- Home

- »

- Next Generation Technologies

- »

-

Smart Glass Market Size And Share Analysis Report, 2030GVR Report cover

![Smart Glass Market Size, Share & Trends Report]()

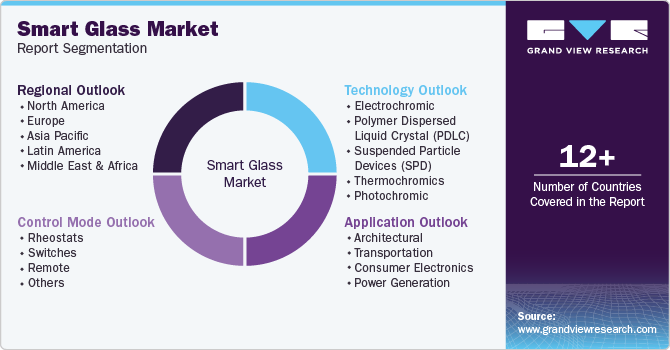

Smart Glass Market Size, Share & Trends Analysis Report By Technology (PDLC, SPD, Electrochromic, Thermochromic, Photochromic), By Application, By Control Mode (Rheostats, Remote), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-213-6

- Number of Pages: 190

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

Smart Glass Market Size & Trends

The global smart glass market size was estimated at USD 6.59 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.9% from 2023 to 2030. The growing energy-conservation initiatives, such as green buildings and eco-friendly structures are expected to drive the market expansion. Moreover, favorable regulatory scenario facilitating financial and tax benefits is also positively influencing the market space. Rise in developments, including an increase in investment level and the establishment of industrial-scale production capacity, has contributed to the glass industry's growth. Recent trends in modern architecture, such as extensive use of window structures inside the buildings, increasing area of glazing, and maximizing external environment interference, are fueling the demand for smart solutions.

Moreover, in multi-story buildings, smart device solution solves the problem of energy-saving and safety concerns. Many building owners and architects are striving for sustainable, green building initiatives that improve occupant health and well-being, energy efficiency, and environmental impact. Glass can be easily exchanged with old, traditional wooden windows providing an effortless transition to new technology. Products, including anti-glare frame windows and electrochromic films, are revolutionizing the glass technology industry. As end-use industries are recognizing unique aesthetics and technical attributes of smart devices, the demand for smart glass-based products is expected to increase in the near future.

Furthermore, the energy safety perspective and environmental regulations have driven the demand for energy-efficient glasses. Furthermore, reduced sun glare is the primary benefit offered by smart glass, resulting in reduced solar heat gains. According to the National Renewable Energy Laboratory, electrochromic windows reduce electricity consumption by up to 49% and decrease lighting costs by up to 51%. This has led to increased demand for electrochromic glasses in commercial buildings and transportation. Boeing 787-9 Dreamliner has incorporated electrochromic glasses in its windows. LG’s new product line of refrigerators features a darkened glass panel that illuminates to become transparent.

Photovoltaic cell-infused glass windows conserve energy by utilizing solar energy to generate electric power, thereby qualifying the construction proposal to reap the benefits of ‘The Green Building Tax Deduction’ 179D Act. Increasing regulatory initiatives to install smart glasses are expected to drive the overall market growth over the forecast period with a high degree of penetration of smart solution devices in construction. The European Union and other regional bodies have established mandates for monitoring energy efficiency to administer the levels of transparency quotient and glass tinting. Growing consumer awareness is expected to fuel market demand in the future. Glasses bestows dynamic switching functionality to its users along with façade provision, heat insulation, and associated energy savings.

Smart glasses are priced twice as much as compared to their legacy counterparts, owing to their nascent origins and distinctive product characteristics. Key offerings of this technology include liquid crystal glasses, SPD glasses, and electrochromic glasses. Liquid crystal glasses cost around USD 50 - USD 65 per square foot. Liquid crystal glass solicitations are not new to the market as technology has long ago been commercialized in technology devices, such as LCD panels in televisions. Suspended particle devices smart glasses cost around USD 85 - USD 130 per square foot.

Market Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The smart glass market is characterized by a high degree of innovation, owing to the advancements in materials science, nanotechnology, and connectivity. High levels of research and development have yielded smart glass solutions that offer dynamic tinting, energy efficiency, and interactive capabilities. Integration with smart home systems and the growing demand for sustainable building solutions further drive innovation.

The smart glass market is also characterized by a high level of merger and acquisition (M&A) activities by the leading market players. Companies are strategically aligning to capitalize on the increasing demand for innovative glass technologies. These transactions often aim to enhance research capabilities, expand product portfolios, or secure a competitive edge in a rapidly evolving market.

The impact of government regulations on the smart glass market is moderate. To strike a balance between privacy concerns and innovation, governments of various countries are encouraging self-regulation within the industry and updating regulations as needed to keep pace with technological advancements. Besides, the growing investment of government in research and development through funding, grants, and public-private partnerships is driving the growth of the smart glass industry while safeguarding national interests.

The threat of substitutes in the smart glass market is relatively low, owing to the unique properties and functionalities offered by smart glass technology. With its ability to transition between transparent and opaque states, smart glass serves diverse applications in architecture, automotive, and electronics. As the demand for energy-efficient and responsive solutions grows, the distinct advantages of smart glass position it as a formidable player, minimizing the influence of substitutes.

