- Home

- »

- Display Technologies

- »

-

Smart TV Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Smart TV Market Size, Share & Trends Report]()

Smart TV Market Size, Share & Trends Analysis Report By Resolution, By Screen Size, By Screen Shape, By Operating System, By Distribution Channel, By Technology, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-209-9

- Number of Pages: 163

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Semiconductors & Electronics

Report Overview

The global smart TV market size was valued at USD 197.82 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.4% from 2023 to 2030. The increased popularity of content on over-the-top (OTT) services has provided a boost to the smart TV market. Several TV content creators are introducing new content with varied genres to cater to every type of viewer’s demands. These content creators are collaborating with different OTT platforms to form exclusive partnerships. Following this trend, leading streaming platforms such as Amazon Prime, Netflix, Disney Plus, and others have developed custom applications for smart TVs to offer their streaming services. Furthermore, the high demand for smart TVs is attributed to their advanced features such as voice command, screen mirroring/sharing, and video calling, among others, which creates a more appealing environment for the users.

During the COVID-19 pandemic, governments around the world imposed stringent lockdown restrictions, forcing people to stay indoors. The lockdowns have pushed people to turn towards indoor forms of entertainment. Movie producers also followed the trend by releasing movies on over-the-top platforms as movie theaters were closed. Viewers could purchase or rent new movies on streaming platforms and watch them on their smart TVs in the comfort and safety of their homes. This caused a notable rise in internet video streaming and, as a result, the demand for smart TVs.

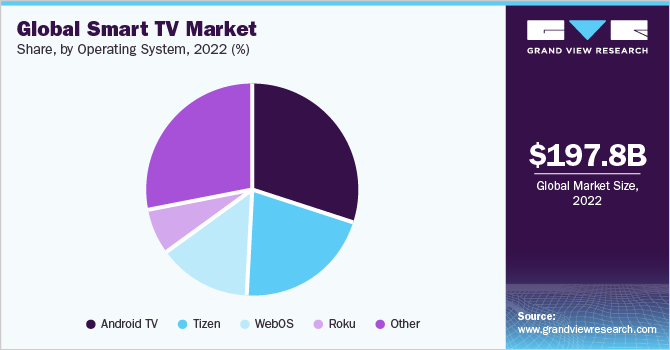

Moreover, a smart TV includes an operating system, which enables viewers to interact with features such as downloading applications, streaming video, and purchasing content, among others, on the TV. Manufacturers are introducing their own operating systems for the smart TVs that they produce to counter the popular operating systems. For instance, the Tizen operating system is developed by Samsung Electronics Co. Ltd for their smart TV range, helping viewers access streaming applications to enjoy TV content. Additionally, LG offers its own operating systems, which support exclusive features such as magic remote, voice command, and more.

The trend of video-on-demand (VoD) is likely to drive market growth, as smart TVs support various popular video platforms that offer on-demand content. For instance, ESPN+ smart TV application offers on-demand sports streaming and content. Moreover, customers can browse the internet and run supported applications including educational applications for children on smart TVs. Smart TVs also support the interactive features of educational applications such as voice input, remote cursor, and more.

Moreover, manufacturers are attracting clients by developing affordable products and setting competitive prices for customers. Leading manufacturers produce entry-level to high-end smart TVs, based on features and quality. The high-end smart TVs are produced with high-quality display panels and parts, which significantly increase the product price. On the other hand, affordable smart TVs drive the market’s growth by making the product accessible to a wider market and reducing the entry barrier for new customers.

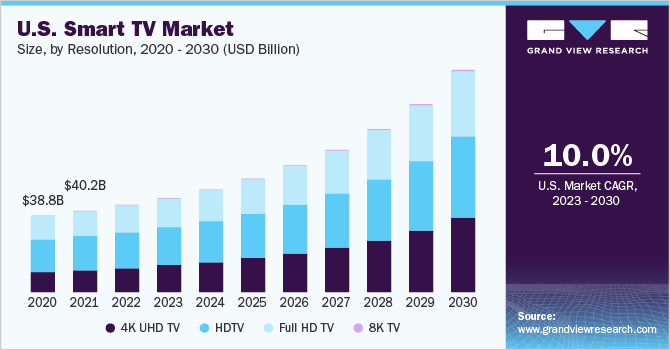

Resolution Insights

The full HD TV segment accounted for the largest market share in 2022, owing to the high-definition picture quality and a wide variety of content supporting it. Full HD TVs provide a resolution of 1920 x 1080 pixels, which has been the industry baseline for many years. This resolution is prevalent as large amounts of existing content support the resolution. Streaming of content and live sports on this resolution does not consume high internet bandwidth while still offering an immersive and good-quality viewing experience.

