- Home

- »

- Electronic & Electrical

- »

-

Smart Home Security Camera Market Size Report, 2030GVR Report cover

![Smart Home Security Camera Market Size, Share & Trends Report]()

Smart Home Security Camera Market Size, Share & Trends Analysis Report By Technology (Wired Camera, Wireless Camera), By Application (Doorbell Camera, Indoor Camera, Outdoor Camera), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-529-8

- Number of Pages: 171

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Market Size & Trends

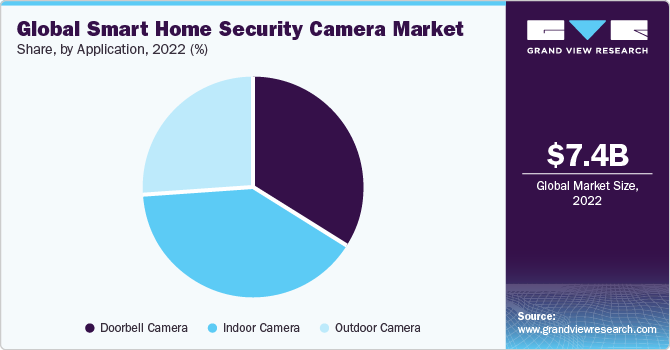

The global smart home security camera market size was valued at USD 7.37 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 19.2% from 2023 to 2030. The increase in smart home security camera usage is attributed to a surge in regional thefts and the cameras' proven ability to prevent burglaries. Additionally, the integration of these cameras with the expanding smart home ecosystem is further propelling their popularity. Advancements in technology have led to the development of sophisticated AI-powered security cameras that can differentiate between regular activities and potential threats. These intelligent systems enhance the overall efficiency of home security, reducing false alarms and providing more accurate threat detection.

The surge in the market for smart home security cameras is driven by a confluence of factors and trends, highlighting a growing emphasis on home safety. Rising security concerns, marked by an increase in thefts and property-related crimes, have propelled the demand for advanced security solutions. Smart home security cameras, with their real-time monitoring capabilities and deterrent effect on potential intruders, have become pivotal in addressing these concerns.

Technological advancements play a key role in the market's expansion, with smart cameras offering features such as high-resolution video recording, night vision, and seamless integration into broader smart home ecosystems. This integration aligns with the overarching trend of adopting smart home technologies, providing users with centralized control over their security systems and enhancing overall convenience.

The effectiveness of smart home security cameras as visible deterrents has resonated strongly with consumers, contributing to their widespread adoption. These devices not only serve as vigilant guardians but also offer remote monitoring and instant alerts, granting homeowners a sense of control and awareness even when away from home.

The growing connectivity landscape and the Internet of Things (IoT) have further facilitated the seamless integration of smart home security cameras into interconnected home environments. This interconnectedness enhances the overall functionality and usability of security systems, reflecting the broader trend of connected living. The trend toward homeownership and the desire to protect property investments have also played a significant role in the rise of the smart home security camera industry.

As individuals become more conscious of safeguarding their homes, these devices are increasingly viewed as essential components in preserving property values. Media coverage of security incidents, coupled with targeted advertising by smart home security camera manufacturers, has heightened awareness regarding potential risks faced by homeowners. This increased awareness has, in turn, prompted proactive investments in home security measures, further driving market expansion.

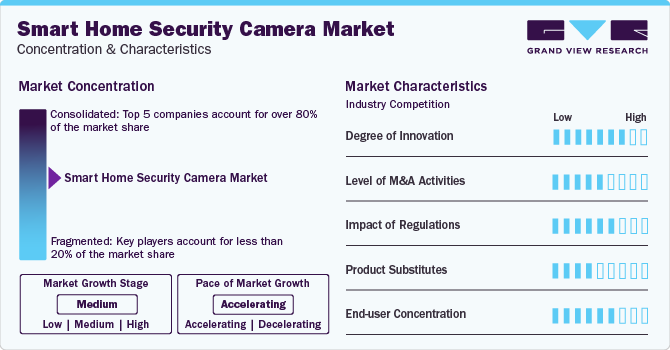

Market Concentration & Characteristics

The global smart home security camera market is characterized by a high degree of innovation, with new technologies and methods being developed and introduced at regular intervals. Continuous technological advancements, particularly in areas such as artificial intelligence (AI), machine learning, and image processing, contribute to smart home security camera innovation. These technologies enable features such as facial recognition, object detection, and improved video analytics, enhancing security cameras' overall capabilities.

