- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Saudi Arabia Masterbatch Market Size Report, 2020-2027GVR Report cover

![Saudi Arabia Masterbatch Market Size, Share & Trends Report]()

Saudi Arabia Masterbatch Market Size, Share & Trends Analysis Report By Type (Oxo-biodegradable, White, Black, Color, Additives, Filler), By Carrier Polymer, By Application, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-182-8

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Bulk Chemicals

Report Overview

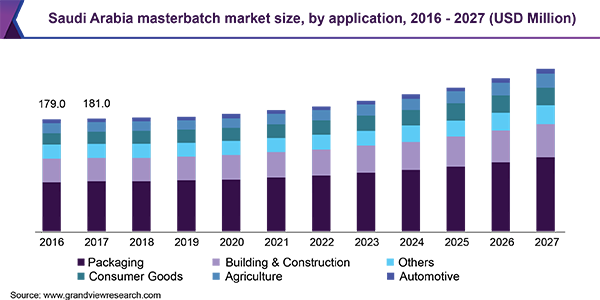

The Saudi Arabia masterbatch market size was valued at USD 184 million in 2019. It is expected to expand at a compound annual growth rate (CAGR) of 4.7%, in terms of revenue, from 2020 to 2027. Increasing demand for plastic components, fibers, wires and cables, and color polymers for application in the automotive, building and construction, agriculture, and packaging industries are the key factors boosting the market growth. Masterbatches are the solid or liquid mixture of pigments or additives, used to impart various colors, such as black or white, along with functional properties to carrier polymers. They offer various properties such as UV stabilizing, flame retardation, antistatic, and antilocking which make them suitable for application in various end-use industries including packaging, building and construction, consumer goods, automotive, and agriculture.

The demand for colored plastics is increasing swiftly led by the growth in the packaging industry. The Saudi Arabia packaging industry is witnessing a significant growth driven by the consolidated development of sub-segments such as food, industrial, retail, consumer, and medical packaging in the country. Changing consumer lifestyles have resulted in the growing demand for ready-to-eat food; this factor coupled with an increase in the number of retail stores selling packaged food is driving the market growth.

However, stringent environmental regulations in Saudi Arabia related to the non-biodegradability of plastics may restrain the market growth over the forecast period. Fluctuating prices of raw materials required for the manufacturing of masterbatch are also expected to hinder the market growth in the coming years.

Product Insights

The white masterbatch segment led the market and accounted for more than a 30% share of the total revenue in 2019. This can be attributed to the rising product demand from end-use industries such as packaging, building and construction, and consumer goods industries.

White masterbatch is widely used in the manufacturing process of polymers or thermoplastics such as polyethylene, PET, and PP for adding whiteness or opacity into the final products. They allow a convenient way of incorporating whiteness in thermoplastics without contamination by dust.

Also, they can be customized to impart properties such as antistatic, coloring strength, and antibacterial. Owing to their excellent dimensional stability, weather resistance, and UV stability, they are widely used in various applications in the packaging, textile and fiber, and home appliances industries.

Application Insights

The packaging segment led the market and accounted for more than 44% share of the total revenue in 2019. The high share of the packaging segment is attributed to the growing application of masterbatch in the plastics used in packaging to offer various properties such as UV stability, weather resistance, antioxidant and antistatic properties for the protection of packaged products.

The increase in the number of FMCG companies in Saudi Arabia has boosted the demand for processed food, consumer products, cosmetics, beverages, and toiletries in recent years. The manufacturers of fast-moving consumer goods (FMCG) are constantly exploring emerging markets through innovative retail models. This approach of FMCG manufacturers has created a great market potential and also increased the demand for the packaging of products.

Companies are adopting new methods of packaging to decrease wastage during transportation and handling. Suppliers are using lightweight products in their supply chain to ensure high quality and safety of products. Retailers are engaged in providing quality packaging in an attempt to maintain the nutrient content, taste of food products, and appealing external packaging. All these factors together are projected to contribute to the growth of the packaging industry, which is, in turn, expected to boost the use of color and additive masterbatch in the country over the forecast period.