The 8K TV segment is predicted to expand at the highest CAGR of around 17% during the forecast period of 2023 to 2030, owing to the demand for super high-resolution picture quality. 8K TVs provide detailed image resolution and support over 33 million pixels. The resolution has an ever-growing content library as it becomes more regular in the market. The segment is expected to grow strongly as manufacturers offer added features, such as Dolby Atmos sound, high-dynamic range (HDR), and more.

Screen Size Insights

The 46 to 55 inches segment dominated the market and accounted for the highest revenue share in 2022, owing to the rising trend of purchasing bigger TVs for a theater-like viewing experience. The segment demand is attributed to the screen size-to-price value for consumers. The 46 to 55 inches segment is attractive to viewers as full HD and 4K smart TV prices are reducing, which in turn is increasing demand. Customers are able to purchase bigger TVs as a result of favorable financial payment methods such as EMIs.

The above 65 inches segment is predicted to expand at the highest CAGR of around 16% during the forecast period, owing to the trend of home theaters along with the reduction of smart TV prices. Furthermore, due to the small price difference between over 65-inch smart TVs and regular-sized TVs, zero-cost payback possibilities, discount offers, and other factors, a significant number of buyers looking to buy 55-inch smart TVs do not hesitate to spend a little extra and choose TVs with over 65-inch displays. The number of customers purchasing large-screen television sets is predicted to grow across the globe in the upcoming years, primarily owing to the rising spending capacity. New market entrants also aim to offer products in this segment with competitive pricing.

Screen Shape Insights

The flat TV segment dominated the market and accounted for the largest market share in 2022 and is expected to record the highest CAGR over the forecast period of 2023 to 2030, as a result of its easy manufacturing process. Consumers prefer flat-screen smart TVs as they are easier to install on walls by mounting. The demand for flat-screen smart TVs is prominent due to their cost being lower than curved smart TVs. Moreover, these TVs offer a larger viewing angle and are less reflective compared to curved screen shapes.

The curved TV segment is expected to expand at a CAGR of around 7% during the forecast period of 2023 to 2030, owing to the more immersive viewing experience. Curved smart TVs are typically seen in big screen sizes so as to offer an added depth experience to the viewer. Curved screens are seen in top-end expensive smart televisions, which offer a premium feel to the viewer.

Operating System Insights

The Android TV segment dominated the market with the largest revenue share in 2022, as a result of the already popular Google Android ecosystem. The segment’s stronghold is attributed to the extensive Play Store access for application downloads. It also adds voice search and content aggregation from multiple media applications and services. The Android TV operating system also facilitates integration with recent Google technologies like Knowledge Graph, Cast, and Assistant.

The Roku segment is anticipated to expand at a CAGR of over 16% during the forecast period from 2023 to 2030 due to its Apple AirPlay compatibility, making it simple to stream movies, photographs, music, and other content from an Apple device to a smart TV. Many smart TV manufacturers are teaming up with Roku to provide the in-built feature of Roku software with no requirement of a set-top box. For instance, in 2021, TCL collaborated with Roku and launched a 4K HDR Roku TV. Such developments are driving the operating system segment growth.

Distribution Channel Insights

The offline segment dominated the market and accounted for the largest revenue share in 2022, owing to increasing sales through electronics retailers, independent TV dealers, stores, and distributors. Several consumers prefer to buy electronic products from brick-and-mortar stores as they can immediately check the product quality and compare it with other similar offerings, which leads to faster purchase decisions.

The online segment is estimated to record the highest growth rate from 2023 to 2030, aided by the increasing consumer preference for e-commerce platforms to buy electronic products. These platforms offer greater convenience, offers, discounts, and coupons, attracting a larger customer base. As a result, several companies are aggressively promoting and distributing smart TVs and related accessories through other e-commerce platforms or their independent online sales channels.

Technology Insights

The QLED segment dominated the market and accounted for the largest revenue share in 2022 and is estimated to record a notable CAGR between 2023 and 2030. The technology involves Quantum dots that are durable, stable, inorganic, and provide enhanced color and brightness. The increasing popularity of the product has urged market players to launch new offerings using the QLED technology. In October 2022, Samsung Electronics Co. Ltd introduced updated models of The Frame TV in India. The QLED TV range is equipped with the company’s Quantum Processor 4K, providing 4K AI upscaling capability.

The OLED segment is expected to capture a significant revenue share by 2030, owing to high consumer demand driven by their high-end picture quality. OLED TVs come with the ability to produce inky black levels, smooth motion, highly saturated colors, and excellent viewing angles. The launch of new offerings in this segment is expected to enhance the market outlook in the coming years. For instance, in September 2022, Sony Corporation launched Bravia XR Master Series A95K OLED TV in India. The new product is powered by the cognitive XR processor, providing an immersive viewing experience.

