- Home

- »

- Alcohol & Tobacco

- »

-

Ready To Drink Cocktails Market Size & Share Report, 2030GVR Report cover

![Ready To Drink Cocktails Market Size, Share & Trends Report]()

Ready To Drink Cocktails Market Size, Share & Trends Analysis Report By Alcohol Base (Wine-based, Spirit-based), By Distribution Channel (Online, Liquor Stores), By Packaging (Cans, Bottles), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-253-5

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

The global ready to drink cocktails market size was estimated at USD 853.2 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.0% from 2023 to 2030. The growing demand for flavored drinks with low alcohol content due to the rising health concerns is anticipated to drive the ready to drink (RTD) cocktails market over the forecast period. Premiumization of the product with flavors, taste, quality, and package design is further expected to drive market growth. The market has experienced a favorable effect due to the COVID-19 pandemic. While the demand for these products was already on the rise, the segment witnessed significant growth following the global outbreak. Factors, such as the flourishing at-home cocktail culture, increased health consciousness, convenience, and improved quality and variety of RTD cocktails have contributed to the surge in demand.

Health-conscious consumers in developed countries are increasingly opting for low-alcohol flavored beverages. These drinks typically have a lower alcohol content, ranging from 4% to 7%, and are infused with enticing flavors, such as lemon, cranberry, orange, and passionfruit. As a result, the popularity of low alcohol by volume (ABV) beverages has been steadily growing. Among them, products based on gin and tequila have witnessed significant demand from consumers. In Russia, Australia, Brazil, China, and South Africa, there has been a notable decrease in per capita alcohol consumption. This trend is attributed to changing lifestyle preferences aimed at enhancing overall well-being, as well as a growing emphasis on responsible drinking.

Consequently, there is an anticipated rise in the demand for RTD cocktails. In addition, the availability of organic, gluten-free, and keto-friendly options in the market is enticing an increasing number of consumers to embrace these products. The demand for convenient ready-to-eat (RTE) or RTD products is being propelled by consumers' increasing preference for quick and easy solutions amidst their busy lifestyles and demanding work schedules. This trend is particularly driven by the growing working population. Furthermore, the market is being influenced by a considerable segment of consumers who favor the convenience of serving homemade drinks at house parties and social gatherings.

Alcohol Base Insights

The spirit-based cocktails segment dominated the market with a revenue share of more than 43.9% in 2022 and is projected to continue its dominance throughout the forecast period. These cocktails typically contain alcohol content of up to 5%, combined with other ingredients, such as juices, and are available in single-serve packaging with a wide range of flavors. Popular spirits like vodka, gin, tequila, whiskey, and rum are commonly used in these cocktails. With a diverse range of options including infused flavors like ginger, rose, and lavender, spirit-based cocktails have become increasingly favored among consumers, making them the preferred choice in the alcoholic beverage category.

The wine-based cocktails segment is expected to experience rapid growth, emerging as the second-fastest-growing segment with a projected CAGR of 13.7% during the forecast period. This growth is driven by consumer perceptions of wine as a healthier alternative to spirits and malts, leading to increased demand for wine-based cocktails. These cocktails typically incorporate fruit juices, such as grapefruit, oranges, passionfruit, lemon, mango, and berries, adding to their appeal. Moreover, wine-based cocktails align with evolving consumer trends toward adopting a healthier lifestyle by opting for beverages with lower ABV content. As a result, manufacturers are introducing healthier options that are gluten-free, low in carbs, made with organic/natural ingredients, and have a lower alcoholic content, catering to the growing demand for health-conscious beverages.

Packaging Insights

The bottle packaging segment held the largest revenue share of over 57.9% in 2022 establishing its dominance in the global market. The concept of RTD cocktails was initially introduced in bottle packaging, gaining widespread popularity globally. However, due to the aluminum shortage in countries like the U.S., there has been a shift toward using glass bottles. This market trend has led to an increased demand for glass bottles in the global market for RTD cocktails.

The cans segment is poised to experience the fastest CAGR of 14.5% from 2023 to 2030. Cans have gained popularity as a preferred packaging option for ready-to-drink cocktails due to their lightweight and compact design. Consumers are increasingly seeking convenient and portable beverage choices that align with their styles and preferences.

