- Home

- »

- Food Additives & Nutricosmetics

- »

-

Sorbitol Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Sorbitol Market Size, Share & Trends Report]()

Sorbitol Market Size, Share & Trends Analysis Report By Product (Liquid, Crystal), By Application (Oral Care, Vitamin C, Surfactant), By End-use (Personal Care), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-199-3

- Number of Pages: 145

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Report Overview

The global sorbitol market size was valued at USD 1.66 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. The market is expected to witness significant growth over the forecast period owing to the rising usage of diabetic and dietetic food and beverages. The growing product demand as a substitute for sugar in consumer food products is also expected to drive demand for the product over the next few years. Sorbitol is also increasingly being used in oral care products as it is metabolized at a slower rate as compared to other sugar alcohols, preventing dental problems such as cavities and tooth decay. The benefits of the same are expected to propel industry growth over the forecast period. Additionally, the trend of shifting production capacities to the Asia Pacific due to low production and labor costs has resulted in low costs for sorbitol, therefore causing rising demand for non-food applications.

The major driver for the market is the growing demand from the food and beverage industry for nutritive sweeteners. Approval from safety regulatory and human health bodies such as the FDA and the U.S. Department of Agriculture (USDA) for the use of the product in medicines and bakery foods is expected to further drive the market in the U.S. In addition, sorbitol also finds application as a humectant in pharmaceutical products, thereby fueling the growth of the product in the country due to the presence of one of the biggest pharmaceutical industries. As a result, the demand for sorbitol is also anticipated to increase over the forecast period.

The increasing use of the product in chocolates and confectionary products owing to its textural, moisture-stabilizing, and non-carcinogenic properties is expected to positively affect the overall demand of the market. Sorbitol is chemically relatively inert and is a stable chemical, which is expected to result in high demand for the product as it is easy to incorporate into other food products without hampering the recipe. Due to the unique and useful texture-enhancing properties of sorbitol, it has varied applications, including the manufacturing of cosmetics.

Sorbitol is an intermediate product whose demand largely depends on the demand for end products in its application industries. Ample availability of starch sources, such as potato and corn, in India, China, and Brazil is expected to work favorably for its production over the forecast period. In addition, the number of raw material suppliers is expected to increase in China and India due to the growth of the agricultural sector, aided by the low labor costs and growing demand across the world.

Moreover, sorbitol is used in the production of biofuels. Biofuels are naturally derived fuels that are promoted by various organizations such as the European Commission or EPA through the implementation of favorable policies. The growing popularity of biofuels, coupled with the support of government organizations, is expected to result in an increased number of manufacturers over the coming years. The growing research and applications for the same, especially in developed regions like North America and Europe, are expected to drive the demand for sorbitol over the forecast period.

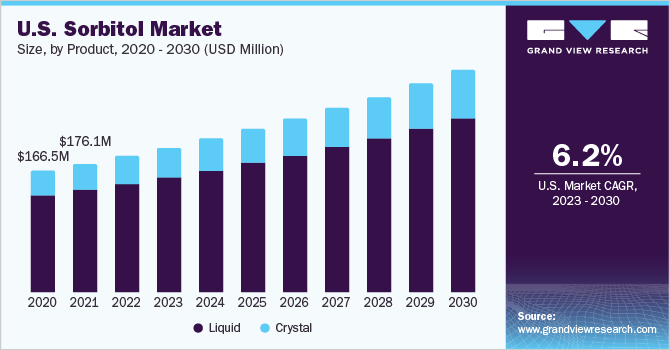

Product Insights

Liquid segment dominated the market with a revenue share of more than 76% in 2022.Liquid sorbitol is majorly used as a substitute for sugar in the pharmaceutical and food and beverage industries. The growing demand for low-calorie food caused by the growing number of health-conscious consumers as well as patients with obesity across the globe is expected to fuel the use of the product in these industries.

Crystal sorbitol is widely utilized as a food additive for producing frozen raw fish, shrimp balls, roasted fish fillets, dried squid thread, polydextrose (soluble dietary fiber), chewing gum, and mint tablets. It is also used in several other frozen aquatic products as well as sugar-free foodstuffs. The growing demand for application products, primarily in meat products and frozen foods, is expected to promote market growth over the forecast period.

Crystal-based product is also used as a humectant in various cosmetic products, such as moisturizers and face cream, owing to their capacity to resist bacteriological degradation and retain moisture. Other applications of crystal sorbitol include its use as a plasticizer in the production of capsule outer shell and as a filler and excipient in the production of pharmaceutical tablets. Thus, the growing demand for cosmetic products is anticipated to prove beneficial for sorbitol demand over the coming years.

