- Home

- »

- IT Services & Applications

- »

-

Robotic Process Automation Market Size, Share Report 2030GVR Report cover

![Robotic Process Automation Market Size, Share & Trends Report]()

Robotic Process Automation Market Size, Share & Trends Analysis Report By Type (Software, Services), By Deployment (Cloud, On-premise), By Organization (Large, Small & Medium Enterprises), By Operations, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-145-0

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

Robotic Process Automation Market Trends

The global robotic process automation market size was valued at USD 2,942.7 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 39.9% from 2023 to 2030. As a result of the COVID-19 pandemic, businesses worldwide had to shift towards automating business workflow, which has helped accelerate the growth of market leaders in robotic process automation from 2023 to 2030. For instance, according to a survey conducted by Blue Prism Limited (a U.K.-based RPA solution provider) published a survey report in February 2022 named "RPA In the APAC Financial Services Sector." According to the report, 21% of India's financial services organization respondents said their organizations adopted RPA during the COVID-19 pandemic.

Some of the major features of RPA for which businesses are adopting RPA include improved productivity, optimizing performance, integrating new technologies, generating higher returns, and moving business processes across the enterprise. All these factors mentioned have resulted in higher adoption of RPA across various industries, resulting in the growth of the robotic process automation market from 2023 to 2030.. Robotic process automation in the manufacturing market has matured over the years. It is anticipated to become much more complex from 2023 to 2030., as the latest technologies such as AI, ML, OCR (Optical Character Recognition), and analytics are being integrated with RPA, enabling increased performance. Intelligent automation is expected to eliminate approximately 40% of service desk interaction by 2025.

The increasing demand for automation of business processes is one of the major factors influencing the growing adoption of RPA technology. Businesses opt for RPA solutions with advanced features integrated with the latest technologies, such as AI. Companies in robotic process automation have been collaborating to work towards offering enhanced RPA solutions is seizing the robotic process automation RPA market opportunity. For instance, in March 2021, Google partnered with Automation Anywhere to make the Automation Anywhere platform available in the google cloud, enabling both companies to develop AI mutually and RPA-powered solutions. Such collaboration has helped the availability of better RPA solutions in the market, enabling wider adoption in the market. Moreover, the cognitive robotic process automation market allows the automation of business processes that involve unstructured data sources. Cognitive robotic process automation integrates AI-enabled bots to understand the deep complexities and drive analytics-based process automation.

Increased capability of RPA solution with the integration of AI technology in terms of improved business results, creating new positions, improved ROI, and reduced wage costs, among others. Robotic process automation tools in the market can also perform activities across different systems to get information on digital platforms. For instance, adopting RPA in the smartphone manufacturing industry, where robots can efficiently place soldering, components and flexible quality control and the manufacturer can make informed decisions via digital platforms, is prompting the growth of robotic process automation for smartphone manufacturing market. Such services have resulted in reduced manual involvement and enabled the offering of improved customer experience. The proliferation in thesize of artificial intelligence market including robotic process automationaims to incorporate AI capabilities into RPA solutions, enterprises may attain new levels of productivity. AI algorithms may evaluate and learn from data patterns, allowing robots to make better decisions, adapt to changing situations, and complete tasks with higher accuracy than conventional RPA.

Although the robotic process automation market is expected to grow significantly from 2023 to 2030., businesses are still reluctant to switch from manual to automated processes. Companies' reluctance can be attributed to long-term sustainability, error magnification, overall risk, and maintenance. Although such a factor is restraining market growth, the persistence of the digitalization wave is expected to negate this factor in the coming years. Robotic process automation and energy market trends are being employed to enhance customer service in the energy sector. RPA-powered chatbots and virtual assistants can handle client inquiries, billing data, and assistance, all of which contribute to a better customer experience. Moreover, robotic process automation in aerospace market is streamlining complex supply chain procedures by automating order processing, inventory management, and cargo tracking for ensuring timely deliveries with reduced errors.The insurance robotic process automation market size is widely incorporating RPA solutions to automate repetitive and rule-based operations such as claims processing, policy administration, collecting data, and screening. This process of automation significantly improves operating efficiency but also minimizes errors and speeds up response times.

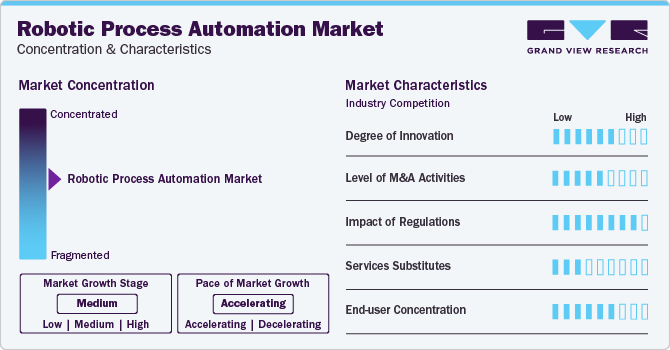

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. Robotic Process Automation (RPA) has emerged as an important aspect of enterprises' global digital transformation journeys. The RPA market has expanded significantly, driven by consumer demands for more efficiency, lower operational costs, and higher production. Larger organizations are purchasing minor RPA providers to diversify their service capabilities and gain a competitive advantage.

