- Home

- »

- Next Generation Technologies

- »

-

Global Self-checkout Systems Market Size Report, 2030GVR Report cover

![Self-checkout Systems Market Size, Share & Trends Report]()

Self-checkout Systems Market Size, Share & Trends Analysis Report By Component (Systems, Services), By Type (Cash, Cashless Based), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-411-6

- Number of Pages: 112

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

The global self-checkout systems market size was valued at USD 3,865.8 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 13.4% from 2023 to 2030. Self-checkout (SCO) systems are automated systems, which are adopted across grocery stores, retail, and hospitality sectors to aid customers in checkout and self-order without the help of employees. The earlier self-checkout systems included separate, off-the-shelve components and occupied a large storage area.

However, the current self-checkout systems are manufactured and re-engineered as per demand to suit the store structure and offer competitive functionality, reliability, form factors, and costs. The increasing demand for secure and self-payment technologies has resulted in small vendors delivering cashless systems, which are anticipated to boost the self-checkout systems industry growth over the forecast period.

Automation is rapidly becoming the key transformational force across many industries globally. The increased penetration of automation across industries/sectors such as retail and hospitality is likely to drive the adoption of self-checkout systems across store operations and warehouses. Features such as self-scan & pay and self-ordering, while avoiding large queues, contribute to their increased popularity in the self-checkout systems industry. Also, to cope with the declining workforce, the adoption of robotic and automation products has risen notably in the retail sector in recent years.

Increasing IoT penetration and technological developments in retail premises are the factors that contribute to the growth of the SCO systems industry. Retailers are investing in technology to reduce in-store issues. These issues are often related to product information identification, inventory mapping, customer experience, and payment. For instance, laser motion sensors aid retailers detect if a product is shoplifted or has not been scanned at a self-checkout counter.

Furthermore, the deployment of SCO systems helps customers understand various product features, provides in-store promotional offers and aids consumers to check out rapidly without any intervention from employees. Hence, self-checkout systems serve as an additional touchpoint, providing retailers with improved customer engagement and enhanced shopping experiences.

However, the market growth is anticipated to be restrained by downsides such as a lack of product awareness. The rising instances/incidences of skimming, fraud, and shoplifting are anticipated to pose a challenge to market growth. Reluctance to use self-checkout services among the elderly population is another factor that may impact the industry’s growth.

Senior citizens with mobility issues and conditions such as dementia, hearing, sight, and memory loss require more in-person care. Additionally, limited technology know-how in underdeveloped economies often leads to the avoidance of self-checkout systems across retail outlets.

During COVID-19, decreased wait time in queues, the need to maintain social distancing, and discounts & offering products beyond retail store properties boosted the market growth. Additionally, the increasing costs of retail premises and increasing consumer queue time to order or checkout are other factors driving the market. Moreover, the shortage of skilled laborers in developing nations, increasing labor costs, and the inclination toward personalized shopping experiences are some of the other factors enhancing the growth of the self-checkout systems industry.

The spread of COVID-19 urged governments across the globe to undertake several precautionary methods. Many retailers implemented business models at a higher rate, from zero-touch practices to remote working. These practices created avenues as well as challenges for the self-checkout systems industry growth. Furthermore, the limited workforce availability in retail shops promoted a self-servicing shopping experience, wherein consumers selected the required products without the assistance of employees to guide them with the product details.

However, procuring raw materials and components across countries was a challenge among global vendors, owing to the shutdown in operations. As most of the suppliers were concentrated in China and other Asia Pacific countries, the supply of components remained halted due to the disruption of the travel & transportation sector during the lockdown phase.

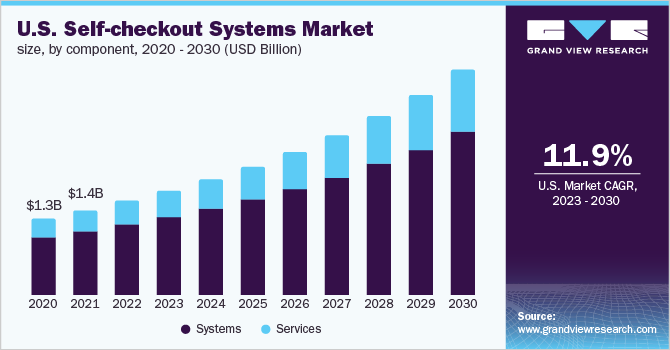

Component Insights

The systems segment held the highest market share of over 60.0% in 2022. The large share is attributable to the growing adoption of advanced technologies such as artificial intelligence, voice interface, and computer vision in self-checkout systems. Retailers strongly prefer advanced hardware systems rather than traditional checkout systems.

The latest hybrid self-checkout systems provide advanced security-based features, high-capacity coin dispensing systems, an intuitive customer interface, multi-item scanning ability, and cashless transactions. Moreover, increasing consumer inclination toward both cash and cashless transactions drives retailers to install new systems with advanced capabilities.

