- Home

- »

- Biotechnology

- »

-

Sequencing Reagents Market Size, Share, Industry Report, 2019-2026GVR Report cover

![Sequencing Reagents Market Size, Share & Trends Report]()

Sequencing Reagents Market Size, Share & Trends Analysis Report By Technology (NGS, TGS), By Reagent Type, By Application (Oncology, Clinical Investigation), By End Use (Academic & Clinical Research), And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-683-7

- Number of Pages: 175

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Healthcare

Report Overview

The global sequencing reagents market size was valued at USD 4.5 billion in 2018 and is expected to register a CAGR of 13.7% over the forecast period. The market is benefitted by constant developments in sequencing technologies to provide higher throughput data for large-scale genomic research. The development of novel technologies, such as Nanopore and Single-Molecule Real-Time (SMRT) sequencing, for efficient and cost-effective preparation of sequencing libraries, enable researchers to sequence the entire genome within a short period at a lower cost. This, coupled with the availability of new commercial kits providing reagents for specific sequencing applications, drives the market progression.

Streamlining the workflow and automation have gradually reduced the overall time of the library preparation step. Besides, tagmentation during library preparation combines adaptor ligation and genome fragmentation into a single step. Incorporation of this technique into existing sequencing procedures simplifies workflow, reduces cost, and improves data quality.

Exponential decline in genetic sequencing cost from USD 10-15 million per genome in 2001 to USD 1,200 per genome in 2017 has significantly boosted the growth of sequencing technologies, which in turn fuels the utilization of sequencing reagents. This reduction in cost has also decreased the price for the installation of sequencing platforms in recent years.

The presence of supportive government programs has augmented the growth of genome sequencing in identifying the genomic variations associated with human diseases. For instance, in December 2018, NHS England, in partnership with Genomics England, sequenced 100,000 whole genomes from NHS patients to uncover new diagnoses and treatment for patients with cancer and rare inherited diseases.

Furthermore, an increase in funding from public and private entities has supplemented the growth of high throughput technology, subsequently enhancing demand for their respective reagents. For instance, in March 2018, the German Research Foundation funded USD 17.3 million to four new German sequencing centers to equip them with NGS technology.

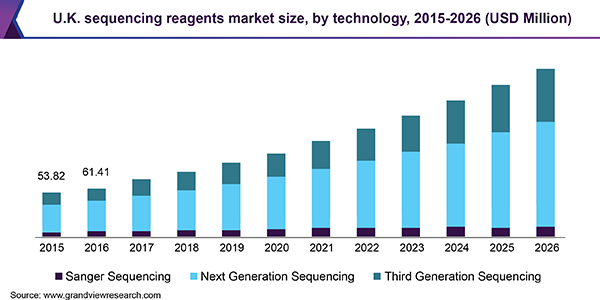

Technology Insights

The NGS segment occupied a major market share in 2018. This is because NGS has become a common practice in molecular diagnostics, molecular pathology, and other clinical research applications due to its lower costs and higher throughput capabilities. Moreover, the deep sequencing approach offered by NGS platforms allows better discovery power to determine novel or rare variants.

NGS technology has exhibited strong potential for the expansion of companion diagnostics and personalized medicine for the treatment of chronic diseases. This further drives the development of more efficient, targeted, and complex medicines and enables clinicians to increasingly adopt NGS platforms for in-vitro diagnostics, thus influencing NGS demand.

A rise in the demand for third-generation sequencing (TGS) technologies is attributive to the lucrative growth rate of this segment. With the emergence of TGS, genome sequencing has become a faster and reliable method to study genomic variations. SMRT technology has allowed scientists to initiate re-sequencing of the genome that has already been sequenced to accomplish a higher level of accuracy. For instance, by using the SMRT technique, Escherichia coli can be sequenced to an accuracy of 99.99%.

Reagent Type Insights

The sequencing kits segment dominated the market in terms of revenue in 2018 and is expected to maintain its lead throughout the forecast period. This is due to the presence of major high throughput platforms such as the MiniSeq, MiSeq, iSeq, NextSeq, HiSeq X, and NovaSeq series from Illumina; PGM, IonS5, Ion Proton system from Thermo Fisher Scientific; and MinION, GridION X5, and PromethION from Oxford Nanopore.

Constant developments enhancing library preparation workflow is expected to significantly drive the library kits segment in the coming years. Automating the library construction with the use of liquid handling platforms, along with its accessories for heating, cooling, shaking, and magnetic bead manipulations, yield high-quality libraries for whole-genome sequencing.

Application Insights

Oncology accounted for the largest share in the sequencing reagents market in 2018 due to the high usage rate of reagents for clinical research and the development of cancer diagnostics and therapeutics. With the rapid development of sequencing capabilities, it has become easier for oncologists to access genetic information and heterogeneity associated with cancer and cancer-related genes.

Analysis of tumor transcriptomics, genomics, and epigenomics by NGS is positively influencing biomarker discovery for cancer diagnostics and tumor stratification. Enhancement of sequencing capabilities has also assisted the development of precision oncology that stimulates new oncological clinical trial designs for the detection of genetic vulnerabilities in patients.

Identification of pathogens by high-throughput technologies and bioinformatics results in the delivery of in-depth insights into antimicrobial resistance, virulence, and disease transmission. This drives the adoption of reagents in the field of clinical and public health microbiology. The clinical investigation segment is projected to witness the fastest growth throughout the forecast period.