Furthermore, strategic alliances between RPA suppliers and other technology providers have grown more prevalent. With the growing importance of data security and regulatory compliance, RPA companies are focusing on improving the security elements of their solutions. This includes strong encryption, authentication systems, and adherence to industry-specific requirements.

The trend to develop industry-specific RPA solutions is expected to continue as enterprise robotic process automation market companies want personalized automation for their specific operations. RPA suppliers will continue to invest in understanding industry peculiarities and offering tailored solutions to distinctive challenges and regulatory requirements. Hype automation, that combines numerous automation technologies including RPA, Artificial Intelligence (AI) and Machine Learning, is expected to determine the future of the RPA market. Organizations are searching for comprehensive automation solutions that can manage end-to-end operations involving unstructured as well as structured data. The rise of RPA as a Service (RPAaaS) models will broaden access to automation capabilities. The upward trajectory will allow firms to employ RPA without making major upfront investments, resulting in broader adoption across companies of every dimension.

Type Insights

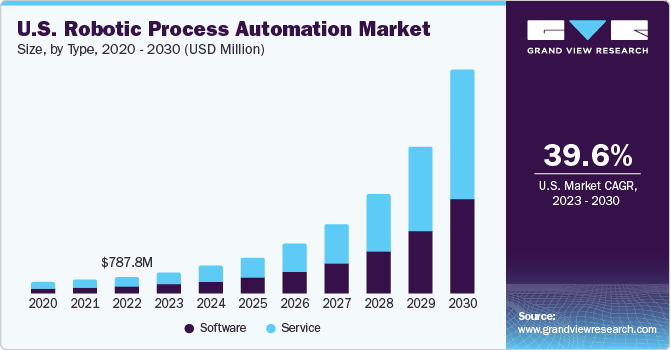

The robotic process automation service segment is expected to occupy the largest market share in 2022 which is around 64%. The service segment includes consulting, implementing, and training series. Increased competition among enterprises has resulted in RPAA service providers enhancing the services offered. The continuous upgrades in automation services that enable high scalability and minimize cost have driven the demand for RPA as a service. The implementation of RPA as a service assists the organization to identify the automation opportunities to be optimized and then building business cases by concentrating on the proper vendor selection for a step toward pilot project deployment.

Implementing RPA as a service helps businesses identify automation opportunities for optimization. RPA software also enables cost-effective and agile business operations attributed to the rapid automation of manual and back-office processes. RPA services also enable increased accuracy and reduce the cost of creating a virtual workforce. The market leaders in robotic process automation offer software/platform licenses per enterprise robotic business need and rules required to automate the specified processes. In June 2021, Kofax Inc. a U.S.-based company acquired PSIGEN Software, Inc., a leading provider of content management, document capture, and workflow automation software and solutions, providing a wide range of solutions and software in the marketplace and augmenting the intelligent automation platform of the company. PSIGEN’s content management software, PSIsafe, and document capture software, PSIcapture, are quite simple to deploy and offer robust capabilities.

Deployment Insights

The on-premises segment of the robotic process automation market is expected to occupy the largest share in 2022 which is nearly 72%. On-premise deployment of RPA enables businesses to ensure RPA access policies are in line with in-house protocols. Additionally, it helps the company to govern customer RPA systems regarding the requirement. Additionally, large-scale enterprises were doubtful about revealing their information and internal data, leading to the high adoption of on-premise deployment of RPA systems.

The cloud segment of the robotic process automation market is expected to have significant growth from 2023 to 2030. RPA service providers purchase and convert licenses for clients, enabling clients to deploy RPA bots into processes, allowing both to be immediately ready to be operated once the clients start using RPA cloud services. RPA, which is offered via the cloud, provides lower infrastructure costs, automatic upgrades, lower maintenance, and ease of deployment.

Organization Insights

The large enterprise segment of the robotic process automation market is expected to occupy the largest market share in 2022, 65.0%. Large enterprises are deploying RPA to reduce the time wasted in conventional activities and help save time for strategic decision-making. Moreover, RPA helps large enterprises minimize human error, improve work efficiency, and reduce overhead expenses. RPA vendors have extended licensing periods with no additional cost during the COVID-19 pandemic for the existing clients enabling them to benefit from RPA evening during the pandemic.

The SME segment is projected to have the highest CAGR from 2023 to 2030. SMEs are highly pushing towards adopting RPA regarding its cost-effectiveness, flexibility, reduced technology risks, and improved organizational productivity. The rise in awareness among SMEs regarding the benefits of automating business processes has also played a part in the growth of the SME segment in the robotic process automation market. The RPA enables SMEs to overcome the reduced human error and shortage of employees for redundant tasks by supporting automation functions, which is expected to boost the robotic process automation market.

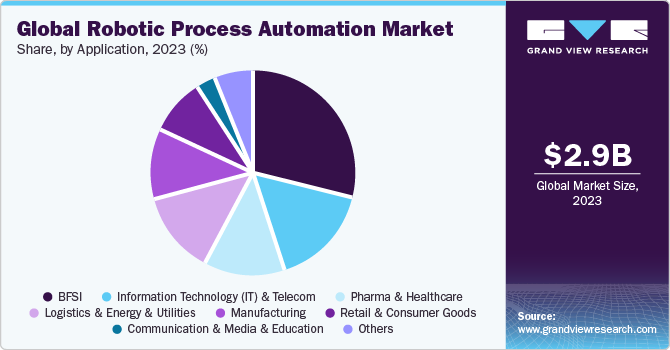

Application Insights

The BFSI segment of the robotic process automation market holds the largest revenue share in 2022, accounting for around 29% of the overall market. The use of robotic process automation market trends in the financial industry helps banks and other financial institutions to automate business processes, which include lending loans, account opening, and deposits, among others. Moreover, the implementation of RPA improves efficiency and work speed. Also, it opens the window to integrating RPA with AI, which is essential for the BFSI sector to set new policies and services.

