutics’ AMONDYS 45 (casimersen injection) for the treatment of DMD. Based on route of administration, the global market is segmented into oral, injectable, and others.

Recently, in July 2022, Pfizer Inc. received approval for Xalkori (crizotinib) by the U.S. FDA for the treatment of pediatric and adult patients with ALK-positive inflammatory myofibroblastic tumor (IMT). The recommended dose in adult patients is 250 mg and is to be administrated orally twice daily until disease progression stops. This approval is also expected to fuel the oral segment growth.

Drug Type Insights

Biologics dominated the market with a revenue share of over 55.0% in 2021. The advancement in biotechnology and research techniques has facilitated the development of novel biologics. High target specificity and potential of biological drugs revolutionizing the treatments of several rare diseases are expected to fuel the segment growth. For instance, in 2019, the U.S. FDA approved Zolgensma, a gene therapy, for the treatment of spinal muscular atrophy. Based on drug type, the global market is segmented into biologics, biosimilars, and small molecules.

The emergence of biosimilars for the treatment of rare diseases proved to be a breakthrough for patients. The patent expiration of orphan biologics and supportive regulatory policies will pave the way for new players to enter the market and drive competition, leading to a reduction in drug price that is used for the treatment of various rare diseases, thereby fueling the segment growth. For instance, according to the Center for Biosimilars, approximately 11% of orphan biologics providers have biosimilar candidates in the product pipeline. However, high costs associated with R&D and a small consumer base may hamper the segment growth.

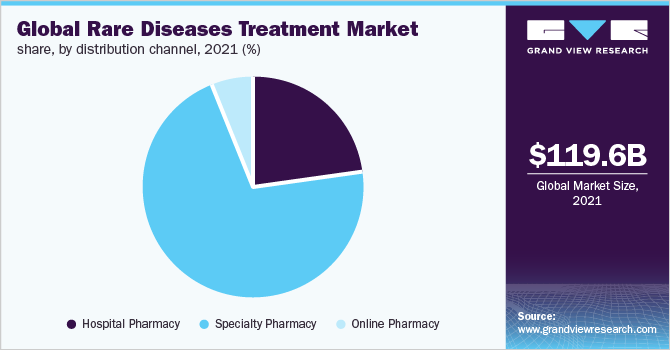

Distribution Channel Insights

The specialty pharmacy segment dominated the market with a revenue share of over 70.0% in 2021. The dominance can be attributed to strategic initiatives undertaken by key players, such as the acquisition of specialty pharmacies for the distribution of their products. For instance, in December 2020, Centene acquired PANTHERx, the largest specialty pharmacy in the U.S., which engages in distributing high-cost orphan drugs that are used for the treatment of various types of rare diseases. Centene serves as an intermediary for government and privately sponsored health insurance programs. Such acquisitions are expected to boost segment growth during the forecast period. Based on distribution channels, the global market is further segmented into hospital pharmacy, specialty pharmacy, and online pharmacy.

Hospital pharmacy is expected to be the fastest-growing segment during the assessment period. This can be attributed to the high hospitalization rate of SMA. The majority of patients are treated in hospitals due to the high risk of respiratory issues and scoliosis. According to the Orphanet Journal of Rare Diseases (2020), the inpatient ratio was the highest in pediatric patients aged 0 to 4 years.

Regional Insights

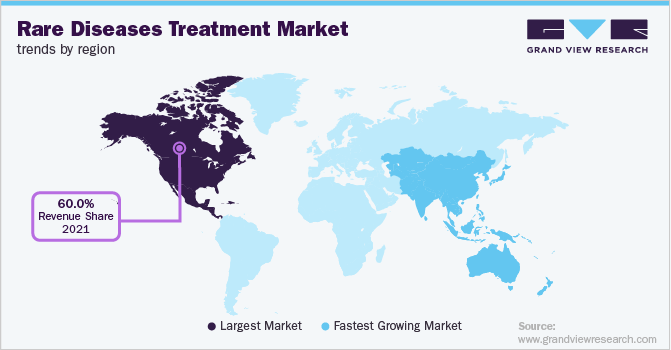

North America dominated the market in 2021 with a revenue share of over 60.0% due to the high burden of diseases, favorable healthcare infrastructure, and new product approvals for treatment. In October 2021, AstraZeneca received orphan drug designation for Tezepelumab from the U.S. FDA for the treatment of eosinophilic esophagitis (EoE). The accessibility to products may increase patient compliance, consequently expanding the consumer base and increasing the revenue for the market.

