- Home

- »

- Clinical Diagnostics

- »

-

Saliva Collection And Diagnostics Market Share Report, 2030GVR Report cover

![Saliva Collection And Diagnostics Market Size, Share & Trends Report]()

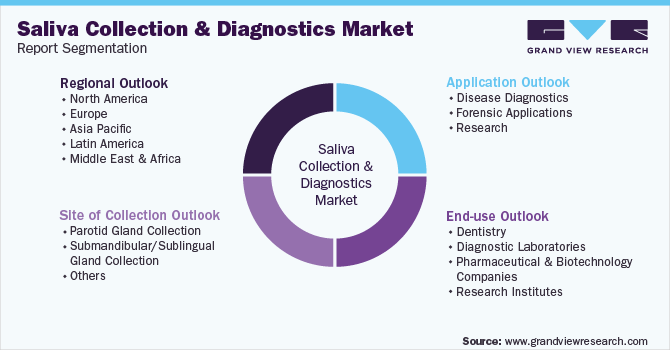

Saliva Collection And Diagnostics Market Size, Share & Trends Analysis Report By Site Of Collection (Parotid Gland Collection, Submandibular/Sublingual Gland Collection), By Application, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-990-3

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

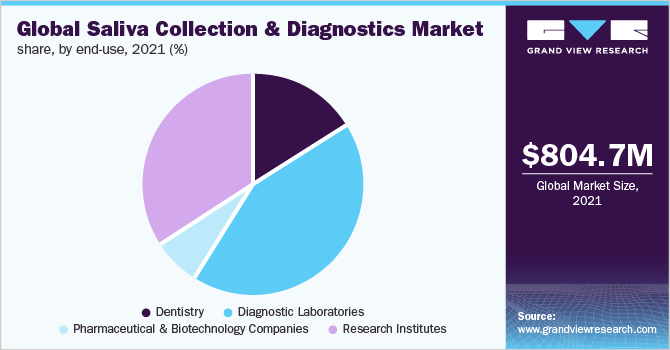

The global saliva collection and diagnostics market size was valued at USD 804.7 million in 2021 and is projected to witness a compound annual growth rate (CAGR) of 8.4% from 2022 to 2030. The growth of the market is attributed to factors such as the increasing need for rapid diagnosis of chronic diseases, technological advancements in infant saliva collection, and rising awareness among the population regarding the easy and safe diagnosis of several diseases, among others. For instance, in September 2021, Thermo Fisher Scientific, Inc. launched SpeciMAX Stabilized Saliva Collection Kit, which aims to collect samples safely for research use. The kit comprises of the spill-resistant funnel, a standardized-size tube, and a crew cap for proper sample collection.

The COVID-19 outbreak has positively impacted the market due to increasing cases of infectious diseases among people, new product launches, and a growing preference for self-saliva-based and non-invasive tests. Saliva could be used as a potential alternative biological sample for the diagnosis of COVID-19. Saliva collection is significantly accepted by the patients, as it does not require personal protective equipment (PPE) and the involvement of healthcare personnel, and could be self-collected by the individual. The increasing need to diagnose COVID-19-infected patients has created significant opportunities in the growth market. In February 2022, researchers from IrsiCaixa AIDS Research Institute and ICFO-The Institute of Photonic Sciences launched a cost-effective portable device that manipulates fluid and light for the detection of SARS-CoV-2 in saliva samples.

Saliva-based tests are painless and precise. These tests are reliable methods to evaluate female hormone levels. Over the past few years, blood tests were used to measure female hormone levels. However, blood sampling is expensive, invasive, and difficult to perform. Therefore, a significant shift has been witnessed toward the adoption of more inexpensive and convenient sample types. Saliva-based diagnostics is used to measure several physiological conditions such as stress, depression, and sleep disorders. These tests are also used in occupational health and sports medicine. These factors are driving the growth of the market.

Furthermore, with the rising number of assays, saliva collection could become the best alternative option for the detection and diagnosis of various diseases, cancers, and others along with detecting disease reoccurrence, monitoring treatment efficacy, and stratifying patient risk. For instance, in November 2021, Salignostics launched a pregnancy test, SaliStick, which delivers results from saliva samples.