The number of companies in the robotic process automation market offering RPA solutions tailor-made for the BFSI sector also has facilitated the segment's growth from 2023 to 2030. For instance, UiPath offers an RPA solution for the BFSI sector, which has an 80% faster reconciliation time and twice the transaction processing capacity. The presence of such players in the robotic process automation market has helped grow the BFSI segment from 2023 to 2030.

Regional Insights

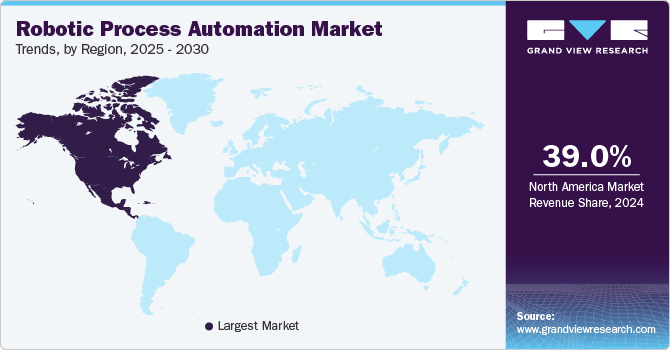

North America Robotic Process Automation Market Trends

The demand for robotic process automation was highest in the North America region, accounting for around 37.0% of revenue share in 2022 with a CAGR of around 39% from 2023-2030. Factors that resulted in the high penetration rate of RPA adoption in North America can be attributed to the increased adoption of RPA among government agencies and enterprises in the region. Moreover, the implementation of RPA in SMEs located in North America area is utilized to enhance business functions, including procurement detail, data entry, and accounting/finance, resulting in market growth. Therefore, aforementioned factors are collectively driving the growth of the North America robotic process automation market.

Asia Pacific Robotic Process Automation Market Trends

Asia Pacific is projected to have the highest CAGR nearly of 42% from 2023 to 2030, which can be attributed to an increase in the adoption of RPA across the IT, pharma, healthcare, Telecom, manufacturing, and retail industries. Therefore, driving the growth of the Asia Pacific robotic process automation market.

China Robotic Process Automation Market Trends

The robotic process automation market in China is projected to grow at a CAGR nearly of 41% from 2023 to 2030. The Chinese RPA market is expected to witness surging growth owing to the increasing need for a virtual workforce across the country. Further, the rapid rise of digital transformation with sophisticated methodologies in hyper automation is also propelling the Chinarobotic process automation market growth.

Japan Robotic Process Automation Market Trends

The robotic process automation market in Japan is projected to grow at a CAGR nearly of 40% from 2023 to 2030. The Japan robotic process automation market growth can be attributed to the increasing need to optimize operations to enhance efficiency and achieve maximum return in the business operations, growing integration of innovative technologies, and transformation of business process across organizations.

India Robotic Process Automation Market Trends

The robotic process automation market in India is projected to grow at a CAGR of 44.6% from 2023 to 2030. Robotic process automation is underway in India and quickly changing the businesses functions and operations. Moreover, Market players are increasingly acknowledging the fundamental role of automation in resolving their pain points, such as finding automation skills, developing business cases, and selecting an implementation partner, among others and accelerating India robotic process automation marketgrowth.

Europe Robotic Process Automation Market Trends

The robotic process automation market in Europe is growing significantly at a CAGR of 37.5% from 2023 to 2030. Several technological advancements in AI adoption such as Chabot and natural language processing in RPA is expected to propel the market growth from 2023 to 2030.

U.K. Robotic Process Automation Market Trends

The robotic process automation market in U.K. is growing significantly at a CAGR nearly of 39% from 2023 to 2030. The robotic automation process market is expected to witness a significant growth from 2023 to 2030. Ascribed to the presence of several logistics and industrial companies in the region. The technology assists in rationalizing pickup and drop operations to achieve significant advancements in cycle time and improve the customer experience.

Germany Robotic Process Automation Market Trends

The robotic process automation market in Germany is growing significantly at a CAGR nearly of 38% from 2023 to 2030. In Germany, the robotic automation process market growth can be attributed to the technological advancements and an increase in R&D activities in artificial intelligence, particularly machine learning and deep learning, will lead to more applications for traditional industrial robots and collaborative robots.

France Robotic Process Automation Market Trends

The robotic process automation market in Franceis growing significantly at a CAGR nearly of 37% from 2023 to 2030. In France, collaborative robots are becoming increasingly popular as they combine modern software, sensors, and end-of-arm tooling to adapt swiftly and securely to environmental shifts and help improve efficiency. In addition, there has been a constant increase in industrial robot investment in the chemical, banking, pharmaceutical, and automotive infrastructure industries.

