- Home

- »

- Clothing, Footwear & Accessories

- »

-

Socks Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Socks Market Size, Share & Trends Report]()

Socks Market Size, Share & Trends Analysis Report By Product (Athletic, Casual), By Raw Material (Cotton, Nylon, Wool), By End-user (Men, Women, Children), By Distribution Channel (Supermarket & Hypermarket, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-347-8

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Consumer Goods

Socks Market Size & Trends

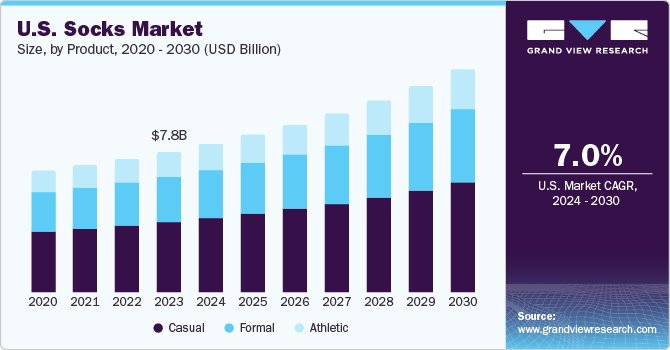

The global socks market size was valued at USD 47.08 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. The increasing prominence of maintaining formal clothing amongst white-collar professionals on a universal level is anticipated to play a vital role in boosting market growth. Furthermore, growing spending on health as well as fitness amongst adults is anticipated to prompt the demand for different shoe accessories that include sports socks and ankle socks. Over the last couple of years, different healthcare professionals have increased their spending on publishing several research papers on keeping the healthy foot in light of growing occurrences of foot disorders related to diabetes.

Thus, the growing concerns over effects related to foot ulcers amongst diabetic patients are anticipated to endorse the usefulness of innovative sock alternatives as a foot-caring medium over the forecast period. Some of the companies including Dr. Oxyn and Podolite have launched customized diabetic socks to reduce the risk of foot ulcers, which act as a root cause of infections, or possible amputation. Increasing penetration of corporate offices in emerging economies including China, Bangladesh, India, and Mexico as a result of supportive policies to promote investments at domestic levels is expected to remain a favorable factor for the industry. Increasing demand for footwear other than shoes, such as sandals and slippers, is hindering the growth of the market.

The growing demand for specialized socks, such as compression socks for improved circulation, grip socks for enhanced stability during workouts, and waterproof socks for outdoor activities, reflects a shift towards functional and performance-oriented apparel. Consumers are increasingly valuing innovative features that cater to specific needs, driving the popularity of these specialized sock types and contributing to the overall growth of the socks market.

The rising prevalence of diabetes is fueling demand for diabetic socks in the market, designed to provide extra cushioning, seamless construction, and moisture-wicking properties, addressing specific foot care needs, and reducing the risk of complications in diabetic individuals. According to the World Health Organization, approximately 422 million people globally, predominantly in low- and middle-income countries, suffer from diabetes, with the disease directly causing 1.5 million deaths each year. Over recent decades, there has been a consistent increase in both the prevalence and incidence of diabetes.

The rising demand for specialized socks along with the increasing awareness about fitness & health in various regions will bring development opportunities for the market. The COVID-19 pandemic has largely impacted the global socks industry, as demand for the product has decreased largely. With movement being stopped to a large extent, socks sales have been drastically impacted. However, top companies in the industry are hopeful; as many are reinventing their product lines and most of them have utilized the lockdown period to innovate their production and retail approach. Furthermore, the increasing penetration of smartphone users in these countries has forced the socks manufacturers to launch their product variants at discounted prices, along with various value-added services including cash-on-delivery services.

This is further expected to drive the global market over the forecast period. In addition, many governments all over the globe are promoting adventurous sports tourism, such as camping, which is also contributing to the market growth. The increasing necessity of multiple footwear products by urban customers is another major factor driving the market. Moreover, the increasing trend of athletic shoes along with athletic celebrity endorsement by top brands is driving the market growth. It has been seen that customers are buying high-quality socks to use during gym training as well as outdoor sports activities.

