- Home

- »

- Alcohol & Tobacco

- »

-

Roll-Your-Own Tobacco Products Market Size Report, 2030GVR Report cover

![Roll-Your-Own Tobacco Products Market Size, Share & Trends Report]()

Roll-Your-Own Tobacco Products Market Size, Share & Trends Analysis Report By Product (RYO Tobacco, Rolling Paper & Cigarette Tubes, Injector, Filter & Paper Tip), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-593-9

- Number of Pages: 88

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

The global roll-your-own tobacco products market size was valued at USD 30.7 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2022 to 2030. The growing preference for hand-rolled or handmade cigarettes as they are relatively less expensive compared to Factory-made (FM) cigarettes has been driving the demand for Roll-Your-Own (RYO) tobacco products across the world. Handmade cigarettes are generally subject to fewer regulations and less taxation. As a result, these products are gaining popularity among financially stressed young consumers and lower annual income groups. However, some studies have found that RYO tobacco products' consumption has been increasing in developed countries over the years.

The financial crisis caused by the COVID-19 pandemic has increased price sensitivity among low- and middle-income consumer groups. As a result, price-conscious consumers are shifting toward lower-cost alternatives from their previous choice. Furthermore, according to a study published by University College London (UCL) in 2018, RYO smokers are less likely to quit smoking than factory-made cigarette consumers. The key reason for RYO smokers’ unwillingness to quit is the comparatively lower cost of RYO products as compared to FM cigarettes. Thus, the market for roll-your-own tobacco products is expected to witness healthy growth in the upcoming years.

An increase in the consumption of tobacco products among women and students is also driving the growth. The key companies have been launching new products to cater to the changing demands of millennial and generation Z consumers. For instance, in February 2018, Japan Tobacco Inc. launched a ‘heat-not-burn’ (HNB) in Japan. The company further strategized to spend over JPY 100 billion over the next three years on the R&D of Reduced-risk Products (RRP) and cigarette alternatives that do not utilize combustible ingredients to produce nicotine.

Market players are offering a range of roll-your-own tobacco products with new and exciting flavors, specifically for the youth (customers aged 18-30), men, and women. The introduction of flavors like mint, eucalyptus, berries, fruits, licorice, whiskey, spices, bergamot, cedar, spearmint, wintergreen, menthol, citrus, dry fruit, hay, leather, smoky, and tea are attracting consumers across the globe. Menthol is the most popular flavor in the smoking industry. As per the U.S. Food and Drug Administration (FDA), as of 2020, over 19.5 million people in the U.S. smoke menthol cigarettes.

Companies are looking to maintain their brand image and gain customer loyalty by upgrading their offerings to customer specifications and by studying consumer behavior patterns. Key players in the market for roll-your-own tobacco products are offering products in different sizes, flavors, and attractive packaging. These initiatives by manufacturers are propelling the global demand for premium roll-your-own products. For instance, Amber Leaf Original hand rolling tobacco consists of Virginia and Burley tobaccos, offering the user a premium and unique experience. Amber Leaf is a brand owned by the Gallaher Group division of Japan Tobacco International and is accessible in different size packs including 9 g, 10 g, 12.5 g, 25 g, 30 g, and 50 g.

According to the National Youth Tobacco Survey 2020, the popularity, as well as consumption of e-cigarettes, has gone up among high-school and middle-school students in the U.S. since 2014. Around 4.7% of middle school and 19.6% of high school students used e-cigarettes in 2020. The consumption of hookah remained unchanged from 2011 to 2019. An estimated 2 out of every 100 middle-school students and around 3 out of every 100 high-school students reportedly consumed hookah in the past 30 days of the survey. The increasing popularity of e-cigarettes and hookah is posing a challenge for the roll-your-own tobacco products market.