Middle East & Africa Robotic Process Automation Market Trends

Middle East & Africa robotic process automation market is anticipated to witness significant growth at a CAGR of 40% from 2023-2030. Initiatives undertaken by governments and corporations to promote advanced technologies, such as machine learning, business analytics, and AI, coupled with continuous adoption of cloud-based technologies, are anticipated to fuel the demand for implementing digital transformation across business processes, thereby flourishing the robotic process automation market growth in Middle East & Africa countries.

Saudi Arabia Robotic Process Automation Market Trends

Saudi Arabia robotic process automation market is anticipated to witness significant growth from 2023-2030. The increasing use of Bluetooth, Wi-Fi, RFID, and sensors has ushered in the IoT revolution. RPA IoT is used in IoT applications to provide rapid, automated, and data-driven processes to events.

Key Companies & Market Share Insights

Some of the key players operating in the market include SAP; Blue Prism Limited; Microsoft and NTT Advanced Technology Corp. among others.

-

SAP is an enterprise application software company that aims to redefine ERP and creates network for intelligent enterprises resiliency, transparency, and sustainability across supply chains. The company’s product offering includes SAP IRPA automates repetitive operations using robotic process automation and machine learning, allowing enterprises to improve operational efficiency and minimize manual labor.

-

Blue Prism Limited is a multinational software business that specializes in robotic process automation (RPA). The Blue Prism RPA platform is the cornerstone of the company's solutions. It offers an adaptable and secure automated solution that enables businesses to automate monotonous, rule-based operations.

-

Microsoft, is a multinational technological conglomerate, which offers services in the software, hardware, and cloud computing sectors. Azure, Microsoft's cloud computing platform, is vital for enabling enterprises' digital transformation. Power Automate interacts smoothly with Azure services, serving as a bridge between robotic process automation and cloud computing. This interface enables enterprises to use Azure's size and flexibility for automation initiatives. Microsoft's Power Automate is a key component of its automation strategy. It is an RPA solution that enables enterprises to automate routine procedures and workflows, thereby increasing productivity and decreasing manual effort.

-

KOFAX, Inc. and OnviSource, Inc., are some of the emerging market participants in the robotic process automation market.

-

KOFAX, Inc. is a digitally transform information-intensive intelligent provider and automation software platform.Kofax specializes in cognitive capture systems that use cutting-edge technology such as artificial intelligence (AI) and machine learning (ML). KOFAX, Inc. RPA, a key product in the company's portfolio, provides a scalable safe automation platform. It aims to streamline repetitive processes across a variety of company sectors, including finance, customer support, and human resources. KOFAX, Inc. aims to offer enterprises the tools required for adapting to evolving company demands and staying competitive by integrating intelligent automation technology.

-

Uniphore technology company that specializes in Conversational Service Automation (CSA). Uniphore's CSA technique expands on traditional Robotic Process Automation (RPA) by emphasizing intelligent, natural language-based interactions. Uniphore uses RPA concepts to improve client interaction, automate repetitive operations, and enable an increasingly personalized and efficient service delivery model.

Key Robotic Process Automation Companies:

- Automation Anywhere

- Blue Prism Limited (Acquired by SS&C Technologies Holdings, Inc.)

- BlackLine Inc.

- EdgeVerve Systems Ltd. (Acquired by Infosys)

- FPT Software

- KOFAX, Inc.

- Microsoft

- NICE

- NTT Advanced Technology Corp.

- OnviSource, Inc.

- Pegasystems Inc.

- SAP

- UiPath

- Uniphore.

- WorkFusion, Inc.

Recent Developments

-

In October 2023, Rockwell Automation and Microsoft aimed to expand their long-lasting relationship and accelerate industrial automation design and development via generative AI. The firms aimed to combine technologies to enable the workforce and enhance customer-building industrial automation systems. Both firms recognize that utilizing AI to boost automation across various roles, from control engineers to decision-makers and operators, is a key zone where they intend to help customers streamline their procedures and drive worker efficiency.

-

In April 2023, UiPath, announced that NTT DOCOMO, Japan's largest telecoms operator, is employing the UiPath Test Suite to improve its application delivery infrastructure. The Test Suite, which uses AI-driven automation, drastically lowered mobile application test times, allowing NTT DOCOMO to boost release frequency from quarterly to biweekly. This effective implementation demonstrates UiPath's contribution to improving operational efficiency and accelerating digital transformation at a large telecommunications company using Robotic Process Automation (RPA).

-

In April 2023, Kofax, Inc. announced a relaunch of the Kofax, Inc. marketplace, a digital hub of connectors, tools, and applications for advanced integration of automation software and leading businesses. The Kofax, Inc. Marketplace offers access to in-depth learning and ready-made assets that can connect with existing key platform elements such as RPA and Kofax TotalAgility, among others.

-

In October 2022, Pegasystems Inc. has announced the availability of the latest version of Robot Studio, a low-code development environment for robotic process automation (RPA). As the market's need for RPA grows, Pegasystems Inc.'s current Robot Studio makes it easier to automate manual processes for users of all skill levels. This advancement solves the issues that organizations encounter while designing and managing RPA bots efficiently, resulting in a more seamless and efficient incorporation of RPA into business processes.

