- Home

- »

- Medical Devices

- »

-

Saudi Arabia Medical Disposables Market Report, 2021-2028GVR Report cover

![Saudi Arabia Medical Disposables Market Size, Share & Trends Report]()

Saudi Arabia Medical Disposables Market Size, Share & Trends Analysis Report By Product (Wound Management, Drug Delivery), By Raw Material (Plastic Resin, Nonwoven Material), By End Use, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-378-0

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

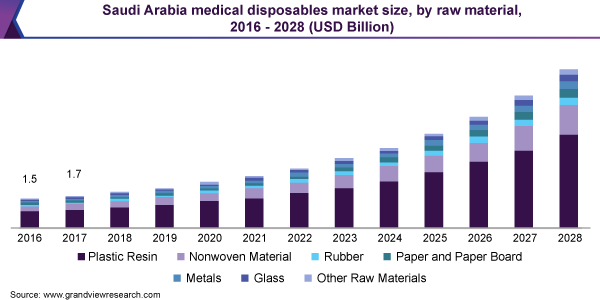

The Saudi Arabia medical disposables market size was valued at USD 2.3 billion in 2020. The market is expected to expand at a compound annual growth rate (CAGR) of 17.0% from 2021 to 2028. The growth of the market in Saudi Arabia is attributed owing to the growing number of surgeries, rising prevalence of Hospital Acquired Infections (HAIs), increasing prevalence of chronic disorders, and impact of Covid-19.

The increasing prevalence of chronic diseases, such as cardiovascular diseases and diabetes is the major factor driving the market for medical disposables in Saudi Arabia. For instance, as per the report published by the International Diabetes Federation (IDF) in 2020, the prevalence rate of diabetes in Saudi Arabia is 18.3%. It also reported that Saudi Arabia is the 7th-highest country for new cases of type 1 diabetes. The WHO data estimated that about 7.00 million of the population in Saudi Arabia is diabetic and 3 million have pre-diabetes. As long-term diabetes causes diabetic foot ulcers, which, in turn, extends hospital stays, thus, driving the market over the projected period.

Supplies and devices specified for the management of chronic diseases might witness high revenue growth amongst medical disposables. The supplies and devices segment majorly comprises dialysis, transdermal drug delivery, urinary drainage, respiratory disorders, ostomy, and incontinence. Demand for first aid kits and medical waste disposal supplies is also anticipated to grow rapidly, owing to growing self-treatment applications, and rising preferences for high value-added products with superior infection prevention protections. Additionally, advances in the quality of medical disposables will also advance the safety and outcome of numerous patient procedures in Saudi Arabia.

The current COVID-19 outbreak is expected to have a substantial impact on the market for medical disposables in Saudi Arabia. According to Worldometer estimates, as of 7 June 2021, there are total 458,707 cases in Saudi Arabia, of which, 7,471 people died and 441,860 have recovered. The COVID-19 pandemic has drastically increased the demand for medicines, medical disposable products, and hospital equipment, and emergency supplies. Furthermore, in May 2020, Saudi Basic Industries Corp (SABIC) is aiding India to combat the COVID-19 pandemic by enabling local manufacture of around 150,000 protective essentials and testing products daily. These include Covid-19 test kits, goggles, gloves face shields, surgical masks, and gowns.

Increasing government healthcare expenditure is a key factor fueling the growth of the market for medical disposables in Saudi Arabia. For instance, according to the Flanders Investment and Trade Market Survey in 2020, the government allotted about USD 48.71 billion (SR 177 billion) to healthcare in which, 19.00% of the budget was allocated for building new hospitals with large bed capacity, developing new primary healthcare units and medical research centers. However, following the outbreak of Covid-19, spending on health has amplified by more than 50.00% of the budget allocated to the Ministry. Moreover, the healthcare sector in Saudi Arabia is predicted to increase at a compound annual growth rate of 12.3% by the end of 2020, as per Aon Hewitt, a US-based consultant.