The end user concentration in the smart glass market varies, with a distribution leaning towards medium to high levels. This sector caters to diverse industries such as automotive, construction, and electronics, leading to a broad consumer base. While certain applications like smart windows in buildings attract a widespread audience, specialized applications like Augmented Reality (AR) smart glass displays may have a more concentrated user base within specific sectors.

Technology Insights

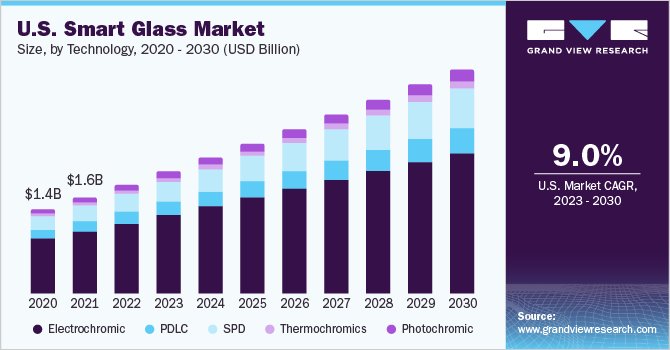

Electrochromic segment captured a significant market share of around 62.0% in 2022. This can be credited to increasing consumer demand, driven by the ability of electrochromic glass to control the amount of light passing through it, becoming opaque or transparent through a switch or a remote control. It allows light to pass through, preventing the entry of heat in times as hot as summer enabling lesser consumption of air conditioning in the house. Windows made of electrochromic glass increase visual comfort since light transmission can be reduced in periods, especially when there is excessive light from the external environment. It also enables energy savings.

In summer, high Infrared waves coming through the windows can cause a rise in temperature of the indoor environment. Reduction in the intensity of these waves decreases the energy used by air conditioners to keep the room temperature cool. On the other hand, these windows maximize the use of solar radiation to heat the environment during winter. Suspended particle device (SPD) segment is expected to witness the fastest CAGR of around 11.1% from 2023 to 2030 on account of its high stability against UV rays. It blocks around 99.5% visible light, which makes it suitable for energy control and shading, without blocking views.

SPD can be dimmed and tuned using an automation system and touch panel, which enables users to control the amount of light entering the room. Moreover, it eliminates glare, which reduces eye strain and provides a comfortable environment. For instance, Research Frontiers Inc. and Gauzy Ltd. & Entities exhibited the SPD-Smart light-control technology by the latter at the CES 2022 event focusing on Smart Cities. It demonstrated an entire smart city experience with an emphasis on display technologies and mobility solutions. Its high-end technologies based on PDLC and SPD can be integrated with personal and public vehicles, and smart buildings to reduce carbon emissions, save energy, and convert the glass into entertainment, information, privacy, and shading systems.

Application Insights

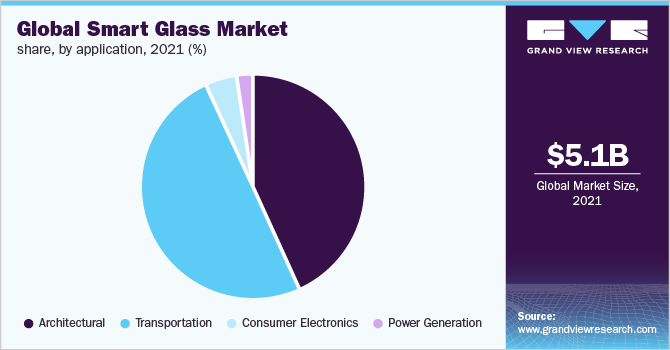

Transportation application segment accounted for a considerable market share of around 49.0% in 2022 due to an increased inclination of automakers toward adopting SPD glass, especially in the luxury car segment. SPD glass comprising a tint material blocks 99% of light providing shade as well as transparency required by the driver to operate the vehicle. The potential application of glass in transportation segment lies in vehicle windows displaying time and location-based information, dynamic shading by blocking up to 99% light, and temperature & solar control. For instance, in January 2023, BMW unveiled BMW iVISION Dee at the CES 2023 event, equipped with high-end technologies and ultra-modern design.

It has been endowed with glass technologies by Gauzy Ltd. & Entities. This new concept vehicle features the latter’s SPD and PDLC smart glass technologies throughout greenhouse glazing, offering an unprecedented experience that is light-controlled, private, and immersive as windows turn into digital displays. Integrating solar power generation with smart glass technologies has significant potential for sustainable energy generation and enhanced building performance. By incorporating solar panels into smart glass facades or windows, buildings can generate clean and renewable energy directly from sunlight.

This integration maximizes energy efficiency by utilizing available space for both power generation and smart functionality. Integrating solar panels into smart glass eliminates the need for separate mounting structures or dedicated land space, making efficient use of building envelope. Combining them allows seamless integration into building facades or windows maintaining architectural aesthetics and design flexibility. Smart glass can be employed to enhance the efficiency of solar panels by mitigating factors, such as glare, reflections, and shading. It also has coatings that can self-clean or repel dust, reducing the need for frequent manual cleaning and ensuring optimal performance of solar panels.