Robotic Process Automation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2,942.7 million

Revenue forecast in 2030

USD 30,850.0 million

Growth rate

CAGR of 39.9% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

type, deployment, organization, operations, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, U.K., Germany, France, China, India, Japan, Australia, South Korea, Australia, Brazil, Mexico, UAE, Saudi Arabia, South Africa

Key companies profiled

Automation Anywhere; Blue Prism Limited; BlackLine Inc.; EdgeVerve Systems Ltd.; FPT Software; KOFAX, Inc.; Microsoft; NICE; NTT Advanced Technology Corp.; OnviSource, Inc.; Pegasystems Inc.; SAP; UiPath; Uniphore.; WorkFusion, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Robotic Process Automation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global robotic process automation market report based on type, deployment, organization, operations, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Service

-

Consulting

-

Implementing

-

Training

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Operations Outlook (Revenue, USD Billion, 2018 - 2030)

-

Rule Based

-

Knowledge Based

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Pharma & Healthcare

-

Retail & Consumer Goods

-

Information Technology (IT) & Telecom

-

Communication and Media & Education

-

Manufacturing

-

Logistics and Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global robotic process automation market size was estimated at USD 2,322.9 million in 2022 and is expected to reach USD 2,942.7 million in 2023.

b. The global robotic process automation market is expected to grow at a compound annual growth rate of 39.9% from 2023 to 2030 to reach USD 30,850.0 million by 2030.

b. The service segment accounted led the global robotic process automation market and accounted for the highest market share of over 60% in 2022.

b. The consulting segment dominated the global robotic process automation market and accounted for the largest revenue share of over 40% in 2022.

b. The on-premise segment led the global robotic process automation market and accounted for the largest revenue share of over 75% in 2022.

b. The large enterprise segment dominated the global robotic process automation market and accounted for the largest revenue share of more than 60% in 2022.

Table of Contents

Chapter 1 Robotic Process Automation Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2 Robotic Process Automation Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3 Robotic Process Automation Market: Variables, Trends & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Market Opportunity Analysis

3.4. Robotic Process Automation Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Robotic Process Automation Market: Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Robotic Process Automation Market: Type Movement Analysis, USD Billion, 2023 & 2030

4.3. Software

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Service

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.2. Consulting

4.4.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.3. Implementing

4.4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.4. Training

4.4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Robotic Process Automation Market: Deployment Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Robotic Process Automation Market: Deployment Movement Analysis, USD Billion, 2023 & 2030

5.3. Cloud

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. On-premise

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Robotic Process Automation Market: Organization Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Robotic Process Automation Market: Organization Movement Analysis, USD Billion, 2023 & 2030

6.3. Large Enterprises

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. Small & Medium Enterprises

6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Robotic Process Automation Market: Operations Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Robotic Process Automation Market: Operations Movement Analysis, USD Billion, 2023 & 2030

7.3. Rule Based

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. Knowledge Based

7.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Robotic Process Automation Market: Application Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Robotic Process Automation Market: Application Movement Analysis, USD Billion, 2023 & 2030

8.3. BFSI

8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4. Pharma & Healthcare

8.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5. Retail & Consumer Goods

8.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6. Information Technology (IT) & Telecom

8.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.7. Communication and Media & Education

8.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.8. Manufacturing

8.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.9. Logistics and Energy & Utilities

8.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.10. Others

8.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 9. Robotic Process Automation Market: Regional Estimates & Trend Analysis

9.1. Robotic Process Automation Market Share by Region, 2023 & 2030 (USD Billion)

9.2. North America

9.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.2.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.2.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.2.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.2.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.2.7. U.S.

9.2.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.7.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.2.7.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.2.7.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.2.7.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.2.7.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.2.8. Canada

9.2.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.8.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.2.8.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.2.8.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.2.8.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.2.8.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3. Europe

9.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.3.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.3.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.3.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.3.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.7. U.K.

9.3.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.7.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.3.7.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.3.7.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.3.7.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.3.7.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.8. Germany

9.3.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.8.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.3.8.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.3.8.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.3.8.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.3.8.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.9. France

9.3.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.9.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.3.9.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.3.9.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.3.9.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.3.9.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4. Asia Pacific

9.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.4.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.4.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.4.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.4.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.7. China

9.4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.7.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.4.7.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.4.7.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.4.7.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.4.7.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.8. India

9.4.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.8.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.4.8.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.4.8.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.4.8.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.4.8.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.9. Japan

9.4.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.9.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.4.9.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.4.9.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.4.9.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.4.9.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.10. Australia

9.4.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.10.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.4.10.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.4.10.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.4.10.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.4.10.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.11. South Korea

9.4.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.11.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.4.11.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.4.11.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.4.11.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.4.11.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.5. Latin America

9.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.5.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.5.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.5.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.5.6. Brazil

9.5.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.6.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.5.6.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.5.6.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.5.6.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.5.6.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.5.7. Mexico

9.5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.7.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.5.7.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.5.7.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.5.7.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.5.7.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6. Middle East & Africa

9.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.6.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.6.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.6.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.6.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.7. UAE

9.6.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.7.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.6.7.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.6.7.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.6.7.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.6.7.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.8. Saudi Arabia

9.6.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.8.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.6.8.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.6.8.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.6.8.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.6.8.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.9. South Africa

9.6.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.9.2. Market Size Estimates and Forecasts by Type, 2018 - 2030 (USD Billion)

9.6.9.3. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.6.9.4. Market Size Estimates and Forecasts by Organization, 2018 - 2030 (USD Billion)