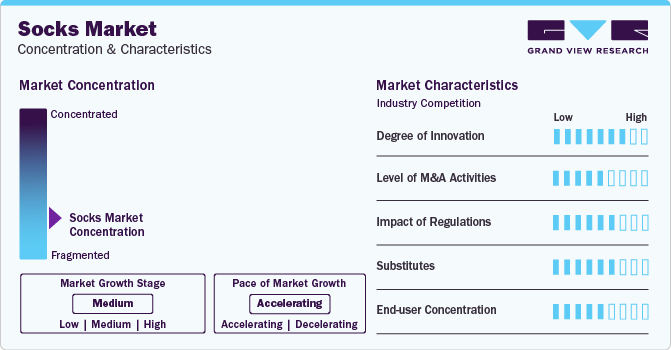

Market Concentration & Characteristics

The socks market is witnessing a notable degree of innovation with the introduction of advanced materials, performance-enhancing features, and sustainable practices. Brands are leveraging technology to create socks with moisture-wicking properties, ergonomic designs, and eco-friendly materials, meeting diverse consumer preferences and elevating the overall product experience.

The socks market has witnessed notable M&A activities, as companies strategically consolidate to enhance product portfolios, expand market reach, and capitalize on emerging trends. This trend reflects a dynamic industry landscape with players seeking synergies to stay competitive, foster innovation, and cater to evolving consumer preferences in the global hosiery market.

Regulations in the socks market play a crucial role in ensuring product quality, safety, and fair business practices. Compliance with textile standards and labeling requirements influences consumer trust, impacting purchasing decisions. Moreover, environmental regulations push the industry towards sustainable practices, encouraging eco-friendly materials and manufacturing processes in the production of socks.

Substitutes in the socks market include alternatives like barefoot styles, compression sleeves, and foot coverings integrated into footwear. Athletic and casual footwear with built-in moisture-wicking or antibacterial properties also serve as potential substitutes, offering consumers diversified choices beyond traditional sock options.

The socks market displays a diversified end-user concentration, catering to various age groups, lifestyles, and specific activity needs. From performance-driven athletic socks for fitness enthusiasts to fashionable and comfort-focused options for everyday wear, the market addresses the preferences of a wide consumer demographic.

Product Insights

The casual product segment was the largest and accounted for the largest revenue share of around 53.8% in 2023. Casual socks are comfortable and versatile socks that can be worn in everyday settings. They are usually made from a blend of cotton, wool, or synthetic fibers, and come in a variety of colors and patterns. Some popular types of casual socks are crew socks, ankle socks, and no-show socks. Casual socks can be worn with a variety of outfits, including jeans, shorts, and sneakers.

The athletic segment is expected to witness the fastest CAGR of 7.3% from 2024 to 2030. Athletic socks have come a long way from the earlier basic white version. The athletics community is one of the most popular end-users of these socks and the Tour de France was one of the first to opt for no-show socks. Nike offers a range of no-show socks for men & women and these are usually sold in packs of 3 pairs. Similarly, Zukeasox’s men’s no-show socks are available in packs of 6 pairs. The socks are made from non-slip cotton, and have a low cut, an invisible casual ankle liner, and a silicon grip, enhancing user comfort.

Raw Material Insights

Cotton socks dominate the market due to their widespread popularity stemming from inherent qualities such as breathability, comfort, and moisture absorption. The natural fibers of cotton allow for better air circulation, reducing the risk of foot perspiration and discomfort. London Sock Company, a UK-based company, introduced its line of back-to-work socks in October 2023. To ensure they endure longer, these are hand-finished from beautifully knitted, trademark stretch-cotton blend material.

Wool socks are preferred for their excellent insulation properties, keeping feet warm in cold weather while effectively wicking away moisture to maintain dryness. The natural elasticity of wool fibers provides a snug fit, offering both comfort and support. The country's first Merino wool versions of DeFeet's Woolie Boolie and Wooleator Pro socks, bearing the Responsible Wool Standard (RWS) mark on the package, were introduced in October 2023 by the world's first manufacturer devoted to creating sustainable, elite performance socks.

End-user Insights

Men’s socks dominated the market and accounted for a revenue share of nearly 63% in 2023. Men show a higher preference for formal socks as compared to women. Other categories are also bought depending on their personal style and the activities they engage in on a regular basis.

The demand for women’s socks is anticipated to grow at a CAGR of 7.3% from 2024 to 2030. The World Federation of the Sporting Goods Industry (WFSGI) states that more female involvement in sports will benefit the sportswear industry. In addition, since 2019, there have been more female runners than males. According to a 2020 BBC report, around 30% of the women in India were engaged in sports. Female involvement in numerous sports is growing, and they are more likely than men to view sports as essential to maintaining their health and well-being.

