- Home

- »

- Next Generation Technologies

- »

-

Server Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Server Market Size, Share & Trends Report]()

Server Market Size, Share & Trends Analysis Report By Product (Rack, Open Compute Project), By Enterprise Size (Large, Medium), By Channel (Reseller, Direct), By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-914-2

- Number of Pages: 112

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Server Market Size & Trends

The global server market size was estimated to be USD 89.26 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. The growth of the server industry can be attributed to smartphone proliferation increasing number of data centers, among others. The growing number of new data centers globally is one of the key factors expected to fuel market growth. Several cloud service providers and industries, such as IT and telecom, healthcare, BFSI, and government and defense, are engaged in upgrading their servers to manage the continuously rising volume of data. The upgradation of the IT infrastructure provides enhanced security, storage, and processing speeds for managing higher data volumes. The COVID-19 pandemic has resulted in a minor decline in server sales, affecting the server's growth. However, during the lockdowns, several organizations have adopted the work-from-home model for their employees to reduce the spread of the covid virus.

The increased usage of e-commerce websites and OTT platforms has also paved the way for the growth of the server during the pandemic times. Moreover, the inclination toward digital payments has also resulted in driving the demand for servers, thereby driving the growth of the market. Newer applications that demand specific configurations and high computing requirements from users and service providers are increasing the adoption of cloud servers for efficient functioning. Enterprises are adopting virtual or cloud servers to enhance their global networking capabilities and cut operational and maintenance costs on their IT infrastructure. Additionally, cloud service providers have to invest significantly in the maintenance of cooling equipment as physical servers dissipate more heat. Due to this, provisions such as renting servers and virtualization have been gaining traction in recent years.

Continued advances in emerging technologies, such as AI, IoT, big data, cloud computing, and 5G, and the growing adoption of innovative solutions based on these technologies across various industries and industry verticals are driving the demand for edge data centers in emerging economies. As businesses are moving to private and public clouds, the edge cloud, co-location facilities, and data centers have started utilizing software-defined networks (SDNs) and virtualization to facilitate the implementation of new data analytics models. However, having realized that the incumbent servers cannot handle the complex workloads, market players in the region are introducing new server designs with higher computational power.

Various governments worldwide have been involved in various initiatives to improve the IT infrastructure for which production schemes have been initiated. For instance, in January 2023, The central government of India announced the launch of the Production Linked Incentive (PLI) scheme and additional incentives for server and IT hardware manufacturers. The government also plans to offer additional incentives for manufacturers to incorporate Indian-designed IP into their products. Such initiatives in countries such as India, where digitization is happening rapidly, are expected to boost the availability of servers at a cheaper rate, thereby driving the market's growth.

Product Insights

The rack segment is projected to occupy the largest share of the market in 2022, occupying more than 35%. Rack servers are configured to support a broad range of requirements and are individually mounted in a rack. The rack servers' design and construction suit low and high computing requirements. Besides, rack servers require less floor space, be cooled instantly, and can be scaled up easily. The segment growth can be attributed to the growing need for scalable data centers, high-density computing, and advancements in emerging technologies, such as IoT, cloud computing, and edge computing, creating vast growth opportunities for market players. Rack servers provide a facility for storing and computing information at a lower cost, which helps enterprises establish a server for their private use.

The open compute project segment is projected to have a significant growth rate of more than 9.5% in the market over 2023-2030. The open compute project allows small- and medium-sized enterprises to replicate the efficient data center designs made public by established cloud service providers. OCP assists in improving data center designs to shorten build times, reduce material use, and maximize efficiency. OCP offers an innovative Rapid Deployment Data Center (RDDC) concept and a lean and modular construction approach that helps lower Capital Expenditure (CAPEX) and Operational Expenditure (OPEX) while also providing simplicity, high density, scalability, manageability, energy and cooling efficiency, and serviceability.

