- Home

- »

- Beauty & Personal Care

- »

-

Shea Butter Market Size And Share Analysis Report, 2030GVR Report cover

![Shea Butter Market Size, Share & Trends Report]()

Shea Butter Market Size, Share & Trends Analysis Report By Product (Raw & Unrefined, Refined), By Application (Cosmetics & Personal Care, Food, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-490-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

The global shea butter market size was valued at USD 2.17 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. Increasing demand for cocoa butter substitutes and rising consumption of cocoa and bakery products are expected to drive the growth of the market over the forecast period. According to an article published by Dairy Reporter, in October 2021, shea butter is regarded as a healthier alternative to cocoa butter. In addition, said product is widely used in various food applications as a substitute for edible vegetable fats and oils, which is further expected to boost the scope of the market.

The outbreak of COVID-19 negatively impacted the market owing to the disruption of the supply of raw materials to the manufacturing units due to a strict lockdown. Additionally, businesses and shops were closed, which further reduced the sales of the product made from shea butter. According to an article published by National Center for Biotechnology Information (NCBI), in November 2021, the usage of shea butter in soap products was reduced by 25%. Furthermore, the global economic recession compelled people to save and spend money with caution, affecting the market.

In recent years, the cosmetics industry has begun diversifying the use of shea butter due to the growing consumers' desire to purchase products that provide multiple benefits and nourishment. In addition, it is used in skin products, hair products, color cosmetics, baby oil, lotions, and other products. Shea butter has a wide range of uses, which is expected to boost the growth of the market in the next seven years. For instance, in June 2022, Beurre Shea Butter Skincare launched a line of products that are meant to protect and soothe skin with the usage of shea butter as the key ingredient.

The growing demand for confectionary and baked goods, as well as the need for cocoa butter substitutes, is likely to increase the demand for the market in the years to come. Shea butter is utilized as a raw ingredient, in baked goods such as puff pastry, biscuits, and chocolates, among others. For instance, in December 2020, Bunge Loders Croklaan launched shea-based butter to advance its level of chocolate confectionary which meets consumer needs for sustainable food options. These factors are projected to fuel the segment's market expansion throughout the forecast period.

Increased awareness of shea butter's therapeutic advantages for skin, such as anti-aging capabilities, extra moisturizing properties, and healing impact, is predicted to boost market revenue in the approaching years. Furthermore, the growing preference of individuals, particularly women and young people, for natural ingredient-based cosmetic products is expected to support the expansion of the market in the future. According to an article published by National Programs, in March 2022, approximately 85% of consumers across the world prefer skin care products with natural ingredients such as shea butter.

The market is also expected to grow due to an increasing number of new products being launched in the personal care and cosmetics industries and the entry of smaller and niche brands. For instance, Karité is a New Jersey, U.S.-based skincare brand launched by a team of three sisters from Ghana. The company offers a range of body care products, such as lip balms, hand creams, and body creams, made with pure, unrefined shea butter and palm oil from West Africa. Using raw shea butter ensures a high concentration of vitamins E and A and essential fatty acids, resulting in ultra-rich moisturizing products that leave the skin soft, smooth, and glowing. Karité products are available through several retail and beauty stores in the U.S. and Canada.

Market Dynamics

Shea butter has witnessed a significant growth in demand from the confectionery and baked goods industries in recent years. It is a popular ingredient used for imparting a delicious, creamy taste to a diverse array of foods like chocolates, pastries, cakes, cookies, bread, and similar treats. With its unique texture and nutty taste, shea butter is a popular choice to replace regular butter in numerous recipes, resulting in a healthier and more flavorful option. This drives its uptake among eateries, restaurants, bakeries, and food manufacturers.

Shea butter possesses favorable characteristics for varied culinary applications, making it a versatile choice for baking and frying. With its spreadable consistency, neutral flavor and odor, and high heat tolerance, it aligns with traditional culinary practices in local cuisines. It can also be used as a plant-based alternative to dairy-based butter. Rising awareness of the therapeutic benefits of shea butter for the skin, including its anti-aging, moisturizing, and healing properties, is also expected to drive market growth in the coming years.