Products Insights

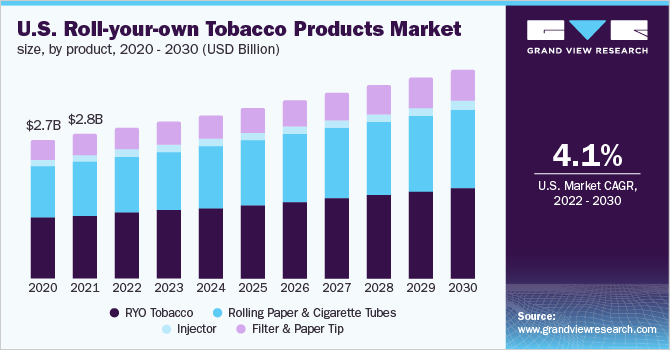

The RYO-tobacco dominated the market for roll-your-own tobacco products and accounted for a revenue share of more than 40.0% in 2021. The growing popularity of roll-your-own tobacco is attributed to the belief that rolling cigarettes is a way to cut back on smoking or avoid the harmful chemicals that are present in commercially produced regular filtered cigarettes. Several smokers also assume that roll-your-own tobacco is less harmful because they are more natural. Manufacturers introduce tobacco products that are chemical- and additive-free, ensuring that users do not experience any adverse effects as they do with factory-made cigarettes. These manufacturers offer pure tobacco, whole leaf, as well as shredded. The flavor is another factor that plays a significant role in product demand.

The filter and paper tip is projected to register the fastest growth during the forecast period. Filter tips are great for customers who prefer to roll their tobacco but want the option of filtered smoke. These are made of cellulose acetate fiber, paper or activated charcoal, phenol-formaldehyde resins, and asbestos. Cellulose acetate is made by esterifying bleached cotton or wood pulp with acetic acid. Smokers are increasingly using filters to decrease the consumption level of tar and other harmful components.

Manufacturers offer a variety of filter tips, ranging from low-cost to premium filter tips, to enhance customer experience. For instance, U.K.-based Essentra plc offers a wide portfolio of filter tips. The company’s patented Infused filter tip maximizes the strength of the paper, and offers cost savings and higher tar retention while maintaining a taste similar to standard cellulose acetate filter tips. Similarly, the company’s Myria filter tip is a single-segment paper filter. It offers higher levels of tar and nicotine retention compared to standard mono-acetate filter tips.

Distribution Channel Insights

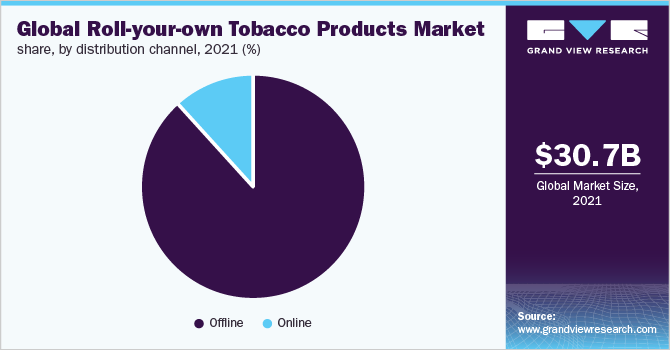

The offline distribution channel dominated the market for roll-your-own tobacco products and accounted for a revenue share of more than 85.0% in 2021. The segment includes convenience stores, supermarkets, liquor stores, newsstands, and pharmacies. The sale of roll-your-own tobacco is primarily done through smoke shops or retail shops under strict guidelines. These products are also sold online, but it is heavily regulated and hence, the volume of transactions online is low compared to offline distribution channels. The companies use a variety of methods in the retail environment to advertise and promote their products. For instance, companies reduce the prices of their products to circumvent higher taxes by dropping wholesale prices and employing tactics such as couponing and multipack discounts. Along with this, the companies pay retailers to strategically place tobacco products front-and-center in retail environments, often around the checkout counter, which makes them easy to see for customers.

The online is expected to expand at a CAGR of 4.7% from 2022 to 2030. In addition to classic mail-order sales and the many internet-based retailers, the growing prevalence of app-based retailers and delivery services that are especially popular with young consumers is driving the segment. For instance, in India, there is no ban on the online sale of tobacco or cigarettes. But in the recent Cigarettes and Other Tobacco Products (Prohibition of Advertisement and Regulation of Trade and Commerce, Production, Supply, and Distribution) (Amendment) Bill 2020, the minimum age for smoking has been raised to 21, up from 18. This can hamper online sales in the country.

