- Home

- »

- Advanced Interior Materials

- »

-

Shell And Tube Heat Exchanger Market Size Report, 2030GVR Report cover

![Shell And Tube Heat Exchanger Market Size, Share & Trends Report]()

Shell And Tube Heat Exchanger Market Size, Share & Trends Analysis Report By Material (Hastelloy, Steel, Nickel & Nickel Alloys, Tantalum), By End-use (Power Generation, Chemical), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-674-5

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Market Size & Trends

The global shell and tube heat exchanger market size was valued at USD 6,274.9 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. Shell & tube heat exchangers have become increasingly popular due to rapid industrialization in the emerging countries of Asia and the Pacific and expanding investments in commercial, manufacturing, and industrial projects. The expanded use of the product across a wide range of end-use industries including petrochemicals, power generation, HVAC & refrigeration, chemical, and food & beverage, is expected to surge the market growth. There has been a noticeable shift in the demand for shell & tube heat exchangers between developed countries like Europe and North America and emerging economies in the Asia Pacific like China and India. Due to increasing investments, strong government control, tightening environmental regulations, high sector fragmentation, and the increasing significance of specialty chemicals, the chemical industry is one of the largest in China.

The chemical industry is among the largest manufacturing industry in the U.S. and serves both domestic and export needs. Shell & tube heat exchangers are used in the manufacturing of chemicals in industrial chemical production. Moreover, in an industrial process, shell & tube heat exchangers are required for cooling, heating, and mixing a substance at a desired temperature. The rapid expansion of the chemical industry in the country is expected to act as a major factor in steering market growth.

Shell & tube heat exchangers are used in a wide variety of industries for pharmaceutical products for the market, refining oil, ensuring that food and dairy products are safe to eat, and helping breweries create the perfect pint of beer, among other use cases. These equipment are designed and manufactured in line with appropriate industry standards.

The three combinations of shell & tube heat exchangers, namely, fixed tube sheet exchangers, U-tube exchangers, and floating header exchangers, are primarily used. The parameters considered while designing the shell & tube heat exchangers include diameter layout, pitch, the number of tubes, type & position of baffles, and type of shell. Other technical specifications related to mechanical & thermal design, include shell-side flow distribution, tube-side pressure drop, mean temperature difference, overall heat transfer coefficient, shell thickness, and flange thickness, among others. These factors play an important role in designing the product.

Conventional manufacturing techniques are changing with the rising adoption of advanced manufacturing techniques, such as 3D printing (additive manufacturing), which aid in the fabrication of compact and complex heat exchangers. This process aids in the production of the entire heat exchanger without the need for welding or brazing of components.

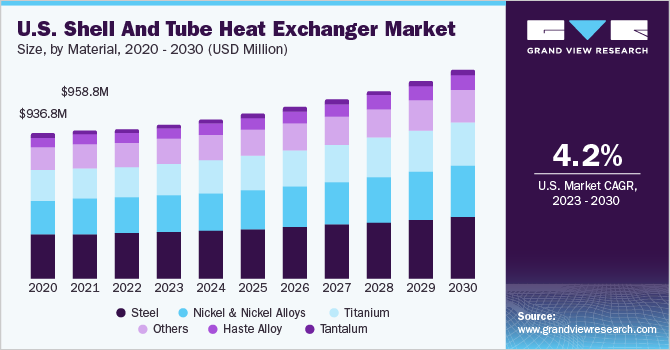

Material Insights

The steel material segment led the market and accounted for 31.1% of the global revenue share in 2022. Due to the growing demand for highly efficient plant operations and the elimination of expensive plant shutdowns, stainless steel shell & tube heat exchanger sales are expected to increase significantly. The material's low-cost aids in increasing its uptake in a variety of end-use sectors. It is anticipated that the characteristics of stainless steel, such as its resistance to corrosion in chemical environments and cooling waters, high-temperature resistance to scaling and oxidation, good strength in low- and high-temperature applications, and resistance to fouling caused by corrosion, will increase material penetration in heat exchangers.

The different materials considered as part of nickel & nickel alloys include Inconel, Monel, Nickel 200, Nickel 201, Alloy 200, Monel 400, Monel R405, Monel K500, Inconel 600, Inconel 601, Inconel 625, and Inconel X 750. The nickel & nickel alloys segment is expected to witness the fastest growth on account of rising demand for Monel and Inconel heat exchangers in end-use industries including chemical, oil & gas, and pharmaceutical.