Regional Insights

North America dominated the market in 2022 accounting for largest revenue share of over 33.0%. This growth can be attributed to the growing inclination toward green buildings. Smart windows are emerging as a promising solution for sustainable and green buildings. As they control the amount of solar radiation entering a building, they can reduce heating and cooling energy needs of the building. Moreover, immense growth in the construction sector is opening new growth avenues for the market with shifting focus toward integrating energy efficiency solutions to deliver buildings that are appealing, affordable, low-carbon, and high-performance.

Asia Pacific is projected to record a fastest CAGR of over 11.0% from 2023 to 2030 as the region presents remarkable growth opportunities in the transportation sector. Increased investments in domestic and international constructions are driving the adoption of smart glass solutions in this region. In addition, strong momentum of the real estate sector in the region is further providing an impetus to market growth. Increasing inclination toward green buildings is also expected to offer significant growth opportunities for the regional market.

Another crucial factor favoring the expansion of regional market is the thriving automotive industry. Asia Pacific is a hub for several prominent automakers, such as Hyundai, Toyota, General Motors, Daimler-Benz, and Honda. For instance, in May 2022 AGC Inc., a smart glass manufacturer in the region, released a Low-E coating-based light-control panoramic roof, which has been deployed in LEXUS RZ, a BEV model by Toyota Motor Corporation. This new solution offers an open cabin environment, as well as a comfortable cabin temperature, eliminating sunshade and providing a lighter body.

Recent Developments

-

In October 2023, Guardian Industries Holdings, LLC introduced SunGuard SNX 70+, a triple silver-coated glass featuring a visible light transmission of 68% and a solar heat gain coefficient of 0.28 when applied to Guardian UltraClear low-iron glass. Engineered to ensure a uniform neutral reflected color, this glass maintains its aesthetic appeal whether observed directly or from an angled perspective.

-

In August 2023, Gauzy Ltd. partnered with Kolbe, a producer of top-tier windows and doors to launch a complete switchable privacy glass solution to the residential sector, enabling homeowners to effortlessly merge customized living spaces with cutting-edge integrated technology. The solution incorporates Premium Polymer Dispersed Liquid Crystal (PDLC) films, which are laminated between dual glass panes providing an innovative and adaptable privacy feature for residential applications.

-

In February 2023, AGC Inc. announced its partnership with Saint-Gobain flat glass manufacturers. This collaboration aimed to design a flat glass line which reduce CO2 emissions significantly.

-

In January 2023, BMW unveiled BMW iVISION Dee at the CES 2023 event, equipped with high-end technologies and ultra-modern design.

-

In May 2022, AGC, Inc. developed a Low-E coating based light-control panoramic roof, which will be incorporated in Toyota Motor Corporation’s LEXUS RZ. The Low-E glass with high solar control and heat insulation characteristics will provide a comfortable cabin temperature and an open cabin environment. Its ability to eliminate sunshade provides a lighter body.

-

In February 2022, ChromoGenics entered a cooperation agreement with Finnglass Oy for the manufacturing, marketing, and distribution of dynamic glass ConverLight Dynamic. The latter is known to be a leading supplier of advanced glass solutions with expertise in the integration of electrical functions in glass and modern processes of manufacturing.

Key Smart Glass Companies:

- AGC Inc.

- ChromoGenics

- Corning Incorporated

- Gauzy Ltd.

- Gentex Corporation

- Guardian Industries Holdings, LLC

- Halio Inc.

- Merck KGaA (Merck Group)

- Nippon Sheet Glass Co. Ltd.

- PPG Industries Inc

- RavenWindow

- Research Frontiers Inc.

- Saint Goblin S.A.

- Smartglass International

- VELUX Group

- RavenWindow

- View Inc.

- Polytronix Inc.

- Smart Glass Technologies LLC

Smart Glass Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.59 billion

Revenue forecast in 2030

USD 12.76 billion

Growth Rate

CAGR of 9.9% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, control mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; UAE; South Africa; Saudi Arabia

Key companies profiled

AGC Inc.; ChromoGenics; Corning Inc.; Gauzy Ltd. & Entities; Gentex Corp.; Guardian Industries Holdings, LLC; Halio Inc.; Merck KGaA (Merck Group); Nippon Sheet Glass Co. Ltd.; PPG Industries Inc.; RavenWindow; Research Frontiers Inc.; Saint Goblin S.A.; Smartglass International Ltd.; VELUX Group; View Inc.; Polytronix Inc.; Smart Glass Technologies LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Glass Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart glass market report based on technology, application, control mode, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrochromic

-

Polymer Dispersed Liquid Crystal (PDLC)

-

Suspended Particle Devices (SPD)

-

Thermochromics

-

Photochromic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Architectural

-

Residential Buildings

-

Commercial Buildings

-

-

Transportation

-

Automotive

-

Aircraft

-

Marine

-

Consumer Electronics

-

Power Generation

-

-

Control Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Rheostats

-

Switches

-

Remote

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart glass market size was estimated at USD 5.83 billion in 2022 and is expected to reach USD 6.59 billion in 2023

b. The global smart glass market is expected to grow at a compound annual growth rate of 9.9% from 2023 to 2030 to reach USD 12.76 billion by 2030.

b. The electrochromic technology segment dominated the global smart glass market with a share of over 60% in 2022. This is attributable to low driving voltage, high blockage ratio of UV and IV rays, and capability to integrate with large glass panels.

b. Some of the key players in the global smart glass market include AGC Inc.; ChromoGenics; Corning Incorporated; Gauzy Ltd.; Gentex Corporation; Guardian Industries; Kinestral Technologies, Inc.; Nippon Sheet Glass Co., Ltd.; PPG Industries, Inc.; RavenWindow; Research Frontiers Inc.; Saint-Gobain S.A.; Smartglass International Limited; VELUX Group; View, Inc.; Vision Systems.

b. Key factors that are driving the smart glass market growth include surging demand for smart glass-based products, high adoption in the transportation sector, and favorable administrative initiatives for green building proposals.