Regional Insights

Europe dominated the market for roll-your-own tobacco products and accounted for a revenue share of more than 65.0% in 2021. A study published in BMC Public Health in 2018 in Ireland found that the artisanal appeal of RYO cigarettes is another reason why young people use them and are getting addicted to them, while the consumption of factory-made (FM) cigarettes is decreasing, the use of roll-your-own tobacco is becoming increasingly popular. Studies in Spain, Italy, and the United Kingdom have indicated that RYO consumption continues to rise as consumers have switched from FM to RYO cigarettes for financial reasons. As per the observations of a study by the Society for Research on Nicotine and Tobacco, cigarette smoking prevalence is majorly linked to lower income levels. These market trends are anticipated to propel the demand.

In the Asia Pacific, the market for roll-your-own tobacco products is expected to witness a CAGR of 4.4% from 2022 to 2030. According to the World Health Organization, tobacco is the world’s leading cause of preventable death, killing nearly 8 million persons every year. Further, it claims more than 1.6 million lives in the South East Asian Region (SEAR) alone, which is also amongst the largest producers and consumers of tobacco. China, the Philippines, Vietnam, Malaysia, India, Thailand, Bangladesh, and Indonesia are some of the largest markets in the region. The demand is anticipated to rise over the coming years due to the increased adoption of products by women and the elderly in various countries.

According to a research titled ‘Recent Trends of Tobacco Use in India’ published in the Journal of Public Health, in 2019, India had a substantial smoking population, a factor that is likely to fuel market growth. Furthermore, increased advertising for marketing various tobacco products on social media and satellite television channels is expected to compel buyers to increase their spending on new products. Increasing women's employment rates across India are acting as a catalyst for this market.

Key Companies & Market Share Insights

The market for roll-your-own tobacco products is characterized by the presence of various well-established players and several small and medium players. However, the industry is dominated by the top international players, such as Imperial Brands; British American Tobacco; and Japan Tobacco Inc. Product launches are expected to fuel market growth.

-

For instance, in April 2021, Zomo Paper launched colored rolling papers to its Classic line. These include papers in colors such as Slim Silver, Perfect Pink, and Perfect Black.

-

In March 2021, Greenlane Holdings, Inc. a manufacturer of premium cannabis accessories, child-resistant packaging, and specialty vaporization products, announced the launch of the new line of organic hemp rolling papers and cones collection called VIBES. This new organic hemp line features papers and cones made with 100% organic hemp fibers and uses only organic Arabic gum from the Acacia tree for the production.

-

In December 2017, Karma Filter Tips launched its 100% biodegradable filter tip. These tips are featured with plant seeds that breed plants once they are disposed of in the ground and enhance the smoking experience.

Some of the prominent players in the roll-your-own tobacco products market include:

-

Imperial Brands

-

British American Tobacco

-

Scandinavian Tobacco Group A/S

-

Altria Group, Inc.

-

Philip Morris International

-

HBI International

-

Curved Papers, Inc.

-

Karma Filter Tips

-

Shine Brands

-

Japan Tobacco International

Roll-Your-Own Tobacco Products Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 31.3 billion

Revenue forecast in 2030

USD 43.2 billion

Growth rate

CAGR of 4.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; Australia; Brazil

Key companies profiled

Imperial Brands; British American Tobacco; Scandinavian Tobacco Group A/S; Altria Group, Inc.; Philip Morris International; HBI International; Curved Papers, Inc.; Karma Filter Tips; Shine Brands; Japan Tobacco International

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Roll-Your-Own Tobacco Products Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global roll-your-own tobacco products market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

RYO Tobacco

-

Rolling Paper & Cigarette Tubes

-

Injector

-

Filter & Paper Tip

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global roll-your-own tobacco products market size was estimated at USD 30.07 billion in 2021 and is expected to reach USD 31.27 billion in 2022.

b. The global roll-your-own tobacco products market size is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2022 to 2030 to reach USD 43.15 billion by 2030.

b. Europe dominated the roll-your-own tobacco products market with a share of 68.0% in 2021. This is attributed to predominant consumption in countries U.K., Germany, France, the Netherlands, Belgium, and Luxembourg.

b. Some key players operating in the roll-your-own tobacco products market include Imperial Brands, British American Tobacco, Scandinavian Tobacco Group A/S, Altria Group, Inc., Philip Morris International, HBI International, Curved Papers, Inc., Karma Filter Tips, Shine Brands, Japan Tobacco International.

b. Key factors that are driving the roll-your-own tobacco products market growth include low cost as compared to factory-made (FM) cigarettes and a supportive taxation regime for roll-your-own tobacco products tobacco in some countries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."