In addition, the Saudi medical devices market represents about 50.0% of the Middle Eastern market which was projected to reach USD 2.1 billion (SR 7.5bn) in 2020, expanding at a CAGR of 10.0%. The growth is owing to augmented demand for healthcare services, increased government expenditure, and the spread of health insurance services. Saudi Arabia imports nearly 90.00% of its medical device requirements from abroad mainly from the U.S. and Europe owing to inadequate local supply. However, the Covid-19 pandemic has encouraged many local manufacturers to enter the market for medical disposables in Saudi Arabia. For instance, 3.7 million face masks and 1.5 million liters of sanitizers were manufactured locally, according to current numbers by the Saudi Food and Drug Authority. The Industrial Cluster (IC) reported that disposable plastic devices signify 40.00% of products manufactured in Saudi Arabia. It is also expected that glucose meters and strips will be manufactured to suffice the need of domestic and regional markets. Such developments will further promote market growth.

Continuous initiatives by the key players are also anticipated to drive the market for medical disposables in Saudi Arabia. Key players are implementing several strategies to maintain a strong foothold in the market for medical disposables in Saudi Arabia. For instance;

-

In March 2021, Careon Healthcare Solutions has finalized joint ventures in Saudi Arabia and Sri Lanka for surgical, medical disposable products. This might expand the customer base of the firm.

-

In December 2020, Jofo Nonwovens Co. and Takween Advanced Industries jointly signed an agreement for the sale of 70.00% of the shares of Advance Fabrics Company (SAAF), a Saudi Arabia-based nonwovens manufacturer. The transaction enables Jofo, to enter the medical market of Saudi Arabia.

-

In October 2020, SABIC, collaborated with Fibertex Personal Care, to manufacture a variety of non-woven disposables using high-purity recycled plastics from SABIC’s TRUCIRCLE product portfolio and services. The initiative will aid in a more sustainable supply chain and better recyclability for non-woven.

Thus, such initiatives by the key players are anticipated to propel market growth over the forecast period.

Product Insights

The disposable masks segment dominated the market for medical disposables in Saudi Arabia and accounted for the largest revenue share of 12.8% in 2020. This can be attributed to growing pollution levels, industrialization, and the impact of COVID-19. Furthermore, the increasing number of surgeries performed on a daily basis, combined with the unprecedented spread of the coronavirus, is promoting the use of disposable face masks. Disposable masks act as a protective shield between medical personnel and patient. It also aids in the prevention of germs and the reduction of the chance of being affected by environmental toxins. For instance, according to the WHO guidelines, the air quality in Saudi Arabia is considered unsafe. As per the most recent data in IAMAT, indicates the country's annual mean concentration of PM2. 5 is 88 µg/m3, surpassing the recommended maximum of 10 µg/m3. Thus, the rising pollution level in Saudi Arabia will augment the segment growth. Moreover, increasing airborne diseases, growing consumption of masks for personnel use, upsurge in cases of hospital-acquired infections will also create high demand for disposable face masks.

The recent outbreak of COVID-19 has significantly impacted the market for medical disposables in Saudi Arabia and has significantly amplified the sales of disposable masks in Saudi Arabia. This is mainly because they prevent or slow down the transmission of life-threatening COVID-19 infections. Also, face masks have been employed as a public and personal health control measure against the spread of SARS-CoV-2. Furthermore, the Food and Drug Administration (FDA) has eased regulations on face masks and respirators to fight against COVID-19. Hence, this is expected to considerably boost the segment growth over the forecast period.

In addition, as per the WHO, the production of masks needs to be raised by 40% to meet global demand. The government in Saudi Arabia has restricted exports of masks to achieve domestic demand through amplified production. This has resulted in shortages of masks as Saudi Arabia depends on imports. For instance, as per the World Integrated Trade Solution, in 2019, the top importers of disposable masks and garments from Saudi Arabia were Kuwait (USD 166.11K, 1,960 Kg), United Arab Emirates (USD 19.32K, 2,665 Kg), Netherlands (USD 0.14K, 6 Kg). Thus, to meet the increasing demand for masks, companies are making efforts to surge the manufacture of face masks. For instance, in September 2020, Globalpharma, a wholly-owned subsidiary of Dubai Investments, has launched UAE-made surgical disposable face masks under the brand “GP+”. The facemasks are of high-quality melt blown filter under UV sterilization, providing maximum filtration rate.

The hand sanitizers segment is expected to witness the fastest growth over the forecast period. Hand sanitizers are used to eliminate harmful pathogens from the hands. The outbreak of COVID-19 has immensely surged the demand for hand sanitizers in Saudi Arabia. As per the WHO, FDA, and Centers for Disease Control and Prevention guidelines, regular application of hand sanitizers is recommended to each individual in order to prevent the transmission of coronavirus. As a result of these initiatives, the demand for hand sanitizers has increased due to their convenience and rising awareness regarding sanitization.