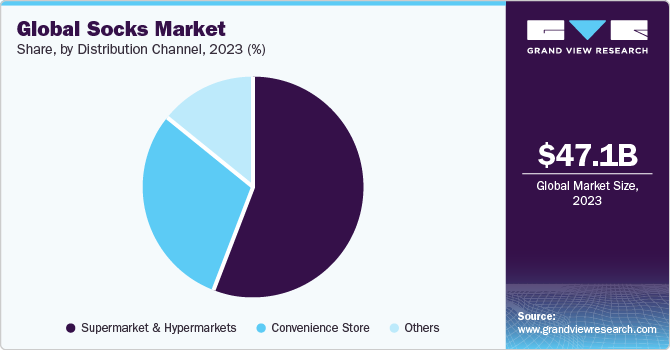

Distribution Channel Insights

The hypermarkets and supermarkets segment dominated the market with a share of 56.4% in 2023. Consumers primarily look for product life cycle and price/value factor while purchasing a product and find retail shops the most convenient place to try & check products and accordingly make a buying decision. Moreover, the presence of skilled staff with knowledge of product specialty and other information about product segments is attracting first-time buyers of these products to this channel.

The online distribution channel is anticipated to grow at a CAGR of 7.4% during the forecast period. Consumers prefer online portals and official websites to purchase premium products to gain value-added services, such as convenient return policies, cash on delivery, and integrated & centralized customer services. Consumers are likely to purchase sportswear from e-commerce sites on account of the availability of trending styles at the best prices.

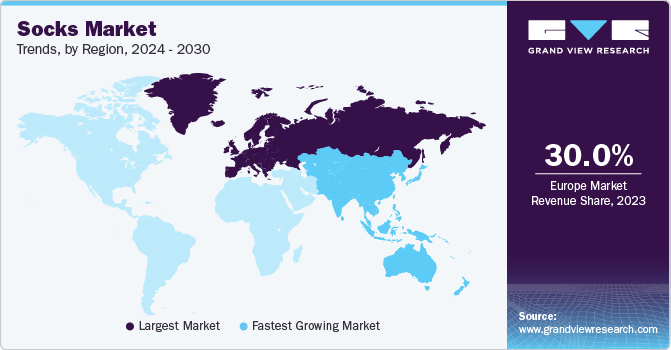

Regional Insights

The Asia Pacific socks market is expected to grow at a CAGR of 7.8% from 2024 to 2030. Population growth, rising disposable income, and rapid urbanization in developing counties including China, Bangladesh, Pakistan, and India are expected to have a positive impact on the market growth. In addition, an increasing number of professional sports cricket leagues including the Indian Premier League (IPL) and Big Bash League in India and Australia are projected to open new avenues for domestic players to increase their expenditure on purchasing premium sports accessories including shoes and socks.

The market in Europe accounted for nearly 30.0% of the global revenues in 2023. Fast industrial growth along with high disposable income levels fueled by rapid economic growth is projected to boost market growth in Europe. Moreover, over the last couple of years, new fashion trends and shift in lifestyles, such as a rise in the use of footwear, contributed largely to the Europe socks market. Furthermore, some of the companies are manufacturing customized socks to meet the requirements of sports professionals in this region.

U.K. socks market

The socks market in the UK accounted for a revenue share of 13.8% in the European market. The industry here is poised for growth as fashion-conscious consumers influenced by trends seek premium-quality sock options.

India socks market

The socks market in India is expected to grow at a CAGR of 8.0% from 2024 to 2030, driven by factors such as increasing disposable incomes, improving quality of life, global exposure to professional yet fashionable apparel trends, and rising expansion of sport goods companies in the country.

Kenya socks market

The socks market in Kenya is projected to grow due to urbanization and evolving fashion preferences. As lifestyles change and global fashion trends influence consumers, there is a growing demand for diverse and stylish sock options in the country.

South Africa socks market

The socks market in South Africa is set to grow at a CAGR of around 5.5% from 2024 to 2030. Manufacturers in the country have been focusing on various strategies like mergers and acquisitions and are expanding their product portfolios to gain traction.