9.6.9.5. Market Size Estimates and Forecasts by Operations, 2018 - 2030 (USD Billion)

9.6.9.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

Chapter 10. Competitive Landscape

10.1. Recent Developments & Impact Analysis by Key Market Participants

10.2. Company Categorization

10.3. Company Market Share Analysis

10.4. Company Heat Map Analysis

10.5. Strategy Mapping

10.5.1. Expansion

10.5.2. Mergers & Acquisition

10.5.3. Partnerships & Collaborations

10.5.4. New Product Launches

10.5.5. Research And Development

10.6. Company Profiles

10.6.1. Automation Anywhere

10.6.1.1. Participant’s Overview

10.6.1.2. Financial Performance

10.6.1.3. Product Benchmarking

10.6.1.4. Recent Developments

10.6.2. Blue Prism Limited (Acquired by SS&C Technologies Holdings, Inc.)

10.6.2.1. Participant’s Overview

10.6.2.2. Financial Performance

10.6.2.3. Product Benchmarking

10.6.2.4. Recent Developments

10.6.3. BlackLine Inc.

10.6.3.1. Participant’s Overview

10.6.3.2. Financial Performance

10.6.3.3. Product Benchmarking

10.6.3.4. Recent Developments

10.6.4. EdgeVerve Systems Ltd. (Acquired by Infosys)

10.6.4.1. Participant’s Overview

10.6.4.2. Financial Performance

10.6.4.3. Product Benchmarking

10.6.4.4. Recent Developments

10.6.5. FPT Software

10.6.5.1. Participant’s Overview

10.6.5.2. Financial Performance

10.6.5.3. Product Benchmarking

10.6.5.4. Recent Developments

10.6.6. KOFAX, Inc.

10.6.6.1. Participant’s Overview

10.6.6.2. Financial Performance

10.6.6.3. Product Benchmarking

10.6.6.4. Recent Developments

10.6.7. Microsoft

10.6.7.1. Participant’s Overview

10.6.7.2. Financial Performance

10.6.7.3. Product Benchmarking

10.6.7.4. Recent Developments

10.6.8. NICE

10.6.8.1. Participant’s Overview

10.6.8.2. Financial Performance

10.6.8.3. Product Benchmarking

10.6.8.4. Recent Developments

10.6.9. NTT Advanced Technology Corp.

10.6.9.1. Participant’s Overview

10.6.9.2. Financial Performance

10.6.9.4. Recent Developments

10.6.10. OnviSource, Inc.

10.6.10.1. Participant’s Overview

10.6.10.2. Financial Performance

10.6.10.3. Product Benchmarking

10.6.10.4. Recent Developments

10.6.11. Pegasystems Inc.

10.6.11.1. Participant’s Overview

10.6.11.2. Financial Performance

10.6.11.3. Product Benchmarking

10.6.11.4. Recent Developments

10.6.12. SAP

10.6.12.1. Participant’s Overview

10.6.12.2. Financial Performance

10.6.12.3. Product Benchmarking

10.6.12.4. Recent Developments

10.6.13. UiPath

10.6.13.1. Participant’s Overview

10.6.13.2. Financial Performance

10.6.13.3. Product Benchmarking

10.6.13.4. Recent Developments

10.6.14. Uniphore.

10.6.14.1. Participant’s Overview

10.6.14.2. Financial Performance

10.6.14.3. Product Benchmarking

10.6.14.4. Recent Developments

10.6.15. WorkFusion, Inc.

10.6.15.1. Participant’s Overview

10.6.15.2. Financial Performance

10.6.15.3. Product Benchmarking

10.6.15.4. Recent Developments

List of Tables

Table 1 Robotic Process Automation market 2018 - 2030 (USD Billion)

Table 2 Global robotic process automation market estimates and forecasts by region, 2018 - 2030 (USD Billion)

Table 3 Global robotic process automation market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 4 Global robotic process automation market estimates and forecasts by deployment, 2018 - 2030 (USD Billion)

Table 5 Global robotic process automation market estimates and forecasts by organization, 2018 - 2030 (USD Billion)

Table 6 Global robotic process automation market estimates and forecasts by opeartions, 2018 - 2030 (USD Billion)

Table 7 Global robotic process automation market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 8 Type market by region, 2018 - 2030 (USD Billion)

Table 9 Software market by region, 2018 - 2030 (USD Billion)

Table 10 Service market by region, 2018 - 2030 (USD Billion)

Table 11 Consulting market by region, 2018 - 2030 (USD Billion)

Table 12 Implementing market by region, 2018 - 2030 (USD Billion)

Table 13 Training market by region, 2018 - 2030 (USD Billion)

Table 14 Deployment market by region, 2018 - 2030 (USD Billion)

Table 15 Cloud market by region, 2018 - 2030 (USD Billion)

Table 16 On-premise market by region, 2018 - 2030 (USD Billion)

Table 17 Enterprise Size market by region, 2018 - 2030 (USD Billion)

Table 18 Large Enterprises market by region, 2018 - 2030 (USD Billion)

Table 19 Small & Medium Enterprises market by region, 2018 - 2030 (USD Billion)

Table 20 Operations market by region, 2018 - 2030 (USD Billion)

Table 21 Rule Based market by region, 2018 - 2030 (USD Billion)