Table of Contents

Chapter 1. Smart Glass Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Smart Glass Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook (1/2)

2.3. Segment Outlook (2/2)

2.4. Competitive Landscape

Chapter 3. Smart Glass Market: Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.2.1. Process and Equipment Used for Glass Lamination

3.2.2. Smart Glass Production Process

3.2.2.1. Installation of Switchable Layer

3.2.2.2. Comparative Analysis of Vacuum Lamination Furnaces

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Industry Opportunity Analysis

3.4. Smart Glass Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

3.5. Pricing Analysis

3.5.1. Price Point Comparison By Technology

3.5.2. Price Point Comparison By Application

3.6. Smart Glass Market Trends

3.6.1. Liquid Crystal Smart Glass & Patent Analysis

3.7. Case Studies Of Smart Glass By Application

3.7.1. Architecture

3.7.2. Automotive

3.7.3. Consumer Electronics

3.7.4. Power Generation Plant

3.8. Technology Roadmap: Smart Glass Market

3.9. Smart Glass Market - Covid-19 Impact Analysis

Chapter 4. Smart Glass Market: Technology Estimates & Trend Analysis

4.1. Technology Movement Analysis & Market Share, 2022 & 2030

4.2. Smart Glass Market: Technology Movement Analysis, 2023 & 2030 (USD Million)

4.3. Electrochromic

4.3.1. Electrochromic Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4. Polymer Dispersed Liquid Crystal (PDLC)

4.4.1. Polymer Dispersed Liquid Crystal (PDLC) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5. Suspended Particle Devices (SPD)

4.5.1. Suspended Particle Devices (SPD) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6. Thermochromics

4.6.1. Thermochromics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.7. Photochromic

4.7.1. Photochromic Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Smart Glass Market: Application Estimates & Trend Analysis

5.1. Application Movement Analysis & Market Share, 2022 & 2030

5.2. Smart Glass Market: Application Movement Analysis, 2023 & 2030 (USD Million)

5.3. Architectural

5.3.1. Architectural Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.3.2. Residential Buildings

5.3.2.1. Residential Buildings Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.3.3. Commercial Buildings

5.3.3.1. Commercial Buildings Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. Transportation

5.4.1. Transportation Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4.2. Automotive

5.4.2.1. Automotive Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4.3. Aircraft

5.4.3.1. Aircraft Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4.4. Marine

5.4.4.1. Marine Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. Consumer Electronics

5.5.1. Consumer Electronics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.6. Power Generation

5.6.1. Power Generation Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Smart Glass Market: Control Mode Estimates & Trend Analysis

6.1. Control Mode Movement Analysis & Market Share, 2022 & 2030

6.2. Smart Glass Market: Control Mode Movement Analysis, 2023 & 2030 (USD Million)

6.3. Rheostats

6.3.1. Rheostats Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4. Switches

6.4.1. Switches Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5. Remote

6.5.1. Remote Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6. Others

6.6.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Smart Glass Market: Regional Estimates & Trend Analysis

