- Home

- »

- Next Generation Technologies

- »

-

Smart Finance Connectivity Market Report, 2022 - 2028GVR Report cover

![Smart Finance Connectivity Market Size, Share & Trends Report]()

Smart Finance Connectivity Market Size, Share & Trends Analysis Report By End Use (Banks & Financial Institutions, Independent ATM Deployer), By Connectivity Type (Wired, Wireless), By Region, And Segment Forecasts, 2022 - 2028

- Report ID: GVR-4-68039-927-6

- Number of Pages: 78

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Technology

Report Overview

The global smart finance connectivity market size was valued at USD 228.42 million in 2021 and is expected to expand at a compound annual growth (CAGR) of 4.0% from 2022 to 2028. The global smart finance connectivity market is primarily driven by the rapidly evolving digital transformation in the global banking industry, rising demand for smart devices for ATMs, and offers effective consumer services. As a result of technology breakthroughs that launched the digital revolution by connecting ATM hardware and software equipment to the internet, the Internet of Things (IoT) has revolutionized the banking industry in recent years. The global smart finance connectivity market is predicted to develop rapidly in the next few years on account of rising government spending on digital infrastructure, improved network connections, and the availability of a variety of wired and wireless connectivity platforms.

IoT technology has emerged as the most pervasive and advanced technical invention in recent years, instigating business transformation. According to a report published by Cisco Systems, Inc., by 2020, there will be 50 billion connected devices. As a result of this advancement in IoT-connected devices, industries such as IT and telecommunications, manufacturing, BFSI, media and entertainment, aerospace and military, and government are all likely to see an increase in digital services. IoT is predicted to have a huge influence on many elements of the ATM industry, from banking and insurance to financial planning and security & monitoring. With the aid of data collected by sensors, the IoT allows financial institutions and banks to predict consumer trends and plan business functionalities accordingly.

Many early IoT applications were enabled via cellular IoT, which was extensively accepted throughout the world with 2G and 3G connections. With the advancements in 4G technology, the industry will see more bandwidth, lower latency, and enhanced support for huge numbers of devices per cell. These will be strengthened even further with the coming of 5G networks, which will enable Ultra-Reliable Low Latency Communications (URLLC) that support increasingly important applications, as first enabled by the 5G New Radio (NR) standard. Additionally, the rise of connected devices and the increased demand for secure, reliable, and high-speed communication are driving the growth of the market. The growing demand to integrate standalone as well as non-standalone components of the IoT ecosystem into ATMs is contributing to the growth of the market.

Banks can provide easy-to-access services to both credit card and debit card consumers using integrated IoT solutions and services. Banks may monitor ATM kiosk usage rates in certain locations and adjust ATM installation based on usage volumes. Banks may leverage IoT data in conjunction with ATMs to offer on-demand services closer to clients by providing kiosks and enhancing service accessibility. IoT-enabled customer data may assist banks in identifying their customers' business demands, and value chains, and gaining customer insights. Customer information connected through IoT touchpoints may help banks and ATM deployers provide value-added services and customized products to gain a wide consumer base.

The COVID-19 pandemic has contributed to greater use of online banking, such as more digital transactions and fewer visits to ATMs and physical branches. As a result of the pandemic, consumers and businesses adopted digital banking applications as their default. This has limited the use of ATM branches and the number of new ATM installations. Furthermore, increasing COVID-19 cases throughout the world have resulted in a global economic crisis. This can be witnessed in the banks and financial institutions' investments in deploying new IoT solutions for ATMs and a resulting focus on core competencies. However, as financial services and banks continue to recover from the global recession induced by the pandemic, the industry is expected to develop in the next few years.