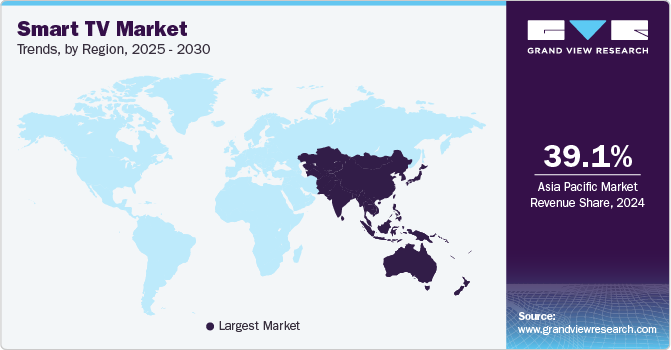

Regional Insights

The Asia Pacific region dominated the smart TV market and accounted for the largest revenue share of over 40.0% in 2022. The growing popularity of smart TV in rapidly developing countries like India is significantly driving regional market expansion. China holds a significant share in the Asia Pacific smart TV market, aided by the emergence of new players such as Hisense Co., Ltd., and TCL Corporation, expanding their footprint and increasing rivalry among major players.

The Europe region is expected to record a CAGR of over 10.1% over the forecast period from 2023 to 2030. Modern developments in content production have added to the demand for smart TVs. For instance, the show You versus Wild on Netflix allows users to choose the protagonist’s next actions. Moreover, the ever-changing consumer focus on streaming online content, owing to the increasing availability of high-speed internet broadband connections, is further favoring product demand in the region.

Key Companies & Market Share Insights

Key players use strategies such as partnerships, ventures, innovations, research and development, and geographical expansion to solidify their market position. They are focusing on improving their product offerings to better suit the changing needs of users and stay competitive. Streaming platforms are collaborating with manufacturers to preinstall their applications in smart TVs so customers have quick access. Netflix and Amazon Prime, two leading streaming platforms, come preinstalled on Samsung and LG smart TVs.

Leading market players are introducing new products with competitive pricing and different features to cater to a range of customers. For instance, in April 2022, Samsung Electronics Co. Ltd launched its Neo QLED 8K smart TV range. This launch included 65-inch and 85-inch screen-sized televisions. Samsung Electronics Co. Ltd also runs promotional offers, enabling consumers to purchase TVs at lower costs, thus increasing the demand for its products. Some of the prominent players in the global smart TV market include:

-

Haier Inc.

-

Hisense International

-

Intex Technologies

-

Koninklijke Philips N.V

-

LG Electronics Inc

-

Panasonic Corporation

-

Samsung Electronics Co. Ltd

-

Sansui Electric Co. Ltd

-

Sony Corporation

-

TCL Electronics Holdings Limited

-

Toshiba Visual Solutions (TVS Regza Corporation)

Smart TV Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 211.42 billion

Revenue forecast in 2030

USD 451.26 billion

Growth rate

CAGR of 11.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million units, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue and demand forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resolution, screen size, screen shape, operating system, distribution channel, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Benelux; Nordic Countries; Russia; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Mexico; Brazil; Argentina; Saudi Arabia; UAE; Egypt; South Africa; Nigeria

Key companies profiled

Haier Inc; Intex Technologies; Koninklijke Philips N.V.; LG Electronics; Panasonic Corporation; Samsung Electronics Co. Ltd; Sansui Electric Co. Ltd; Sony Corporation; TCL Electronics Holdings Limited; Toshiba Solutions; Hisense International

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart TV Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart TV market report based on resolution, screen size, screen shape, operating system, distribution channel, technology, and region:

-

Operating System Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Android TV

-

Tizen

-

WebOS

-

Roku

-

Other

-

-

Resolution Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

4K UHD TV

-

HDTV

-

Full HD TV

-

8K TV

-

-

Screen Size Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Below 32 inches

-

32 to 45 inches

-

46 to 55 inches

-

56 to 65 inches

-

Above 65 inches

-

-

Screen Shape Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Flat

-

Curved

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Technology Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

OLED

-

QLED

-

LED

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Benelux

-

Nordic Countries

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

South Africa

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global smart TV market size was estimated at USD 197.82 billion in 2022 and is expected to reach USD 211.42 billion in 2023.

b. The global smart TV market is expected to grow at a compound annual growth rate of 11.4% from 2023 to 2030 to reach USD 451.26 billion by 2030.

b. The 4K HDTV segment registered the highest volume share of around 40% in 2022 and is expected to retain its dominance over the forecast period in the smart TV market.

b. Some of the key players operating in the smart TV market include Haier Inc; Intex Technologies; Koninklijke Philips N.V.; LG Electronics; Panasonic Corporation; Samsung Electronics Co. Ltd; Sansui Electric Co. Ltd; Sony Corporation; TCL Electronics Holdings Limited; Toshiba Solutions; Hisense International

b. Key factors that are driving the smart TV market growth include an increase in the usage of streaming devices and the internet and the rising popularity of newer TV resolutions in 4K, UHD, and 8K.

b. The flat-screen type segment dominated the industry in 2022 and accounted for the lion’s share of more than 95% both in terms of volume and revenue in the smart TV market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."