Service is anticipated to become the fastest-growing segment over the forecast period. Factors such as the demand for effective systems to offer flexibility at the front end of a store, faster processing, and easy integration of systems and services in the traditional checkout systems and self-checkout options are pushing retailers to implement installation, consulting, and maintenance services.

The need for tailored systems in line with store layouts to drive the progression of retail in-store transformation also contributes to the growth in consulting and managed services. Additionally, customization or modification in software and a need for professional consulting services to implement upgraded or updated software in the systems also fuel the segment’s growth.

Type Insights

The cash-based self-checkout systems emerged as the largest segment with a market share of over 50.0% in 2022. Growing demand for paper-based transactions among small, medium, and large-sized retailers is the prominent factor driving growth. Consumers with a limited number of items in baggage prefer to checkout at self-service terminals inside stores.

Furthermore, these customers prefer to make payments through cash or card. Cash-based systems offer higher flexibility to consumers for both cash and cashless transactions, leading to the growth of the segment. Additionally, the U.S. government promoting cash-based transactions in retail outlets is further influencing the market growth.

Cashless self-checkout systems are gaining high traction due to the growing preference for digital payments and electronic transactions among consumers. The segment is expected to expand at the fastest CAGR of above 14.0% over the forecast period.

Although cash or paper-based payment transaction is dominating, an inclination toward electronic payments is rising among the middle age group consumers and millennials. Moreover, the availability of digital payment solutions and growing trends of mobile commerce are the other driving factors for cashless self-checkout systems.

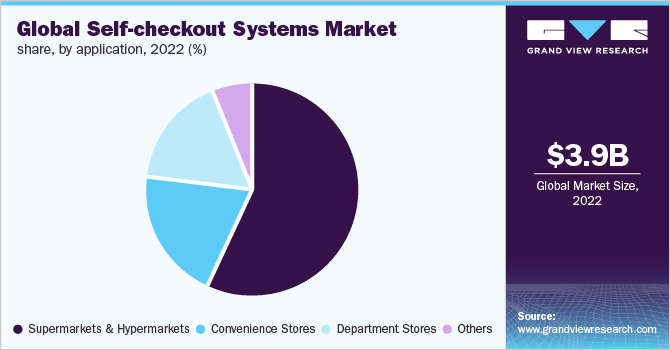

Application Insights

The supermarkets & hypermarkets segment accounted for the highest market share of 57.16% in 2022. The growth is attributed to the growing demand for self-checkout systems across supermarkets & hypermarkets. The significant increase in the number of shoppers across hypermarkets & supermarkets is the main factor driving the growth of the market.

Additionally, the need to maximize employee efficiency in these stores while enhancing customer satisfaction is another key factor attributed to the adoption of self-checkout systems. The increasing labor costs and the need to utilize floor space efficiently are enabling stores to adopt self-checkout systems. The demand for self-checkout solutions among supermarkets & hypermarkets in 2022 accounted for USD 2,209.5 million and is expected to grow at a significant rate over the forecast period.

However, convenience stores are increasingly embracing advanced and updated self-service technologies to provide seamless customer service 24/7. Herein, the availability of the varied type of products assorted in different departments drives a high volume of customers across department stores. Hence, department stores are highly invested in in-store transformation to provide greater customer satisfaction and improve the consumer experience.

Furthermore, the availability of larger floor space and a need to provide efficient checkouts to consumers is surging the adoption of self-checkout systems. However, due to the declining profits among the department stores, the demand for self-checkout systems is expected to grow at a steady rate.

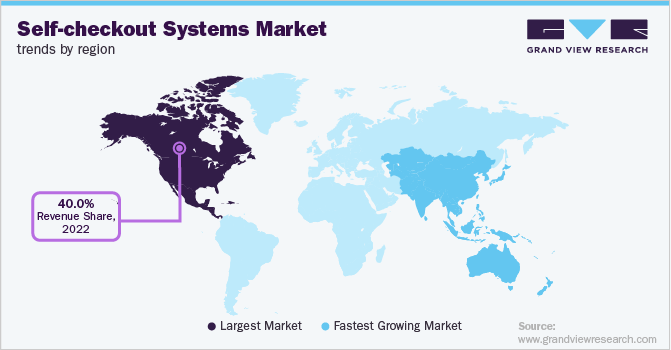

Regional Insights

North America region dominated the global market with a share of over 40.0% in 2022. The market size was valued at USD 1,711.4 million in 2022 and is expected to register a CAGR of over 12.1% from 2023 to 2030. The presence of many grocery and supermarket chains, coupled with growing retail in-store transformation, drives the growth of the regional self-checkout systems market.

The rising adoption of self-checkout systems by hypermarkets and supermarkets in Canada and the U.S. contributed to the regional segment growth. The demand for a higher pay scale among employees is the primary reason for the unfilled job gap in the U.S. Owing to the rising demand for employees at an optimized pay scale, the demand for self-checkout systems is growing across physical store formats.

The Asia Pacific is expected to emerge as the fastest-growing regional segment to reach USD 2,860.7 million by 2030, registering a significant CAGR of above 15.7% over the forecast period. The growth in the retail and hospitality industry, coupled with the growing automation & digitization trend, is expected to boost the regional market growth.