Distribution Channel Insights

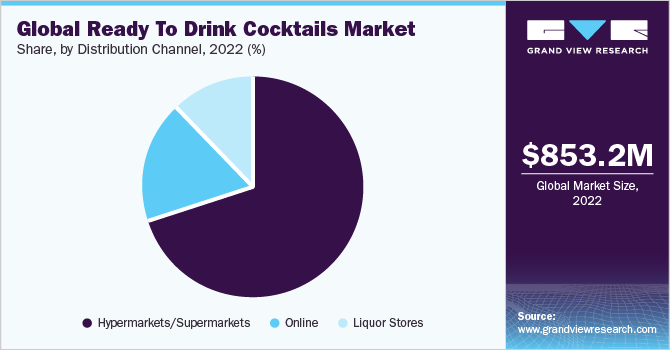

In 2022, the hypermarkets/supermarkets segment dominated the market with a significant revenue share of 69.8%. This segment is expected to maintain its leading position throughout the forecast period due to the strong consumer preference for purchasing grocery products from supermarkets, convenience stores, specialty stores, and grocery stores. Consumers prefer hypermarkets/supermarkets for their extensive product choices and convenient shopping experience. Within these retail outlets, grocery stores play a vital role as distribution channels for RTD cocktails. This includes both local grocery stores and well-known national chains like Kroger in the U.S., which are integral parts of the mainstream grocery distribution platform. These establishments ensure that ready-to-drink cocktails are readily available to consumers seeking convenience and variety in their beverage choices.

Supermarkets and hypermarkets are globally recognized distribution channels, with retail giants like Target and Walmart holding significant market shares. These establishments cater to larger order sizes compared to traditional grocery stores. On the other hand, the online segment is projected to grow at the fastest CAGR of 14.9% from 2023 to 2030. This segment includes company websites and various e-commerce platforms where RTD cocktails are made available for purchase. The increasing consumer preference for online shopping has prompted companies to actively offer their products through this channel, meeting the evolving demands of consumers who seek convenience and accessibility.

Regional Insights

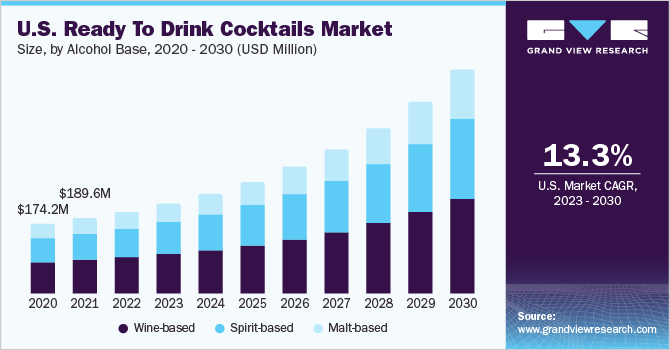

In 2022, North America emerged as the dominant market capturing a revenue share of over 33.6%. This regional dominance is expected to continue throughout the forecast period. The market growth is primarily driven by the increasing demand for vodka and whiskey-based beverages in the region. The appeal of these ready cocktails lies in their low alcohol content and affordability compared to those served at bars, making them an attractive choice for young consumers. Among the countries in North America, the United States accounted for the largest revenue share in 2022. This can be attributed to the rising consumer demand for a wide variety of flavors and the shifting preference toward convenient on-the-go products.

The market in the U.S. is projected to maintain a robust growth rate with a CAGR of 13.3% during the forecast period. According to a report by the WHO, Europeans above the age of 15 years consumed 9.5 liters of alcohol, which comprised 24 liters of spirits, 80 liters of wine, and 190 liters of beer in 2021. Convenient options and easy portability of RTD cocktails are fueling the market growth in Europe. The region held the second-largest market share of 27.1% in 2022. The UK market dominated the region with a share of 22.1% in 2022.

Asia Pacific is poised to experience a CAGR of 15.4% from 2023 to 2030 due to the increasing demand for premium, convenient, and high-quality cocktails, influenced by the Western culture that has gained prominence in the region. Changing lifestyles and the rising consumption of alcohol are among the key factors driving the demand for these products. The convenience, combined with the lower alcohol content and affordable pricing compared to counterfeit cocktails served in bars, makes RTD cocktails an appealing choice for young consumers in the region. Notably, the market in Japan is expected to exhibit a robust CAGR of 15.9% from 2023 to 2030.

