- Home

- »

- Biotechnology

- »

-

Global Sample Preparation Market Size & Share Report, 2030GVR Report cover

![Sample Preparation Market Size, Share & Trends Report]()

Sample Preparation Market Size, Share & Trends Analysis Report By Product (Instruments, Consumable), By Technique (Protein Preparation), By Application, By End User, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-999-9

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

The global sample preparation market size was valued at USD 6,155.5 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2022 to 2030. Sample preparation is the first step in any analytical process. The increasing advancement of technology in the collection and preparation of specimens is anticipated to be the key determinant of growth in the market. For instance, in October 2022, Thorne HealthTech, Inc. collaborated with GenTegra to develop a next-generation collection and extraction kit for whole blood DNA. The partnership will allow companies to develop a new product by integrating GenTegra patented technology of active chemical protection with Thorne’s collection device. This strategy is to the used comparative advantage of both companies to generate high revenue at low costs of R&D.

The market has witnessed a substantial increase in revenue due to the COVID-19 pandemic. Increasing demand for sample preparation in various applications assisted startups in the fundraising process. For instance, in September 2022, two startups, Inso Biosciences, Inc. and Halomine, Inc. announced to receive grants for developing and commercializing solutions for COVID-19 research. The aggregate amount for 18 grants by New York State Biodefense Commercialization Fund was USD 15.3 million. While, Inso Biosciences, a platform developer for genomic sample preparation received USD 955,000.

Similarly, companies are taking initiatives to enhance and maintain the integrity of the specimen for accurate results. For instance, in September 2022, an Australian-based bioanalytical lab, Agilex Biolabs established its first satellite processing lab to support the clinical trials. The lab is expected to conduct time-sensitive sample processing approaches in the same location as clinical trial participants. Hence, this stores the integrity that might decline during the transportation of the specimen. The lab also has expertise in numerous sample preparation techniques, such as whole blood stimulation for cytokine release assays.

Expanding the scope of sample preparation techniques in various types of sequencing is anticipated to drive the growth of the market. Since the techniques differ according to the type of sequencing being conducted and the use of technology is considered for sample preparation. For instance, in target sequencing, the requirement of sample input is less as compared to other sequencing types. The key approaches are amplicon sequencing and hybridization capture. The volume of sequencing data is growing, hence driving the requirement for further diverse protocols for sample preparation.

Moreover, in October 2022, 10x Genomics collaborated with Oxford Nanopore Technologies to build a comprehensive sequencing solution for full-length isoform single-cell and spatial sequencing. The collaboration is to allow a streamlined sequencing workflow with integrated sample preparation on highly accessible devices. Hence, the solution is anticipated to improve the result's resolution and process high-yield whole genome sequencing data in hours rather than days.

However, the installation and maintenance of equipment for sample preparation are complex. Along with that, the technology for sample preparation differs depending on the applications, adding further cost and time for the users.

Product Insights

The consumables are projected to have a considerable market share with 63.2% of the market in 2021 and maintain the trend with the fastest growth rate in the forecasted period. The consumables are primarily recurring in nature and are less susceptible to the seasonality of the market and industry cycles as compared to instruments. For instance, in May 2022, PacBio announced a 22.16% increase in the consumables revenue from USD 10.4 million in the previous year to USD 12.7 million having a positive impact on segment growth.

The instruments segment is considered to have a stable growth rate during the forecasted period. The purchase frequency of instruments by the end-users is low owing to a higher lifespan and pricing than consumables. For end-users, it is essential to incorporate accurate quality instruments to eliminate potential interfering contamination from the sample. For instance, the nucleic acid extraction sample preparation system by Bioteke Corporation is an automated instrument for the extraction process of DNA/RNA.

The increasing innovation in product offerings by the players is anticipated to support the market share of instruments during the forecast period. For instance, in October 2022, Thermo Fisher Scientific launched a comprehensive and automated system for sample preparation of chromatography. It is considered to be the first of its kind to extract and concentrate components from semi-solid and solid samples, in a single instrument. The product eliminates the need for manual transferring from a walk-away sample to a vial workflow.

Technique Insights

The protein preparation segment is considered to have the largest market share in 2021 and is projected to have similar momentum with the fastest CAGR at 7.0% during the forecasted period. The increasing innovation in proteomics is likely to surge the overall market. The extraction process from the sample can result in the loss of proteins by eliminating contaminants and lowering the data reproducibility. In July 2022, researchers from the Babraham Institute advanced the conventional protocols of sample preparation in proteomics by developing a new approach. The technique rises the inclusion of hard to capture cellular proteins, hence improving the readouts of proteomics.