Key Companies & Market Share Insights

The global socks market is characterized by the presence of a few well-established players and several local and regional players. Some top players in this market are as Nike Inc.; Puma S.E.; Adidas A.G.; Asics Corp.; Skechers USA, Inc.; Hanesbrands Inc.; Under Armour, Inc.; VF Corp.; Jockey International Inc.; Drymax Technologies Inc. Key players vie for market share by emphasizing sustainability, performance enhancements, and unique style propositions to capture consumer attention in this dynamic and fashion-forward industry.

Key Socks Companies:

The following are the leading companies in the socks market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these socks companies are analyzed to map the supply network.

- Nike Inc.

- Puma S.E.

- Adidas A.G.

- Asics Corporation

- Skechers USA, Inc.

- Hanesbrands Inc.

- Under Armour, Inc.

- VF Corporation

- Jockey International Inc.

- Drymax Technologies Inc.

Recent Developments

-

In January 2024, Puma S.E. announced the opening of its latest Dubai store at the popular City Walk location in UAE. The store is the company’s fourth store to open in the UAE 2024 and will feature some of the most popular products of the brand.

-

In December 2023, Under Armour, Inc. opened its first outlet store at the O2 multipurpose indoor arena in London, UK.Designed as part of the brand's new Factory House retail concept, the 3,949-square-foot store offers a selection of sportswear, shoes and accessories.

-

In December 2023, Nike Inc. partnered with STÜSSY, an apparel company, to introduce the Stüssy x Nike Air Flight 89 collection, encompassing a range of hoodies, jackets, tops, sweatpants, and socks. The collection highlighted timeless DRIFIT socks adorned with uncomplicated contrast branding on the sock ribbing.

-

In November 2022, Jockey International Inc. unveiled its 10th Exclusive Brand store in the UAE, marking a strategic move to enhance its retail presence and drive accelerated growth by strengthening market penetration in the region. This expansion underscores the company's commitment to catering to a broader consumer base in the UAE.

Socks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 49.66 billion

Revenue forecast in 2030

USD 73.69 billion

Growth Rate (Revenue)

CAGR of 6.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, raw material, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Australia & New Zealand, Brazil, Argentina, South Africa, UAE, Saudi Arabia, Kenya

Key companies profiled

Nike Inc.; Puma S.E.; Adidas A.G.; Asics Corp.; Skechers USA, Inc.; Hanesbrands Inc.; Under Armour, Inc.; VF Corp.; Jockey International Inc.; Drymax Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

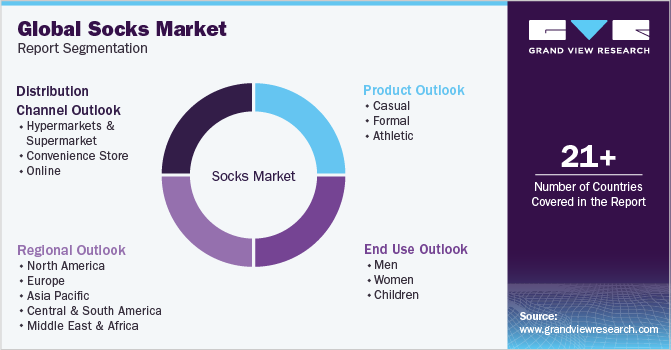

Global Socks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global socks market report on the basis of product, end user, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Casual

-

Formal

-

Athletic

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Cotton

-

Nylon

-

Wool

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets and Supermarket

-

Convenience Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kenya

-

-

Frequently Asked Questions About This Report

b. The global socks market size was estimated at USD 44.7 billion in 2022 and is expected to reach USD 47.1 billion in 2023.

b. The global socks market is expected to grow at a compound annual growth rate of 6.4% from 2023 to 2030 to reach USD 73.69 billion by 2030.

b. Asia Pacific dominated the socks market with a share of 37.5% in 2022. This is attributable to Population growth, rising disposable income and urbanization in developing counties including China, Bangladesh, Pakistan, and India.

b. Some key players operating in the socks market include Nike Inc.; Puma S.E.; Adidas A.G.; Asics Corporation; Renfro Corporation; THORLO, Inc.; Hanesbrands Inc.; Balega; Drymax Technologies Inc.; and Under Armour, Inc.

b. Key factors that are driving the socks market growth include the rising importance of maintaining formal attire among white-collar professionals and increasing spending on health and fitness among adults worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."