7.1. Smart Glass Market Share, By Region, 2023 & 2030, USD Million

7.2. North America

7.2.1. North America Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.2.2. U.S.

7.2.2.1. U.S. Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.2.3. Canada

7.2.3.1. Canada Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.3. Europe

7.3.1. Europe Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.3.2. U.K.

7.3.2.1. U.K. Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.3.3. Germany

7.3.3.1. Germany Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.3.4. France

7.3.4.1. France Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.3.5. Italy

7.3.5.1. Italy Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.3.6. Spain

7.3.6.1. Italy Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.2. China

7.4.2.1. China Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.3. Japan

7.4.3.1. Japan Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.4. India

7.4.4.1. India Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.5. South Korea

7.4.5.1. South Korea Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.6. Australia

7.4.6.1. Australia Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5. Latin America

7.5.1. Latin America Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.2. Brazil

7.5.2.1. Brazil Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.3. Mexico

7.5.3.1. Mexico Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6. Middle East and Africa

7.6.1. Middle East and Africa Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.2. UAE

7.6.2.1. UAE Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.3. Saudi Arabia

7.6.3.1. Saudi Arabia Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.4. South Africa

7.6.4.1. South Africa Smart Glass Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis by Key Market Participants

8.2. Company Categorization

8.3. Company Market Positioning

8.4. Company Market Share Analysis

8.5. Company Heat Map Analysis

8.6. Strategy Mapping

8.6.1. Expansion

8.6.2. Mergers & Acquisition

8.6.3. Partnerships & Collaborations

8.6.4. New Product Launches

8.6.5. Research And Development

8.7. Company Profiles

8.7.1. AGC Inc.

8.7.1.1. Participant’s Overview

8.7.1.2. Financial Performance

8.7.1.3. Product Benchmarking

8.7.1.4. Recent Developments

8.7.2. ChromoGenics

8.7.2.1. Participant’s Overview

8.7.2.2. Financial Performance

8.7.2.3. Product Benchmarking

8.7.2.4. Recent Developments

8.7.3. Corning Incorporated

8.7.3.1. Participant’s Overview

8.7.3.2. Financial Performance

8.7.3.3. Product Benchmarking

8.7.3.4. Recent Developments

8.7.4. Gauzy Ltd.

8.7.4.1. Participant’s Overview

8.7.4.2. Financial Performance

8.7.4.3. Product Benchmarking

8.7.4.4. Recent Developments

8.7.5. Gentex Corporation

8.7.5.1. Participant’s Overview

8.7.5.2. Financial Performance

8.7.5.3. Product Benchmarking

8.7.5.4. Recent Developments

8.7.6. Guardian Industries Holdings, LLC

8.7.6.1. Participant’s Overview

8.7.6.2. Financial Performance

8.7.6.3. Product Benchmarking

8.7.6.4. Recent Developments

8.7.7. Halio Inc.

8.7.7.1. Participant’s Overview

8.7.7.2. Financial Performance

8.7.7.3. Product Benchmarking

8.7.7.4. Recent Developments

8.7.8. Merck KGaA (Merck Group)

8.7.8.1. Participant’s Overview

8.7.8.2. Financial Performance

8.7.8.3. Product Benchmarking

8.7.8.4. Recent Developments

8.7.9. Nippon Sheet Glass Co. Ltd.

8.7.9.1. Participant’s Overview

8.7.9.2. Financial Performance

8.7.9.3. Product Benchmarking

8.7.9.4. Recent Developments

8.7.10. PPG Industries Inc.

8.7.10.1. Participant’s Overview

8.7.10.2. Financial Performance

8.7.10.3. Product Benchmarking

8.7.10.4. Recent Developments

8.7.11. RavenWindow

8.7.11.1. Participant’s Overview

8.7.11.2. Financial Performance

8.7.11.3. Product Benchmarking

8.7.11.4. Recent Developments

8.7.12. Research Frontiers Inc.

8.7.12.1. Participant’s Overview

8.7.12.2. Financial Performance

8.7.12.3. Product Benchmarking

8.7.12.4. Recent Developments

8.7.13. Saint Goblin S.A.

8.7.13.1. Participant’s Overview

8.7.13.2. Financial Performance

8.7.13.3. Product Benchmarking

8.7.13.4. Recent Developments

8.7.14. Smartglass International

8.7.14.1. Participant’s Overview

8.7.14.2. Financial Performance

8.7.14.3. Product Benchmarking

8.7.14.4. Recent Developments

8.7.15. VELUX Group

8.7.15.1. Participant’s Overview

8.7.15.2. Financial Performance

8.7.15.3. Product Benchmarking

8.7.15.4. Recent Developments

8.7.16. View Inc.

8.7.16.1. Participant’s Overview

8.7.16.2. Financial Performance

8.7.16.3. Product Benchmarking

8.7.16.4. Recent Developments

8.7.16.5.

8.7.17. Polytronix Inc.

8.7.17.1. Participant’s Overview

8.7.17.2. Financial Performance

8.7.17.3. Product Benchmarking

8.7.17.4. Recent Developments

8.7.18. Smart Glass Technologies LLC

8.7.18.1. Participant’s Overview

8.7.18.2. Financial Performance

8.7.18.3. Product Benchmarking

8.7.18.4. Recent Developments

List of Tables

Table 1 List of manufacturers providing equipment used in smart glass production

Table 2 Comparative analysis of vacuum lamination furnaces

Table 3 Smart Glass market - Key market driver impact

Table 4 Key market restraint/challenges impact

Table 5 Key market opportunity impact

Table 6 Pricing comparison

Table 7 Pricing comparison by application

Table 8 Liquid crystal pricing comparison by glass & film

Table 9 Liquid Crystal Smart Glass & Patent Analysis

Table 10 Smart glass - technology comparative analysis

Table 11 Global Smart Glass Market Revenue Estimates and Forecast, By Technology, 2018 - 2030 (USD Million)

Table 12 Global Smart Glass Market Revenue Estimates and Forecast, By Application, 2018 - 2030 (USD Million)

Table 13 Global Smart Glass Market Revenue Estimates and Forecast, By Control Mode, 2018 - 2030 (USD Million)

Table 14 Recent Developments & Impact Analysis, By Key Market Participants

Table 15 Company Heat Map Analysis

Table 16 Key Companies undergoing expansions/divestitures

Table 17 Key Companies involved in M&As

Table 18 Key Companies undergoing collaborations

Table 19 Key Companies launching new products

Table 20 Key Companies adopting investment

List of Figures

Fig. 1 Smart Glass Market Segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot (1/2)

Fig. 8 Segment Snapshot (2/2)

Fig. 9 Competitive Landscape Snapshot

Fig. 10 Smart Glass - Industry Value Chain Analysis

Fig. 11 Partial cross-sectional view of an Insulated Glass Unit (IGU)

Fig. 12 Market dynamics

Fig. 13 Total investment potential in green buildings between 2018 to 2030

Fig. 14 Share of cumulative power capacity by technology, 2010 - 2027

Fig. 15 Smart Glass market: PORTER’s Analysis

Fig. 16 Smart Glass Market: PESTEL Analysis

Fig. 17 Technology Roadmap

Fig. 18 Smart Glass Market, by Technology: Key Takeaways

Fig. 19 Smart Glass Market, by Technology: Market Share, 2023 & 2030

Fig. 20 Electrochromic Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 21 PDLC Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 22 SPD Market Estimates & Forecasts, 2018 – 2030 (USD Million)

