- Home

- »

- Next Generation Technologies

- »

-

Small Cell 5G Network Market Size And Share Report, 2030GVR Report cover

![Small Cell 5G Network Market Size, Share, & Trends Report]()

Small Cell 5G Network Market Size, Share, & Trends Analysis Report By Component, By Network Model, By Architecture, By Deployment, By Frequency Type, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-887-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2019 - 2021

- Industry: Technology

Small Cell 5G Network Market Size & Trends

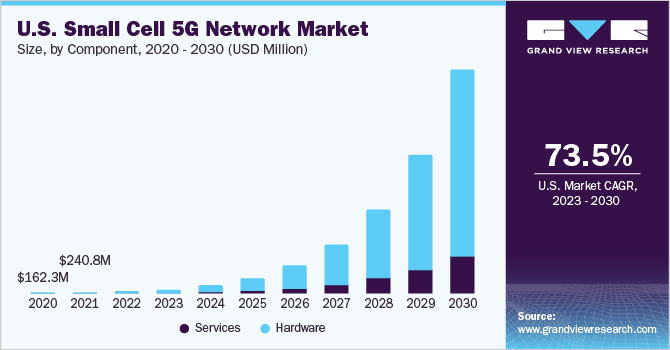

The global small cell 5G network market size was estimated to be USD 1.58 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 72.5% from 2023 to 2030. In terms of hardware volume, the market was worth 1,204 thousand units in 2021. The abruptly increasing demand for fast mobile data connectivity among consumers has increased the deployment of the next-generation 5G Radio Access Network (RAN). The rising installation of small cell 5G networks is growing across industrial, enterprise, and residential applications to provide enhanced coverage capacity at an affordable cost. Additionally, the rapidly building smart cities in developed countries such as the U.S., Canada, Singapore, U.K., Germany, Italy, and France have surged the deployment of small cell 5G networks for several applications, such as residential, industrial, commercial, and government, among others.

Mobile data traffic and 5G adoption is increasing rapidly across the globe. With the rising demand for 5G services, telecom service providers are investing heavily in developing and improving 5G infrastructure. As of 2022, several countries have already deployed 5G. 5G services are currently provided using the existing (non-standalone) network infrastructure. However, as the number of 5G users increases rapidly, the existing infrastructure is expected to become insufficient, and telecom operators will move to deploy standalone 5G infrastructure. Small cell 5G network is a crucial component of the overall 5G standalone (and non-standalone) ecosystem. Hence, increasing 5G demand and increasing 5G standalone network infrastructure deployment is anticipated to create significant growth opportunities for the market.

The deployment of next-generation small cell networks is estimated to witness significant growth over the forecast period. This is attributable to the increasing demand for the 5G network from a massive chunk of customers at public locations such as offices, malls, and stadiums. Also, the demand for 5G data services for several use cases, including seamless video calling, Ultra-high Definition (UHD)/4K video, and cloud-based VR/AR gaming, is rapidly mounting. 5G small cell network can improve the overall signal performance. The growing demand for data-intensive 5G applications is anticipated to drive the small cell 5G network market's growth over the forecast period.

Growing demand for 5G connectivity from various end-use industries is anticipated to create demand in the market. Some of the largest economies, such as the U.S. and China, are expected to continue spending insistently on provisioning healthcare facilities. The healthcare industry, especially in developed economies, has begun emphasizing remote diagnosis and patient surgeries. Additionally, the COVID-19 pandemic has enabled several key countries to build more robust healthcare capabilities through investing in advanced technologies such as 5G infrastructure. Thus, to deliver constant data connectivity during remote patient surgeries and telemedicine, the demand for a small cell 5G network is expected to drive market growth over the forecast period.

However, the COVID-19 pandemic adversely affected the market due to delays in 5G deployment. Additionally, the pandemic postponed telecom regulatory authorities' 5G spectrum auction plans, thereby adversely impacting the market growth for a short period. For instance, governments in a few key countries, including the U.S., France, Spain, and Australia, temporarily postponed the spectrum auctions on several frequencies, such as Sub-6 GHz and mmWave, during the pandemic. The aforementioned factors have collectively posed a challenge to market growth, especially over the next couple of years. Moreover, the trade war between the two largest economies, China and the U.S., is hindered market growth.