Product Insights

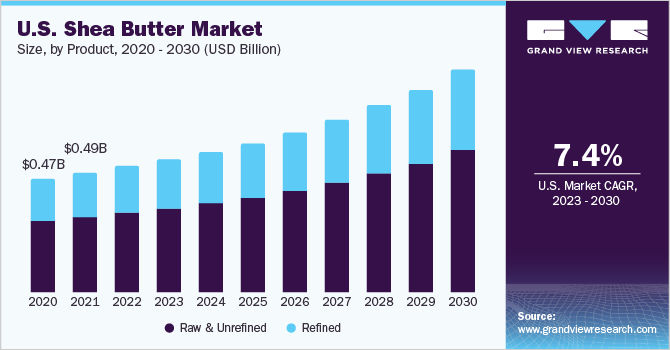

The raw and unrefined shea butter segment held the larger market share of 62.4% in 2022 and is expected to maintain dominance over the forecast period. Consumers are becoming more interested in less processed oils as a result of benefits such as boosting skin moisture, healing cuts, and scrapes, and helping fight breakouts. For instance, in March 2020, Karite Shea Butter launched Crème Corps Body Cream which is a natural, body care brand that provides the benefits of raw and unrefined making it safe for the skin. Such launches are expected to support the positive market growth trend.

The refined segment is projected to register the second-fastest growth during the forecast period with a CAGR of 6.8% from 2023 to 2030. The trend of using refined is increasing among consumers owing to the longer shelf life of the product. Furthermore, the refining process removes the scent and color of the product which is expected to increase its scope in skin care products by manufacturers while developing anti-sensitive products. For instance, in May 2021, Crafters Choice introduced personal care products such as body lotion and soap formulation using ultra-refined pure shea butter.

Application Insights

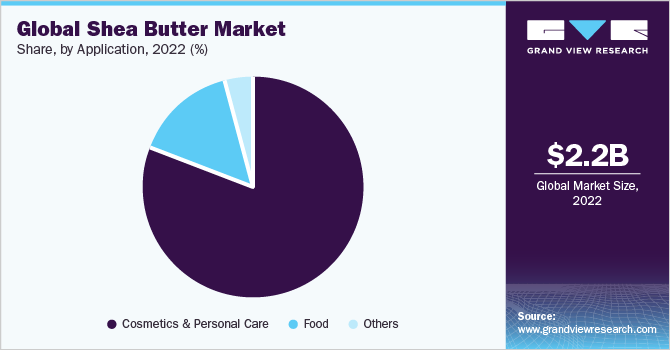

The food segment is projected to register the fastest growth during the forecast period with a CAGR of 7.7% from 2023 to 2030. Increased premiumization of food and beverages is boosting the use of shea butter for the above-mentioned segment. Furthermore, due to the ever-growing chocolate market's proliferating demand, it is expected to see a proportionate increase in demand as the product is used to enhance the consistency, texture, and other properties of chocolate. According to an article published by Tastewise, an AI-powered data platform for food & beverage, in October 2021, shea butter witnessed a total consumption with a yearly growth rate of 8.63%.

The cosmetics & personal care segment accounted for the largest market share in 2022. Growing consumer interest in cosmetic shea butter as an alternative ingredient in creams, lotions, color cosmetics, soaps, and toiletries, is expected to support the growth of the segment. According to an article published by Wonderflow, in January 2022, about 24% of U.S. adults are customers of natural skincare products. Hence, increasing health and beauty awareness among consumers, as well as the growing importance of sustainability among product developers, has resulted in a steady increase in demand for organic and natural cosmetics, which is expected to open up opportunities for key players to develop new products.

