- Home

- »

- Food Additives & Nutricosmetics

- »

-

Sodium Nitrite Market Size, Share, Trends Forecast, 2030GVR Report cover

![Sodium Nitrite Market Size, Share & Trends Report]()

Sodium Nitrite Market Size, Share & Trends Analysis Report By Application (Food & Beverages, Pharmaceuticals, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-690-4

- Number of Pages: 109

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Specialty & Chemicals

Report Overview

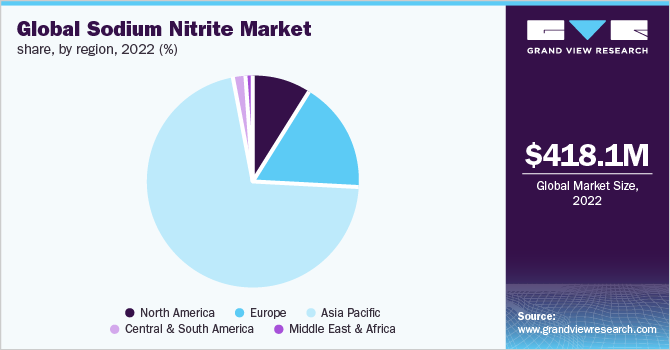

The global sodium nitrite market size was valued at USD 418.1 million in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. The demand for the product is anticipated to be driven by its increasing usage in meat-curing applications. Additionally, the growth is also fueled by the growing demand for processed meat products, including sausages, seafood, bacon, and ham. The product finds its application in several industries including pharmaceuticals, textiles, and food & beverages. It is employed as a preservative, mainly in the meat processing sector, because it serves as a color fixative and acts as an antioxidant and antimicrobial, preventing the growth of toxic bacterial microbes that spoil the food. It is not only used in meat but in other perishable foods to prevent decay and maintain taste & freshness.

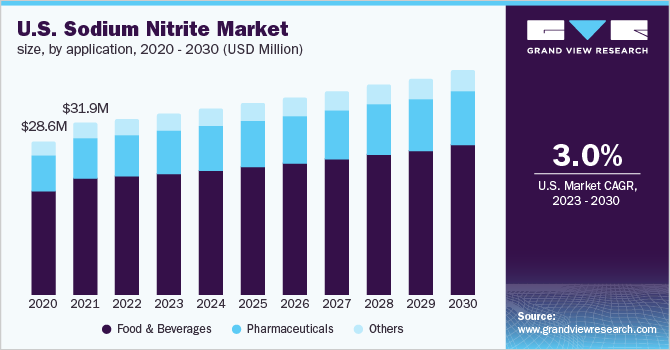

The utilization of sodium nitrite has grown over the years as the pharmaceutical industry is involved in research & development. It is used in cardiovascular therapy to reduce the effects of hypotension. Multiple applications of sodium nitrite in the pharmaceutical industry indicate that the demand for pharmaceutical-grade sodium nitrite is expected to increase in the coming years. The U.S. is the largest consumer of sodium nitrite in North America. This is attributed to the increase in demand from the processed meat industry. Due to the changing consumer lifestyles and increased urbanization, which affect consumer consumption patterns, the U.S. market is expected to rise steadily over the forecast period. Additionally, the U.S. was the top meat consumer in 2019, according to the United States Department of Agriculture (USDA), and has been since 2017.

Protein-rich processed foods have been in high demand as consumers in the country become more aware of the importance of getting enough protein. The total consumption of meat in the U.S., which includes chicken, pork, beef, and turkey, was roughly 200 pounds per person per year in 2012, according to estimates supplied by the National Chicken Council, which rose to 225 pounds per person per year in 2019.

Application Insights

The food and beverages application segment dominated the global market with a revenue share of over 66% in 2022. The growth is attributed to the increased usage of food additives in the poultry and meat industries. In the meat industry, the product also acts as an antimicrobial apart from a pigment inhibitor, thereby restricting the growth of foodborne pathogens. It is utilized and added during the curing process of meat to prevent bacteria from growing and keep the meat fresh. Sodium nitrite can remove germs from meat that develop in the presence of moisture and limits bacterial growth by dehydrating them.

