- Home

- »

- Clothing, Footwear & Accessories

- »

-

Shoe Deodorizer Market Size & Share, Industry Report, 2025GVR Report cover

![Shoe Deodorizer Market Size, Share & Trends Report]()

Shoe Deodorizer Market Size, Share & Trends Analysis Report By Product (Spray, Powder, Insole), By Distribution Channel (Online, Offline), By Region, Competitive Landscape, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-252-5

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Consumer Goods

Report Overview

The global shoe deodorizer market size was valued at USD 102.0 million in 2018. Factors such as growing awareness about personal hygiene and consumer inclination toward adoption of quick and easy solutions for shoe cleaning to avoid long hours of washing and drying drive the demand for deodorizers. Moreover, increasing the use of sports shoes as a result of a growing number of fitness enthusiasts contributes to the demand for these deodorizers which offer quick solutions for odor issues.

The rising number of fitness and healthcare centers drives the demand for use of appropriate sports footwear. According to an article by Forbes, there were 32,000 health and fitness facilities in the U.S. in 2018. This scenario has boosted the sportswear segment, of which sports shoes are the largest category. The need for maintaining proper care and hygiene of regularly-used footwear is expected to drive the market for deodorizer products.

Instances of smelly feet, particularly among children and working professionals, due to long hours spent outside the house are a major concern. According to the National Foot Health Assessment in 2012, conducted by the NPD group for the Institute for Preventive Foot Health, 16% of adults aged 21 and older, i.e., approximately 36 million people in the U.S. experienced foot odor issues. This subsequently drives the demand for odor control products such as footwear deodorizers.

The availability of a wide variety of styles has significantly impacted the production and purchase of shoes. According to the World Footwear Yearbook, footwear production worldwide reached 24.2 billion pairs in 2018. Moreover, the rising working population in Asian countries such as India, China, and Vietnam, particularly those with white-collar jobs, drive the demand for formal footwear. This scenario is expected to propel the demand for shoe deodorizers in order to maintain proper hygiene.

Distribution Channel Insights

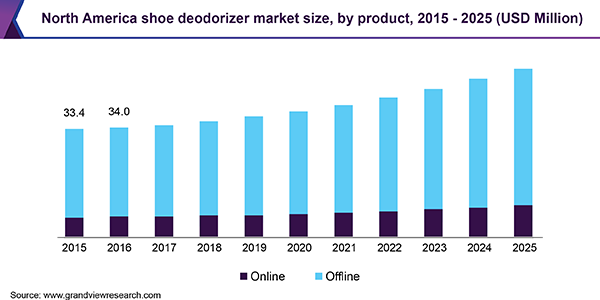

In 2018, the offline distribution channel dominated the market with a share of 81.0% in terms of revenue. The large presence of offline retail shops catering to the shoe care segment is the key factor for the dominance of this channel. In addition, wider availability of various shoe care products, including deodorizers in specialty stores such as Sketchers, Mochi, Vans, and Puma and other hypermarkets and supermarkets drives the product sales through this channel.

The online distribution channel is expected to register the highest CAGR of 6.4% from 2019 to 2025. Increasing penetration of shoe care companies through online portals owing to growing consumer preference for online shopping due to added convenience has led to the availability of these products online. Moreover, the increasing popularity of e-commerce among consumers as it helps save time and effort in locating the product in stores is expected to provide lucrative growth opportunities for these deodorizers over the forecast period.