Nickel heat exchangers are majorly used in chemical processing and nuclear industries on account of their properties such as high-temperature bearing capacity, high durability, corrosion resistance, and high tensile strength. A protective film is applied to the inside surface of these heat exchangers to boost their resistance to corrosion.

Titanium is categorized as a corrosion-resistant alloy (CRAs) or reactive metal. The characteristics portrayed by the metals in this category include sustenance in an oxidizing or reducing environment and resistance to stress, crevice, pitting, corrosion, and high temperatures. Other characteristics of titanium include the ability to retain structural properties, high tensile strength ranging from 30,000 psi to 200,000 psi (210-1380 MPa), biocompatibility, and high melting point compared to aluminum & steel.

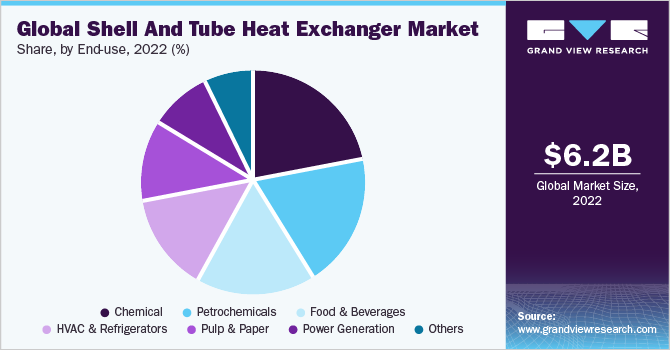

End-use Insights

The chemical end-use segment led the market and accounted for 21.6% of the global revenue share in 2022. Major products manufactured in the chemical industry include fertilizers, agrochemicals, pesticides, inorganic chemicals, basic chemicals, roof & window coatings, and LED lightings. Acquisitions and capacity expansions of chemical facilities in the Asia Pacific and Europe are anticipated to drive the chemical industry over the forecast period.

Increasing awareness regarding the advantages of renewable energy sources over conventional sources has resulted in their increased utilization, thereby driving the power generation industry's growth. Shell & tube heat exchangers are used in hydroelectric dams as coolers to minimize the downtime of transformers, generators, and turbines. Shell & tube heat exchangers are excellent for heat recovery applications, pre-heating, and effluent cooling applications.

Growing construction projects in the commercial and residential sectors such as supermarkets, apartments, swimming pools, and public buildings are expected to augment the demand for HVAC over the forecast period. Furthermore, increasing consumer spending, coupled with the growing demand for thermal management in residential and commercial establishments, is anticipated to boost the growth of the HVAC industry over the forecast period.

The augmenting demand for high-quality paper is expected to drive the paper & pulp industry over the forecast period. Furthermore, rising awareness regarding eco-friendly paper in the printing industry is likely to boost industry growth. However, declining consumption of printed material is anticipated to hamper the paper & pulp industry over the coming years.

Reheating water or steam forms an essential part of the paper manufacturing process. Shell & tube heat exchangers are used in various heating and cooling applications in the pulp & paper industry. One of the major benefits offered by shell & tube heat exchangers is that they avoid the fouling caused while handling highly viscous media such as slurries and other fouling process fluids.

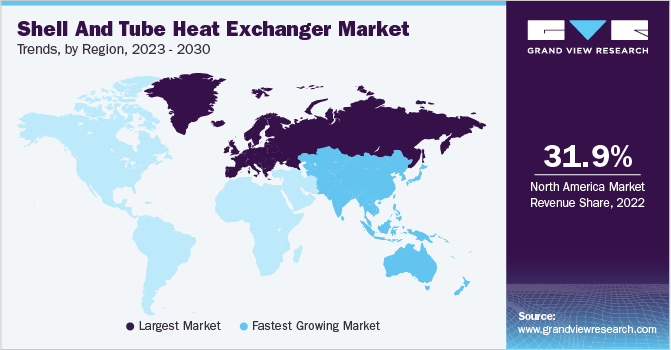

Regional Insights

Europe led the shell & tube heat exchangers market and accounted for 31.9% of the global revenue share in 2022. The European Union is one of the leading chemical manufacturing and exporting regions in the world. Total chemical sales in the EU were around USD 702.2 billion in 2021, which was the second highest after China, according to Cefic 2023 report. The construction sector is a major buyer of chemicals and is anticipated to surge owing to several factors like low-interest rates and growing infrastructure investments. Therefore, the demand for chemicals is anticipated to be stable in the years to come, thereby having a positive impact on shell & tube market growth.

