- Home

- »

- Healthcare IT

- »

-

Smart Card In Healthcare Market Size Report, 2021-2028GVR Report cover

![Smart Card In Healthcare Market Size, Share & Trends Report]()

Smart Card In Healthcare Market Size, Share & Trends Analysis Report By Product Type (Hybrid, Contactless, Contact-based, Dual-interface), By Component (Memory-card Based, Microcontroller Based), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-280-8

- Number of Pages: 163

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

The global smart card in healthcare market size was valued at USD 1.01 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 12.4% from 2021 to 2028. The increasing digitalization of the healthcare systems globally and the use of smart cards to store patient data and ensure high levels of privacy and security are expected to boost the market growth. The COVID-19 pandemic impacted the healthcare industry and the rippled effect was observed in the healthcare IT industry too. Smart card market players reported a flat or decline in their sales growth of smart cards business. For instance, Brady Corporation, the parent company of IDenticard Systems, reported a decline of 9.1% in its IDS segment, which consists of smart cards for healthcare applications. Similarly, Thales Group reported a 2% decline in its growth rate from 2019 to 2020. Frequent lockdowns and supply chain inadequacies were primarily responsible for hindered adoption.

Increasing government initiatives for the implementation of smart cards in the healthcare system are also expected to boost market growth. For instance, the government of India launched the Rashtriya Swashthya Bima Yojana (RSBY) in 2008. The scheme relies exclusively on a centralized digital artifact to function, made visible by the RSBY smart card. Till April 2020, about 120 million Indians have been registered in the RSBY database through these smart cards.

COVID-19 impact: Around 7.0% increase in demand owing to a sudden rise in need for contactless cards

Pandemic Impact

Post COVID Outlook

The earlier projections depicting approximately 7.6% YoY growth were countered by the pandemic resulting in the difference of ~0.11 USD million revenue in the earlier and recent estimations.

The market is expected to recover beyond 2020, with a CAGR of 7.68% from 2020 to 2021 and 8.85% from 2021 to 2022.

Thales Group experienced a decline of 7.67% in its total revenue from 2019 to 2020.

Market players are expected to experience high demand for their contactless smart cards.

Market players also experienced disruptions in their supply chain.Governments of various countries are also expected to adopt smart cards in their healthcare systems for efficient healthcare data management.

Smart cards assist healthcare workers in maintaining the efficiency of patient care and privacy safeguards. These cards also allow for the safe storage of information about a patient’s medical history and instantly access the information while also facilitating the provision to update if required. This reduces the risk of healthcare frauds, hence boosting the market growth.

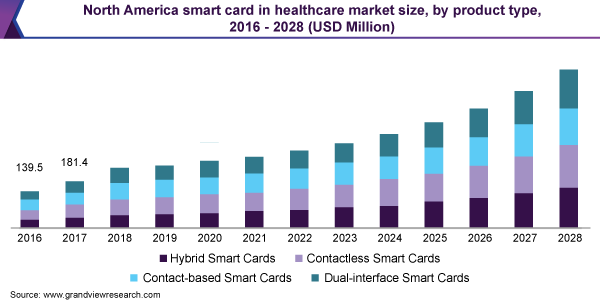

Product Type Insights

Contactless smart cards held the largest share of over 28.0% in 2020. The rising adoption of contactless smart cards because of their advantages over contact-based smart cards and no requirement of a reader is expected to boost the segment growth. They work using NFC technology or radio frequencies, which establishes wireless communication between the smart card and wherever it is intended to use.

The hybrid smart cards segment is expected to expand at the fastest CAGR of 14.6% from 2021 to 2028. These smart cards consist of more than one card technology. For instance, they might contain an embedded microprocessor smart card along with a contactless RFID proximity chip. On the other hand, dual interface smart cards use a single chip technology to communicate via both contact-based and contactless interfaces.

