- Home

- »

- Next Generation Technologies

- »

-

Global Restaurant Management Software Market Report, 2030GVR Report cover

![Restaurant Management Software Market Size, Share & Trends Report]()

Restaurant Management Software Market Size, Share & Trends Analysis Report By Software (Purchasing & Inventory Management, Accounting & Cash Flow), By Deployment, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-376-8

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

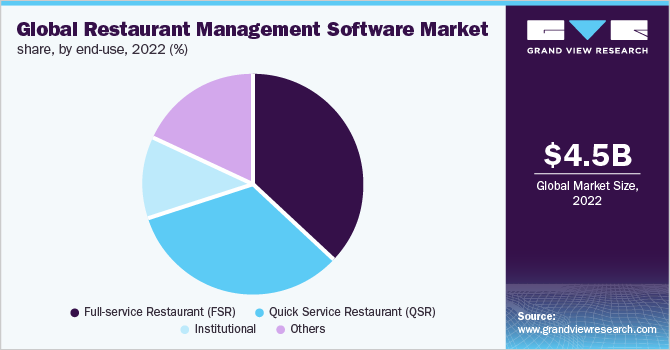

The global restaurant management software market size was valued at USD 4,556.4 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 16.3% from 2023 to 2030. The growth can be attributed to the increasing number of restaurants worldwide along with the widening usage of cloud-based technology and growing acceptance of Quick Service Restaurant (QSR) services. The COVID-19 pandemic impacted the restaurant industry by causing temporary closures and a lack of dine-in customers. However, the use of Point of Sale (POS) solutions enabled restaurants to survive the pandemic by providing contactless payment options.

Owing to the pandemic, many packaged food services, and restaurants chose online sales channels to meet consumer needs. As a result, the added benefit of installing POS systems to precisely identify customer preferences and sales trends is expected to augment the market’s growth. Technological advancements in the restaurant industry and the growing demand for restaurant-specific software such as billing and payment, inventory management, and table management, are expected to drive the growth. Further, several recent advancements in order processing techniques have aided restaurateurs in streamlining their order management.

For instance, Kitchen Display System (KDS), a digital menu board for kitchen staff, automatically displays orders based on priority and flags any special dietary requests. This system communicates directly with the restaurant's POS system and tracks meal delivery times. It also ensures better communication and long-term kitchen operations. These developments would further drive the growth of the restaurant management software market during the forecast period.

Restaurants, bars, and food service providers highly rely on Point of Sale (POS) technology to track sales, products, operations, and inventory. Touchscreen ordering solutions are preferred to guarantee accurate customer orders. POS technology tends to account for the largest portion of the IT budgets and investments of restaurants.

Restaurant operators seek innovative ways to deliver higher levels of guest satisfaction. Mobile POS systems, for instance, allow employees to spend more time on the floor with customers rather than making several trips to the kitchen and admin sections. Thus, restaurants can create an optimized culture built on improved customer service. The growing adoption of mobile POS systems is expected to drive the industry’s growth.

Furthermore, food delivery websites, such as GrubHub, PostMates, and Zomato, are allowing restaurants to improve their online presence and providing them with an opportunity to gain new customers and generate extra revenue. At the same time, restaurant review sites are also helping restaurants build up their reputation. While advances in the software and applications related to the food service industry show no signs of abating, restaurants need to adapt to the changing ecosystem of their business and adopt management software to remain ahead of the competition. The scenario is anticipated to boost the market growth.

The increasing smartphone and internet penetration and rising disposable incomes of consumers enable them to demand customized and personalized services from restaurants. Moreover, growing advancements in technology and the rising adoption of artificial intelligence, virtual assistants, the internet of things, and cloud-based solutions in restaurants allow owners to deliver the best customer services that could engage customers for longer durations.

For instance, food restaurant chains such as KFC, Pizza Hut, and Domino’s are installing voice-activated ordering systems and chatbots to provide a seamless customer experience. Mobile apps integrated with major virtual assistants such as Google Assistant and Alexa provide easy navigation to customers for placing orders using voice commands. These developments have helped these food restaurant chains achieve growth in customer engagement and retention and deliver personalized customer experience, and engage customers for longer periods.