Site Of Collection Insights

The submandibular/sublingual gland collection segment captured the highest revenue share of 48.7% in 2021 and is anticipated to continue to dominate during the forecast period. Approximately 70.0% of unstimulated saliva is produced in the submandibular gland. The most prevalent condition affecting the salivary glands in middle-aged adults is known as sialoliths or salivary stones. Approximately 80% of salivary sialoliths develop in the submandibular gland, followed by the parotid gland accounting for 6–15% and 2% in the minor or sublingual salivary glands. The increasing cases of sialolithiasis may contribute to the segment’s growth in the coming years.

The parotid gland collection segment is anticipated to witness considerable growth in the coming years. Salivary gland cancer is a rare malignancy that develops in the tissue of the salivary gland. Signs of this cancer include trouble swallowing or a lump. Majority of the salivary gland cancers are benign and occur in the parotid glands. This condition is evaluated by imaging tests or biopsies, such as CT scan, MRI, and positron emission tomography scans. The increasing incidence of parotid cancer has contributed to the segment’s saliva collection and diagnostics market growth.

Application Insights

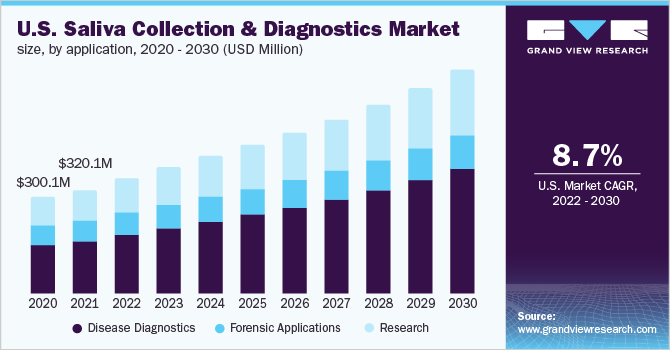

The disease diagnostics segment captured the highest market share of 50.2% in 2021, owing to the increasing prevalence of diseases globally along with the increasing need for the proper diagnostic approach. According to the data published by CDC, in 2019, there were 8,916 new cases of tuberculosis, 58,371 cases of salmonella, 34,945 cases of Lyme disease, and 371 cases of meningococcal disease. Moreover, the saliva collection method is been used for the mass COVID-19 screening which is also one of the factors driving the growth of the segment.

The research segment is anticipated to witness significant growth in the coming years due to increased funding by public and private market players and the government in the R&D sector. Compared to conventional biofluids such as blood, oral biofluids holds significant potential for diagnostic testing. For instance, in September 2022, researchers from the Yale School of Public Health, Australia stated that saliva-based testing is useful for SARS-CoV-2 detection. Similarly, in October 2022, researchers from Ahmedabad University discovered miRNA in a human saliva sample, which shows promising results to predict the prognosis of oral cancer.

End-use Insights

The diagnostic laboratories segment dominated the market and accounted for the largest revenue share of 43.0% in 2021, owing to the presence of a higher number of diagnostics labs and chains globally to meet the growing needs of customers, thus driving the segment's growth. For instance, in February 2021, Eurofins Scientific launched an ultra-fast extraction-free RT-PCR technique to be used with a saliva sample and pharynx gargle matrices. Similarly, in October 2020, Synlab International GmbH announced the successful authentication of saliva sampling, a non-invasive sampling procedure for RT-PCR testing for SARS-CoV-2 detection.

The pharmaceuticals and biotechnology companies are projected to witness lucrative growth owing to several product launches and strategic alliances by the key market players. For instance, in September 2021, EQL Pharma launched a saliva-based Covid-19 antigen self-test. This is the first CE-marked test sold directly to customers rather than healthcare professionals. Similarly, in July 2021, Nusantics Group and Bio Farma launched the Bio Saliva test which could detect the presence of coronavirus in patients with or without symptoms using the gargling method.