Key Companies & Market Share Insights

The market is characterized by the presence of a few well-established and several small- and medium-scale players. Companies have been launching new products across the globe owing to the rising demand. In addition, regional and local players also have a significant presence in the market. Key companies undertake various strategies, such as new product launches, mergers, and acquisitions, to gain higher market shares. For instance:

-

In April 2023, Absolut launched three flavors of RTD cocktails. These flavors include coffee, strawberry, and passion fruit. The new product range has only 5% ABV and was launched in the UK in May 2023.

-

In April 2023, American singer and actress Jennifer Lopez launched ‘The House of Delola’ a premium range of spirit-based and organic RTD cocktails. Launched in three flavors, namely Bella Berry Spritz (10.5% ABV), L’Orange Spritz (10.5% ABV), and Paloma Rosa Spritz (11.5% ABV), the cocktails are enhanced with fruit flavors and have fewer calories

-

In January 2022, The Coca-Cola Company signed a brand authorization agreement with Constellation Brands Inc. to launch FRESCA Mixed, a line of full-flavored, spirit-based RTD cocktails in the U.S. The FRESCA brands aim to appeal to consumers seeking fuller-flavored experiences and higher-quality RTD cocktails to bridge between refreshing hard seltzers and full-flavored bar cocktails

-

In March 2021, Diageo plc launched new Crown Royal RTD cocktails for whisky and cocktail enthusiasts. It includes three classic, signature Crown Royal serves in apple, cranberry, cola, and peach tea flavors

-

In August 2020, Diageo Plc. launched a range of flavored, low-calorie, RTD cocktails under its Ketel One brand in the U.S. The product is formulated with vodka blended with botanicals, natural fruits, and sparkling water and comprises of three-strong flavors including Peach & Orange Blossom, Cucumber & Mint, and Grapefruit & Rose

Some prominent players in the global ready to drink cocktails market include:

-

The Absolut Company

-

House of Delola, LLC

-

Diageo plc

-

Brown-Forman

-

Bacardi Limited

-

Asahi Group Holdings, Ltd.

-

Pernod Ricard

-

Halewood Wines & Spirits

-

Shanghai Bacchus Liquor Co., Ltd.

-

Suntory Holdings Limited

-

Manchester Drinks Company Ltd.

-

Anheuser-Busch InBev

Ready To Drink Cocktails Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 942.8 million

Revenue forecast in 2030

USD 2.43 billion

Growth rate

CAGR of 14.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Alcohol base, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; South Korea; Australia & New Zealand; India; Brazil; South Africa

Key companies profiled

The Absolut Company; House of Delola, LLC; Diageo plc; Brown-Forman; Bacardi Limited; Asahi Group Holdings, Ltd.; Pernod Ricard; Halewood Wines & Spirits; SHANGHAI BACCHUS LIQUOR CO., LTD.; Suntory Holdings Limited; Manchester Drinks Company Ltd.; Anheuser-Busch InBev

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ready To Drink Cocktails Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global ready to drink cocktails market report based on alcohol base, packaging, distribution channel, and region:

-

Alcohol Base Outlook (Revenue, USD Million, 2017 - 2030)

-

Malt-based

-

Spirit-based

-

Wine-based

-

-

Packaging Outlook (Revenue, USD Million, 2017 - 2030)

-

Bottles

-

Cans

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Hypermarkets/Supermarkets

-

Online

-

Liquor Stores

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

France

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

Australia & New Zealand

-

South Korea

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ready to drink cocktails market size was estimated at USD 853.2 million in 2022 and is expected to reach USD 942.8 million in 2023.

b. The global ready to drink cocktails market is expected to grow at a compounded growth rate of 14.0% from 2023 to 2030 to reach USD 2,429.9 million by 2030.

b. North America dominated the global ready to drink cocktails market with a share 33.59% in 2022. This regional dominance is expected to continue throughout the forecast period. The market growth is primarily driven by the increasing demand for vodka and whiskey-based beverages in the region.

b. Some key players operating in the ready to drink cocktails market include The Absolut Company; House of Delola, LLC; Diageo plc; Brown-Forman; Bacardi Limited; and Asahi Group Holdings, Ltd.

b. Key factors that are driving the market growth include health-conscious consumers in developed countries are increasingly opting for low-alcohol flavored beverages.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."