- Home

- »

- Power Generation & Storage

- »

-

Solid State Battery Market Size & Share Report, 2021-2028GVR Report cover

![Solid State Battery Market Size, Share & Trends Report]()

Solid State Battery Market Size, Share & Trends Analysis Report By Application (Energy Harvesting, EVs), By Battery Type (Thin Film, Portable Batteries), By Capacity (Below 20 mAh, Above 500 mAh), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-000-4

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Energy & Power

Report Overview

The global solid state battery market size was valued at USD 590.9 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 36.0% from 2021 to 2028. Rising demand for solid-state batteries among end-use sectors along with the rising research and development activities focused on commercializing the battery cost are expected to propel the market growth over the forecast period. The growing adoption of electronic gadgets, the increasing utility of battery energy storage systems, and the rising deployment of electric vehicles are among the key factors driving the industry. These batteries offer higher energy density, low flammability, and higher electrochemical stability when compared to conventional batteries, thereby enhancing their commercial market value.

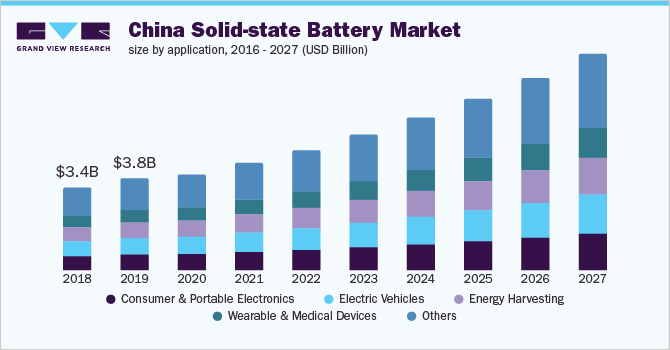

China dominates the global market on account of the bulk manufacturing of batteries and the presence of major market players across the country. Vehicle manufacturers in China, such as Nio, Enovate, and Weltmeister, are focusing on the commercial development of solid-state batteries that can be used in the transportation sector. Moreover, the Chinese government is providing heavy funding to battery production projects, thereby driving market growth across the country.

Strategic partnerships among leading industry players are expected to further boost the product demand across several end-use segments. For instance, in February 2020, Panasonic Corp. and Toyota Motor Corp. announced a joint venture named Prime Planet Energy & Solutions, Inc. that will focus on the development, manufacturing, and marketing of solid-state batteries in the automotive sector.

High costs associated with the initial stage development of solid-state batteries are expected to hinder the commercial viability of the product. In addition, the growing impact of the COVID-19 pandemic on the market supply chain is expected to further impede the market growth. Battery pack manufacturers, electrode material producers, raw material suppliers, and others have suffered a major setback and are estimated to take a significant amount of time to recover.

Application Insights

Consumer & portable electronics segment occupied the largest market share of over 33.6% in 2020 owing to the high demand for portable electronic devices in various end-use segments. Rapid urbanization along with rising discretionary expenditures are expected to result in higher purchasing of electronic devices including smartphones, laptops, media players, gaming consoles, and others. This trend is anticipated to stimulate segment growth over the forecast period.

The electric vehicles segment is anticipated to occupy the leading position in the market, in terms of revenue share, by 2028 owing to the rising deployment of clean energy-powered vehicles across major economies of the world. Technological advancements in batteries along with the presence of favorable regulatory policies encouraging the adoption of electric vehicles are expected to boost the segment growth.

The Wearable & medical devices segment accounted for a significant market share and is anticipated to witness prominent growth over the forecast period. Rising demand for small energy storage sources and wearable electronics is projected to favor the segment growth. Moreover, innovations in medical technology are likely to maximize the penetration rate of wearable batteries.

Capacity Insights

Below 20 mAh segment is anticipated to register the fastest CAGR of over 42% during the forecast period. The batteries that fall under this category are mainly thin-film batteries that cater to a wide application range including cosmetic and medical patches, wireless sensors, packaging, and others. Limited internal space, compact size, and usage across low drain devices that do not require large battery capacity are among the key factors bolstering the demand for batteries below 20 mAh of capacity.

The above 500 mAh segment accumulated the market of 19.6% in 2019 owing to the increased usage of solid-state batteries in electric vehicles market. Government policies favoring clean energy transportation are driving the current segment demand. In addition, growing demand for battery energy storage systems across commercial and industrial sectors is further expected to augment the segment growth.