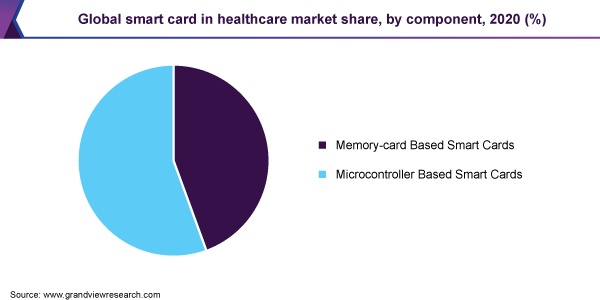

Component Insights

The microcontroller-based smart cards segment held the largest share of more than 55.0% in 2020. They are portable and have vast memory, which is expected to boost the growth of this segment during the forecast period. The segment is also expected to expand at the fastest CAGR from 2021 to 2028 due to its increasing adoption in the healthcare segment.

The memory-card-based smart cards segment held the second-largest share in 2020 as these cards are used for temporal purposes only. Their memory capacity is quite low and is often discarded after use. Stored data cannot be changed or edited in these types of cards.

Regional Insights

In 2020, Europe held the largest revenue share of over 30.0%. Rising initiatives by various government as well as non-government organizations for ensuring good healthcare facilities are anticipated to propel the product demand in this region. The European Health Insurance Cards are issued for free to residents of 32 countries. Many of the European countries have their own national healthcare ID card. Such factors are expected to boost the market growth.

The market in Asia Pacific is anticipated to register the fastest growth rate of 13.2% over the forecast period owing to factors such as technologically advanced healthcare and favorable government initiatives. In addition, the regional market is expected to become the largest shareholder by 2028.

Key Companies & Market Share Insights

Vendors are investing in product launches, geographical expansions, collaborative agreements, and acquisitions to sustain themselves in the market. For instance, in January 2020, Thales Group partnered with Confidex for launching a flexible smart card for the Calypso-based system. With this, Thales provided Confidex with a Gemalto’s OS, which conforms with the Calypso Light Application (CLAP). Some prominent players in the global smart card in healthcare market include:

-

Atos SE

-

Giesecke+Devrient GmbH

-

Infineon Technologies AB

-

NXP Semiconductors

-

Texas Instruments Incorporated

-

Thales Group

-

CardLogix Corporation

-

IDenticard Systems

Smart Card In Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.09 billion

Revenue forecast in 2028

USD 2.46 billion

Growth Rate

CAGR of 12.4% from 2021to 2028

Base year for estimation

2020

Actual estimates/Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion & CAGR from 2021 to 2028

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product type, component, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Japan; China; India; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Atos SE; Giesecke+Devrient GmbH; Infineon Technologies AB; NXP Semiconductors; Texas Instruments Incorporated; Thales Group; CardLogix Corporation; IDenticard Systems

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global smart card in healthcare market report on the basis of product type, component, and region:

-

Product Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Hybrid Smart Cards

-

Contactless Smart Cards

-

Contact-based Smart Cards

-

Dual-interface Smart Cards

-

-

Component Outlook (Revenue, USD Million, 2016 - 2028)

-

Memory-card Based Smart Cards

-

Microcontroller Based Smart Cards

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global smart card in healthcare market size was estimated at USD 1.01 billion in 2020 and is expected to reach USD 1.09 billion in 2021.

b. The global smart card in healthcare market is expected to grow at a compound annual growth rate of 12.4% from 2021 to 2028 to reach USD 2.46 billion by 2028.

b. Contactless smart cards held the largest share of over 28.0% in 2020 in the smart card in healthcare market.

b. Some key players operating in the smart card in healthcare market include Atos SE, Giesecke+Devrient GmbH, Infineon Technologies AB, NXP Semiconductors, Texas Instruments Corporated, Thales Group, CardLogix Corporation, and IDenticard Systems, among others.

b. Key factors driving the smart card in healthcare market growth include rising usage of smart cards by healthcare providers to maintain the efficiency of patient care & privacy safeguards, safe storage of patient information in smart cards, and technological advancements.

b. The microcontroller-based smart cards segment held the largest share of more than 55.0% in 2020 in the smart card in healthcare market.

b. In 2020, Europe held the largest revenue share of over 30.0% in the smart card in healthcare market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."