The solid-phase extraction segment accounted for a considerable revenue share in 2021. The expansion of techniques in various fields, such as food and environment, is likely to impact the overall market growth. For instance, in October 2022, Waters Corporation announced to launch Extraction+ connected device that can perform automation preparation of forensics, biological, environmental, and food specimen via solid phase extraction. The solution eliminates the requirement for a manual pipette and extraction of the sample. Similarly, the development of supplementary products to perform liquid-liquid extraction techniques is considered to be a supporting factor for market growth. For instance, in October 2022, nRichDX introduced two products for use with a sample preparation system. This strategic initiative assisted the company to enhance its applications in liquid biopsy.

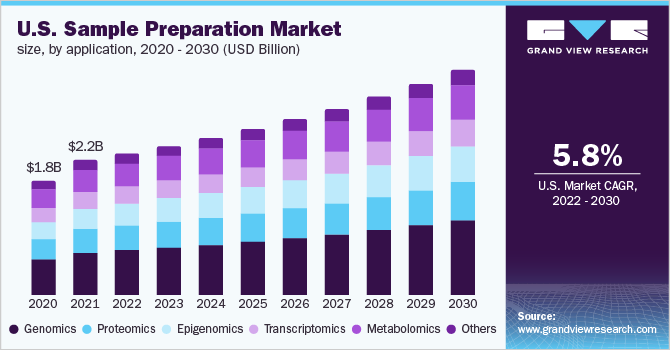

Application Insights

The genomics segment is estimated to capture the major market share in 2021 and is expected to maintain the trend with the fastest CAGR at 7.2%. Increasing strategic initiatives by companies in the market for genomics applications are expected to surge the overall growth rate. For instance, in October 2022, Bionano Genomics, Inc. and Hamilton announced the joint development of a product to extract and isolate Ultra High Molecular Weight DNA as the initial part of the sample preparation workflow. The use of long string vantage is in optical genome mapping.

One of the key drivers of this application is expanding the technique for developing personalized treatment through genomics research. For instance, in October 2022, Sight Diagnostics, a technology developer in blood sample preparation, installed its first portable instrument for hematology analysis in the Caribbean. The instrument is installed to offer immediate complete blood count to Tobago and Trinidad patients and assist in diagnosing patients with oncology, critically ill, and pediatrics.

Similarly, numerous approaches such as extraction and separation, are developing aligned with smart devices, lab automation, and biosensors. The technological advancement in the market is anticipated to ease the adoption rate by the end-users. For instance, in April 2020, an article published on a portal by Cambridge Healthtech Institute, states that sample preparation has substantial potential in a point-of-care setting. The article underlined developing sample-preparing techniques such as electrokinetic-like separation and electrowetting, which can be incorporated in a PoC setting.

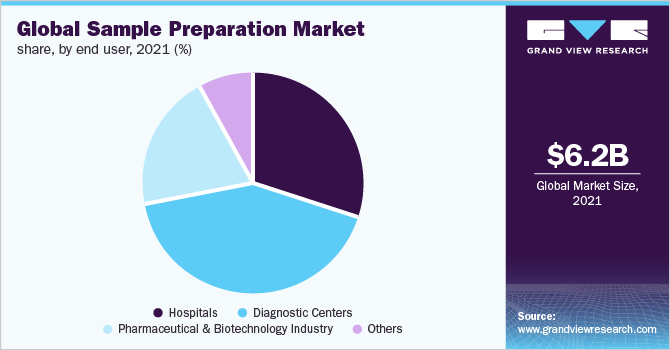

End User Insights

The diagnostic center is the largest revenue generating segment in 2021 with a 42.2% market share. It is projected to be an emerging end-user of the market with the fastest growth rate. The segment in the sample preparation market is estimated to be skewed towards the mature regions, majorly in Western Europe, North America, and Japan. However, increasing spending on human health in emerging markets is likely to drive the market.

The sample preparation has become an integrated part of the multiple areas’ value chain, including therapeutic research, discovery and development, clinical trials, manufacturing and quality assurance, and quality control. Hence, advancement in collection method is expected to ease the preparation process for the end-users. For instance, in October 2022, Tasso collaborated with Catapult Health to commercialize its U.S.-FDA-cleared device for collecting blood specimen at home. Hence, pharmaceutical and biotechnology companies also showcased stable growth in the market.