COVID-19 Impact on the Small Cell 5G Network Market

The outbreak of COVID-19 slowed down the implementation of 5G infrastructure owing to the interruptions in further trials and testing needed to validate the stability and processing performance of 5G networks. Additionally, due to the COVID-19 pandemic, key countries such as China and the U.S. have seen a robust decline in the trade of small cell telecom equipment for 5G New Radios (NR). Supply chain disruptions caused by the COVID-19 pandemic are expected to delay the implementation of private 5G networks by halting the testing and QA activities necessary to verify the processing performance and stability of 5G standalone networks. Moreover, the labor shortage and the disruption of logistics and supply chains worldwide caused the delay in 5G network deployment, impacting the overall market growth in the first and second quarters of 2020. However, as the world is recovering from the COVID-19 pandemic, the small cell 5G network is poised for future growth. Furthermore, the pandemic has further highlighted the need for robust network connectivity, ultimately increasing investments in telecom and 5G infrastructure. These factors are expected to drive the market’s growth over the forecast period.

Component Insights

In terms of revenue, the hardware segment dominated the market in 2022. The hardware segment is further bifurcated into Picocell, Femtocell, and Microcell. In terms of volume, the femtocell segment dominated the market, with a share exceeding 63.0% in 2022. This is attributed to its increasing demand for unified bandwidth coverage for several enclosed applications such as malls, homes, offices, and hospitals. Based on their different ranges, small cells are mainly available in three categories, including femtocells, picocells, and microcells. The covering bandwidth ranges of femtocells, picocells, and microcells encompass up to 50 meters, up to 250 meters, and up to 3 Kilometers, respectively. Out of the three, femtocells rely on fiber or wired backhaul networks and tend to be the lowest-cost option for small cells, which is driving the adoption of the femtocell segment.

The Picocell segment is expected to register significant growth over the forecast period. Picocells play a vital role in covering a large portion of the population, delivering high-speed internet capacity in places like stadiums, concerts, festivals, and others, which is increasing its demand in the market. Moreover, telecom service providers still face uninterrupted data services across rural areas due to line-of-sight problems. Microcells provide seamless connectivity to consumers, especially in remote or rural areas up to 3 km of distance, which is anticipated to drive the demand for microcells in the market. The aforementioned factors it is expected to stimulate the implementation of picocells and microcells over the forecast period.

The services segment is anticipated to register significant growth over the forecast period. The services segment is further bifurcated into consulting, deployment & integration, and training and support & maintenance. The deployment & integration segment dominated the market with a share of more than 57.0% in 2022.

Network Model Insights

In terms of revenue, the non-standalone (NSA) network model dominated the market, with a share exceeding 81.0% in 2022. This is attributed to the early rollouts of the non-standalone network across the globe. The non-standalone network is generally deployed in integration with the existing legacy network infrastructure, because of which it has been a time and cost-efficient option. Besides, several key service providers, such as AT&T, Inc and Verizon Communications, have first deployed a 5G non-standalone (NSA) network model that caters to the primary use cases, including cloud-based AR/VR gaming, mobile streaming, and UHD videos.

The standalone network segment is anticipated to register significant growth over the forecast period. The swiftly rising industrial digitalization has paved a new revenue stream for service providers across the globe. To provide endless connectivity between machines to machines, the need for ultra-reliable high frequency with low latency communication is a prerequisite. Besides, the need for unified bandwidth capacity with minimum latency to establish seamless communication between autonomous vehicles is expected to drive market demand in the transportation & logistics segment. Therefore, the growing need for faster data speed across the verticals, as mentioned above, is anticipated to boost the deployment of the standalone network model during the forecast period.