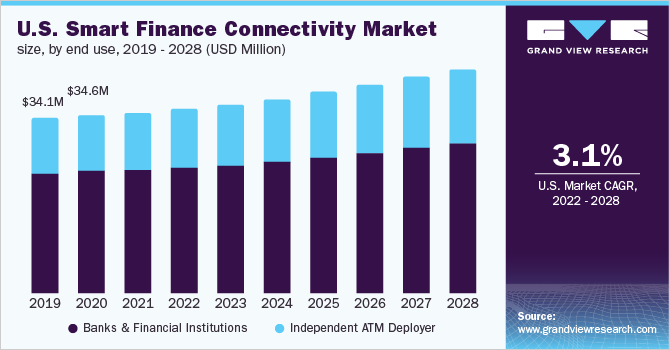

End-use Insights

The banks & financial institutions segment captured around 70% of the global revenue in 2021. This is due to the fact that they are integrating IoT connectivity solutions while deploying ATMs to offer value-added services to customers and enabling predictive analytics models based on consumer behavior. Moreover, smart finance connectivity solutions enable banks and financial institutions to provide customized services and a more efficient experience based on the location of their customers. As a result, smart finance platforms are projected to develop rapidly in the near future since banks and financial organizations face ongoing competition and technological innovations.

Furthermore, some pioneering banks and financial institutions recognize that the shifts in the digital world are opening up new opportunities for ATMs and the role they may play in society. Banks are integrating IoT-based ATM solutions to boost cashpoint efficiency and services, allowing ATMs to become much more than just cash dispenser that handles basic financial transactions. Through the connection of ATMs with the internet, banks can maximize uptime, offer expanded services, and increase profitability.

Independent ATM deployers are expected to witness strong adoption of smart finance platforms and a significant CAGR of 4.8% during the forecast period. Vendors may also be able to design and deliver new features more quickly to stay competitive and meet changing customer needs. The IoT connectivity platforms provide ATM manufacturers and vendors with significant competitive advantages, including complete flexibility in developing new transaction processes, and managing internal connectivity, which improves transaction workflows and fastens up the time to market.

Furthermore, several financial institutions that formerly provided self-service ATM services began to outsource ATM servicing and cash management to third-party suppliers and independent deployers during the COVID-19 pandemic. Many banking institutions have discovered that outsourcing their ATM maintenance reduces their liability while enhancing their overall efficiency in their cash operations. This has further boosted the market growth.

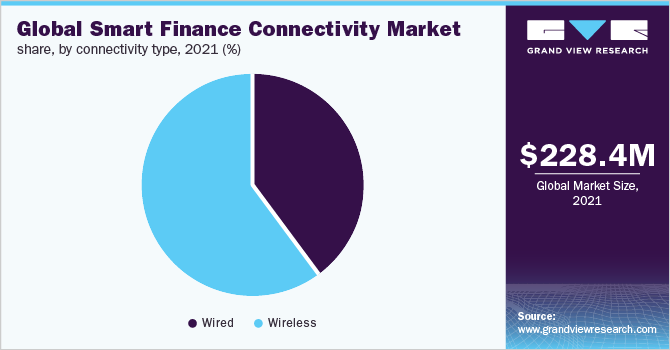

Connectivity Type Insights

The wireless connectivity segment captured the largest market share of 60% in 2021 and is anticipated to maintain its dominance during the forecast period. Banks and financial institutions are extensively using reliable, resilient, and secure networks that are required to offer seamless communications in daily operations. Various ATM suppliers and banks employ wireless connectivity to supplement daily operating requirements and handle crucial connectivity difficulties. The rising need for wireless sensor and connection networks in the development of smart ATMs, as well as a considerable increase in the internet penetration rate and rise demand for low-power wide-area (LPWA) networks in IoT applications, are all contributing to market growth.

Wired connectivity solutions captured a significant market share in 2021. Traditionally, banks and ATM deployers have been using wired connectivity to establish network communication. Wired connectivity has offered a basic foundational infrastructure for IoT establishments. Additionally, to establish ATM connectivity in rural and unconnected areas, banks have been using wired connections to fulfill network requirements. This has contributed to the growth of the wired segment.