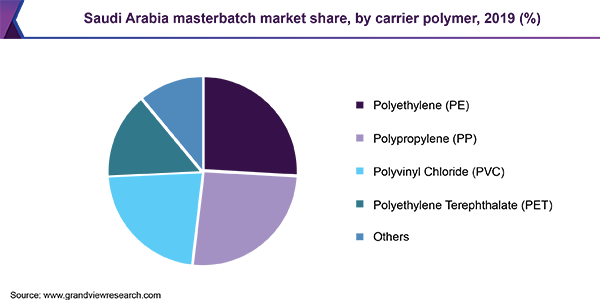

Carrier Polymer Insights

The polyethylene segment led the market and accounted for more than a 26% share of the total revenue in 2019. The high share is attributed to rising demand for polyethylene in the manufacturing of different types of sheets and films, which find application in food packaging, carrier bags, geosynthetics, industrial films, refuse bags, and lamination.

Polyethylene is a widely accepted plastic due to its versatility, ease of processing, lower cost, and recyclability. The ability to obtain polyethylene from shale gas along with biobased materials is likely to provide a cost advantage to polyethylene. Polyethylene as a carrier polymer is also used in the manufacturing of HDPE, LDPE, and LLDPE, which finds extensive application in the packaging industry.

Key Companies & Market Share Insights

The fragmented market makes this industry highly competitive. Continuous innovation in the product required by the application segment and end-use industry to serve specifically tailored solutions is the most comprehensive trend noticed in the industry. International players are focusing on expanding their product portfolio in the country to cater to the broad range of customer needs. Therefore, intense rivalry is expected among players in the coming years.

The manufacturers in the market are deploying various strategies and introducing products that offer fast and long-term performance to keep up with the growing customer needs and remain competitive in the intensified marketplace. For instance, in October 2019, Cabot Corporation launched a new series of black masterbatch, namely TECHBLAK 85, which is processed from recycled polymers and post-industrial carbon black. The new product helps plastic manufacturers meet their sustainability targets of lowering carbon footprint and increasing the amount of recycled content in the end products. Some of the prominent manufacturers in the Saudi Arabia masterbatch market include:

-

Avient Corporation

-

Astra Polymer Compounding Co., Ltd.

-

Cabot Corporation

-

Ingenia Polymer Corp.

-

Ampacet Corporation

-

Juffali PolyOne Master Batches Co. Ltd.

-

MD International Masterbatch & Compound

-

Pure Polymers

-

Rifd Plastics

Saudi Arabia Masterbatch Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 187.6 Million

Revenue forecast in 2027

USD 259.6 Million

Growth Rate

CAGR of 4.7% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in Tons and Revenue in USD Million & CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, carrier polymer, application

Country scope

Saudi Arabia

Key companies profiled

Avient Corporation; Astra Polymer Compounding Co., Ltd.; Cabot Corporation; Ingenia Polymer Corp.; Ampacet Corporation; Juffali PolyOne Master Batches Co. Ltd.; MD International Masterbatch & Compound; Pure Polymers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts volume and revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For this study, Grand View Research has segmented the Saudi Arabia masterbatch market report based on products, carrier polymer, and application:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2016 - 2027)

-

Oxo-Biodegradable Masterbatch

-

White Masterbatch

-

Black Masterbatch

-

Color Masterbatch

-

Additives

-

Filler

-

-

Carrier Polymer Outlook (Volume, Tons; Revenue, USD Million, 2016 - 2027)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2016 - 2027)

-

Packaging

-

Building & Construction

-

Consumer Goods

-

Automotive

-

Agriculture

-

Others

-

Frequently Asked Questions About This Report

b. The Saudi Arabia masterbatch market size was estimated at USD 184.0 million in 2019 and is expected to reach USD 187.6 million in 2020.

b. The Saudi Arabia masterbatch market is expected to grow at a compound annual growth rate of 4.7% from 2020 to 2027 to reach USD 259.6 million by 2027.

b. Packaging dominated the Saudi Arabia masterbatch market with a share of 44.8% in 2019. This is attributable to the growing application of masterbatch in the plastics used in packaging to offer various properties such as UV stability, weather resistance, antioxidant and antistatic properties for the protection of packaged products.

b. Some of the key players operating in the Saudi Arabia masterbatch market include Avient Corporation, Astra Polymer Compounding Co., Ltd., Cabot Corporation, Ingenia Polymer Corp., Ampacet Corporation, Juffali PolyOne Master Batches Co. Ltd., MD International Masterbatch & Compound, Pure Polymers, and Rifd Plastics.

b. Key factors driving the Saudi Arabia masterbatch market growth include the growing replacement of metal by plastic in various end-use industries and increasing demand for plastics in the packaging industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."