Several market players such as ADT Inc., Brinks Home Security, Wyze Lab, Inc., and SimpliSafe, Inc. are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Regulatory frameworks frequently impose guidelines and requirements pertaining to the privacy of people captured by surveillance devices. To ensure privacy rights are protected, smart home security cameras may be subject to regulations that require features such as facial blurring, user consent mechanisms, or limitations on where cameras can be placed. Compliance with privacy laws is critical for both manufacturers and users to avoid legal consequences and ensure responsible surveillance technology use.

Smart home security cameras are necessary because of their advanced features, such as real-time monitoring and integration with smart home ecosystems, which provide enhanced security and convenience. Traditional security cameras, webcams, DIY surveillance systems, baby monitors, dummy cameras, home automation sensors, smart doorbells without cameras, and outdoor lighting with motion sensors are available as alternatives. These alternatives differ in terms of features and limitations, catering to various needs and preferences in terms of cost, functionality, and ease of use.

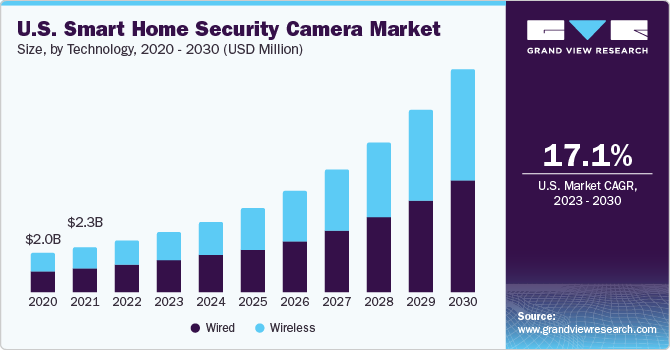

Technology Insights

Wired smart home security cameras accounted for the largest revenue share of 54.6% in 2022. The rising popularity of wired security systems can be attributed to their long-term cost-effectiveness stemming from reduced maintenance requirements. This economic advantage is a crucial factor in driving their adoption. Wired systems provide heightened reliability by avoiding potential issues related to WiFi connectivity or battery life. Even during a WiFi outage, these cameras maintain operational continuity, recording footage locally and ensuring uninterrupted surveillance.

Wireless technology is anticipated to witness the fastest growth over the forecast period. Wireless technology-enabled security systems are one of the most significant advancements in home security solutions and IoT, with many homeowners preferring them for effective protection. The widespread adoption of IoT products for creating connected homes influences market trends. People are increasingly installing smart devices, including locks, lighting, and cameras, to achieve a unified living experience, which also enhances their home security and convenience.

Application Insights

The indoor camera segment dominated the market in 2022. There is an increase in the number of theft and burglary cases, which has raised public awareness about the importance of protecting one's house from criminal activity. Indoor smart cameras offer a variety of capabilities, including instant messaging in the event of a theft, alarm activation, and movement and behavior recognition, which has led to their widespread use in a variety of applications. These cameras are crucial for monitoring homes during absences, such as vacations or work hours. They provide reassurance by allowing homeowners to check on the security of their property and be alerted about package deliveries or any unexpected occurrences.

Doorbell cameras are anticipated to grow at a rapid pace during the forecast period. The growing desire to live in smart homes, facilitated by rising internet penetration, is positively impacting the demand for doorbell cameras. These devices integrate security with the convenience of smart home technology, allowing homeowners to control and monitor their homes with ease. Advancements in technology, such as integration with platforms like Google Assistant, Amazon Alexa, Samsung SmartThings, and Apple Homekit, have made doorbell cameras more appealing. These devices now offer features like precise differentiation among animals, people, packages, and vehicles, enhancing their utility and attractiveness to end-users.

