- Home

- »

- Medical Devices

- »

-

Smart Orthopedic Implant Market Size & Share Report, 2030GVR Report cover

![Smart Orthopedic Implants Market Size, Share & Trends Report]()

Smart Orthopedic Implants Market Size, Share & Trends Analysis Report By Application (Knee, Hip, Others), By Component (Implants, Electronic Components), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-946-5

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range:

- Industry: Healthcare

Report Overview

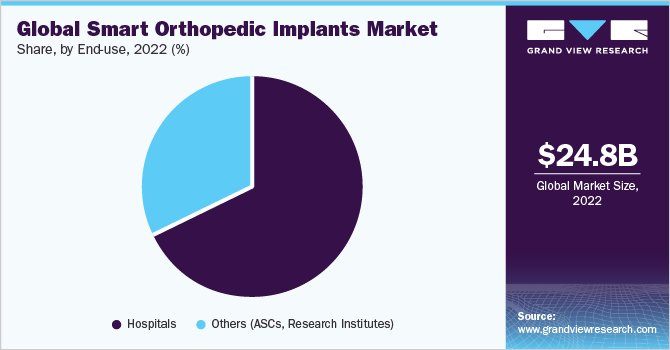

The global smart orthopedic implants market size was valued at USD 24.8 billion in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. The total addressable market value represents the available revenue opportunity for smart orthopedic implants. Growing R&D initiatives, orthopedic procedures, advancements in enabling technologies, such as robotics & surgical navigation, and initiatives by key companies are some of the key drivers of smart orthopedic implants' total addressable market. In August 2021, Zimmer Biomet received FDA clearance and a De Novo classification grant to launch the world’s first smart knee implant for total knee replacement surgery.

The COVID-19 pandemic adversely impacted the overall joint replacement market including smart orthopedic implants with reduced demand and sales. This resulted from deferred or canceled elective procedures, operational challenges in conducting clinical trials, supply chain hurdles, and reduced sales and marketing activities. Key market players reported a decline in sales, especially during 2020. Stryker, for instance, reported about a 9.1% decline in net revenue compared to 2019. Zimmer Biomet witnessed a revenue decline of around 11% during 2020 compared to the previous year. The pandemic notably impacted the knee replacement sales as the procedure is deemed less urgent compared to hip replacement.

Zimmer Biomet reported continued decline/volatility in elective surgical procedures across the globe in 2021 due to the pandemic. In Q3 and Q4 2021, in particular, the highly contagious Delta and Omicron variants resulted in the further postponement of elective procedures. Staffing shortages at hospitals were identified as another adverse impact by the company that further led to the deferral of elective procedures. However, the market is anticipated to recover with the resumption of elective surgeries. Elective procedures are projected to return to pre-COVID numbers as their underlying causes remain unchanged.

These factors are estimated to contribute to the total addressable market growth during the forecast period. Many public and private health institutions have released guidelines to support the resumption of surgeries, such as those released by the American Society of Anesthesiologists (ASA). Rising R&D initiatives and product enhancements are other key factors contributing to the total addressable market growth. This is due to the growing demand for smart orthopedic implants that offer better utility, reliability, consistency, efficiency, and safety. Market players are also involved in developing new technologies and expanding product applications. Zimmer Biomet, for instance, plans to expand its connected digital portfolios from smart knee to hip and extremities joint replacement.

