- Home

- »

- Consumer F&B

- »

-

Sauces, Dressings & Condiments Market Size, Industry Report, 2025GVR Report cover

![Sauces, Dressings & Condiments Market Size, Share & Trends Report]()

Sauces, Dressings & Condiments Market Size, Share & Trends Analysis Report By Product (Cooking Sauces, Dips), By Distribution Channel, By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-614-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Consumer Goods

Report Overview

The global sauces, dressings, and condiments market size were valued at USD 130.4 billion in 2018. Shifting consumer diet preferences and consumption patterns towards healthy and nutritional food is a major factor for industry growth. Furthermore, the increasing popularity of international cuisines, coupled with flavorful ethnic sauces, is fueling the demand for sauces, dressings, and condiments.

Consumers are shifting towards natural and organic food products, which are tastier, healthier, and more nutritious. This consumption trend is widespread among the young adult population across the globe. These beliefs among consumers who seek products with a clean label, coupled with increasing concerns over food safety, are resulting in a shift in preferences towards the purchase of sauces, dressings, and condiments. In addition, rapid urbanization, coupled with growing consumer interest in multi-cuisine culture, is anticipated to fuel the demand for sauces, dressings, and condiments in the foreseeable future. Moreover, a significant increase in product innovations and new product launches are supporting industry growth.

The increasing popularity of Asian cuisines in the U.S. has increased the demand for different flavors of sauces, dressings, and condiments. According to an article published by ‘The Washington Post’, in 2014, large restaurants chains in the U.S. account for 50% of their sale through Asian cuisines across the U.S. For instance, ‘Panda Express’ a fast food restaurant chain that reported a sales of USD 2 billion in which 50% was reported from the Asian cuisines. This growing popularity of international cuisines across the globe is expected to expand the scope of the market for sauces, dressings, and condiments over the forecast period.

Governments across the globe are taking initiatives in order to promote the condiments, sauces, and dressing products. Many governments are providing incentives as well as subsidies on the import of products, which is opening new avenues for the trader. For instance, the governments of South Korea and Australia have reduced tariffs on tomato ketchup as well as prepared mustard (prime ingredient for mustard sauce) from 4.5% in 2016 to 3.4% in 2017 under the Korea-Australia Free Trade Agreement (KAFTA). This significant reduction of tariffs increased the opportunities for the Australian traders to enter South Korea. These initiatives by the governments are supporting the increasing demand for sauces, dressings, and condiments.

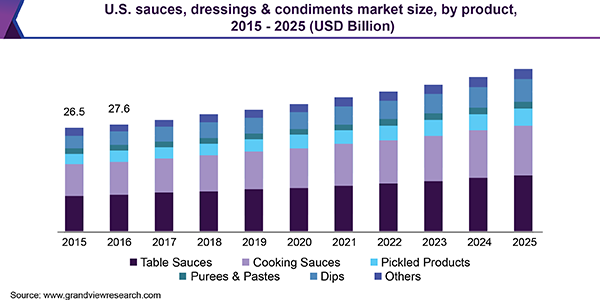

Product Insights

Cooking sauces held the largest share of 38.1% in 2018. Key industry participants are launching new products in order to cater to increasing demand for cooking sauces as a result of the rising popularity of international cuisines across the globe. For instance, in March 2017, Kinneret Farm, an Israel-based company, launched a wide range of cooking sauces, marinades, and natural date molasses under the brand name, ‘Oriendi’ for the U.K. market. These products offer new flavors as well as convenience to the customers. These product innovations are expected to drive the market for sauces, dressings, and condiments in the coming years.

Dips are expected to be the fastest-growing segment, expanding at a CAGR of 5.3% from 2019 to 2025 owing to increasing demand for the on-the-go food among the youth population across the globe. Manufacturers are launching new and innovative products, in order to gain the maximum consumer base. For instance, in December 2018, The Kraft Heinz Company launched a wide range of dips under the brand name, Philadelphia Dips. The dips are available in three flavors including jalapeño cheddar, southwest style with black bean and corn, and buffalo style with celery. These product launches are expected to remain favorable for the dips segment over the forecast period, thereby driving the market for sauces, dressings, and condiments.

Distribution Channel Insights

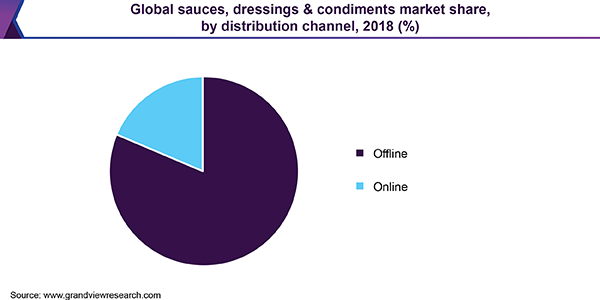

Offline was the largest distribution channel with a share of 81.5% in 2018. This supply channel includes convenience stores, supermarkets, brand outlets, hypermarkets, unorganized retail, and direct selling. Major players of sauces, dressings, and condiments such as Walmart, Amazon, and 7-Eleven are investing in developing countries, such as India, Thailand, and Taiwan, in order to cater to the increasing consumer demand for sauces, dressings, and condiments.