Retail stores in the region are expanding through hyperlocal offerings and are increasingly integrating omnichannel strategies to provide consumers with a seamless shopping experience. In addition, a rise in household expenses, shrinking household size, rapid urbanization, increasing disposable income, and advanced technology adoption are the other factors that contribute to regional growth.

For instance, in June 2021, Toshiba Corporation, based in Japan, partnered with Worldline, a French multinational payment and transactional services provider, which helped the former company bring its Pro-X Hybrid Kiosk to market for a more flexible approach to point-of-sale terminals. The kiosk acts as both a traditional register and a self-checkout station. The launch of the solution, through this partnership, was aimed at capturing a higher market share.

Key Companies & Market Share Insights

The global self-checkout systems industry is concentrated and competitive with the presence of established vendors. These include NCR Corporation; Diebold Nixdorf, Incorporated; Fujitsu; Gilbarco Veeder-Root Company.; MetroClick; Toshiba Global Commerce Solutions; Pyramid Computer GMBH; ITAB; StrongPoint; and ePOS HYBRID. These vendors are engaged as strategic partners with large and small retail vendors to digitize and transform their retail front ends. Furthermore, with a strong network of direct and indirect sales channel presence, these companies have maintained their market share throughout.

Additionally, with a strong sales channel, these companies have partnered with large retail store chains. For instance, in February 2021, Pyramid Computer GmbH entered into a partnership agreement with Scheidt & Bachmann GmbH. This Germany-based enterprise offers solutions for retail stores across fuel stations and parking sites. As per the agreement, the latter company would integrate its SIQMA Smoove, a checkout solution, into the former company’s hardware. The two companies intend to promote self-checkout solutions at fuel retail stores.

Moreover, these key companies are also adopting strategic partnerships, contract extensions, and R&D investment activities to maintain market competitiveness. For instance, in June 2021, Toshiba Corporation entered into a partnership with Worldline, a France-based payment solution provider, which brings Toshiba’s Pro-X Hybrid Kiosk to market with this partnership. The kiosks are aimed at helping retailers offer a better, and more flexible outlook to the point of sale (POS) in their stores, making the check-out experience more sophisticated for the customers. The kiosk will act as both a traditional register and a self-checkout station. Some prominent players in the global self-checkout systems market include:

-

NCR Corporation

-

Diebold Nixdorf, Incorporated

-

Fujitsu

-

Gilbarco Veeder-Root Company.

-

MetroClick

-

Toshiba Global Commerce Solutions

-

Pyramid Computer GMBH

-

ITAB

-

StrongPoint

-

ePOS HYBRID

Self-checkout Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4,354.7 million

Revenue forecast in 2030

USD 10,494.3 million

Growth Rate

CAGR of 13.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Poland; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

NCR Corporation; Diebold Nixdorf, Incorporated; Fujitsu; Gilbarco Veeder-Root Company.; MetroClick; Toshiba Global Commerce Solutions; Pyramid Computer GMBH; ITAB; StrongPoint; ePOS HYBRID

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Self-checkout Systems Market Segmentation

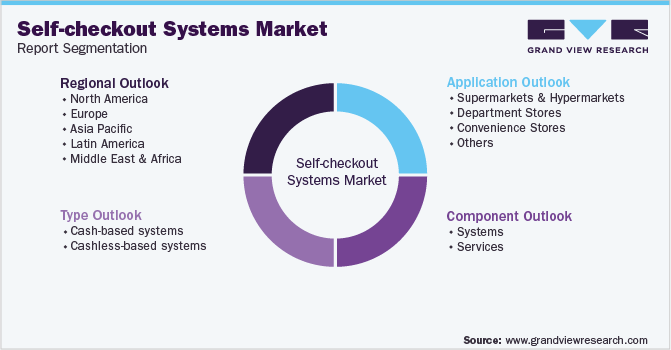

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global self-checkout systems market report based on component, type, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Systems

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cash-based systems

-

Cashless-based systems

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Department Stores

-

Convenience Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

France

-

Germany

-

Poland

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include a rising number of customers with medium-size shopping carts in stores, adoption of automated technologies to improve in-store purchase experience and an increase in labor costs and shortage of skilled laborers.

b. The global self-checkout systems market size was estimated at USD 3,865.8 million in 2022 and is expected to reach USD 4,354.7 million in 2023.

b. The global self-checkout systems market is expected to grow at a compound annual growth rate of 13.4% from 2023 and reach USD 10,494.3 million by 2030.

b. North America dominated the self-checkout systems market with a share of 44.3% in 2022. This is attributable to the increasing adoption of these systems by the supermarkets and hypermarkets in the U.S. and Canada to improve the in-store consumer checkout experience.

b. Some key players operating in the self-checkout systems market include NCR Corporation; Toshiba Global Commerce Solutions; Diebold Nixdorf, Incorporated; FUJITSU; ITAB Group; and ECR Software Corporation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."