Furthermore, the local players in the country are adopting various strategies, such as launching new products and collaborations to fulfill the rising demand, owing to the spread of COVID-19 across the country. For instance, in June 2020, Sadara Chemical Co. and Sahara International Petrochemical Co. partnered to supply high-quality ethanol essential for the production of hand sanitizers. The ethanol was delivered free of charge to local manufacturers in order to manufacture much-needed hand sanitizers. It was then donated to the Ministry of Health for distribution to the healthcare sector across Saudi Arabia in order to tackle the COVID-19 pandemic. Also, in September 2020, Globalpharma launched a UAE-made hand rub sanitizer. The GP+ sanitizer is permitted by the Dubai Municipality and produced in accordance with the latest guidelines by the WHO. The formulation provides rapid, insistent action and aids protect against several microorganisms and viruses.

Raw Material Insights

The plastic resin segment dominated the market for medical disposables in Saudi Arabia and held the largest revenue share of 58.3% in 2020. The segment is expected to witness a considerable growth rate over the forecast period. Resins are commonly used in the production of disposable medical devices as they provide improved clarity, cost-effectiveness, and biocompatibility. To attain suitable qualities for application in medical devices, the availability of several polymers such as Polyethylene (PE) and Polystyrene (PS) has expanded the applications of plastics in the healthcare sector. Glass and metal equipment are prone to corrosion and shattering, but as plastic is resistant to both, is an ideal material for medical devices. Most medical plastic devices are designed for one-time use and are designed to withstand repeated sterilizations for a longer period of time. Most major plastics are recyclable, making them an environmentally friendly solution for medical uses. In addition, key companies in this country are developing new products and materials to enhance their footprints in the competitive industry. For instance, in February 2020, SABIC launched new LNP ELCRES CRX PC copolymers that resist stress cracking in devices exposed to harsh disinfectants. Further, in November 2019, SABIC launched NORYL WM330G resin featuring proprietary impact-resistant technology.

The nonwoven material segment is predicted to witness the fastest growth rate over the forecast period. Nonwoven fabric is used to produce a variety of healthcare products, including a face mask, surgical gowns, drapes, aprons, and wound dressings. They're also used in sanitary pads, sanitary towels, tampons, napkin liners, infant diapers amongst many other things. The nonwoven material is chosen over woven material as it offers superior protection against hospital-acquired illnesses and surgical-site infections. It provides benefits such as low weight, cheap cost, and simple recycling processes that are expected to increase demand for these materials. Furthermore, because of the simple manufacturing techniques and cheap availability of its raw materials, such as polyester, this material has a lower manufacturing cost than its alternatives. The aforementioned advantages are raising its demand and leading to segment growth. In addition, as a result of the COVID-19 outbreak, there's been an exponential surge in the demand for nonwoven face masks to prohibit the virus from spreading. This has led to a considerable surge in demand for nonwoven textiles.

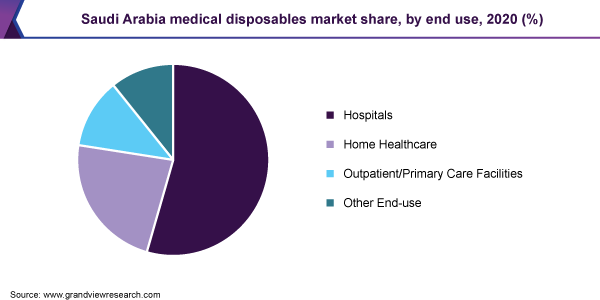

End-use Insights

The hospitals segment dominated the Saudi Arabia medical disposables market and accounted for the largest revenue share of 54.4% in 2020. The market is expected to witness a significant growth rate over the forecast period. Medical disposables are a vital component in hospitals, as they save staff time and lessen healthcare-related expenses. Moreover, the rising number of patient admissions in hospitals for surgeries and treatments for COVID-19 is driving the segment. For instance, according to the ‘Flander Investment and Trade’ data, currently (2020), Saudi Arabia has a total of 494 hospitals providing 75,225 beds with 1.3 beds per 1,000 people in private hospitals and 2.5 beds in government hospitals. Saudi might need an additional 5,000 beds by the end of this year and 20,000 beds by 2035, owing to rapidly increasing outpatient admissions. For instance, as per the same source, the rapid change of lifestyle has also led to an increase in the number of outpatients at a CAGR of 1.5%. Thus, amplified usage of medical disposables in the hospitals due to the growing number of patients might stimulate the segment growth over the forecast period.

