- Home

- »

- Consumer F&B

- »

-

Soup Market Size, Share, Industry Report, 2019-2025GVR Report cover

![Soup Market Size, Share & Trends Report]()

Soup Market Size, Share & Trends Analysis Report By Product (Canned, Dried, UTH), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-902-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Consumer Goods

Report Overview

The global soup market size was valued at USD 16.1 billion in 2018 and is expected to grow at a compound annual growth rate (CAGR) of 3.0% from 2019 to 2025. The industry is driven by increasing demand for convenience food and growing awareness regarding health benefits of soups. Soups are rich in vitamins, minerals, nutrients, and protein. Changing consumer lifestyle and rising inclination towards consumption of healthy food products are expected to propel the overall demand over the next few years.

Increase in disposable income, urbanization, and introduction of innovative flavors are also expected to drive the global demand for soup in future. Moreover, growing working population and increasing preferences for processed food due to its health benefits are boosting the market demand. In addition, shifting of rural population to the urban areas in the developing countries of Asia Pacific, including India and China, is expected to increase the demand for soup.

Dried soup products dominated the market due to their high content of nutrition, vitamins, minerals, and proteins as compared to the other forms of convenience soup products. Moreover, packed soups are mostly preferred over soups served in restaurants and food outlets due to the ease of access and durability of the packages.

High content of salt and corn in dried products is considered to hamper an individual’s health as it increases the level of blood pressure and blood sugar, thereby restraining the market growth. In addition, the supply chain of the canned foods is expected to be a major restraining factor in the market, as canned products need timely delivery and sale, else the product will be damaged or expired. These factors can pull down the global market demand for soups in the coming future.

Product Insights

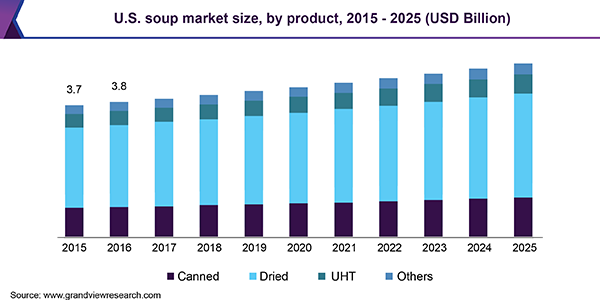

The market can be segmented into canned, dried, UTH, and others. The dried product segment dominated the market and generated a revenue of USD 9.6 billion in 2018. The segment growth is attributed to high consumption of packed, convenience, and healthy processed food in the working population. Working people are more inclined towards healthy food including easy to eat and make food products. Moreover, introduction of new products with additional flavors and ingredients, which are gaining popularity among the young population, is expected to increase the demand for dried soup products.

The canned and UTH soup products are anticipated to witness high demand in the coming years. Consumption of canned foods is high in the developed countries of North America and Europe, including U.S., Canada, U.K., and Germany. The population of these regions is inclined towards ready to eat products on account of busy schedule of the working people. The manufacturers are focusing on making new flavors and products with associated health benefits.

Other segments where soup is served in restaurants, food outlets, and food joints also hold a small share of the global market. Increasing economic independency in both men and women due to growing working population and busy schedule is expected to restrain the market growth in restaurant and food outlets.

Distribution Channel Insights

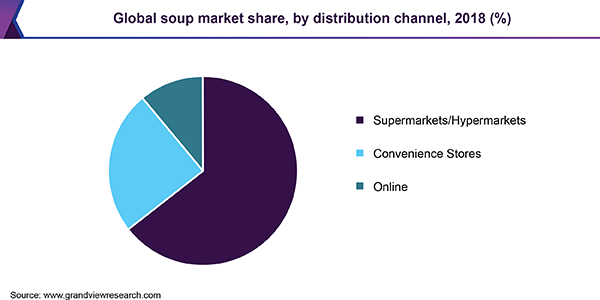

In terms of distribution channel, the market can be divided into supermarkets/hypermarkets, convenience stores, and online channel. The supermarkets/hypermarkets segment generated a revenue of USD 10.4 billion in 2018 and is anticipated to witness significant growth in the coming years.

The online segment for soup market is expected to expand at a CAGR of 4.1% over the forecast period due to introduction of various food joints in the online market to increase the supply of products and provide an ease of availability to the customers. New companies like Eat24 and Uber Eats are coming up with new online services for delivering hot served soups to the customers. These factors are expected to open new avenues and escalate the demand for the market in the coming future.

Regional Insights

Europe emerged as the dominant regional market for soups. The region generated a revenue of USD 6.4 billion in 2018 and is anticipated to account for a major market share in the forecast period. North America held the second largest market share of more than 30.0% in 2018. Therefore, soups are mostly consumed by the population of Europe and North America on account of high disposable income of the consumers, along with advanced lifestyle.

The market in Asia Pacific and rest of the world has growth opportunity for new segments. Population in developing countries, including India, China, Thailand, and Bangladesh is adopting western culture of living and working. This, in turn, can boost the demand for canned and dried soup products in these regions. Moreover, growing awareness regarding health, along with busy working lifestyle, is expected to increase the demand for overall market in Asia Pacific, Central and South America, and Middle and East Africa.

Key Companies & Market Share Insights

Companies are developing new product designs according to the latest consumer preferences for flavor and health benefits in order to acquire a larger market share. Some of the prominent players in the soup market include:

-

Associated British Foods PLC

-

TSC Foods

-

Campbell Soup Company

-

Bear Creek Country Kitchens LLC

-

Nestlé (Switzerland)

-

Baxters Food Group Limited

Soup Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 17.02 billion

Revenue forecast in 2025

USD 19.82 billion

Growth Rate

CAGR of 3.0% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; India; China, Brazil

Key companies profiled

Associated British Foods PLC; TSC Foods; Campbell Soup Company; Bear Creek Country Kitchens LLC; Nestlé (Switzerland); Baxters Food Group Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global soup market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2015 - 2025)

-

Canned

-

Dried

-

UTH

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

India

-

China

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global soup market size was estimated at USD 16.54 billion in 2019 and is expected to reach USD 17.02 billion in 2020.

b. The global soup market is expected to grow at a compounded annual growth rate of 3.0% from 2019 to 2025 to reach USD 19.82 billion by 2025.

b. Dried products dominated the global soup market with a share of 59.8% in 2019. This is attributed to high consumption of packed, convenience, and healthy processed food in the working population.

b. Some of the key operating players in the soup market include Associated British Foods PLC,TSC Foods, Campbell Soup Company, Bear Creek Country Kitchens LLC, Nestlé (Switzerland), and Baxters Food Group Limited.

b. Key factors that are driving the market growth include increasing demand for convenience food and growing awareness regarding health benefits of soups.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."