Fig. 23 Thermochromic Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 24 Photochromic Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 25 Smart Glass Market, by Application: Key Takeaways

Fig. 26 Smart Glass Market, by Application: Market Share, 2023 & 2030

Fig. 27 Architectural Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 28 Residential Buildings Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 29 Commercial Buildings Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 30 Transportation Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 31 Automotive Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 32 Aircraft Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 33 Marine Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 34 Consumer Electronics Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 35 Power Generation Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 36 Smart Glass Market, by Control Mode: Key Takeaways

Fig. 37 Smart Glass Market, by Control Mode: Market Share, 2023 & 2030

Fig. 38 Rheostats Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 39 Switches Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 40 Remote Market Estimates & Forecasts, 2018 – 2030 (USD Million)

Fig. 41 Others Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 42 Smart Glass Market Revenue by Region, 2023 & 2030 (USD Million)

Fig. 43 Regional marketplace: Key takeaways (1/2)

Fig. 44 Regional marketplace: Key takeaways (2/2)

Fig. 45 North America smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 46 U.S. smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 47 Canada smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 48 Europe smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 49 UK smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 50 Germany smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 51 France smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 52 Italy smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 53 Spain smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 54 Asia Pacific smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 55 China smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 56 India smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 57 Japan smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 58 South Korea smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 59 Australia smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 60 Latin America smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 61 Brazil smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 62 Mexico smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 63 Middle East and Africa smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 64 UAE smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 65 Saudi Arabia smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 66 South Africa smart glass market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 67 Key Company Categorization

Fig. 68 Company Market Positioning

Fig. 69 Company Market Share Analysis, 2023

Fig. 70 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Smart Glass Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Smart Glass Application Outlook (Revenue, USD Million, 2018 - 2030)

- Architectural

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Smart Glass Control Mode Outlook (Revenue, USD Million, 2018 - 2030)

- Rheostats

- Switches

- Remote

- Others

- Smart Glass Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- North America Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- North America Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- U.S.

- U.S. Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- U.S. Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- U.S. Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- U.S. Smart Glass Market, By Technology

- Canada

- Canada Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Canada Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- Canada Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- Canada Smart Glass Market, By Technology

- North America Smart Glass Market, By Technology

- Europe

- Europe Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Europe Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- Europe Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- U.K.

- U.K. Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- U.K. Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- U.K. Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- U.K. Smart Glass Market, By Technology

- Germany

- Germany Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Germany Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- Germany Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- Germany Smart Glass Market, By Technology

- France

- France Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- France Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- France Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- France Smart Glass Market, By Technology

- Italy

- Italy Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Italy Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- Italy Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- Italy Smart Glass Market, By Technology

- Spain

- Spain Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Spain Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- Spain Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- Spain Smart Glass Market, By Technology

- Europe Smart Glass Market, By Technology

- Asia Pacific

- Asia Pacific Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Asia Pacific Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- Asia Pacific Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- China

- China Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- China Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- China Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- China Smart Glass Market, By Technology

- India

- India Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- India Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- India Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- India Smart Glass Market, By Technology

- Japan

- Japan Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Japan Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- Japan Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- Japan Smart Glass Market, By Technology

- South Korea

- South Korea Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- South Korea Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- South Korea Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- South Korea Smart Glass Market, By Technology

- Australia

- Australia Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Australia Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- Australia Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- Australia Smart Glass Market, By Technology

- Asia Pacific Smart Glass Market, By Technology

- Latin America

- Latin America Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Latin America Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- Latin America Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- Brazil

- Brazil Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Brazil Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- Brazil Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- Brazil Smart Glass Market, By Technology

- Mexico

- Mexico Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Mexico Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- Mexico Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- Mexico Smart Glass Market, By Technology

- Latin America Smart Glass Market, By Technology

- MEA

- MEA Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- MEA Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- MEA Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- UAE

- UAE Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- UAE Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- UAE Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- UAE Smart Glass Market, By Technology

- Saudi Arabia

- Saudi Arabia Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- Saudi Arabia Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- Saudi Arabia Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- Saudi Arabia Smart Glass Market, By Technology

- South Africa

- South Africa Smart Glass Market, By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromic

- Photochromic

- South Africa Smart Glass Market, By Application

- Architectural

- Residential Buildings

- Commercial Buildings

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Architectural

- South Africa Smart Glass Market, By Control Mode

- Rheostats

- Switches

- Remote

- Others

- South Africa Smart Glass Market, By Technology

- MEA Smart Glass Market, By Technology

- North America

Smart Glass Market Dynamics

Drivers: Surging Demand For Smart Glass-Based Products

Smart glass technology is undergoing a revolution with the introduction of products like anti-glare frame windows and electrochromic films. The unique aesthetic and technical features of smart glass are being acknowledged by end-use industries, leading to a projected rise in demand for smart glass-based products. Energy safety considerations and environmental regulations are also driving the demand for energy-efficient smart glass. One of the key advantages of smart glass is its ability to reduce sun glare, which in turn minimizes solar heat gains. The National Renewable Energy Laboratory states that electrochromic windows can cut electricity use by as much as 49% and lower lighting expenses by up to 51%. This has spurred the demand for electrochromic glasses in commercial buildings and transportation. For instance, the Boeing 787-9 Dreamliner has integrated electrochromic glasses into its windows. Additionally, LG’s latest line of refrigerators includes a darkened glass panel that lights up to become see-through.