The Asia Pacific is expected to be the fastest-growing region during the forecast period. The growth of the region can be attributed to the initiatives undertaken by governments to support orphan disease patients. For instance, in July 2022, the Indian government directed national and state governments to ensure the effective implantation of health policies developed for the treatment of patients suffering from orphan diseases. This measure creates an opportunity for manufacturers to supply high-quality orphan medicines to the government and generate revenue.

Key Companies & Market Share Insights

Major players are adopting strategies such as mergers & acquisitions for regional expansion and to acquire a greater market share. For instance, in July 2021, AstraZeneca acquired Alexion Pharmaceuticals, Inc. at a cost of USD 13.3 billion. This acquisition strengthens the company’s rare disease product portfolio and offers a high growth opportunity for the company. Some prominent players in the global rare diseases treatment market include:

-

F. Hoffmann-La Roche Ltd.

-

Pfizer, Inc.

-

PTC Therapeutics

-

AstraZeneca

-

Novartis AG

-

Takeda Pharmaceutical Company

-

Bayer AG

-

AbbVie Inc.

-

Merck & Co. Inc.

-

Bristol Myers Squibb

Rare Diseases Treatment Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 128.42 billion

Revenue forecast in 2030

USD 335.84 billion

Growth rate

CAGR of 12.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapeutic area, route of administration, drug type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

F. Hoffmann-La Roche Ltd.; Pfizer, Inc.; PTC Therapeutics; AstraZeneca; Novartis AG; Novo Nordisk; Bayer AG; AbbVie Inc.; Merck & Co. Inc.; Bristol Myers Squibb

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rare Diseases Treatment Market Segmentation

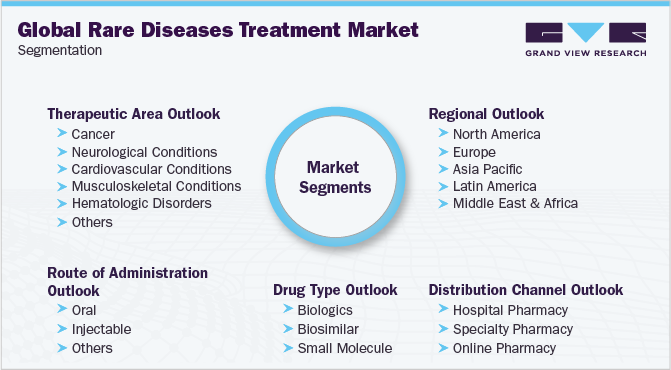

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global rare diseases treatment market report on the basis of therapeutic area, route of administration, drug type, distribution channel, and region:

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Neurological Conditions

-

Cardiovascular Conditions

-

Musculoskeletal Conditions

-

Hematologic Disorders

-

Infectious Diseases

-

Metabolic disorders

-

Endocrine disorders

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Others

-

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Biosimilar

-

Small Molecule

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Specialty Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

- UAE

-

-

Frequently Asked Questions About This Report

b. The global rare disease treatment market is expected to witness a compound annual growth rate of 12.8% from 2022 to 2030 to reach USD 335.84 billion in 2030.

b. The global rare disease treatment market size was estimated at USD 119.6 billion in 2021 and is expected to reach USD 128.42 billion in 2022.

b. Based on the therapeutic area, cancer dominated the market in 2021 with a share of 30.29% owing to the high prevalence of rare cancers coupled with the presence of a large number of products approved for their treatment.

b. Some key players operating in the rare disease treatment market include companies such as F. Hoffmann-La Roche Ltd, Pfizer, Inc., Takeda Pharmaceutical Company Limited, PTC Therapeutics, AstraZeneca, Novartis AG, and Novo Nordisk amongst others.

b. Key factors driving the rare disease treatment market growth include increasing product launches, rising prevalence of rare diseases, and rising investment in R&D for rare disease treatment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."