Regional Insights

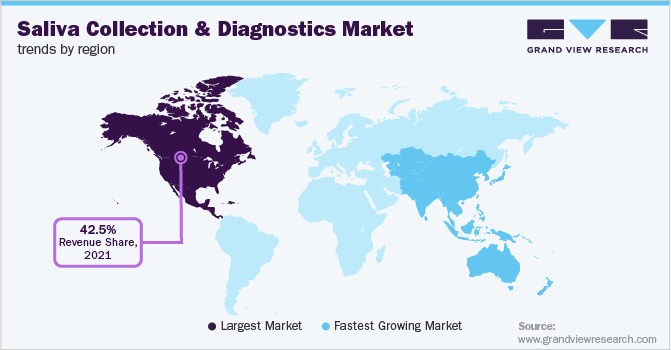

North America captured the highest market share of 42.5% in 2021 owing to increasing preference for saliva tests, the rising cases of infectious diseases, and the launch of novel products by the market players operating in the region. According to the data published by the American Cancer Society, in 2022, the U.S. to witness an estimated 54,000 new cases of oropharyngeal cancer or oral cavity, accounting for 11, 230 deaths. Furthermore, according to the data published by CDC, approximately 9 million new cases are to be registered in 2022, accounting for approximately 20,000 flu-related deaths. The growing burden of infectious diseases is creating significant demand for saliva collection and diagnostics, therefore, creating significant opportunities in the region.

Asia Pacific region is anticipated to witness the fastest growth rate owing to the significant advancements in the diagnostic testing field. According to a recent study published in April 2022, India witnessed a huge adoption of home-diagnostic tests and the trend is expected to increase in the coming years. People are adopting home-based diagnostic testing as it offers quick results at a lower cost. These factors have fueled the demand for saliva-based testing in the region.

Key Companies & Market Share Insights

Key players operating in the market are focusing on entering into several strategic collaborations, partnerships, and geographical expansion, in economically and emerging favorable regions. For instance, in December 2021, F. Hoffmann-La Roche Ltd announced of receiving the CE mark to use samples with Cobas SARS-CoV-2 qualitative test on the company’s Cobas 6800/8800 systems. Some prominent players in the global saliva collection and diagnostics market include:

-

Thermo Fisher Scientific, Inc.

-

Neogen Corporation

-

Abbott

-

Sarstedt AG & Co.KG

-

Autogen, Inc.

-

Oasis Diagnostics

-

Porex

-

Salimetrics, LLC

-

Takara Bio, Inc.

-

Arcis Bio

-

Orasure Technologies

Saliva Collection And Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 888.8 million

Revenue forecast in 2030

USD 1.7 billion

Growth rate

CAGR of 8.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Site of collection, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Thermo Fisher Scientific Inc.; Neogen Corporation; Abbott; Sarstedt AG & Co.KG; Autogen, Inc.; Oasis Diagnostics; Porex; Salimetrics, LLC; Takara Bio Inc.; Arcis Bio; Orasure Technologies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Saliva Collection And Diagnostics Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global saliva collection and diagnostics market on the basis of site of collection, application, end-use, and region:

-

Site of Collection Outlook (Revenue, USD Million, 2018 - 2030)

-

Parotid Gland Collection

-

Submandibular/Sublingual Gland Collection

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Disease Diagnostics

-

Forensic Applications

-

Research

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dentistry

-

Diagnostic Laboratories

-

Pharmaceutical & Biotechnology Companies

-

Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global saliva collection and diagnostics market size was estimated at USD 804.7 million in 2021 and is expected to reach USD 888.8 million in 2022.

b. The global saliva collection and diagnostics market is expected to grow at a compound annual growth rate of 8.4% from 2022 to 2030 to reach USD 1.7 billion by 2030.

b. North America dominated the saliva collection and diagnostics market with a share of 42.56% in 2021. This is attributable to the increasing preference for saliva tests, the rising cases of infectious diseases, and the launch of novel products by the market players operating in the region.

b. Some key players operating in the saliva collection and diagnostics market include Thermo Fisher Scientific Inc., Neogen Corporation, Abbott, Sarstedt AG & Co.KG, Autogen, Inc., Oasis Diagnostics, Porex, Salimetrics, LLC, Takara Bio, Inc., Arcis Bio, Orasure Technologies.

b. Key factors that are driving the saliva collection and diagnostics market growth include the increasing need for rapid diagnosis of chronic diseases, technological advancements in infant saliva collection, and rising awareness among the population regarding the easy and safe diagnosis of several diseases, among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."