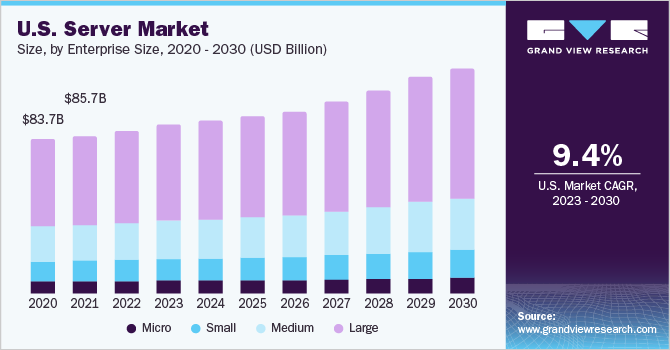

Enterprise Size Insights

By enterprise size, the large segment of the market is projected to witness the highest growth rate of more than 9% over 2023-2030. Large enterprises are shifting their focus toward hosted application servers because they can handle workloads from multiple sites, typically from the same database. Hosted application server deployment is more accessible than traditional application servers as it requires fewer system integrations and no upfront installations, reducing operating and maintenance costs. A hosted application server is wholly managed by a hosted service provider, which regularly updates the version and offers continuous technical & customer support. Market players focus on launching industry-specific solutions to attract potential business clients and increase their market revenue. For instance, in May 2022, Nokia Corporation launched Nokia Cloud Native Communication Suite explicitly designed for WiFi, 4G, and 5G deployments. The solution features Media Resource Function (MRF), Telephony Application Server (TAS), and Cloud Native Network Function (CNF), among others.

The medium segment of the market by enterprise size is projected to witness a significant growth rate over 2023-2030. The demand for servers among medium-sized enterprises can be attributed to the growing adoption of cloud services, the need for green data centers, and the utilization of complex business tools, such as data analytics and big data. Furthermore, private cloud server solutions can help medium enterprises enhance their business processes. A private cloud server offers benefits such as lower operational costs, options to pay per usage, and offerings tailored to business requirements. Several market players offer scalable infrastructure and affordable services ideal for medium enterprises, which is expected to encourage medium enterprises to adopt private cloud deployment. Furthermore, private cloud server solutions enable medium enterprises to capitalize on 24x7 assistance and eliminate the need to hire dedicated IT personnel. These benefits are expected to further supplement the demand for servers in medium enterprises during the forecast period.

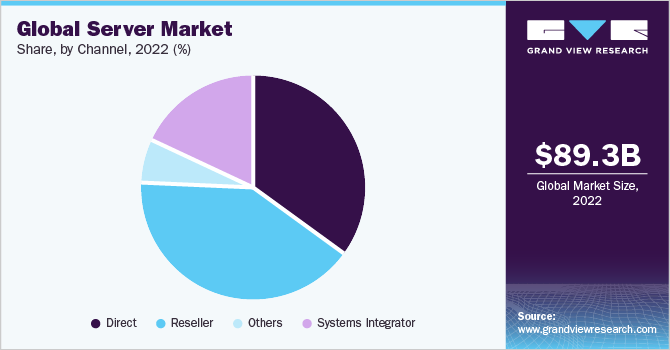

Channel Insights

The reseller segment of the market by channel is projected to occupy the largest share in 2022 and 2030. Resellers constitute the technology distribution channel in the middle of an extensive network of IT service providers and sales agents. Working with a reseller can also help users find products faster. An organization that needs to buy multiple technology components can do so through a single reseller rather than directly approaching multiple manufacturers or service providers. Furthermore, resellers operate across a wide range of industry verticals. For instance, a web hosting reseller buys services from a larger hosting company and resells them to customers. A reseller may also buy and resell server access in a hosting and colocation facility. The reseller functions as a retailer, acquiring and reselling services from hosting and internet service providers acting as wholesalers.

The direct segment of the market by channel is projected to witness the highest growth rate of more than 10% over the period 2023-2030. The segment growth can be attributed to the customized designs and competitive prices offered by Original Design Manufacturers (ODMs). ODM servers are cheaper as the manufacturers sell servers directly to customers, which reduces promotional and intermediary costs. Furthermore, with direct distribution, they can control the customer experience and build brand awareness. Moreover, direct distribution can shorten lead times by sending goods directly to customers when they are ready for deployment. These benefits are expected to further supplement the growth of the direct channel during the forecast period.

End-Use Insights

The IT & Telecom segment of the market is projected to occupy the largest share in 2022 and 2030. For the last few years, the IT & telecom industry has seen a transformation in implementing fixed-to-mobile broadband services. The IT industry has seen a growing implementation of cloud-based services over on-premise ones. Subscribers now get most services through a single service provider. Furthermore, mobile phones' constantly evolving multimedia capabilities are giving rise to new issues related to after-sales service delivery and execution. Moreover, network operators are transforming into software companies and predominantly into information technology companies. These factors are contributing to market growth.

The BFSI segment is projected to witness a significant growth rate in the market over the period 2023-2030. Web-based banking systems use secure, dedicated servers throughout a banking network to ensure that transactions and secure and authentic. The use of secure servers for linking transaction processes between various parties, such as buyers, sellers, and financial institutions helps financial institutions develop and maintain several banking applications and offer concurrent support. They also help reduce financing costs and improve business efficiency. The proliferation of cloud computing in financial services has further revolutionized the sector. The flexibility and scalability of day-to-day operations in the financial sector have improved significantly in tandem with the growing adoption of and advances in cloud computing technology.

