- Home

- »

- Clothing, Footwear & Accessories

- »

-

Smart Shoes Market Size & Share, Global Industry Report, 2019-2025GVR Report cover

![Smart Shoes Market Size, Share & Trends Report]()

Smart Shoes Market Size, Share & Trends Analysis Report By End User (Male, Female), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Online), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-668-4

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Consumer Goods

Industry Insights

The global smart shoes market size was valued at USD 151.6 million in 2018 and is projected to register a CAGR of 20.2% during the forecast period. Rising popularity of smart wearables pertaining to increased participation in sports and fitness activities is anticipated to drive the growth. Increasing demand for tracking and evaluating health metrics is projected to drive the adoption of technology integrated fitness products, such as smart shoes, which is, in turn, is expected to drive the market.

Technological advancements in traditional shoes to boost comfort, convenience, and health are anticipated to create growth opportunities for smart shoes in smart wearables market. Rising adoption of athleisure and fitness as a way of life is expected to drive the demand for smart textiles and wearables. Smart shoes have embedded sensors and Bluetooth controlled insoles to track the distance travelled, calories burned, and other health specific biometric data. In addition, rising demand for sneakers is anticipated to encourage manufacturers to incorporate smart technology in the category to cater to the rising demand.

Rising awareness regarding the advantage of walking and running with respect to health and fitness is anticipated to drive the demand for running shoes. As a result, the manufacturers focus on introducing smart running shoes with features that help track cadence, stride, and help the users improve their form. In 2017, about 60 million people in the U.S. participated in running, jogging, and trail running, while around 100 million took up walking for fitness. In the U.S., more than 30,000 running events including 5k, 8K/5 mile, and 10k races and half-marathons and marathons are organized every year. Rising participation in these fitness and sporting activities is expected to drive demand for smart wearables including smart shoes.

Manufacturers focus on product innovation to incorporate advanced fitness technologies to cater to the rising demand. For instance, in 2019, Nike Inc. launched its second smart shoe called Nike Adapt BB which includes lace-less feature enabling advance power-lacing system, an app, and continually updated firmware featured as the new Nike Adapt Basketball shoe. The objective is to provide fitness and comfort with the use of power lacing through an app. Under Armour, Inc. introduced its latest smart shoe HOVR Sonic2, which can be paired with a smartphones and displays features such as step and distance tracking and instant health statistics.

End-User Insights

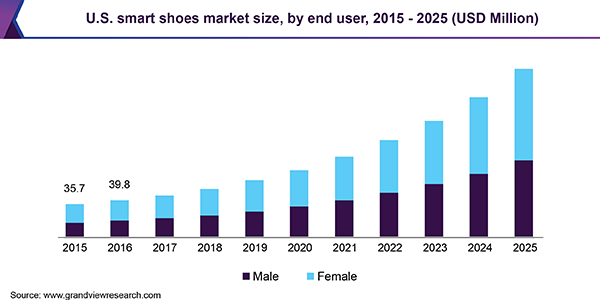

The male segment held the largest share of the smart shoes market with more than 52.0% revenue share in 2018. Growing trend of athleisure in the footwear industry has resulted in increasing number of male consumers. Additionally, dominance of male population in sports and gym activities is anticipated to further bode well for the segment growth and encourage product development. For instance, in February 2019, Xiaomi announced the launch of its new product water resistant Mijia Smart Shoes with a built-in Intel Curie chip processor. The product can distinguish between running, walking, and climbing and can showcase the total calories burned through the Mi Fit App.

The female segment is expected to register the fastest CAGR of 20.5% from 2019 to 2025. Increasing awareness regarding health and fitness coupled with increased spending capacity is anticipated to drive the segment growth. Rising popularity and participation in various female sports stars across numerous international games and championships such as Olympic Games, International Women’s Cricket, and Grand Slam Tournaments has increased the demand for smart products.

Distribution Channel Insights

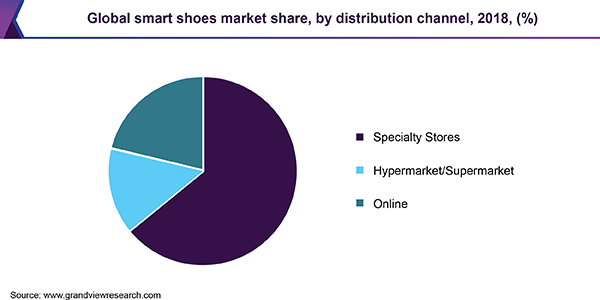

Specialty stores held the largest market share of more than 64.1% in 2018. Increasing number of footwear retail outlets in countries such as Brazil, India, and China is expected to positively impact the segment growth. Mass brands such as Nike Inc.; Under Armour, Inc.; and Xiaomi among others have multiple outlets featuring footwear and other sports accessories across various regions. Rising trend of catalogue shopping in developed economies provide pleasant shopping experience to consumers which is also expected to increase the importance of specialty store outlets.

Online distribution channel is projected to foresee the fastest CAGR of 20.6% from 2019 to 2025 owing to increasing influence of digital media and social media marketing. Increasing internet penetration in various countries such as India, China, Canada, and Brazil among others is anticipated to continue driving the segment growth in the near future. Moreover, rise in social media promotion and advertisements has positively influenced buyer decision. Rising consumer awareness regarding technologically advanced products and smart wearables due to media bloggers and celebrity endorsements is anticipated to further fuel the segment growth. Online retail channels are widely used in developed countries such as U.S., Germany, and the U.K., for purchasing sports accessories.

Regional Insights

North America held the largest market share of 38.8% in terms of revenue in 2018. Increasing product availability with mass brands in this region has increased the demand for smart shoes in online as well as offline channels. High consumer inclination toward fitness and healthy lifestyle coupled with presence of some of the leading professional competitions such as National Basketball Association (NBA), National Football Association (NFA), and National Hockey League (NHL) is expected to further fuel the regional demand for smart shoes. The U.S. leads the global market in terms of product demand with more consumer willingness to spend on fitness and body recovery products.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period on account of rising urban population and adoption of fitness activities. Rapid growth of fitness industry implying increased investment on body exercising and body enhancing products is expected to drive the regional demand for smart shoes. Availability of advanced and innovative products coupled with increasing awareness regarding different sports is likely to fuel the demand for smart wearable products and sports accessories.

Smart Shoes Market Share Insights

The global market is highly competitive in nature with the presence of top players such as Nike Inc., Adidas AG; Under Armour Inc.; Digitsole; Puma SE; Salted Venture; TRAQshoe; Vivobarefoot; Xiaomi Corporation Limited; and ShiftWear. Leading players actively focus on innovation and product developments to sustain the competition and to cater to the evolving consumer requirements. For instance, in 2017, Digitsole launched smart shoes that provide personalized feedback for analyzing health, fatigue, posture, steps and calories. These shoes are easily connected through Bluetooth and also provide personalized coaching as well as precise data for tracking and monitoring health. The product showcase features such as auto-lacing and temperature regulation.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Million & CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Country Scope

U.S., Germany, U.K., China, India, Brazil.

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global smart shoes market report on the basis of end-user, distribution channel, and region:

-

End-User Outlook (Revenue, USD Million, 2015 - 2025)

-

Male

-

Female

-

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Hypermarket/Supermarket

-

Specialty Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."