High Adoption In The Transportation Sector

The aerospace and transportation industry is expected to become a significant consumer of smart glass, thereby boosting market revenue. The introduction of SPD smart glass has opened up numerous possibilities, including its use in rearview mirrors, side-view windows, and sunroofs. These glasses help to lower the temperature inside vehicles by blocking solar heat gain. SPD automotive rear and side windows, as well as sunroofs, provide a wealth of benefits to both passengers and drivers. Their rapid-switching and infinite tuning capabilities reduce unwanted glare and light, allowing users to enjoy not only the view outside but also a glare-free view of displays and video screens. The ability to block heat enhances fuel efficiency and decreases carbon emissions from vehicles.

Restrains: High Acquisition Cost Of Smart Glass Solutions

The technology of smart glass is advancing and is predicted to experience significant economic and technological changes in the future. To boost their Return on Investments (ROI), smart glass producers are employing price-skimming strategies. The market growth may be impeded by the use of alternative solutions offered by traditional competitors, which cost a third of what smart glass does. Additionally, the market growth could be further constrained by other options like chemical coatings and glazing that serve as alternatives to smart glass products. The transportation industry is projected to be a significant contributor to the smart glass market, due to the increasing preference of luxury car manufacturers for smart glass solutions. It is anticipated that smart glass will be used in side-view mirrors, rearview mirrors, car doors, and sunroofs. However, the growth of the automotive sector may be somewhat hindered by less expensive alternatives like tinted glass and glazing solutions, which offer sufficient privacy benefits. Deploying smart glass on a large scale necessitates substantial capital investment, with costs depending on the purpose and scale of the application. Over time, technological advancements and government regulations on smart glass deployment may help to decrease the overall production cost.

What Does This Report Include?

This section will provide insights into the contents included in this smart glass market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Smart glass market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Smart glass market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the smart glass market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for smart glass market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of smart glass market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Smart Glass Market Categorization:

The smart glass market was categorized into four segments, namely technology (Electrochromic, Polymer Dispersed Liquid Crystal, Suspended Particle Devices, Thermochromics, Photochromic), application (Architectural, Transportation, Automotive, Aircraft, Marine, Consumer Electronics, Power Generation), control mode (Rheostats, Switches, Remote), and regions (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Segment Market Methodology:

The smart glass market was segmented into technology, application, control mode, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The smart glass market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into seventeen countries, namely, the U.S.; Canada; Germany; the UK.; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; UAE; South Africa; Saudi Arabia.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Smart glass market companies & financials:

The smart glass market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Asahi Glass Co. Ltd. (AGC, Inc.) , Asahi Glass Co. Ltd., based in Tokyo, Japan, specializes in the production of glass and ceramics. The company’s operations are divided into four main sectors: glass, electronics, chemicals, and ceramics & others. Through its glass division, it offers a variety of automotive and architectural glass products. For automotive applications, the company produces laminated glass, tempered glass, privacy glass, water-repellent glass, module assembly windows, glass antennas, laminated acoustic glass, snow-melting windshields, laminated side glass, and cover glass for car-mounted displays. In the architectural sector, the company’s offerings include multi-layered glass, heat-ray reflection/absorption glass, fireproof/fire-resistant glass, laminated glass, tempered glass, and soundproof glass. As of December 2020, Asahi Glass Co. Ltd. oversees close to 217 subsidiaries and employs around 55,600 people worldwide. The company is publicly traded on the Tokyo Stock Exchange. In March 2022, the company, under the name AGC Inc., launched a glass antenna called WAVEATTOCH. This antenna is compatible with all 5G Sub6 spectrum frequencies allocated to Japan’s four Mobile Network Operators. This innovative product allows for shared telecom infrastructure among multiple operators, thereby reducing capital investment.

-

ChromoGenics AB , Founded in 2003, ChromoGenics AB is a Swedish company based in Uppsala. The company’s inception was a result of research conducted on electrochromic materials at the Angstrom Laboratory of Uppsala University, also located in Sweden. ChromoGenics provides a cleanroom environment and maintains a production line for all its products, which can be manufactured in sizes up to 80 x 200 cm. The company also produces ConverLight Foil and offers automated testing in conjunction with a glass lamination laboratory. In 2016, ChromoGenics began supplying its products to real estate projects throughout Scandinavia. Since March 2017, the company has been listed on the Nasdaq First North.

-

Corning Incorporated , Corning Incorporated, a company based in the U.S., specializes in the production of glass and ceramics. Its main business areas encompass environmental technologies, display technologies, life sciences, optical communications, and specialty materials. The display technologies division of the company supplies glass substrates for Liquid Crystal Displays (LCDs), which are predominantly used in LCD televisions, flat-panel desktop monitors, and laptop computers. The specialty materials division of the company focuses on the development of a variety of material formulations for glass, fluoride crystals, and glass ceramics. Corning Incorporated has two joint ventures, namely Dow Corning and Pittsburgh Corning. In the year 2020, the company was awarded approximately 480 patents in the U.S. and over 1600 patents in other countries.