Table 22 Knowledge Based market by region, 2018 - 2030 (USD Billion)

Table 23 Application market by region, 2018 - 2030 (USD Billion)

Table 24 BFSI market by region, 2018 - 2030 (USD Billion)

Table 25 Pharma & Healthcare market by region, 2018 - 2030 (USD Billion)

Table 26 Retail & Consumer Goods market by region, 2018 - 2030 (USD Billion)

Table 27 Information Technology (IT) & Telecom market by region, 2018 - 2030 (USD Billion)

Table 28 Communication and Media & Education market by region, 2018 - 2030 (USD Billion)

Table 29 Manufacturing market by region, 2018 - 2030 (USD Billion)

Table 30 Logistics and Energy & Utilities market by region, 2018 - 2030 (USD Billion)

Table 31 Others market by region, 2018 - 2030 (USD Billion)

Table 32 North America robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 33 North America robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 34 North America robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 35 North America robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 36 North America robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 37 U.S. robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 38 U.S. robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 39 U.S. robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 40 U.S. robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 41 U.S. robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 42 Canada robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 43 Canada robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 44 Canada robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 45 Canada robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 46 Canada robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 47 Europe robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 48 Europe robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 49 Europe robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 50 Europe robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 51 Europe robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 52 U.K. robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 53 U.K. robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 54 U.K. robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 55 U.K. robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 56 U.K. robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 57 Germany robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 58 Germany robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 59 Germany robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 60 Germany robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 61 Germany robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 62 France robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 63 France robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 64 France robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 65 France robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 66 France robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 67 Asia Pacific robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 68 Asia Pacific robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 69 Asia Pacific robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 70 Asia Pacific robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 71 Asia Pacific robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 72 China robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 73 China robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 74 China robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 75 China robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 76 China robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 77 India robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 78 India robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 79 India robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 80 India robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 81 India robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 82 Japan robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 83 Japan robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 84 Japan robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 85 Japan robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 86 Japan robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 87 Australia robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 88 Australia robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 89 Australia robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 90 Australia robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 91 Australia robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 92 South Korea robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 93 South Korea robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 94 South Korea robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 95 South Korea robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 96 South Korea robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 97 Latin America robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 98 Latin America robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 99 Latin America robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 100 Latin America robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 101 Latin America robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 102 Brazil robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 103 Brazil robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 104 Brazil robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 105 Brazil robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 106 Brazil robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 107 Mexico robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 108 Mexico robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 109 Mexico robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 110 Mexico robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 111 Mexico robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 112 MEA robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 113 MEA robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 114 MEA robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 115 MEA robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 116 MEA robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 117 UAE robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 118 UAE robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 119 UAE robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 120 UAE robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 121 UAE robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 122 Saudi Arabia robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 123 Saudi Arabia robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 124 Saudi Arabia robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 125 Saudi Arabia robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 126 Saudi Arabia robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 127 South Africa robotic process automation market, by type, 2018 - 2030 (Revenue, USD Billion)

Table 128 South Africa robotic process automation market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 129 South Africa robotic process automation market, by organization, 2018 - 2030 (Revenue, USD Billion)

Table 130 South Africa robotic process automation market, by opeartions, 2018 - 2030 (Revenue, USD Billion)

Table 131 South Africa robotic process automation market, by application, 2018 - 2030 (Revenue, USD Billion)

List of Figures

Fig. 1 Robotic Process Automation Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/2)

Fig. 9 Segment Snapshot (2/2)

Fig. 10 Competitive Landscape Snapshot

Fig. 11 Robotic Process Automation Market: Industry Value Chain Analysis

Fig. 12 Robotic Process Automation Market: Market Dynamics

Fig. 13 Robotic Process Automation Market: PORTER’s Analysis

Fig. 14 Robotic Process Automation Market: PESTEL Analysis

Fig. 15 Robotic Process Automation Market Share by Type, 2023 & 2030 (USD Billion)

Fig. 16 Robotic Process Automation Market, by Type: Market Share, 2023 & 2030

Fig. 17 Software Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 18 Service Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 19 Consulting Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 20 Implementing Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 21 Training Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 22 Robotic Process Automation Market Share by Deployment, 2023 & 2030 (USD Billion)

Fig. 23 Robotic Process Automation Market, by Deployment: Market Share, 2023 & 2030

Fig. 24 Cloud Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 25 On-premise Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 26 Robotic Process Automation Market Share by Organization, 2023 & 2030 (USD Billion)

Fig. 27 Robotic Process Automation Market, by Organization: Market Share, 2023 & 2030

Fig. 28 Large Enterprises Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 29 Small & Medium Enterprises Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 30 Robotic Process Automation Market Share by Operations, 2023 & 2030 (USD Billion)

Fig. 31 Robotic Process Automation Market, by Operations: Market Share, 2023 & 2030

Fig. 32 Rule Based Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 33 Knowledge Based Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 34 Robotic Process Automation Market Share by Application, 2023 & 2030 (USD Billion)

Fig. 35 Robotic Process Automation Market, by Application: Market Share, 2023 & 2030