Regional Insights

North American region is estimated to dominate the market in 2022 and is projected to continue its dominance over 40% of the market by 2030. The region's growth can be attributed to significant companies in the market, including Alphabet Inc.; Dell Inc.; Hewlett Packard Enterprise Development LP; and Microsoft. Moreover, the high usage of cloud services in the region contributes to the regional market's growth. For instance, as per a survey carried out in November 2020 by BARC, a German analyst firm for business software, 29% of the respondents in North America were fully committed to using a cloud strategy, which was only 19% in Europe.

Asia Pacific region is projected to witness the highest growth rate from 2023 to 2030. The growth of the Asia Pacific market can be attributed to significant players in the region, including Tencent Cloud, Huawei Technologies Co., Ltd., Baidu, and Alibaba.com. Moreover, the region has been witnessing high growth in digitalization, especially in countries such as India. According to the Southeast Asia Development Solution (SEADS), Southeast Asia’s digital economy was worth USD 200 billion in 2022. The high growth of the digital economy is fueling the demand for servers, which is expected to contribute to the growth of the Asia Pacific market over the forecast period.

Key Companies & Market Share Insights

The key players operating in the server market include Dell Inc., Inspur, IBM, Lenovo Corporation, and Intel Corporation. To broaden their product offering, industry companies utilize a variety of inorganic growth tactics, such as mergers, partnerships, and acquisitions. Some of the prominent players dominating the global server market include:

-

ASUSTeK Computer Inc.

-

Cisco Systems, Inc.

-

Dell Inc.

-

Fujitsu

-

Hewlett Packard Enterprise Development LP

-

Huawei Technologies Co., Ltd.

-

IBM

-

Inspur

-

Intel Corporation

-

Lenovo

-

NEC Corporation

-

Oracle

-

Quanta Computer lnc.

-

SMART Global Holdings, Inc.

-

Super Micro Computer, Inc.

Server Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 94.09 billion

Revenue forecast in 2030

USD 175.29 billion

Growth rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, enterprise size, channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

ASUSTeK Computer Inc.; Cisco Systems, Inc.; Dell Inc.; Fujitsu; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; IBM; Inspur; Intel Corporation; Lenovo; NEC Corporation, Oracle, Quanta Computer lnc.; SMART Global Holdings, Inc.; Super Micro Computer, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Server Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global server market based on product, enterprise size, channel, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Blade

-

Micro

-

Open Compute Project

-

Rack

-

Tower

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Micro

-

Small

-

Medium

-

Large

-

-

Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct

-

Reseller

-

Systems Integrator

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Energy

-

Government & Defense

-

Healthcare

-

IT & Telecom

- Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global server market size was estimated at USD 89.26 billion in 2022 and is expected to reach USD 94.09 billion in 2023.

b. The global server market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 175.29 billion by 2030.

b. The rack segment dominated the server market and accounted for more than 36.90% share of the overall revenue in 2022. This can be attributed to the high rate of adoption of rack servers across diverse verticals.

b. Large enterprises dominated the global server market with the highest revenue share of over 65.82% in 2022, and are likely to maintain their lead over the forecast period. This can be attributed to the fact that large enterprises have the funds to spend significantly on their IT infrastructure.

b. The reseller segment held the largest revenue share of over 40.72% in 2022 in the server market. On the other hand, the direct channel is expected to expand at the fastest revenue-based CAGR of 9.0% over the forecast period.

b. The IT and telecom segment accounted for the largest revenue share of over 39.4% in the server market in 2022. This can be attributed to the rise in network connections and the high penetration of smartphones globally.

b. North America dominated the global server market with a revenue share of 41.59% in 2022. This is attributable to increasing investments made by the data centers and hyper-scale cloud service providers in the region.

b. Some key players operating in the server market include Dell Technologies Inc.; Hewlett-Packard Enterprise Development LP.; IBM Corporation; FUJITSU; Inspur Technologies Co. Ltd.; Huawei Technologies Co., Ltd.; Oracle Inc.; and Lenovo.

b. The growing demand and extensive adoption of online applications running on personal computers and mobile devices have been driving the growth of the market. On the other hand, advances in mobile technology and the continued rollout of high-speed internet networks have triggered the demand for mobile apps for digital payments and gaming, among other application areas. The growing popularity of the 5th Generation (5G) wireless networks and the continued rollout of the high-speed broadband infrastructure to support 5G networks are further expected to propel the adoption of servers..

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."