Network Architecture Insights

In terms of value, virtualized network architecture dominated the market with a share of more than 61.0% in 2022. The dominating share of the segment can be attributed to a robust deployment of a small cell 5G network with a centralized baseband unit controllable architecture. This helps service providers to reduce the Total Cost of Ownership (TCO) and increase the overall flexibility of the network by managing virtually all the small cell base stations. Besides, the introduction of Software-defined Networking (SDN) technology and Network Function Virtualization (NFV) to improve the operational efficiency of the RAN network is further expected to augment the segment growth over the forecast period.

Key telecom operators are massively investing in deploying virtualized small cell 5G network infrastructure across several major countries. For instance, in September 2022, Mavenir announced the launch of high-capacity 5G small cell in-building standalone coverage for public spaces and enterprises. The 5G small cells provide flexibility supporting centralized and distributed end-to-end open radio access network (ORAN) architecture. The company’s ORAN solution offers high-capacity, ease of deployment, and cost-effective solution for end-users, such as warehousing, retail, public spaces, and manufacturing.

Deployment Mode Insights

The indoor segment dominated the market, with a share exceeding 76.0% in 2022. This is attributed to the growing demand for 5G indoor coverage. Small cells provide reliable 5G data connectivity across residential and non-residential applications. The non-residential uses mainly involve enterprises, retail malls, airports, and hospitals, among others. Moreover, the data published by China's Ministry of Industry and Information Technology (MIIT) states that high-value customers are devoting over 80% of their working hours to the indoor premises. As a result, it is estimated elevate the adoption of small cells for indoor applications over the forecast period.

The outdoor segment is expected to register the fastest growth over the forecast period. Outdoor small cells are primarily installed for public networks in suburban, urban, or rural areas. The swiftly growing number of Internet of Things (IoT) devices across many applications, such as autonomous vehicles and vehicles, to infrastructure (V2I) connectivity, have generated the need for high-speed data capacity. Additionally, the deployment of lamp post small cells is gaining popularity in rapidly building smart cities across the globe. This, in turn, is estimated to fuel the growth of the outdoor segment.

Frequency Type Insights

In terms of revenue, sub-6 GHz dominated the market with a share of more than 54.0% in 2022. This is attributed to the enormous investments by key communication service providers in acquiring low and mid-band frequencies to provide customers with high-bandwidth services for businesses and industrial applications. Recently, governments across key countries such as China, the U.S., Japan, South Korea, and many other countries released sub-6 GHz frequencies to provide high-speed internet services in their countries. Furthermore, a few key small cell 5G component providers, such as Qualcomm Technologies, Inc., unveiled a new chipset for 5G small cells, which supports both sub-6GHz and mmWave frequency bands. Owing to the advantages of supporting multi-band frequencies, the sub-6GHz and mmWave segment is anticipated to gain considerable market growth in the forecast period.

The mmWave segment is anticipated to witness significant growth over the forecast period. mmWave frequencies are high band frequencies that provide high bandwidth capacity with very low latency. The spectrum bands are majorly helpful in applications where ultra-reliable connectivity is required, especially in vehicle-to-vehicle (V2V) connectivity and remote patient surgeries. Additionally, the governments of some countries across the developed economies have released the mmWave spectrum bands to provide enhanced data services. For instance, the Federal Communication Commission (FCC) released many types of mmWave frequencies, including 24.25-24.45 GHz, 24.75-25.25 GHz, 47.2-48.2 GHz, and 38.6-40 GHz, among others, with a view of delivering ultra-reliable connectivity for applications including autonomous vehicles, and AR/VR applications. Countries such as India, Japan, Russia, South Korea, and Italy have released mmWave frequencies for improved data capacity across the country. This is expected to augment the mmWave segment growth from 2023 to 2030.