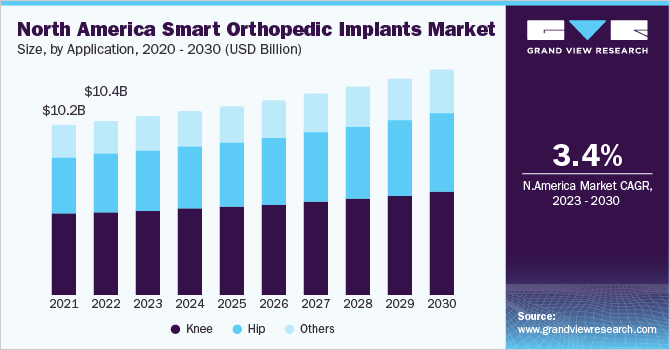

Application Insights

On the basis of applications, the global smart orthopedic implants total addressable market has been further categorized and segmented into the knee, hip, and others. The knee application segment dominated the global market in 2022 and will maintain the leading market position throughout the forecast years. The segment accounted for the maximum share of more than 47.00% of the overall revenue in 2021. On the other hand, the hip application segment is estimated to register the fastest growth rate during the forecast years. One of the key factors contributing to the fast-paced growth of this segment includes the increasing prevalence of knee & hip disorders.

In addition, the rising product advancements and incorporation of digital technologies in the existing line of joint replacement products are projected to support the growth of this segment. Stryker’s acquisition of OrthoSensor in 2021, for instance, was a move to develop smart sensor technologies and implants to empower orthopedic surgeons with data-driven solutions and bolster the company’s digital ecosystem. The growing number of knee and hip replacement procedures is another key market driver. As per the OECD, over 184,000 total knee replacement procedures were performed in Germany in 2018. This number increased to over 188,000 procedures in 2019.

Component Insights

On the basis of components, the global market has been segmented into implants and electronic components. The electronic components segment is estimated to grow at the fastest CAGR of more than 6.20% during the forecast period. The segment comprises sensors and software that make an implant “smart”. This includes additional capabilities, such as remote patient monitoring, tracking of relevant parameters to support post-operative care, and clinical decision-making. Persona IQ smart knee, for instance, is embedded with the canturio-te & CHIRP System developed by Canary Medical.

It allows patients and physicians to track parameters, such as walking speed, cadence, step count, range of motion, etc. The implants component segment accounted for the highest share of the global revenue in 2022. This is attributed to the high cost of implants, availability of products, and initiatives by market players. Large multinational companies are operating in the joint replacement implants market including Stryker, Zimmer Biomet, Depuy Synthes, Microport, B. Braun, Corin, and others. These companies are involved in deploying various strategic initiatives to increase their market presence and share.

Procedure Insights

On the basis of procedures, the global market has been categorized into total replacement, partial replacement, and others. The total replacement procedure segment dominated the global market in 2022 and accounted for the maximum share of more than 55.00% of the overall revenue. The key factors that contributed to the high market share of this segment include the increased prevalence of orthopedic diseases, a high number of joint replacement surgeries performed, and technological advancements. The Persona IQ Smart Knee by Zimmer Biomet, for example, is indicated for patients undergoing a cemented total knee arthroplasty procedure.

The partial replacement procedure segment, on the other hand, is expected to grow at the fastest CAGR during the forecast period. The others segment comprising revision and resurfacing replacement procedures is also projected to grow notably in the coming years. This is due to a notable number of total replacement surgeries failing over time due to failed or worn-out implants, thus leading to the need for revision replacements. Revision procedures are performed to relieve discomfort and enable recovery in the motion. As per information provided by the Arthritis Foundation, annual knee and hip revision procedures are expected to reach 120,000 and 72,000, respectively, by 2030.

End-use Insights

On the basis of end-used, the global market has been bifurcated into hospitals and others. The other end-use segment has been further categorized into Ambulatory Surgical Centers (ASCs) and research institutes. The others segment is anticipated to register the fastest CAGR from 2023 to 2030. This is due to the related cost-effectiveness and increasing number of ambulatory centers. According to the Centers for Medicare & Medicaid Services (CMS) in March 2022, there are approximately 187 Medicare-Certified ASCs in the state of Washington, 442 in Texas, 368 in Georgia, 817 in California, and 457 in Florida.

These numbers are expected to increase over the coming years. The hospitals end-use segment dominated the global market in 2022. The segment accounted for the largest share of the overall revenue in the same year. This is owing to the high volume of orthopedic procedures performed in hospital settings and the adoption of emerging technologies in large hospitals. Deenanath Mangeshkar Hospital in India, for instance, performed over 1500 joint replacements in 2021. The majority of these were total knee replacements followed by some hip replacements along with revision total knee and hip replacements.