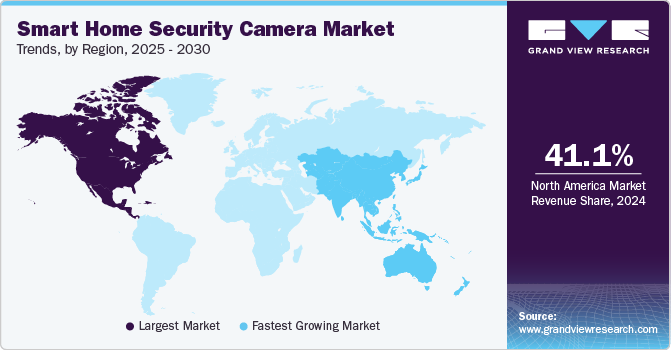

Regional Insights

In 2022, North America was the largest region and accounted for the maximum share of more than 40.63% of the overall revenue. The rapid integration of IoT technology within smart homes is a major driving factor. This technological shift is driving consumers away from conventional mountable Wi-Fi cameras toward sophisticated smart home security cameras, providing advantages such as simplified installation and widespread accessibility. The increasing focus on home remodeling projects, along with a growing enthusiasm for smart home devices, is creating lucrative prospects in the market. The appeal of technologically advanced security cameras, equipped with features like motion detection during periods of house vacancy, holds particular appeal in the market.

The U.S. accounted for the largest share of the market in North America in 2023. The increasing adoption of home automation systems plays a pivotal role in the demand for smart home security cameras in the U.S. Integration with other smart devices and platforms allows for seamless control and monitoring, adding value to the overall smart home experience. Asia Pacific region is expected to grow at the fastest rate during the forecast period. The smart home security camera industry is experiencing growth, propelled by rapid urbanization and increased purchasing power. The surge in smart home adoption is propelling the demand for intelligent appliances for both home automation and security purposes.

Growing consumer awareness about the escalating crime rate is a key factor promoting the widespread adoption of these cameras. Additionally, the expanding aging population in Asia-Pacific presents opportunities for smart home solutions that facilitate independent living and remote health monitoring. Smart security cameras contribute to these assistive technologies, offering safety and security for older people.

Key Companies & Market Share Insights

ADT Inc., Vivint Smart Home, Inc., Nest Labs, and Samsung Electronics Co, Ltd. are some of the dominant players operating in the market.

- Vivint Smart Home, Inc. provides a range of smart home devices, including locks, lights, cameras, thermostats, smoke and carbon monoxide detectors, garage door control, car protection, and security sensors. Additionally, they offer comprehensive home systems, featuring in-home consultations, professional installations, and ongoing support services.

- ADT Inc. operates and markets across three reportable segments such as operates through Commercial, Consumer and Small Business, and Solar segments.

- Samsung Electronics Co, Ltd. operates at several facilities across the U.S., Asia, Europe, and Central & South America and has reached more than 74 markets through direct sales and distributors.

Wyze Lab, Inc., blink, Skylinkhome, Frontpoint Security Solution, LLC and Xiaomi Inc. are some of the emerging market players functioning in smart home security camera sector.

- Wyze Labs, Inc., known simply as Wyze, specializes in smart home products and wireless cameras.

Xiaomi Inc.’s product range is diverse, extending from smartphones to televisions, wearable items, and a variety of smart home products within its Internet of Things and Xiaomi Smart Home ecosystems.

Key Smart Home Security Camera Companies:

- Vivint Smart Home, Inc.

- ADT Inc.

- SimpliSafe, Inc.

- Brinks Home Security

- Xiaomi Inc.

- Skylinkhome

- Protect America, Inc.

- Samsung Electronics Co, Ltd.

- Frontpoint Security Solution, LLC

- Arlo Technologies, Inc.

- Nest Labs

- Wyze Lab, Inc.

- blink

- eufy (Anker Innovations)

- Ring LLC

Recent Developments

-

In September 2023, Eufy Security, the smart home security brand under Anker Innovations, introduced a series of dual-camera devices, establishing the world's first home surveillance mesh powered by local AI. The innovative lineup included cameras with wide-angle and telephoto lenses, elevating the surveillance capabilities of the devices.