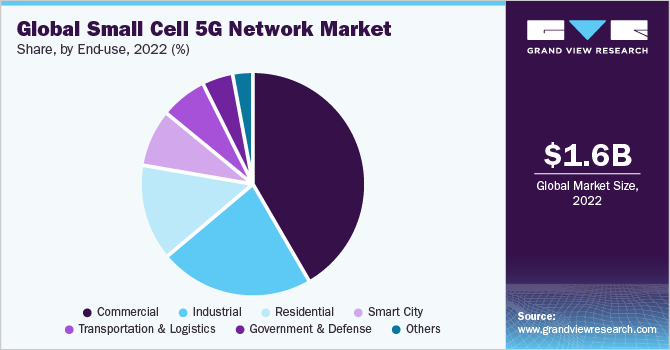

End-use Insights

In terms of revenue, the commercial segment dominated the market with a share of more than 41.0% in 2022. This is attributed to the growing deployment of small cell 5G networks across large as well as Small and Medium Enterprises (SMEs) across the globe. This 5G RAN network helps enterprises cater to the demand for massive data capacity and coverage needs at a very affordable cost. Moreover, small cell 5G networks also help organizations utilize the existing broadband infrastructure to deploy these next-generation networks. Besides, the small cell 5G networks have seen a colossal adoption across residential applications such as smart homes, cloud gaming, and home broadband.

The robust increase in millions of Industrial IoT devices (IIoT) has created the demand for unified data connectivity to establish constant communication among these devices. These IIoT devices mainly include Ultra-HD wireless cameras, extended reality headsets, automated guided vehicles (AGVs), and collaborative robots. To provide seamless connectivity with low latency, installing a small cell 5G network for industrial applications is expected to showcase massive growth over the forecast period. Moreover, another critical use case, such as asset monitoring in the energy & utility sector, is anticipated to experience strong growth in the coming years.

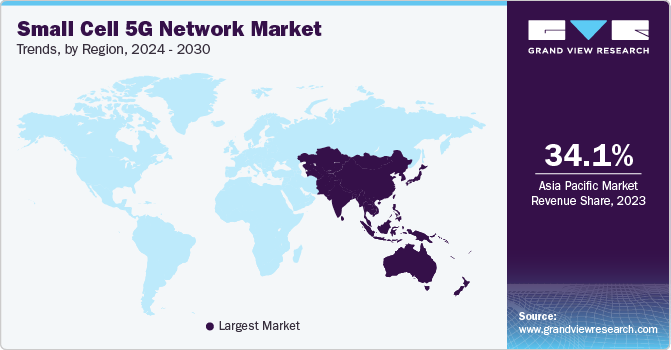

Regional Insights

In terms of revenue, Asia Pacific dominated the market, with a share of more than 33.0% in 2022. This is attributed to the aggressive deployment of 5G new radio infrastructure by major communication service providers such as China Mobile Limited; KT Corporation; Rakuten Mobile, Inc.; and NTT Docomo Inc. In addition, governments across key countries such as Japan, China, and South Korea are highly focused on releasing multiple sub-6GHz and mmWave frequencies to cater to the growing need for high-speed data connectivity among a large subscriber base. Consequently, the market in the region is anticipated to experience robust growth over the forecast period.

The North American regional market is anticipated to experience significant growth over the forecast period. With the presence of large service providers such as AT&T Inc., Sprint Corporation; T-Mobile; and Verizon Communications, the U.S. market is also expected to grow at a significant rate over the forecast period. These prominent service providers are engaged in launching new products to gain a competitive advantage and expand their product portfolio. For instance, in June 2021, Qualcomm Technologies, Inc. announced the launch of its second generation 16 5G open radio access network (ORAN) platform for small cells – FSM200xx. This platform ensures global support, including sub-6 GHz and millimeter wave (mmWave) for enhanced radio frequency coverage.

Key Companies & Market Share Insights

The market is notably consolidated, with few of the players accounting for a significant share of the total market revenue in 2022. Key market players are aggressively focused on new product developments to capture a substantial market share and increase their overall product portfolios. For Instance, in February 2021, Nokia Corporation launched two new small-cell products for indoor and outdoor applications. The first small cell with mmWave supporting capability delivers high-speed bandwidth for outdoor applications such as stadiums, airports, and busy pedestrian zones. Another picocell RAN device from Nokia Corporation caters to improved data connectivity across indoor applications such as shopping malls and hospitals.