According to the World Nuclear Association (WNA), the U.S. leads other countries in the world for the number of operational nuclear reactors. The U.S. has 98 operating nuclear power reactors in 30 states, which are operated by 30 power companies. Ongoing construction activities for additional nuclear capacities are anticipated to boost the power generation sector over the foreseeable future.

Asia Pacific is characterized by several developing countries such as China, India, Thailand, and Indonesia as well as developed countries such as Japan and Australia. Rapid urbanization, coupled with the growing population in several countries including China and India, is expected to drive industrial growth in the region.

The oil & gas industry in Africa is expected to be strongly driven by investments in deep-water exploration. Nigeria and Angola are set to witness a strong surge in investments in offshore acreage. However, uncertain regulatory frameworks, corruption, and volatility of foreign currency are anticipated to restrain the growth of the oil & gas industry in Africa, thereby hampering the Middle East & Africa shell & tube heat exchangers industry.

Key Companies & Market Share Insights

The global shell & tube heat exchangers market is fragmented and is characterized by the presence of small-scale key players as well. Key strategies opted by the key players include technological development, expansion, and merger and acquisitions, to increase revenue generation and market share.

For instance, in April 2023, Kelvion launched dedicated air cooler series for natural refrigerants. The CDF & CDH ranges are dual discharge air coolers highlighting a similar proficient tube system. Some prominent players in the global shell and tube heat exchanger market include:

-

Alfa Laval

-

HRS Heat Exchangers

-

Kelvion Holding GmbH

-

API Heat Transfer

-

Brask, Inc.

-

Koch Heat Transfer Company

-

Xylem Inc.

-

WCR, Inc.

-

Southern Heat Exchanger Corporation

-

Manning and Lewis

-

Elanco, Inc.

-

Mersen

-

Thermex

-

Tinita Engineering Pvt. Ltd

-

Barriquand Technologies Thermiques

Shell And Tube Heat Exchanger Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6,478.5 million

Revenue forecast in 2030

USD 9,200.3 million

Growth rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, trends

Segments covered

Material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; China; India; Japan; Brazil; UAE; Saudi Arabia

Key companies profiled

Alfa Laval; HRS Heat Exchangers; Kelvion Holding GmbH; API Heat Transfer; Brask, Inc.; Koch Heat Transfer Company; Xylem Inc.; WCR, Inc.; Southern Heat Exchanger Corporation; Manning and Lewis; Elanco, Inc.; Mersen; Thermex; Tinita Engineering Pvt. Ltd; Barriquand Technologies Thermiques

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shell And Tube Heat Exchanger Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global shell and tube heat exchanger market report based on material, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Haste Alloy

-

Titanium

-

Nickel & Nickel Alloys

-

Tantalum

-

Steel

-

Stainless Steel

-

Duplex Steel

-

Carbon Steel

-

Super Duplex Steel

-

Others

-

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Generation

-

Petrochemicals

-

Chemical

-

Food & Beverages

-

HVAC & Refrigerators

-

Pulp & Paper

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global shell & tube heat exchangers market size was estimated at USD 6,274.9 million in 2022 and is expected to be USD 6,478.5 million in 2023.

b. The shell & tube heat exchangers market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 9,200.3 million by 2030.

b. Europe dominated the shell & tube heat exchangers market with a revenue share of 31.9% in 2022. Construction sector is a major buyer of chemicals and is expected to grow owing to several factors such as increasing infrastructure investments and low interest rates.

b. Key factors that are driving the shell & tube heat exchangers market growth include rising demand for advanced modern equipment in the petrochemical, pharmaceutical, and power generation industries, providing high efficiency and corrosion resistance.

b. Some of the key players operating in the shell & tube heat exchangers market include: Alfa Laval, HRS Heat Exchangers, Kelvion Holding GmbH, API Heat Transfer, Brask, Inc., Koch Heat Transfer Company, Xylem Inc., WCR, Inc., Southern Heat Exchanger Corporation, Manning and Lewis, Elanco, Inc., Mersen, Thermex, Tinita Engineering Pvt. Ltd, Barriquand Technologies Thermiques.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."