The home healthcare segment is foreseen to witness rapid growth over the prediction period. Medical disposables in the home healthcare sector primarily comprise needles, syringes, and lancets, solid bandages, gloves, and disposable sheets. Moreover, the demand for home healthcare is rapidly growing due to the rising geriatric population. For instance, according to the latest statistics of the Department of Statistics, the government of Saudi Arabia, the ageing population is around 1 million and 3 thousand that is 5% of the total population. Thus, the surge in the volume of the target patient pool is expected to drive the demand for home healthcare over the forecast period. Furthermore, government initiatives to lessen hospital readmission cost and travel is anticipated to propel segment growth. For instance, The Ministry of Health, Saudi Arabia, has a special program known as "Home Healthcare” to offer important and varied services to certain groups.

Key Companies & Market Share Insights

Key players are involved in adopting strategies such as mergers and acquisitions, partnerships, and launching new products to strengthen their foothold in the market.

-

In April 2019, a prominent Saudi Arabian healthcare distribution firm, Salehiya Medical, deployed the ‘Orchestrated Customer Engagement (OCE)’ platform of IQVIA Technologies within its medical supplies sector to complement customer relations through multiple marketing channels and enhance performance.

Some of the prominent players in the Saudi Arabia medical disposables market include:

-

SABIC

-

Medical Disposable Manufacturing Company (MDM)

-

ACTEST Ltd.

-

Al Shidani Middle East L.L.C

-

Smith & Nephew PLC

-

Bayer AG

-

Becton Dickson and Company

-

3M

-

Johnson & Johnson

-

Abbott

-

Medtronic

Saudi Arabia Medical Disposables Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 2.7 billion

Revenue forecast in 2028

USD 7.9 billion

Growth Rate

CAGR of 17.0% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, raw material, end use

Country scope

Saudi Arabia

Key companies profiled

SABIC; Medical Disposable Manufacturing Company (MDM); ACTEST Ltd.; Al Shidani Middle East L.L.C; Smith & Nephew PLC; Bayer AG; Becton Dickson and Company; 3M; Johnson & Johnson; Abbott; Medtronic

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the Saudi Arabia medical disposables market report on the basis of product, raw material, and end use:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Wound Management Products

-

Drug Delivery Products

-

Diagnostic and Laboratory Disposables

-

Dialysis Disposables

-

Incontinence Products

-

Respiratory Supplies

-

Sterilization Supplies

-

Non-woven Disposables

-

Disposable Masks

-

Disposable Eye Gear

-

Disposable Gloves

-

Hand Sanitizers

-

Gel Hand Sanitizers

-

Foam Hand Sanitizers

-

Liquid Hand Sanitizers

-

Other Hand Sanitizers

-

-

Other Products

-

-

Raw Material Outlook (Revenue, USD Million, 2016 - 2028)

-

Plastic Resin

-

Nonwoven Material

-

Rubber

-

Paper and Paperboard

-

Metals

-

Glass

-

Other Raw Materials

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Home Healthcare

-

Outpatient/Primary Care Facilities

-

Other end-use

-

Frequently Asked Questions About This Report

b. The plastic resin segment dominated the market for medical disposables in Saudi Arabia and held the largest revenue share of 58.3% in 2020.

b. The hospital segment dominated the Saudi Arabia medical disposables market and accounted for the largest revenue share of 54.4% in 2020.

b. The Saudi Arabia medical disposables market size was estimated at USD 2.3 billion in 2020 and is expected to reach USD 2.7 billion in 2021.

b. The Saudi Arabia medical disposables market is expected to grow at a compound annual growth rate of 17.0% from 20201 to 2028 to reach USD 7.9 billion by 2028.

b. The disposable masks segment dominated the market for medical disposables in Saudi Arabia and accounted for the largest revenue share of 12.8% in 2020.

b. Some of the key players operating in the Saudi Arabia medical disposables market include SABIC, Medical Disposable Manufacturing Company (MDM), and ACTEST Ltd. Al Shidani Middle East L.L.C.

b. Key factors that are driving the Saudi Arabia medical disposables market growth include the increasing prevalence of chronic diseases, the outbreak of COVID-19, growing awareness about hospital-acquired infections (HAI), and a surge in the aging population across Saudi Arabia.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."