- Home

- »

- Advanced Interior Materials

- »

-

Sorting Machines Market Size Report, 2021-2028GVR Report cover

![Sorting Machines Market Size, Share & Trends Report]()

Sorting Machines Market Size, Share & Trends Analysis Report By End Use (Mining, Food & Beverage, Pharmaceutical), By Product (Weight Sorter, Optical Sorter), By Region (EU, APAC), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-673-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

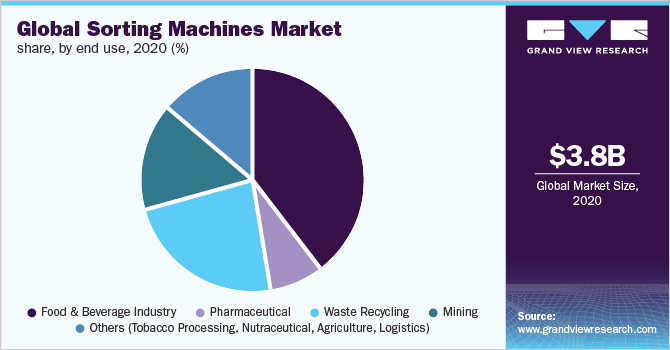

The global sorting machines market was valued at USD 3.81 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 5.9% over the forecast period. The growing pharmaceutical industry across the globe is beneficial for the market owing to its application in sorting capsules and tablets according to their weight, size, and shape to maintain quality and accuracy in production. During the COVID-19 pandemic, the operations of various end-use industries, such as mining, tobacco processing, and plastic, were closed, which impacted the product demand. However, the food and pharmaceutical industries were operating during the lockdown, resulting in the increased product demand from these industries during the pandemic, as it reduces the requirement of labor and speeds up the production process.

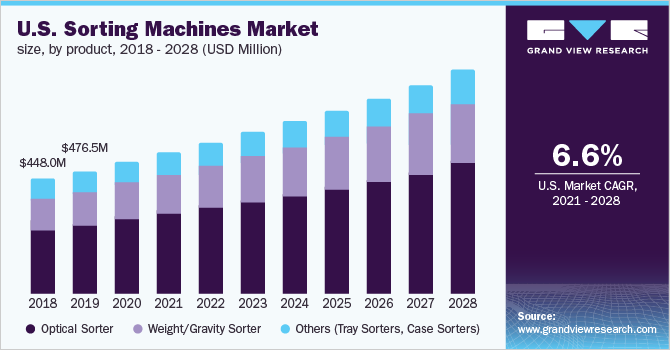

In the U.S., the COVID-19 virus spread rapidly in 2020 resulting in a nationwide lockdown with limited or temporarily closed operations in various factories and manufacturing units, adversely impacting the product demand in 2020. However, the factories, production units, and offices have re-opened in 2021, with the rapid growth of the vaccination drive in the country. The reopening of end-use industries is expected to boost the demand over the forecast period. The rising initiatives by the government and related regulatory bodies for retaining strict standards for food quality are expected to drive the market over the forecast period. In January 2019, FSSAI declared its focus on imposing new food quality standards that were set in 2018 and notified 27 new regulations for food standards.

Automation is one of the important factors, which propels the growth of the market in the food & beverage industry. The companies involved in the global food processing equipment strengthen their position with strong R&D capabilities, which helps them to opt for innovative and advanced processing mechanisms offering fast, error-free, and quality products as per standards. Market players are required to invest in R&D to manufacture machines using advanced technology, which increases the initial cost. Though sorting machines improve product quality, maximize yield, and identify better aspects of processing operations, their high initial cost can be restrictive for some potential end-users with controlled budgets, especially in developing economies.

Product Insights

The optical sorter product segment led the market with a revenue share of over 56% in 2020. Optical sorters are widely used in the food industry across the world, with the increased penetration in the processing of harvested foods including, fruits, vegetables, nuts, and potatoes, where it achieves non-destructive, 100% inspection in-line at full production volumes. They are also used in various industries including nutraceutical, tobacco processing, waste recycling, and pharmaceutical. In the waste recycling industry, they have applications in identifying and discarding manufacturing waste, such as cardboard, metals, drywall, and various plastics.

The weight/gravity sorter segment is estimated to witness the fastest CAGR from 2021 to 2028. It is widely used in the pharmaceutical industry, healthcare R&D, and manufacturing departments. These sorters are used for weighing individual tablets or capsules with accurate measurement as well as for rapidly checking a large number of products, thereby saving production time. The others segment includes tilt tray, push tray, and case sorters. Tilt tray sorters allow bi-dimensional unloading and directing of objects to both sides of the sorter. It provides a secure method of transfer for automated sortation as the product is positioned within the confines of the tray, thereby augmenting its demand over the forecast period.