Product Insights

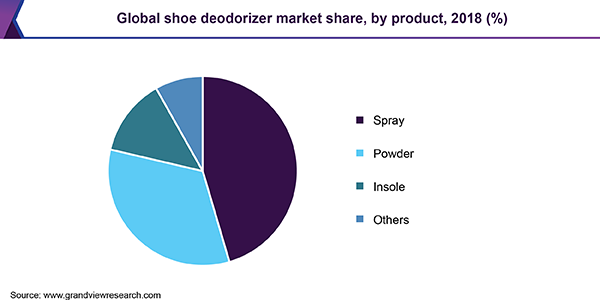

On the basis of product, the market has been segmented into spray, powder, insole, and others. The spray is the largest product category, accounting for more than 45.7% of the market share in 2018. Smelly shoes are a prime concern for a majority of consumers, regardless of hygiene preferences or physical activity, which drives consumer inclination toward these deodorizer sprays that enable easy application and are also travel-friendly. Deodorizer sprays effectively eliminate odor and also help reduce the bacteria that causes odor. New developments in this category are popularizing deodorizer sprays, thereby contributing to the growth of the shoe deodorizer market. For instance, sÅlscience, a company launched in 2016, offers a variety of premium deodorizer sprays, available in multiple scents including Midnight Cherry, Citrus Chill, and Tropicali.

Shoe deodorizer powder is expected to register a significant CAGR of 6.3% from 2019 to 2025. This product helps reduce odor by blocking odor particles and absorbing moisture from footwear. This process also decreases the occurrence of odor in the future. The product comprises anti-fungal properties that help retain clean feet and prevent sweat accumulation. The availability of products in this category with advanced odor-killing attributes attracts consumers toward these products. For instance, Scholl’s Wellness Co. offers Odor-X Odor Fighting Foot Powder with patented Sweatmax technology which eliminates odor.

Regional Insights

North America was the largest market, accounting for 35.2% of the global share in 2018. A higher inclination toward well-being and fitness activities in the region have increased the demand for sportswear, including shoes, which significantly drives the demand for shoe care products such as deodorizers. In addition, the presence of large corporate structures in the U.S. and Canada promotes the usage of formal footwear on a regular basis, which necessitates periodic maintenance and cleanliness of shoes. This scenario is further expected to drive product demand.

The Asia Pacific market is expected to register the highest CAGR of 6.8% from 2019 to 2025. Increasing working-class population, particularly those in white-collar job profiles, in developing countries such as China, India, and Singapore, has increased the adoption of formal attire. This is subsequently expected to drive the market demand for shoe deodorizers. Furthermore, the robust growth of the e-commerce industry in these developing countries is posing lucrative market opportunities for manufacturers to enter the market and gain a competitive market share, thereby driving the product demand.

Shoe Deodorizer Market Insights

Key shoe deodorizer manufacturers include S. C. Johnson & Son, Inc.; Reckitt Benckiser Group plc; Blistex Incorporated; Sanofi S.A.; Ningbo Jiangbei Ocean Star Factory & Trading Co., Ltd; Zamtek Solutions; Puma SE; Scholl’s Wellness Co.; Church & Dwight Co., Inc.; and Chattem, Inc. Leading players in the market focus on product innovation to increase their market share at a global level.

New product launches in the market help draw consumer attention on account of their increasing inclination toward foot health and hygiene. For instance, in January 2019, an ex-SpaceX engineer earned an investment of USD 150,000 for producing odor eliminating shoe pads called Zorpads. These shoe inserts are made from activated carbon cloth and infused with NASA-tested technology to absorb shoe odor and lasts up to 60 years.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Million & CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, and MEA

Country scope

U.S., U.K., Germany, China, India, Brazil, South Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global shoe deodorizer market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2015 - 2025)

-

Spray

-

Powder

-

Insole

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shoe deodorizer market size was estimated at USD 106.4 million in 2019 and is expected to reach USD 111.9 million in 2020.

b. The global shoe deodorizer market is expected to grow at a compound annual growth rate of 6.0% from 2019 to 2025 to reach USD 153.2 million by 2025.

b. North America dominated the shoe deodorizer market with a share of 35% in 2019. This is attributable to the rising use of formal footwear for daily wear among consumers.

b. Some key players operating in the shoe deodorizer market include S. C. Johnson & Son, Inc.; Reckitt Benckiser Group plc; Blistex Incorporated; Sanofi S.A.; Zamtek Solutions; Puma SE; Scholl’s Wellness Co.; Church & Dwight Co., Inc.; and Chattem, Inc.

b. Key factors that are driving the market growth include the increasing popularity of sports shoes among a growing number of fitness enthusiasts and the rising consumer awareness regarding personal hygiene worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."