Application Insights

Diabetic & Diabetic Food & Beverage application dominated the market with a revenue share of over 35% in 2022.The increasing global consumption of functional foods as well as economies of scale has resulted in low manufacturing costs for the major manufacturers while creating new opportunities for the growth of sorbitol in the future. However, a gradual increase in the demand for sweeteners, such as maltitol and xylitol, is expected to pose a threat to the market as they can be substituted with sorbitol.

Sorbitol finds application in surfactants as detergents, dispersants, emulsifiers, and wetting and foaming agents. Biobased surfactants are witnessing increased utilization in the food processing industry. The surfactant acts as a stabilizing agent for a variety of food products, such as bread, ice cream, and cakes. Additionally, the surfactants help in maintaining the viscosity and texture of the food products and extending shelf life. As a result, the growth of the food processing industry is expected to drive the demand for biobased surfactant products over the forecast period.

The Vitamin C application segment is expected to expand at the highest growth rate over the forecast period. Vitamin C is mainly synthesized using two manufacturing processes, namely the Reichstein Grussner process and the two-step fermentation process. Both production processes use sorbitol as a primary starting material for the production of ascorbic acid (Vitamin C). The two-step fermentation process is primarily used by Chinese manufacturers owing to its lower cost.

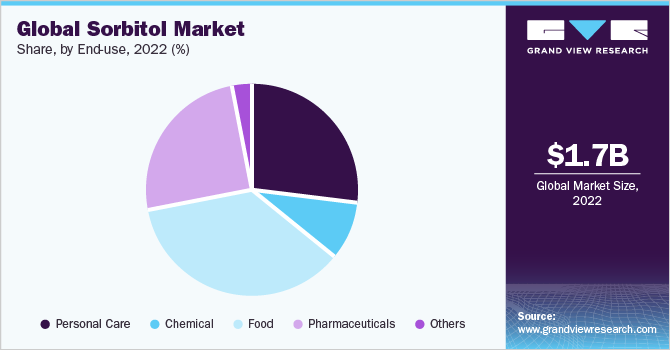

End-use Insights

Food dominated the end-use market with a revenue share of over 35% in 2022.Sorbitol is generally added to food items to induce the sweetness and replace the need for refined sugar. In addition to providing sweetness, sorbitol also acts as an excellent texturizing and anti-crystallization agent in the production of ice cream and bakery products. It is widely used to increase shelf life and maintain the freshness and color of various confectionery and bakery products. Furthermore, it finds application in the production of canned fruit. The food segment is expected to dominate the market over the forecast period, tracing the growth of the food and beverages industry, as applications for the product are expanding in the industry.

Rising awareness regarding dietary supplements owing to their nutritional benefits is expected to have a positive impact on market growth in the near future. In addition, rising concern over low-calorie and sugar-free products on account of the increasing prevalence of diabetes in the world is expected to be a favorable factor for the growth of the market in the near future.

Sorbitol has emerged as one of the key building blocks for the production of bio-based ethylene glycol and propylene glycol. For instance, Archer Daniels Midlands Company in partnership with Pacific Northwest National Laboratory (PNNL) began the commercial production of biobased propylene glycol (PG) from sorbitol and glycerol at its Illinois, U.S.-based manufacturing facility.

Moreover, the growing use of monoclonal antibodies in critical therapeutic areas such as oncology, tuberculosis, and autoimmune diseases is likely to drive demand for sorbitol. The increasing number of contract manufacturing organizations (CMOs) and contract research organizations (CROs) in the pharmaceutical sector is anticipated to drive product demand.

Furthermore, the ion exchange technique is one of the most creative and active fields in the food and beverages industry, which also plays a vital role in the growth of the food industry. The food & beverages end-use segment is anticipated to be the fastest-growing end-use segment owing to the increasingly strict guidelines issued by food regulatory authorities all over the world.

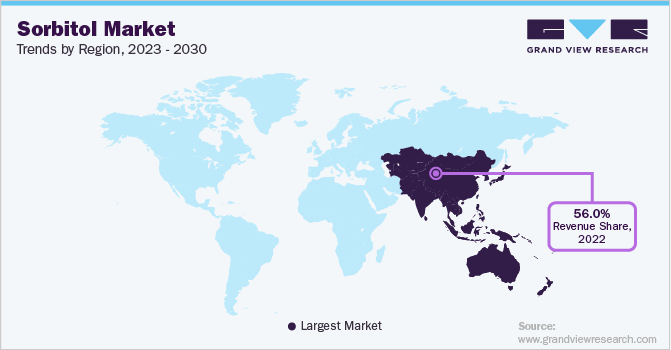

Regional Insights

Asia Pacific region dominated the global sorbitol market with a revenue share of more than 56% in 2022. Increasing health-conscious consumers, coupled with a rise in the number of consumer markets growing at a high pace, is driving the market for sorbitol in the region as it is used widely in various applications, including chocolates, baked goods, and confectionery.