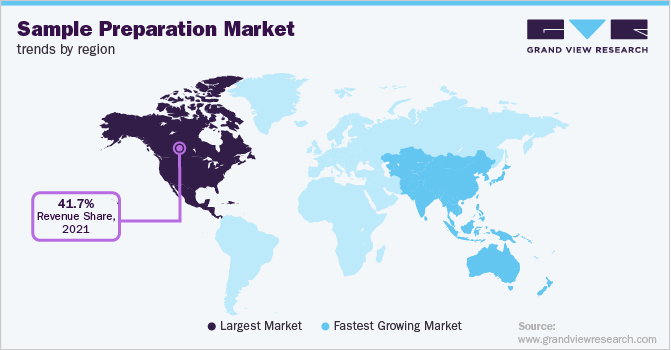

Regional Insights

North America has established global dominance in the sample preparation market with 41.66% of the market share in 2021. The important parament of the largest market share is the presence of well-established suppliers and buyers of the sample preparation solutions in the region. Hence, this speeds up the delivery process from supplier to buyer at a minimal cost. Additionally, increasing accessibility and availability of funds through government and private investors support startup companies to enter the market.

Asia Pacific is projected to experience the fastest CAGR in the market. This can be attributed to the increasing adoption of sequencing in China and India for numerous applications, including the development of personalized medicines. Furthermore, the increasing attention to genomics and proteomics research in the Asia Pacific is anticipated to impact the market with significant growth opportunities during the forecast period.

Key Companies & Market Share Insights

Companies in the sample preparation market are constantly indulging in numerous strategies such as technology development, innovation in the product line, collaborations, building a strong market presence through mergers and acquisitions, startups, and expanding regional footprint, to generate higher revenue. For instance, in October 2022, Thermo Fisher Scientific announced it to expand its clinical research lab in Kentucky by investing USD 59 million. The expansion is to support customers for their clinical testing requirements, including sample management, processing, storage, and preparation. Some of the prominent players in the global sample preparation market include:

-

Merck KGaA

-

Thermo Fisher Scientific Inc.

-

Bio-RAD Laboratories Inc.

-

Tecan Group Ltd.

-

Agilent Technologies Inc.

-

Hamilton Company

-

Promega Corporation

-

Illumina Inc.

-

Roche Applied Science

-

Danaher Corporation

-

Qiagen N.V.

Sample Preparation Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 6,487.5 million

Revenue forecast in 2030

USD 10.6 billion

Growth rate

CAGR of 6.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technique, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Merck KGaA; Thermo Fisher Scientific Inc.; Bio-RAD Laboratories Inc.; Tecan Group Ltd.; Agilent Technologies Inc.; Hamilton Company; Promega Corporation; Illumina Inc.; Roche Applied Science; Danaher Corporation; Qiagen N.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Sample Preparation Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global sample preparation market report on the basis of products, technique, application, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Extraction System

-

Workstation

-

Automated Evaporation System

-

Liquid Handling Instrument

-

Liquid handling workstations

-

Pipetting systems

-

Reagents dispensers

-

Microplate washer

-

other liquid handling systems

-

-

-

Consumable

-

Kits

-

Purification Kit

-

Isolation Kit

-

Extraction Kit

-

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein Preparation

-

Solid-phase extraction

-

Liquid-liquid extraction

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Genomics

-

Proteomics

-

Epigenomics

-

Transcriptomics

-

Metabolomics

-

Others

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Pharmaceutical and Biotechnology Industry

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sample preparation market size was estimated at USD 6,155.5 million in 2021 and is expected to reach USD 6,487.5 million in 2022.

b. The global sample preparation market is expected to grow at a compound annual growth rate of 6.4% from 2022 to 2030 to reach USD 10.6 billion by 2030.

b. North America dominated the sample preparation market with a share of 41.66% in 2021. This is attributable to well-established diagnostic centers and healthcare facilities.

b. Some key players operating in the sample preparation market include Merck KGaA; Thermo Fisher Scientific Inc.; Bio-RAD Laboratories Inc.; Tecan Group Ltd.; Agilent Technologies Inc.; Hamilton Company; Promega Corporation; Illumina Inc.; Roche Applied Science; Danaher Corporation; Qiagen N.V.

b. Key factors that are driving the sample preparation market growth include technological advancement in the collection and preparation of samples and increasing adoption of NGS

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."