In February 2019, 7-Eleven, one of the largest convenience store chains in the world, has entered in an agreement with Future Group to open its first store in India, which is one of the fastest-growing retail markets. SHME Food Brands, a subsidiary of Future Group, will convert existing stores to the 7-Eleven brand store and thus, will open new stores across the country by the end of 2019. The company has planned to offer fresh foods with local recipes, beverages, and snacks. These initiatives will increase the visibility for sauces, dressings, and condiments over the forecast period.

The online distribution channel is expected to be the fastest-growing segment, expanding at a CAGR of 5.1% from 2019 to 2025 owing to increasing internet penetration in various countries such as India and China. Major manufacturers are adopting marketing strategies such as product advertisement and celebrity marketing in order to gain the maximum customer base. For instance, the Online giant ‘Flipkart’ in India, which has become a part of Walmart, launches discount offers on a time-to-time basis in order to propel the sales. This further promotes the online sales channel of grocery products such as sauces, dressings, and condiments.

Regional Insights

Asia Pacific was the largest market, accounting for 32.7% share of the global revenue in 2018. The region is also anticipated to witness the fastest growth in the coming years. Consumption of condiments, sauces, and dressings is significantly increasing in countries including China, Japan, India, Taiwan, and Indonesia as a result of the increasing popularity of traditional foods in the region. Moreover, major manufacturers are launching new products owing to an increasing appetite for global cuisines in countries such as India and Indonesia. This, in turn, is anticipated to drive the industry in the next few years.

The industry participants are focusing on health, convenience, as well as the exotic taste of the sauces, dressings, and condiments in order to gain the maximum customer base. For instance, in September 2018, Nestlé entered into the gourmet dip and spread segment market by launching Dip & Spread under the brand name MAGGI. This product contains around 80% of yogurt with less than 3% fat. A good quantity of yogurt makes it a healthy as well as a tasty alternative for customers.

Key Companies & Market Share Insights

The global market is fragmented in nature owing to the presence of a large number of domestic as well as foreign players including The Kraft Heinz Company; McCormick & Company, Inc.; Campbell Soup Company; Del Monte Foods Inc.; and General Mills Inc. Moreover, key manufacturers are adopting market strategies including mergers and acquisitions, new product launches, and expansion of distribution channels in order to gain the maximum customer base as well as cater to the increasing demand for sauces, dressings, and condiments among health-conscious customers.

For instance, in November 2018, The Kraft Heinz Company signed an agreement to acquire Primal Kitchen brands, a U.S. based food product manufacturer pioneered in manufacturing health-conscious sauces, dressings, and condiments. These strategic moves are anticipated to ensure the significant demand for sauces, dressings, and condiments over the forecast period.

Major players are increasing the visibility of their products including sauces, dressings, and condiments, especially in developed countries, in order to gain the maximum customer reach. The establishment of R&D centers for product innovation, coupled with strategic partnerships with investment companies in order to launch new innovative products as per the customer’s demand in the region, is expected to remain a critical success factor over the next few years. Taking into account all the above-mentioned factors, producers are likely to focus on technology innovation, particularly in developing countries and untapped markets to gain the maximum share.

Sauces, Dressings & Condiments Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 142.50 billion

Revenue forecast in 2025

USD 181.01 billion

Growth Rate

CAGR of 4.8% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; France; China; Japan; Brazil

Key companies profiled

The Kraft Heinz Company; McCormick & Company, Inc.; Campbell Soup Company; Del Monte Foods Inc.; General Mills Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global sauces, dressings, and condiments market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2015 - 2025)

-

Table Sauces

-

Cooking Sauces

-

Pickled Products

-

Purees & Pastes

-

Dips

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include shifting consumer diet preferences towards the nutritional food and increasing popularity of the international cuisines and flavorful ethnic sauces.

b. The global sauces, dressings and condiments market size was estimated at USD 136.24 billion in 2019 and is expected to reach USD 142.50 billion in 2020.

b. The global sauces, dressings and condiments market is expected to grow at a compound annual growth rate of 4.8% from 2019 to 2025 to reach USD 181.01 billion by 2025.

b. Asia Pacific dominated the sauces, dressings and condiments market with a share of 32.8% in 2019. This is attributed to increasing popularity of traditional foods in the countries including China, Japan, India, Taiwan, and Indonesia.

b. Some key players operating in the sauces, dressings and condiments market include The Kraft Heinz Company; McCormick & Company, Inc.; Campbell Soup Company; Del Monte Foods Inc.; and General Mills Inc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."