Fig. 36 Automotive Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 37 BFSI Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 38 Pharma & Healthcare Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 39 Retail & Consumer Goods Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 40 Information Technology (IT) & Telecom Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 41 Communication and Media & Education Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 42 Manufacturing Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 43 Logistics and Energy & Utilities Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 44 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 45 Regional Marketplace: Key Takeaways

Fig. 46 North America Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 47 U.S. Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 48 Canada Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 49 Europe Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 50 U.K. Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030) (USD Billion)

Fig. 51 Germany Robotic Process Automation Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 52 France Robotic Process Automation Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 53 Asia Pacific Robotic Process Automation Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Fig. 54 China Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 55 Japan Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 56 India Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 57 South Korea Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 58 Australia Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 59 Latin America Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 60 Brazil Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 61 Mexico Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 62 MEA Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 63 Saudi Arabia Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 64 UAE Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 65 South Africa Robotic Process Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 66 Key Company Categorization

Fig. 67 Company Market Positioning

Fig. 68 Key Company Market Share Analysis, 2023

Fig. 69 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Robotic Process Automation Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- Robotic Process Automation Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Robotic Process Automation Organization Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Robotic Process Automation Operations Outlook (Revenue, USD Billion, 2018 - 2030)

- Rule Based

- Knowledge Based

- Robotic Process Automation Application Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics and Energy & Utilities

- Others

- Robotic Process Automation Regional Outlook (Revenue, USD Billion, 2018-2030)

- North America

- North America Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- North America Robotic Process Automation Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- North America Robotic Process Automation Market Organization Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- North America Robotic Process Automation Market Operations Outlook (Revenue, USD Billion, 2018 - 2030)

- Rule Based

- Knowledge Based

- North America Robotic Process Automation Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics and Energy & Utilities

- Others

- U.S.

- U.S. Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- U.S. Robotic Process Automation Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- U.S. Robotic Process Automation Market Organization Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- U.S. Robotic Process Automation Market Operations Outlook (Revenue, USD Billion, 2018 - 2030)

- Rule Based

- Knowledge Based

- U.S. Robotic Process Automation Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics and Energy & Utilities

- Others

- U.S. Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Canada

- Canada Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- Canada Robotic Process Automation Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Canada Robotic Process Automation Market Organization Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Canada Robotic Process Automation Market Operations Outlook (Revenue, USD Billion, 2018 - 2030)

- Rule Based

- Knowledge Based

- Canada Robotic Process Automation Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics and Energy & Utilities

- Others

- Canada Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- North America Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Europe

- Europe Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- Europe Robotic Process Automation Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Europe Robotic Process Automation Market Organization Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Europe Robotic Process Automation Market Operations Outlook (Revenue, USD Billion, 2018 - 2030)

- Rule Based

- Knowledge Based

- Europe Robotic Process Automation Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics and Energy & Utilities

- Others

- U.K.

- U.K. Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- U.K. Robotic Process Automation Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- U.K. Robotic Process Automation Market Organization Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- U.K. Robotic Process Automation Market Operations Outlook (Revenue, USD Billion, 2018 - 2030)

- Rule Based

- Knowledge Based

- U.K. Robotic Process Automation Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics and Energy & Utilities

- Others

- U.K. Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Germany

- Germany Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- Germany Robotic Process Automation Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Germany Robotic Process Automation Market Organization Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Germany Robotic Process Automation Market Operations Outlook (Revenue, USD Billion, 2018 - 2030)

- Rule Based

- Knowledge Based

- Germany Robotic Process Automation Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics and Energy & Utilities

- Others

- Germany Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- France

- France Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- France Robotic Process Automation Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- France Robotic Process Automation Market Organization Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- France Robotic Process Automation Market Operations Outlook (Revenue, USD Billion, 2018 - 2030)

- Rule Based

- Knowledge Based

- France Robotic Process Automation Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics and Energy & Utilities

- Others

- France Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Europe Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Asia Pacific

- Asia Pacific Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- Asia Pacific Robotic Process Automation Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Asia Pacific Robotic Process Automation Market Organization Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Asia Pacific Robotic Process Automation Market Operations Outlook (Revenue, USD Billion, 2018 - 2030)

- Rule Based

- Knowledge Based

- Asia Pacific Robotic Process Automation Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics and Energy & Utilities

- Others

- China

- China Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- China Robotic Process Automation Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- China Robotic Process Automation Market Organization Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- China Robotic Process Automation Market Operations Outlook (Revenue, USD Billion, 2018 - 2030)

- Rule Based

- Knowledge Based

- China Robotic Process Automation Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics and Energy & Utilities

- Others

- China Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- India

- India Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- India Robotic Process Automation Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- India Robotic Process Automation Market Organization Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- India Robotic Process Automation Market Operations Outlook (Revenue, USD Billion, 2018 - 2030)

- Rule Based

- Knowledge Based

- India Robotic Process Automation Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics and Energy & Utilities

- Others

- India Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Japan

- Japan Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- Japan Robotic Process Automation Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Japan Robotic Process Automation Market Organization Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Japan Robotic Process Automation Market Operations Outlook (Revenue, USD Billion, 2018 - 2030)

- Rule Based

- Knowledge Based

- Japan Robotic Process Automation Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics and Energy & Utilities

- Others

- Japan Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Australia

- Australia Robotic Process Automation Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

- Consulting

- Implementing

- Training

- Australia Robotic Process Automation Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Australia Robotic Process Automation Market Organization Outlook (Revenue, USD Billion, 2018 - 2030)