-

In June 2023, Xiaomi released a smart security camera with night vision and an intercom. The Xiaomi Outdoor Camera AW300 has an array of security features. Its two bright white and infrared lights allow for sophisticated full-color night vision. Even in complete darkness, this innovative function produces clear and detailed visuals.

-

In March 2023 , Google collaborated with ADT to introduce a DIY home security system called ADT Self-Setup. This innovative package empowers users to select from various Google smart home gadgets to enhance their home security. All the chosen devices seamlessly integrate with the ADT+ smartphone app, providing users with comprehensive support for their home security needs.

-

In May 2023, ADT Inc. introduced an outdoor Wi-Fi camera with advanced features as part of its Smart Home security system. It has two-way audio functionality, enabling communication with individuals in the camera's vicinity. The camera offers full-color HD video footage with night vision capability for low-light conditions.

-

In May 2022, Vivint Smart Home, Inc. unveiled a suite of innovative products aimed at elevating its distinctive smart home experience and introducing intelligent solutions that redefine the benchmarks for smart homes. The offerings included the Doorbell Camera Pro, Outdoor Camera Pro, Spotlight Pro, and Indoor Camera Pro.

-

In July 2022, Xiaomi Inc. expanded its home security offerings by introducing the 360-degree Home Security Camera 1080p 2i. This innovative camera boasts a comprehensive range of features designed to provide enhanced protection and surveillance.

-

In May 2021, Brinks Home Security entered an exclusive agreement to deliver home security and automation services exclusively through the ShopHQ network. Under this arrangement, customers making purchases through ShopHQ gain access to exclusive product packages, professional installation services, and a locked-in monthly rate guaranteed for the entire duration of their contract.

Smart Home Security Camera Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.54 billion

Revenue forecast in 2030

USD 30.10 billion

Growth rate

CAGR of 19.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2022

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; U.K.; Germany; China; India; Brazil

Key companies profiled

Vivint Smart Home; ADT Inc.; SimpliSafe; Brinks Home Security; Xiaomi Inc.; Skylinkhome; Protect America; Samsung Electronics Co; Frontpoint Security Solution; Arlo Technologies; Nest Labs; Wyze Lab; Blink; eufy (Anker Innovations); Ring LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

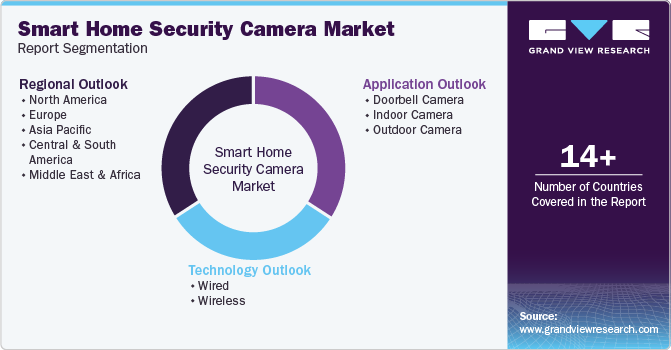

Global Smart Home Security Camera Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart home security camera market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Doorbell Camera

-

Indoor Camera

-

Outdoor Camera

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include growing penetration of smart homes particularly in developing as well as developed states and rising prominence for security devices through the home automation process in order to access security 24/7.

b. The global smart home security camera market size was estimated at USD 7.37 billion in 2022 and is expected to reach USD 8.54 billion in 2023.

b. The global smart home security camera market is expected to grow at a compound annual growth rate of 19.2% from 2023 to 2030 to reach USD 30.10 billion by 2030.

b. North America region dominated the global smart home security camera market with a share of 40.6% in 2022. This is attributable to the increasing trend towards small sized households in American countries such as the U.S., Canada, and Mexico that have urged consumers to invest in household security devices in the absence of residents.

b. Some key players operating in the global smart home security camera market include Vivint, Inc., ADT, SimpliSafe, Inc., Frontpoint Security Solutions, LLC, Brinks Home Security, iSmart Alarm, Inc., LiveWatch Security LLC, Skylinkhome, Protect America, Inc. and SAMSUNG.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."