Regional Insights

Europe accounted for the largest share of 31.01% in the global market in 2022. Shea butter is extensively used for manufacturing products like body lotions, moisturizers, and chocolates in the European region because of the large number of cosmetics and pharmaceutical industries that are found there. According to an article published by the Centre for the Promotion of Imports (CBI), in March 2022, approximately Europe accounts for 25% of major consumption of the above-mentioned ingredient in the form of varied products. Furthermore, it is anticipated that this growth will continue due to the availability of abundant raw material supplies in the region from Sub-Saharan countries.

Asia Pacific is expected to witness a CAGR of 7.9% in the forecast period. A large part of this can be attributed to the large population, which is primarily contributed by India and China. As per United Nations statistics, in December 2021, Asia Pacific is home to more than half of the world's population. Such preliminary data on population would help manufacturers understand their market size and develop new products. For instance, in January 2019, Shilla DF launched a limited-edition L'Occitane hand cream in China, to cater to the demand of consumers in the country.

Key Companies & Market Share Insights

The shea butter market is fragmented with the presence of many developed global players and many developing key market entrants. These players are engaging in major acquisition and promotional activities to increase their customer base and brand loyalty. Some of the initiatives by the key players in the market are:

-

For instance, in September 2021, Shea Radiance launched six new body care products in 520 Whole Foods Stores in Virginia, U.S.

-

In December 2020, Bunge Loders Croklaan launched its shea butter equivalent for chocolate ranges.

-

In November 2019, BLC introduced a new shea-based margarine.

Some of the key players operating in global shea butter market include:

-

BASF SE

-

Olvea Group

-

Sophim S.A.

-

Cargill, Inc.

-

Suru Chemicals

-

Ghana Nuts Company Ltd.

-

Croda International Plc

-

Agrobotanicals, LLC

-

Clariant AG

-

AAK AB

Shea Butter Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.28 billion

Revenue forecast in 2030

USD 3.75 billion

Growth rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K., Germany, France, Italy, Spain, China; India; Japan; Malaysia, Australia; Brazil; South Africa

Key companies profiled

BASF SE; Olvea Group; Sophim S.A.;Cargill, Inc.; Suru Chemicals; Ghana Nuts Company Ltd.; Croda International Plc; Agrobotanicals, LLC; Clariant AG; and AAK AB

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

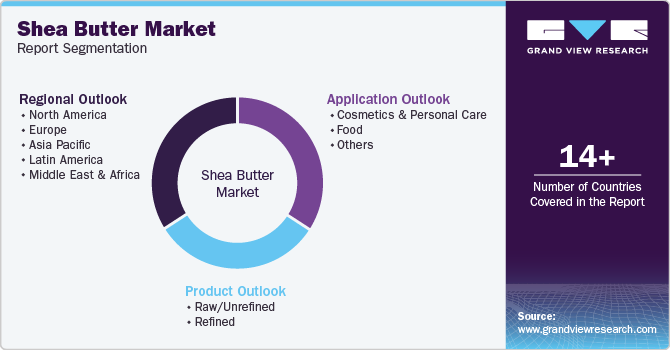

Global Shea Butter Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global shea butter market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Raw & Unrefined

-

Refined

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Cosmetics & Personal Care

-

Food

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shea butter market size was estimated at USD 2.17 billion in 2022 and is expected to reach USD 2.28 billion in 2023.

b. The global shea butter market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 3.75 billion by 2030.

b. Europe dominated the shea butter market with a share of more than 31% in 2022. The increasing number of product offerings through various brands is driving the demand for nail care products in the region.

b. Some of the key players in the shea butter market are BASF SE; Olvea Group; Sophim S.A.;Cargill, Inc.; Suru Chemicals; Ghana Nuts Company Ltd.; Croda International Plc; Agrobotanicals, LLC; Clariant AG; and AAK AB

b. Key factors that are driving the shea butter market growth include increasing demand for cocoa butter substitutes and rising consumption of cocoa and bakery products are expected to drive the growth of the market over the forecast period

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."