Regional Insights

Asia Pacific captured the largest market share of more than 35% in 2021 and is expected to maintain strong growth in the near future. The growth of the regional market is mainly led by the increasing deployment of ATMs in emerging and developed nations, such as China, India, and Australia, and rising government investments in smart city projects. Furthermore, in countries like India, there is a growing need to transform the country’s banking potential to suffice the rising cash demand as the number of consumers increases. Also, banks and financial companies are expected to focus on modernizing existing ATM sites while expanding regional banking networks. Furthermore, the desire to automate ATM services and offline transactions in the unbanked population in emerging markets like Vietnam and Indonesia is expected to drive demand for smart finance connectivity solutions in the region.

Europe captured the second largest market share in 2021. Banks and financial firms in the region are looking for advanced connectivity solutions to address real-time communication problems. Additionally, the expansion of 5G networks in the region is expected to have a major impact on the global market. Followed by Europe, North America is projected to witness strong growth in the global market. North America, the United States, and Canada have well-established economies and sustainable economies, which empower them to spend aggressively on R&D and contribute to the creation of new technology.

Key Companies & Market Share Insights

To boost market penetration and strengthen their position in the business, key companies are pursuing methods such as mergers and acquisitions, product portfolio growth, contracts, and regional expansion. Companies active in the industry are expected to expand through strategic mergers and acquisitions, and alliances, allowing them to obtain rapid access to growing markets. Some prominent players in the global smart finance connectivity market include:

-

TELTONIKA NETWORKS

-

IMS Evolve

-

Inhand Networks, Inc.

-

Datablaze LLC.

-

Xiamen Milesight IoT Co. Ltd.

-

Benison Technologies

-

Diebold Nixdorf, Incorporated.

-

Digi International Inc.

-

Nupeak IT Solutions LLP

-

Optconnect, LLC

Smart Finance Connectivity Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 234.82 million

Revenue forecast in 2028

USD 301.35 million

Growth Rate

CAGR of 4.0% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, connectivity type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Rest of Europe; China; India; Japan; Rest of Asia Pacific; Brazil; Argentina; Rest of Central & South America; GCC; South Africa; Rest of Middle East & Africa

Key companies profiled

TELTONIKA NETWORKS; IMS Evolve; Inhand Networks; Inc.; Datablaze LLC.; Xiamen Milesight IoT Co. Ltd.; Benison Technologies; Diebold Nixdorf; Incorporated.; Digi International Inc.; Nupeak IT Solutions LLP; Optconnect; LLC.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global smart finance connectivity market report based on end-use, connectivity type, and region:

-

End-use Outlook (Revenue, USD Million, 2017 - 2028)

-

Banks & Financial Institutions

-

Independent ATM Deployer

-

-

Connectivity Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Wired

-

Wireless

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia Pacific

-

-

Central & South America

-

Brazil

-

Argentina

-

Rest of Central & South America

-

-

Middle East & Africa

-

GCC

-

South Africa

-

Rest of Middle-East & Africa

-

-

Frequently Asked Questions About This Report

b. The global smart finance connectivity market size was estimated at USD 228.42 million in 2021 and is expected to reach USD 234.82 million in 2022.

b. The global smart finance connectivity market is expected to grow at a compound annual growth rate of 4.0% from 2022 to 2028 to reach USD 301.35 million by 2028.

b. Asia Pacific dominated the smart finance connectivity market with a share of 36.40% in 2021. This is attributable to the increasing deployment of ATMs in emerging and developed nations such as China, India, and Australia and rising government investments in smart city projects.

b. Some key players operating in the smart finance connectivity market include TELTONIKA NETWORKS; IMS Evolve; Inhand Networks, Inc.; Datablaze LLC.; Xiamen Milesight IoT Co. Ltd.; Benison Technologies; Diebold Nixdorf; Incorporated.; Digi International Inc.; Nupeak IT Solutions LLP. and Optconnect, LLC.

b. Key factors that are driving the smart finance connectivity market growth include rapidly evolving digital transformation in global banking industry, rising demand for smart devices for ATM machines, and offer effective consumer services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."