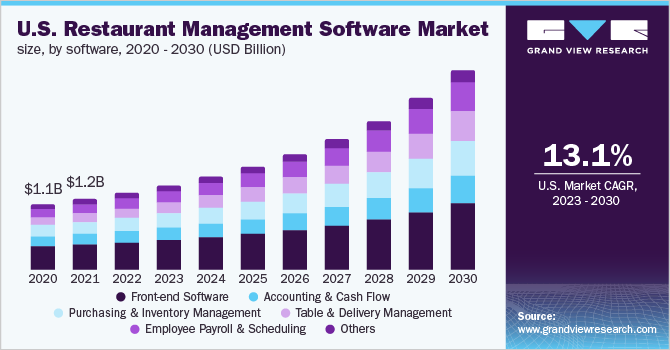

Software Insights

The front-end software segment accounted for a market share of 35.6% in 2022. The restaurant management software with Android support is widely adopted across the globe as it is cheaper than iOS-based software. Easy connectivity to smartphones and other connected devices, lower requirement for technical expertise, flexibility for multiple users to operate, and cost-effectiveness are some of the key factors that are triggering the adoption of Android software over iOS software. However, the growing advancements in cross-platform technologies are encouraging restaurant owners to opt for software solutions that effectively support both operating systems. This is anticipated to drive segment growth over the forecast period.

The table & delivery management segment is anticipated to expand at a CAGR of 18.8%. The segment growth can be attributed to the growing focus on delivering the best customer experiences to stay competitive in the global industry and the increasing need to maximize customer retention rate, which are enabling restaurant owners to opt for table & delivery management solutions. The rising use of the internet and smartphones has empowered customers to seek innovative services at restaurants. Thus, to cater to the increasing demand for better and timely food services at a table, restaurant owners are implementing restaurant management software solutions, thereby driving the segment growth.

Deployment Insights

The cloud segment accounted for a market share of 55.3% in 2022. The adoption of cloud-based restaurant management software has increased significantly over the past few years in the global restaurant industry. This software relies on remote networks of servers that are hosted on the internet to process, manage, and store data, rather than on a local or on-premise server.

For instance, in January 2022, ParTech, Inc. (PAR), a restaurant technology company, partnered with Jolt, a U.S.-based company offering software solutions to restaurant owners, to integrate ParTech’s Brink POS with Jolt’s operations management software. Such developments would further drive the demand for cloud-based solutions for restaurant management software during the forecast period.

The on-premise segment is anticipated to expand at a CAGR of 10.5% during the projection period. The on-premise restaurant management software solution runs through a restaurant’s physical server. As it is located on-site, the restaurant has complete control over the server, and its functioning & database. Large-size or full-service restaurants with huge assets and sensitive data prefer deploying on-premise software solutions to meet compliance requirements and relevant legislation.

Restaurants in remote locations with limited internet access demand on-premise restaurant management solutions. However, with the growing awareness regarding cloud-based solutions and their advantages over on-premise software, this segment is expected to grow at a moderate pace over the forecasted period.

End-use Insights

The Full-service Restaurant (FSR) segment accounted for the largest market share of 36.8% in 2022. Full-service restaurants make significant investments in technology to deliver prompt and timely customer service. These restaurants have a broad menu, a variety of courses, and ample resources for managing business operations. Since they consistently require updated technologies, restaurant management software providers offer a variety of solutions that are customized to fit their requirements.

For instance, in March 2022, Starbucks, a multinational chain of coffeehouses, announced that the company would open 1,000 community stores worldwide by 2030. This initiative will help the company better understand the customers it serves, and provide an accessible store experience that benefits the organization’s employees and its customers.

The Quick Service Restaurant (QSR) segment is expected to register a significant growth rate of 18.0% from 2023 to 2030. Food quality and prompt customer service have long been hallmarks of the Quick Service Restaurant (QSR) industry. However, with rising customer expectations for easy and attractive services, QSR owners are investing heavily in technology to meet customer requirements. Customers of QSR particularly demand customized, accurate, and personalized dining experiences.

Furthermore, restaurant managers must be able to maximize upsells and streamline inventory management. As a result, QSR owners invest strategically in restaurant management software that meets the needs of their users, staff, and indirectly, their customers. Thus, the segment is witnessing increased demand for centralized software.

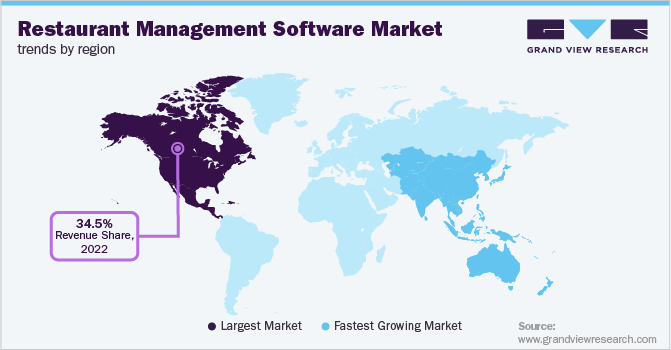

Regional Insights

In 2022, North America held the major share of 34.5% of the global restaurant management software market. The regional market is driven by growing disposable income, swift urbanization, and the high market penetration of vendors. Furthermore, the presence of popular QSR and FSR chains and the wide availability of a variety of cuisines contribute to the region's QSR market movement.