Battery Type Insights

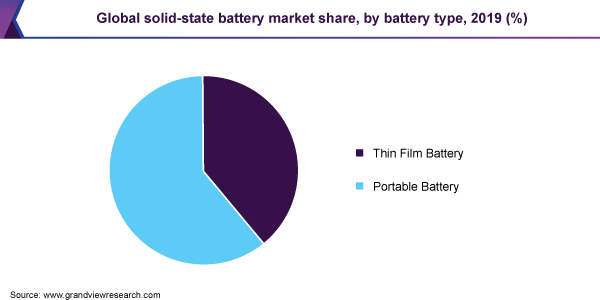

The thin-film battery segment is expected to register the highest CAGR of 36.3% from 2020 to 2027 owing to a wide application scope of solid state batteries. These batteries are mainly used in IoT and wearable devices, such as fitness bands, smart clothing, and smartwatches, due to their efficient recharging rate and compact design. Unlike conventional batteries, thin-film batteries have a minimum environmental impact, which is expected to augment the industry growth over the forecast period.

The adoption of solid state batteries in portable devices is expected to grow at a significant rate owing to low maintenance and higher energy densities offered by them. High demand for consumer electronics is expected to propel the segment's growth.

Significant research is being conducted regarding the application of sodium sulfur batteries in consumer electronics and wearable devices. Solid state batteries are now being utilized in portable devices and consumer electronic products. Even though the application of these batteries in electronics is at a nascent stage, their application scope ranges from mobile phones, laptops, computers, tablets, torches or flashlights, to LED lighting, vacuum cleaners, digital cameras, and calculators.

Regional Insights

Asia Pacific emerged as the largest market, accounting for a 51.2% share of the global solid state battery market in 2020. The significant growth of automotive industry in China, India, Japan, and South Korea is expected to promote the demand for solid state batteries. Furthermore, increasing population in China and India coupled with favorable government regulations aimed at lowering carbon emissions from vehicles and promoting the use of electric vehicles are expected to enhance the product demand in the region over the forecast period.

Europe occupied the second-largest market share in 2020 and is anticipated to retain its market position over the forecast period. The growth can be attributed to the strict implementation of favorable regulatory policies regarding the deployment of battery energy storage systems and electric vehicles across the region. In addition, the European Commission funding aimed at battery-specific R&D projects is expected to further boost the regional market growth.

North America, led by the U.S., Mexico, and Canada, accounted for nearly 20.69% of the global solid-state battery market share in 2020. The presence of prominent battery manufacturers and growing demand for end-use industries are the primary driving factors for North America solid-state battery market.

Key Companies & Market Share Insights

Market players are investing in research and development activities to enhance the technical aspects of solid-state cells and modules that offer lower battery cost, longer life, and better performance when compared to conventional batteries. Industry participants have undertaken several strategic initiatives, such as offering diversified product ranges, joint ventures, collaborations, and mergers and acquisitions. These strategies enable companies to enhance their foothold in the global market. Some of the prominent players in the solid state battery market include:

-

Samsung SDI Co. Ltd.

-

Solvay

-

Cymbet

-

Robert Bosch GmbH

-

Saft

Solid State Battery Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 617.5 million

Revenue forecast in 2028

USD 5.31 billion

Growth Rate

CAGR of 36.0% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, capacity, battery type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

The U.S.; Canada; Mexico; Germany; Russia; The U.K.; Spain; Italy; France; China; Japan; South Korea; India; Australia; Brazil; Colombia; Paraguay; Saudi Arabia; UAE; South Africa; Egypt

Key companies profiled

Samsung SDI Co. Ltd.; Solvay; Cymbet; Pathion Inc.; Robert Bosch GmbH; Saft; Excellatron Solid-state; Toyota Motor; BrightVolt; Solid Power

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global solid state battery market report on the basis of application, capacity, battery type, and region:

-

Application Outlook (Revenue, USD Billion, 2016 - 2028)

-

Consumer & Portable Electronics

-

Electric Vehicles

-

Energy Harvesting

-

Wearable & Medical Devices

-

Others

-

-

Capacity Outlook (Revenue, USD Billion, 2016 - 2028)

-

Below 20mAh

-

20mAh-500mAh

-

Above 500mAh

-

-

Battery Type Outlook (Revenue, USD Billion, 2016 - 2028)

-

Thin Film

-

Portable

-

-

Regional Outlook (Revenue, USD Billion, 2016 - 2028)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

The U.K.

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Colombia

-

Paraguay

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global solid state battery market size was estimated at USD 32.91 billion in 2019 and is expected to reach USD 34.18 billion in 2020.

b. The global solid state battery market is expected to grow at a compounded annual growth rate of 13.0% from 2020 to 2027 to reach USD 87.54 billion by 2027.

b. Asia Pacific dominated the solid state battery market with the highest share of 33.0% in 2019. These batteries offer higher energy density, low flammability, and higher electrochemical stability when compared to conventional batteries are expected to play a vital role in the biomass power market.

b. Some key players operating in the solid state battery market include Samsung SDI Co. Ltd., Solvay, Cymbet, Robert Bosch GmbH, Saft among others.

b. Key factors driving the solid state battery market growth include the growing adoption of electronic gadgets, increasing utility of battery energy storage systems, and rising deployment of electric vehicles are among the key factors propelling the solid-state battery industry demand.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."