Pharmaceuticals is another application segment predicted to exhibit a CAGR of 4.7% over the forecast period. The growth is attributed to the rising usage of sodium nitrite as a raw material in the development of medicines, along with its increased utilization for treating diseases such as neurotransmission imbalances, muscular dystrophy, epilepsy, and cognitive and behavioral problems. Additionally, it is also utilized as a foaming agent for manufacturing polyvinyl chloride. The increasing usage of sodium nitrite in different applications in the global pharmaceuticals industry is thus anticipated to drive the growth of the industry in the coming years.

The others segment, which includes the utilization of sodium nitrite as an electrolyte in electrochemical grinding production processes, bleaching agents, and dye colors in the textile industry, is also anticipated to witness growth over the forecast period due to the growing textile industry in Asia Pacific and Europe.

Regional Insights

Asia Pacific accounted for a revenue share of over 71% in 2022 and maintains a dominating position in the global market. This growth is attributed to the rising demand for food-grade sodium nitrite, notably in countries like China, India, and Japan. China is the world's largest food and beverage consumer market. According to a China Chamber of Commerce article published in 2020, the beverage market which includes drinks, vegetable juices, and fruits generated a revenue of USD 39,330 million. The food and beverage sector is predicted to be driven by population growth and increased per capita disposable income. The eating habits of Chinese consumers have shifted as a result of their fast-paced lifestyles. They are inclined towards packaged foods rather than creating their own meals.

The pharmaceutical market is the largest in India; according to IBEF's November 2021 report, India is the largest generic drug provider across the globe. India accounts for 50% of the global supply of various drugs. The manufacturing of the COVID-19 vaccine has placed India in a significant position in the pharmaceutical sector. The growth of the sector in the country is driving companies to manufacture advanced medicine. As the companies are involved more in the manufacturing of medicines, it is also driving the demand for the sodium nitrite market that is required to manufacture various types of drugs.

Europe accounts for the second-largest market share of over 16% in terms of revenue in 2021. This is attributed to the rising use of sodium nitrite in the pharmaceutical and food & beverage industries and the use of sodium nitrite as a preservative in processed meat. The pharmaceutical sector is one of the major sectors in the U.K. that accounts for USD 8.52 billion in terms of value in 2021. Post-COVID-19, the population became more health conscious, which led to an increase in spending on healthcare in Europe. Additionally, multiple regulations are restricting the use of chemically derived products in food and beverages, specifically in the Europe and North American regions. Regulations have been established by government bodies owing to associated health concerns. This is expected to further strengthen the demand for natural sodium nitrite sources such as celery, lettuce, and other vegetables in North America and Europe in the forecast period.

Key Companies & Market Share Insights

The sodium nitrite market is highly fragmented with the presence of a large number of manufacturers. Multinational corporations in the market have established a global supply chain through in-house supply channels or third-party distributors. For instance, companies such as BASF SE have appointed third-party distributors to supply their products in the market.

In the Asia Pacific region, China is the major producer of the product with the presence of large manufacturers across the country. The global marketplace is likely to exhibit substantial competition among the existing players to sustain itself in the market. Some of the prominent players in the global sodium nitrite market include:

-

Deepak Nitrite Ltd.

-

Airedale Chemical Company Ltd.

-

BASF SE

-

Shijizhuang Fengshan Chemical Co. Ltd.

-

Ural Chem JSC

-

Linyi Luguang Chemical Co. Ltd.

-

Radiant Indus Chem Pvt. Ltd.

-

Yingfengyuan Industrial Group Limited

-

SABIC

Sodium Nitrite Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 433.3 million

Revenue forecast in 2030

USD 580.8 million

Growth Rate

CAGR of 4.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Deepak Nitrite Ltd.; Airedale Chemical Company Ltd.; BASF SE; UralChem JSC; Shijizhuang Fengshan Chemical Co. Ltd.; Radiant Indus Chem Pvt. Ltd.; SABIC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sodium Nitrite Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sodium nitrite market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The food & beverages dominated the sodium nitrite market with a share of over 66% in 2022. This high share is attributable to rising demand for food preservatives in the food processing industry.

b. The global sodium nitrite market size was valued at USD 418.1 million in 2022 and is expected to reach USD 433.3 million in 2023.

b. The global sodium nitrite market is forecast to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030 to reach USD 580.8 million by 2030.

b. Some prominent players in the sodium nitrite market include Deepak, Airedale Chemical Company Ltd., BASF SE, UralChem JSC, Shijizhuang Fengshan Chemical Co. Ltd., Radiant Indus Chem Pvt. Ltd., SABIC

b. The demand for sodium nitrite is anticipated to be driven by its utilization in meat curing applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."