For instance, in October 2021, Fiserv, Inc. a financial technology service provider, announced the acquisition of BentoBox, a digital marketing and commerce platform provider that helps restaurants connect with their guests. The acquisition allowed the company to expand its Clover dining solution, as well as its commerce and business management capabilities, allowing over 200,000 restaurants to provide unique and distinguishing diner experiences, ranging from quick and casual to full service.

The Asia Pacific is anticipated to emerge as the fastest-growing region over the forecast period at a CAGR of 19.4%. The growing need for improved customer experience and increased use of POS software are the primary drivers of regional market growth.

Furthermore, restaurants in China, India, and Japan are implementing software technology that enables customers to order and pay at the table using smartphones and other devices. Moreover, several restaurants are offering cash-back deals, and discounts on plastic card payment options have enticed consumers to spend cashless. This adoption is likely to stimulate regional market growth.

Key Companies & Market Share Insights

Market players are observed to invest resources in research & development activities to support growth and enhance their internal business operations. Companies can be seen engaging in mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage in the market. They are effectively working on new product development, and enhancement of existing products to acquire new customers and capture more market share

For instance, in April 2022, Peabody Hotels & Resorts, a full-service hospitality company, adopted Fourth Enterprises LLC, a restaurant management software service provider, procurement, and inventor management solution, Adaco, to control costs and supply critical support to The Peabody Memphis. The solution will help minimize supplier-related costs and gain critical insights into the profitability of crucial offerings across its 464 rooms. Some prominent players in the global restaurant management software market include:

-

Fiserv, Inc.

-

Personica (Fishbowl Inc.)

-

Fourth Enterprises LLC.

-

Jolt

-

NCR Corporation

-

OpenTable, Inc.

-

Oracle Corporation

-

Revel Systems

-

Square Capital, LLC

-

TouchBistro

Restaurant Management Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.12 billion

Revenue forecast in 2030

USD 14.70 billion

Growth rate

CAGR of 16.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Software, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; UAE; Saudi Arabia

Key companies profiled

Fiserv, Inc.; Personica (Fishbowl Inc.); Fourth Enterprises LLC.; Jolt; NCR Corporation; OpenTable, Inc.; Oracle Corporation; Revel Systems; Square Capital, LLC; and TouchBistro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.Explore purchase options

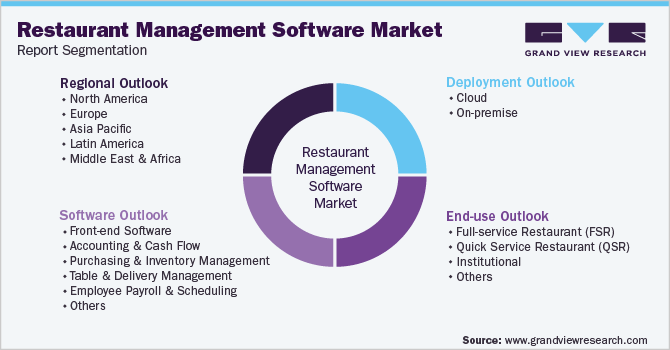

Global Restaurant Management Software Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global restaurant management software market report based on software, deployment, end-use, and region:

-

Software Outlook (Revenue, USD Million, 2018 - 2030)

-

Front-end Software

-

Accounting & Cash Flow

-

Purchasing & Inventory Management

-

Table & Delivery Management

-

Employee Payroll & Scheduling

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018-2030)

-

Cloud

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2018-2030)

-

Full-service Restaurant (FSR)

-

Fine Dine

-

Casual Dine

-

-

Quick Service Restaurant (QSR)

-

Institutional

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018-2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global restaurant management software market size was estimated at USD 4,556.4 million in 2022 and is expected to reach USD 5.12 billion in 2023.

b. The global restaurant management software market is expected to grow at a compound annual growth rate of 16.3% from 2023 to 2030 to reach USD 14.70 billion by 2030.

b. North America dominated the restaurant management software market with a share of 34.5% in 2022. This is attributable to the demand for solutions such as table management, menu management, and kitchen management, among others across a large number of restaurants in the region.

b. Some key players operating in the restaurant management software market include NCR Corporation; Jolt, Square Inc.; Toast, Inc.; HotSchedules; Revel Systems Inc.; Touch Bistro; and ShopKeep.

b. The technological advancements in the restaurant industry and the rising need for restaurant-specific software such as billing and payment, inventory management, and table management are expected to foster the growth of the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."