-

Gauzy Ltd. , Gauzy Ltd. is involved in the production and development of Light Control Glass (LCG) products, utilizing both SPD and Liquid Crystal Technology. The company’s LCG technology involves the combination of SPD emulsions or liquid crystal formulations, which are coated between two sheets of PET-ITO and subsequently cured with UV light, resulting in a new film. This SPD or LC LCG can transition from opaque to transparent, dimming or turning on & off, facilitated by the company’s patented control systems that support dynamic light control.

-

Gentex Corporation , Founded in 1974, Gentex Corporation is a U.S.-based company with its headquarters in Michigan. The company specializes in the design and manufacture of dimmable aircraft windows for the aviation industry, electrochromic automatic-dimming mirrors for the automotive industry, and fire-protection products. In 2021, about 97% of the company’s total revenue was generated from the automotive segment, which primarily includes automotive electronics and interior & exterior electrochromic automatic-dimming rearview mirrors. Gentex Corporation markets its products in Europe, North America, and Asia, primarily through a direct sales force. The company has sales & engineering offices in Sweden, the UK, Germany, France, China, Japan, and South Korea, in addition to its U.S. headquarters. Key competitors in the automotive rearview mirror market include Magna International, Peal Power Automotive, YH America, Inc., BYD Auto Company, and Steelmate, among others. Gentex Corporation holds 39 U.S. Registered Trademarks and 793 U.S. Patents. In addition, the company owns 357 foreign Registered Trademarks and 1224 foreign patents.

-

Guardian Industries Corp. , Guardian Industries Corp., based in Michigan, is a glass manufacturing company established in 1932. It produces fabricated and float glass products for various applications including residential, commercial, and transportation. The company’s operations span approximately 25 countries on five continents. Guardian Industries Corp. has two main business divisions: Guardian Glass and SRG Global. It serves several key sectors such as public and commercial transportation, construction & agriculture, lifestyle, vehicles, nonmotility, safety and protection, and service parts. The company manufactures coated mirrors used in concentrating solar power technology. In addition to its manufacturing activities, the company invests in the research and development of eco-friendly products and seeks business acquisitions and partnerships. Since 2017, Guardian Industries Corp. has been operating as a subsidiary of Koch Industries, Inc.

-

Halio Inc. (formerly known as Kinestral Technologies, Inc.) , Based in San Francisco, Kinestral Technologies, Inc. is a company that offers products utilizing dynamic light control technology. These products are designed for various applications including offices, connected offices, cars, and more. The company’s offerings include the Halio smart tinting glass and a natural light management system, both of which can automatically adjust to block solar heat and minimize glare. Kinestral Technologies’ main investors are SK Holdings, Asahi Glass Co., and GPB Capital Holdings. The company primarily caters to customers in the U.S. and Taiwan. In April 2021, the company rebranded itself as Halio Inc. It is known for its intellectual property, holding 48 patents.

-

Nippon Sheet Glass Co., Ltd. (NSG Group) , NSG Group is a worldwide provider of architectural and automotive glass. The company’s operations are primarily divided into three sectors: creative technology, architecture, and automotive. The architectural division provides glass for building and solar energy applications, while the automotive division caters to original equipment, aftermarket replacement, and specialized transport glazing markets. The creative technology sector aids in the company’s future growth. In terms of the company’s net revenue, the architectural, automotive, and technical glass segments contribute approximately 46.9%, 45.9%, and 6.62% respectively. Geographically, Europe contributes 40% to the company’s revenue, while Asia and the Americas each contribute 30%.

-

PPG Industries, Inc. , PPG Industries, Inc., a company with a rich history dating back to 1883 in Pennsylvania, specializes in the production and supply of a diverse selection of coatings, paints, and specialty materials. The company’s operations are divided into two key segments: performance coatings and industrial coatings. These products find applications in various sectors such as packaging, industrial equipment and components, automotive OEM, aircraft and marine equipment, and other industrial and consumer products. In 2021, PPG Industries, Inc. made significant strides in expanding its business. It acquired five major companies: Ennis-Flint, VersaFlex, Cetelon Lackfabrik GmbH, Wörwag, and Tikkurila. These acquisitions contributed to a 21.5% increase in net sales compared to the previous year. The company also invested a substantial amount of USD 463 million in research and development in the same year. As of 2021, PPG Industries, Inc. boasts over 156 manufacturing facilities across the globe. The company operates two main research centers, the “PPG Coatings Innovation Center” and the “Monroeville Business and Technology Center”, both located in Pennsylvania.

-

RavenWindow , RavenWindow, a company based in Denver, U.S., specializes in the production of advanced smart windows that feature solar-intuitive transitioning technology. The company offers smart glass solutions for thermochromic glass windows, which control solar heat gain without the need for a control system or electrical wiring, offering a maintenance-free solution for clients. The company’s specially designed thermographic filter can be easily applied to a glass surface, transforming it into automatically tinted glass. This technology reduces solar heat and automatically minimizes glare, requiring no manual intervention. It’s a ready-to-use technology that can be utilized for custom designs, new constructions, and retrofitting existing windows. RavenWindow also contributes to LEED certification and its products are suitable for both commercial and residential applications. The company operates a 55,000 sq. ft. manufacturing facility in Denver, capable of producing 100,000 square feet of RavenWindow filters per month.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Smart Glass Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2023, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Smart Glass Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."