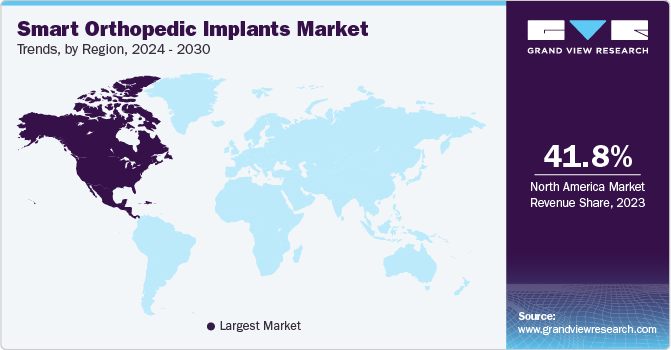

Regional Insights

North America dominated the global market in 2022 and accounted for the maximum share of more than 40.0% of the overall revenue. The high share of the region is attributed to the presence of leading companies, such as Zimmer Biomet. Moreover, the high penetration of digital technologies and robotic systems in healthcare is another key factor attributed to the large share of the region. The growing prevalence of orthopedic disorders is estimated to propel regional growth in the coming years. As per the Centers for Disease Control and Prevention (CDC), the prevalence of doctor-diagnosed arthritis is expected to reach 78.4 million adults by 2040 in the U.S.

The market in the Asia Pacific region is estimated to register the fastest growth rate during the next eight years. The fast-paced growth can be attributed to the rising investments by key market players to strengthen their regional presence, the growing number of surgeries performed and the rapidly improving healthcare infrastructure across the region. As per a study published in the National Library of Medicine, about 146,189 arthroplasties were performed in Japan for all joints in 2017. Among these, over 80,000 accounted for knees while hip joint surgeries were estimated at over 59,000.

Key Companies & Market Share Insights

It is an emerging market with notable growth opportunities. Zimmer Biomet is a leading player in the market owing to its first FDA-approved smart knee- Persona IQ. The company is exploring other applications of its smart implant technology developed in collaboration with Canary Medical. Other key market players are implementing strategic initiatives, such as research and development, partnerships, and mergers & acquisitions, to enter the market and expand their revenue potential. For instance, in January 2021, Stryker acquired OrthoSensor, Inc.-a company specializing in sensor technology for total joint replacement. With this, Stryker intends to innovate and advance smart sensor technologies, including smart implants intraoperative sensors, and wearables across its joint replacement business.

Smart Orthopedic Implants Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 25.6 billion

Revenue forecast in 2030

USD 34.7 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, component, procedure, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Orthopedic Implants Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2030. For the purpose of this report, Grand View Research has segmented the global Smart Orthopedic Implants Market report on the basis of application, component, procedure, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2030)

-

Knee

-

Hip

-

Others

-

-

Component Outlook (Revenue, USD Million, 2021 - 2030)

-

Implants

-

Electronic Components

-

-

Implants Procedure Outlook (Revenue, USD Million, 2021 - 2030)

-

Total Replacement

-

Partial Replacement

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2030)

-

Hospitals

-

Others (ASCs, Research Institutes)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global smart orthopedic implants market size was estimated at USD 24.8 billion in 2022 and is expected to reach USD 25.6 billion in 2023.

b. The global smart orthopedic implants market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 34.7 billion by 2030.

b. North America held over 40% of the smart orthopedic implants market in 2021. This is due to the presence of leading companies such as Zimmer Biomet. High penetration of digital technologies and robotic systems in healthcare is another key factor attributed to the large share of the region.

b. Some key players operating in the smart orthopedic implants market include Zimmer Biomet, Canary Medical, and Stryker.

b. Growing R&D initiatives, orthopedic procedures, advancements in enabling technologies such as robotics & surgical navigation, and initiatives by key companies are some of the key drivers of this market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."