End-use Insights

The food & beverage industry led the market with a revenue share of over 41% in 2020. Food growers, processors, and packers use these machines to sort a variety of fresh, whole products & processed foods to minimize waste and maximize output. In the coffee industry, the product demand is witnessing significant growth owing to its ability to identify and eliminate underdeveloped coffee beans. In the plastic industry, the product discards different types of plastics by differentiating resin types. Resin sorting machines can identify different types of resins including PVC, PE, HDPE, and PLA. They also help in recycling since the discarded materials are stored in bins. These factors are driving the market growth positively.

The pharmaceutical industry is expected to grow at the fastest CAGR from 2021 to 2028 as these machines are useful for sorting tablets and capsules by weight for quality control. Various pharmaceutical companies are using it as it improves product quality as well as production. These machines are used in the mining industry to sort industrial minerals and precious metals. They are also used in various other industries including tobacco processing, nutraceutical, agriculture, and logistics. In the agriculture industry, they are used to sorting various grains based on size and color.

Regional Insights

Europe led the global market with the largest revenue share of over 33% in 2020. Health awareness & wellness is important for the consumers in the region and thus, processed & nutritional food and value-added products are high in demand. The growing food and nutraceutical industries are beneficial for market growth, as the sorting machines are widely used in these industries to reduce the process and delivery time. Germany is expected to show lucrative growth in the regional market over the forecast period owing to the presence of key manufacturers, such as Allgaier Werke, Sesotec, and STEINERT. The increasing demand for high-quality food products within shorter delivery cycles in Germany is expected to boost the market growth.

The Asia Pacific is estimated to be the fastest-growing regional market over the forecast period as industries are concentrating on automation to increase productivity and quality. Rapid automation in the end-use areas of the market is thus anticipated to create high product demand. Governments of various countries in North America are focusing on recycling the waste, which is generated by several industries, to minimize pollution and to keep the environment safe. Sorting machines are widely used for identifying & discarding manufacturing waste, which aids in recycling. This, in turn, is expected to boost the market growth in North America over the forecast period.

Key Companies & Market Share Insights

The product demand is witnessing considerable growth across various end-use industries including food & beverage, mining, pharmaceutical, and waste recycling, resulting in an increased number of new players entering the market. The key manufacturers are investing in R&D to develop new products and to increase the consumer base. Manufacturers are also using this strategy to boost their revenues and increase their share in the market. For instance, in May 2020, TOMRA launched a new optical sorting machine named TOMRA 3C, which achieves extraordinary sorting efficiencies and product yields. In October 2020, Key Technology launched a digital sorter named VERYX BioPrint. Some prominent players in the global sorting machines market include:

-

TOMRA

-

BarcoVision

-

Daewon GSE

-

BT-Wolfgang Binder

-

Bühler Sortex

-

Sesotec

-

Raytec Vision

-

Concept Engineers

-

Key Technology

-

Satake Corporation

-

CP Global

-

National Recovery Technologies

-

GREEFA

-

Allgaier Werke

-

Cimbria

Sorting Machines Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 4.07 billion

Revenue forecast in 2028

USD 6.10 billion

Growth rate

CAGR of 5.9% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2020

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

TOMRA; BarcoVision; Daewon GSE; BT-Wolfgang Binder; Bühler Sortex; Sesotec; Raytec Vision; Concept Engineers; Key Technology; Satake Corp.; CP Global; National Recovery Technologies; GREEFA; Allgaier Werke; Cimbria

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global sorting machines market report on the basis of product, end use, and region:

-

Product (Revenue, USD Million, 2017 - 2028)

-

Optical Sorter

-

Weight/Gravity Sorter

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2028)

-

Food & Beverage Industry

-

Pharmaceutical

-

Waste Recycling

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sorting machines market size was estimated at USD 3.81 billion in 2020 and is expected to reach USD 4.07 billion in 2021.

b. The sorting machines market is expected to grow at a compound annual growth rate of 5.9% from 2021 to 2028 to reach USD 6.10 billion by 2028.

b. Europe dominated the sorting machines market with a share of 33.9% in 2020 owing to the strong presence of various leading sorting machines manufacturers including TOMRA, Buhler, Allgaier Werke, and Cimbria.

b. Some of the key players operating in the sorting machines market include TOMRA, BarcoVision, Daewon GSE, BT-Wolfgang Binder,Bühler Sortex, Sesotec, Raytec Vision, Concept Engineers, Key Technology, Satake Corporation, CP Global, National Recovery Technologies, GREEFA, Allgaier Werke, Cimbria.

b. The key factors that are driving the sorting machines market include its ability to sort all products irrespective of their size, shape, and color resulting in its increased adoption in various end-use industries, for increasing efficiency, improving accuracy and reducing the cost of production

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."