Leading players are actively making partnerships and agreements with key telecom operators to expand their geographical presence. For Instance, in October 2022, HFCL Limited announced its partnership with Qualcomm Technologies, Inc. The partnership envisages designing and developing HFCL’s 5G outdoor small-cell products. Such initiatives and investments in small cell 5G outdoor products will enable faster rollout of 5G networks and will improve the 5G user experience. Such initiatives are anticipated to foster innovation and growth in the market. Some of the prominent players in the small cell 5G network market include:

-

Huawei Technologies Co., Ltd.

-

Samsung Electronics Co., Ltd.

-

Nokia Corporation

-

Telefonaktiebolaget LM Ericsson

-

ZTE Corporation

-

Fujitsu Limited

-

CommScope Inc.

-

Comba Telecom Systems Holdings Ltd.

-

Altiostar

-

Airspan Networks

-

Ceragon

-

Contela

-

Corning

-

Baicells Technologies

Small Cell 5G Network Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.7 billion

Revenue forecast in 2030

USD 125.5 billion

Growth Rate

CAGR of 72.5% from 2023 to 2030

Base year for estimation

2022

Historic year

2019 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Units in thousand units, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, network model, network architecture, deployment mode, frequency type, end-use, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; Italy; Russia; China; India; Japan; South Korea; Brazil; Kingdom of Saudi Arabia (KSA); UAE; Saudi Arabia

Key companies profiled

Huawei Technologies Co., Ltd.; Samsung Electronics Co., Ltd.; Nokia Corporation; Telefonaktiebolaget LM Ericsson; ZTE Corporation; Fujitsu Limited; CommScope Inc.; Comba Telecom Systems Holdings Ltd.; Altiostar; Airspan Networks; Ceragon; Contela; Corning; Baicells Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small Cell 5G Network Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the global small cell 5G network market report based on component, network model, network architecture, deployment mode, frequency type, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2019 - 2030)

-

Hardware

-

Picocell

-

Femtocell

-

Microcell

-

-

Services

-

Consulting

-

Deployment & Integration

-

Training and Support & Maintenance

-

-

-

Network Model Outlook (Revenue, USD Million, 2019 - 2030)

-

Standalone

-

Non-standalone

-

-

Architecture Outlook (Revenue, USD Million, 2019 - 2030)

-

Distributed

-

Virtualized

-

-

Deployment Mode Outlook (Revenue, USD Million, 2019 - 2030)

-

Indoor

-

Outdoor

-

-

Frequency Type Outlook (Revenue, USD Million, 2019 - 2030)

-

Sub-6 GHz

-

mmWave

-

Sub-6GHz + mmWave

-

-

End-use Outlook (Revenue, USD Million, 2019 - 2030)

-

Residential

-

Commercial

-

Corporates/ Enterprises

-

Hospitals

-

Hotels & Restaurants

-

Malls/Shops

-

Stadiums

-

Others

-

-

Industrial

-

Smart Manufacturing

-

Energy & Utility

-

Oil & Gas and Mining

-

-

Smart City

-

Transportation & Logistics

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

Russia

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global small cell 5G network market size was estimated at USD 1.58 billion in 2022 and is expected to reach USD USD 2.7 billion in 2022.

b. The global small cell 5G network market is expected to grow at a compound annual growth rate of 72.5% from 2023 to 2030 to reach USD 125.5 billion by 2030.

b. Asia Pacific dominated the small cell 5G network market with a share of 38.6% in 2022. This is attributable to the aggressive deployment of 5G new radio infrastructure by major communication service providers such as China Mobile Limited, KT Corporation, Rakuten Mobile, Inc., and NTT Docomo Inc., among others.

b. Some key players operating in the small cell 5G network market include Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Nokia Corporation, Telefonaktiebolaget LM Ericsson, ZTE Corporation, Fujitsu Limited, CommScope Inc., Comba Telecom Systems Holdings Ltd. among others.

b. Key factors that are driving the small cell 5G network market growth include ever-rising demand for fast mobile data connectivity among consumers and rising mobile data traffic across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."