The changing lifestyles of the general public and urbanization in developing countries have further fueled the demand for the product as the end-users are increasingly adopting the product to fulfill the demand of the consumers. Sorbitol is extensively used for non-food applications in the Asia Pacific, for instance, Japan has been a major importer of the product for the oral care industry.

Sorbitol is penetrating the market in the European region at a high pace as the region has a well-established food and beverages industry that keeps continuously evolving and adapting to new ingredients. Meat products constitute an important part of the diet of European consumers. Processed meat products are the most consumed food products in Europe.

The European region is not only one of the largest markets for food and beverages but also the most regulated market. The market in Europe is expected to exhibit high growth opportunities owing to the role of the product as a substitute for sugar in sugar-based foods and beverages as well as meat products as sorbitol prevents the charring of meat.

Key Companies & Market Share Insights

Witnessing the growing demand for non-GMO ingredients in the food and beverage, pharmaceutical, and cosmetics industries, manufacturers are increasingly focusing on the production quantity of sorbitol obtained from non-GMO crops. For instance, multiple major players like Cargill, Incorporated, Ingredion, and CREMER OLEO GmbH & Co. KG have introduced non-GMO sorbitol in their product portfolio. Additionally, manufacturers are focusing on local sourcing key raw materials in order to reduce the transportation costs and environmental footprint of the overall manufacturing process.

PT Ecogreen Oleochemicals, Gujrat Ambuja Exports, and Gulshan Polyols are some of the companies that import sorbitol from their overseas manufacturing plants located in Turkey and India. These companies are focusing on customizing their products to match the specific requirements of the industrial and food processing players. Some prominent players in the global sorbitol market include:

-

American International Foods, Inc.

-

ADM

-

Cargill Incorporated

-

DuPont

-

Gulshan Polyols Ltd.

-

Merck KGaA

-

Ecogreen Oleochemicals GmbH

-

Qinhuangdao Lihua Starch Co., Ltd.

-

Roquette Frères

-

SPI Pharma

-

Tereos

-

Ingredion Incorporated

-

Kasyap Sweeteners, Ltd.

Sorbitol Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.77 billion

Revenue forecast in 2030

USD 2.80 billion

Growth rate

CAGR of 6.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; Thailand; Brazil; Saudi Arabia

Key companies profiled

Kasyap Sweeteners, Ltd.; Ingredion Incorporated; Tereos; SPI Pharma; Roquette Frères; Qinhuangdao Lihua Starch Co., Ltd.; Ecogreen Oleochemicals GmbH; Merck KGaA; Gulshan Polyols Ltd.; DuPont; Cargill Incorporated; ADM; American International Foods, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sorbitol Market Report Segmentation

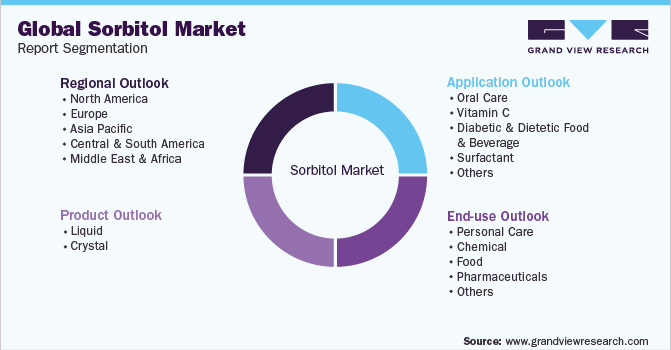

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sorbitol market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Liquid

-

Crystal

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Oral Care

-

Vitamin C

-

Diabetic & Dietetic Food & Beverage

-

Surfactant

-

Others

-

-

End‑use Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Personal Care

-

Chemical

-

Food

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global sorbitol market was estimated at USD 1.66 billion in the year 2022 and is expected to reach USD 1.77 billion in 2023.

b. The global sorbitol market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 2.80 million by 2030.

b. Asia Pacific emerged as the dominant region in the sorbitol market with a volume share of 56.9% in the year 2022, owing to the large adoption of sorbitol in a variety of foods and beverages including sports nutritional beverages and functional foods.

b. The key market players in the global sorbitol market include Ingredion Incorporated, Tereos, SPI Pharma, Roquette Frères, Qinhuangdao Lihua Starch Co., Ltd., Ecogreen Oleochemicals GmbH, Merck KGaA, Gulshan Polyols Ltd., DuPont, Cargill Incorporated, ADM, and American International Foods, Inc.

b. Increasing demand for nutrient-rich foods & beverages in developing as well as emerging consumer markets owing to higher consumer health awareness is expected to drive the growth of the sorbitol market. The increasing demand for sugar-free foods & beverages in developing countries is also expected to aid the market growth over the forecast period.

b. Liquid sorbitol dominated the global market and accounted for more than 76% share in 2022. The product is majorly used as a substitute for sugar in the pharmaceutical and food and beverage industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."