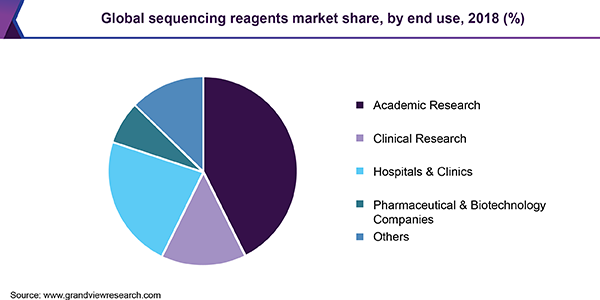

End-use Insights

Based on end-use, the market has been segmented into academic research, clinical research, hospitals and clinics, pharmaceutical and biotechnology companies, and others. Among these, academic research captured the largest revenue share due to the presence of a substantial number of universities and research centers involved in providing courses on molecular biology with a wide application of NGS techniques. Scholarships offered by these centers for Ph.D. projects in NGS is projected to drive demand for NGS reagents.

The clinical research segment is anticipated to register the fastest growth over the forecast period. Rising penetration of high throughput technology-based diagnostic tests that are CLIA waived or are under the process of clinical approval is anticipated to influence the market progression of this segment. The conventional Sanger method and its associated reagents are still a common choice for clinical applications and research. The adoption of NGS reagents is on the rise for clinical diagnostics because's single-nucleotide resolution is capable of detecting the smallest possible mutations (SNPs), without requiring additional information about the mutation. With advancements in technology, the combined detection of larger abnormalities and SNPs has become easier in recent years.

Regional Insights

North America dominated the global market in terms of revenue and is expected to register the highest growth during the forecast period. This is due to simultaneous developments undertaken by well-established as well as emerging players to expand their reagents portfolio. clonal Technology marks this trend with the launch of NGS library preparation kits in September 2018. The Asia Pacific is expected to witness lucrative growth soon. Significant investments and funding in genetics research in China and Japan have resulted in the technological integration of high throughput technologies. This has enhanced the adoption of sequencing technologies in the Asia Pacific.

Sequencing Reagents Market Share Insights

Prominent participants in the market include Thermo Fisher Scientific, Inc.; Illumina, Inc.; QIAGEN; BGI; Pacific Biosciences of California, Inc.; F. Hoffmann-La Roche AG; Oxford Nanopore Technologies; Agilent Technologies, Inc.; Fluidigm Corporation; ArcherDX, Inc.; Takara Bio Inc.; and Bioline.

Market participants are making significant investments to reinforce their market presence and maintain a competitive edge in the space. Moreover, key companies are involved in several collaborative models, product development, and geographic expansion strategies in untapped regions. For instance, in March 2019, Agilent Technologies introduced a new library preparation system for NGS technology called Magnis NGS Prep System. This new system includes reagents and protocols that are designed to easily assay complex genetic aberrations and multiple genes from genomic DNA.

Sequencing Reagents Market Report Scope

Report Attribute

Details

The market size value in 2020

USD 5.9 billion

The revenue forecast in 2026

USD 12.6 billion

Growth Rate

CAGR of 13.7% from 2019 to 2026

The base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2026

Quantitative units

Revenue in USD Million and CAGR from 2019 to 2026

Report coverage

Revenue forecast; company share; competitive landscape; growth factors and trends

Segments covered

Technology, reagent type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; Japan; Brazil; South Africa

Key companies profiled

Thermo Fisher Scientific, Inc.; Illumina, Inc.; QIAGEN; BGI; Pacific Biosciences of California, Inc.; F. Hoffmann-La Roche AG; Oxford Nanopore Technologies; Agilent Technologies, Inc.; Fluidigm Corporation; ArcherDX, Inc.; Takara Bio Inc.; Bioline.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2026. For this study, Grand View Research has segmented the global sequencing reagents market report based on technology, reagent type, application, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2015 - 2026)

-

Sanger Sequencing

-

Next-Generation Sequencing

-

Third Generation Sequencing

-

-

Reagent Type Outlook (Revenue, USD Million, 2015 - 2026)

-

Library Kits

-

Template Kits

-

Control Kits

-

Sequencing Kits

-

Others

-

-

Application Outlook (Revenue, USD Million, 2015 - 2026)

-

Oncology

-

Reproductive Health

-

Clinical Investigation

-

Agrigenomics & Forensics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2015 - 2026)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2026)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

-

Latin America

-

Brazil

-

-

The Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sequencing reagents market size was estimated at USD 5.2 billion in 2019 and is expected to reach USD 5.9 billion in 2020.

b. The global sequencing reagents market is expected to grow at a compound annual growth rate of 13.7% from 2019 to 2026 to reach USD 12.6 billion by 2026.

b. Next-generation sequencing (NGS) segment dominated the sequencing reagents market with a share of 59.3% in 2019. This is because NGS has become a common practice in molecular diagnostics, molecular pathology, and other clinical research applications due to its lower costs and higher throughput capabilities.

b. Some key players operating in the sequencing reagents market include Thermo Fisher Scientific, Inc.; Illumina, Inc.; QIAGEN; BGI; Pacific Biosciences of California, Inc.; F. Hoffmann-La Roche AG; Oxford Nanopore Technologies; Agilent Technologies, Inc.; Fluidigm Corporation; ArcherDX, Inc.;Takara Bio Inc.; and Bioline.

b. Key factors that are driving the market growth include decreasing costs for genetic sequencing, increasing demand for third-generation sequencing, presence of a substantial number of funding programs, and a rise in competition amongst prominent market entities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."