- Home

- »

- Processed & Frozen Foods

- »

-

Global Sourdough Market Trends, Analysis Report, 2019-2025GVR Report cover

![Sourdough Market Size, Share & Trends Report]()

Sourdough Market Size, Share & Trends Analysis Report By Type, By Application (Breads, Cookies, Cakes, Waffles, Pizza), By Region, Competitive Landscape, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-510-6

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Consumer Goods

Report Overview

The sourdough market size was estimated at USD 2.4 billion in 2018. Rising consumer demand for healthier, tastier, and more natural baked products has renewed the success of conventional production over the years. Sourdough refers to a leaven employed in the production of various baked products, including bread, crackers, and cake. The industry is expected to grow exponentially over the forecast period owing to the increasing consumption of sourdough bread across the globe, most notably in Europe.

Sourdough-based baking products are considered to be healthier alternatives to those made using regular dough. The presence of lactobacillus and wild yeast helps neutralize the acid in the leaven (phytic acid), thus making these products easily digestible unlike those made from regular dough. Furthermore, the presence of other vital nutrients, such as folic acid, magnesium, iron, B vitamins, and zinc, make these products a preferred choice among consumers owing to health benefits.

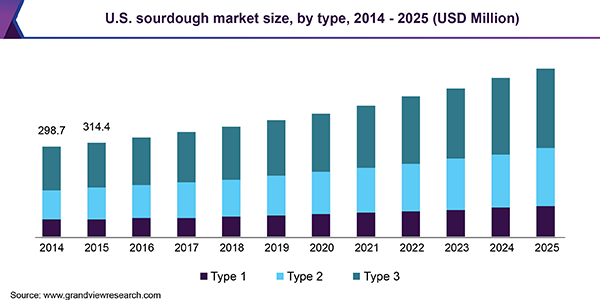

Rapidly shifting consumer predilections toward healthy consumption habits has been contributing to the growth of the U.S. market. The Type II segment in the country is likely to grow at the fastest CAGR of 6.6% over the forecast period. Employment of specific starter cultures is being introduced to the process of Type II production in the U.S., thus contributing to the growth of the segment.

The surge in popularity of gluten-free products, most notably bread, is likely fuel industry growth in the near future. Increasing demand is principally attributed to the prevalence of gluten intolerance across the globe. In this regard, recent years have witnessed a high demand for gluten-free bread, backed by technological advancements in the field.

The growing production of fermented products also drives the industry. In light of this, the sector is being strengthened by the snowballing growth of craft breweries focusing on offering products for digestive health. Thus, the scope of the product is likely to expand in the coming years, underpinned by a noteworthy food trend: rising demand for healthy and naturally baked products.

Demand for stronger flavors has been fueling the consumption rate of the product, specifically the bread segment. Prominent market players have reported having witnessed consumers increasingly preferring bread that is almost indistinguishable in terms of flavor from that of white bread. This trend is expected to sustain throughout the forecast period.

Type Insights

In terms of type, the market has been divided into three categories: Type I, Type II, and Type III. Type I dough is typically firm and have a pH in the range of 3.8-4.5. Type I eliminates the addition/incorporation of S. cerevisiae (baker’s yeast) in the form of a leaving agent, unlike that of type II and type III segments.

Type II refers to a sourdough typical of the industrial type as its fermentation involves the adaption of strains. This type of product is easily pumpable (industrial bakery) as it is also available in liquid form. Type II products have a pH value of 3.5 or less and allow for storage or chilling for a week. Type III is the most extensively employed sourdough variant for commercial production around the world. Industrial bakers prefer Type III products for consistent quality/property. These are also considered to be the most advantageous substances to introduce authentic taste to baked products.

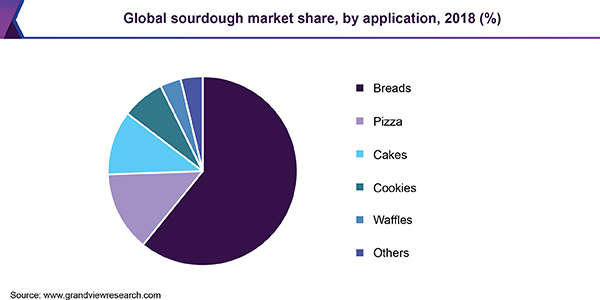

Application Insights

Bread emerged as the largest application segment in 2018 with a share of 61.0% in the global sourdough market. The segment is expected to grow at a steady rate throughout the forecast period to retain its dominant market position. Sourdough bread consists of better inherent properties in comparison with regular bread made using baker’s yeast owing to the presence of lactic acid in the former.

Pizza emerged as the second-largest segment in 2018. The demand for sourdough pizza is driven by increasing consumer receptivity to new flavors. Furthermore, rising R&D investments by prominent restaurant chains in the pizza industry, including Pizza Hut, has contributed positively to the growth of the segment. The segment is anticipated to grow at the fastest rate over the forecast period owing to its rising consumption in Europe.

Regional Insights

Europe emerged as the largest market for sourdough in 2018 with a share of 30.4%. The region is expected to dominate the market throughout the forecast period. Germany is expected to remain the largest market for the product in Europe over the forecast period. Germans have been traditionally known to consume sourdough bread that is made using wheat, spelt, and rye flours.

Asia Pacific is expected to register the highest CAGR of 6.4% over the forecast period with countries such as China, Japan, and India contributing substantially to the growth of the regional market. Growing demand for baked products free of chemicals and preservatives in these countries has put sourdough-based products in the spotlight.

India is likely to have a prominent position in the Asia Pacific market owing to the presence of abundant native and ancient varieties of wheat that are high in nutrition and flavor. Thus, the availability of raw materials in superabundance in Asia Pacific is one of the key drivers augmenting product demand.

Key Companies & Market Share Insights

The industry is characterized by intense rivalry among domestic and international market participants. Some of the key players in the industry are Puratos; Boudin SF; Riverside Sourdough; Lallemand; Truckee Sourdough Company; Gold Coast Bakeries; Alpha Baking Co. Inc.; Josey Baker Bread; Bread SRSLY; and Morabito Baking Co. Inc.

Product innovation and differentiation were observed to be the key strategies deployed by prominent market players to remain competitive. For instance, Bread SRSLY produces a range of gluten-free sourdough-based products. Some of these products are Classic Sourdough, Sweet Onion Sourdough sandwich, and Seeded Sourdough. In the near term, more companies are expected to follow suit by offering differentiated products with a focus on incorporating healthy ingredients.

Recent Developments

-

In February 2022, Puratos launched a range of sourdough made by farmers practicing regenerative agriculture techniques in Melbourne and with flours grown in Australia. These wheat and wholemeal rye flours have a single origin, making it possible for consumers to know where it is grown.

-

In August 2022, Puratos partnered with Shiru, a functional ingredient company, to explore plant-based and sustainable protein ingredients for baked goods. The collaboration aims to bring innovation to patisserie, bakery, and chocolate products while maintaining nutritional value without compromising taste.

Sourdough Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.7 billion

Revenue forecast in 2025

USD 3.5 billion

Growth Rate

CAGR of 5.7% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Netherlands; China; India; Japan; Brazil; UAE

Key companies profiled

Puratos; Boudin SF; Riverside Sourdough; Lallemand; Truckee Sourdough Company; Gold Coast Bakeries; Alpha Baking Co. Inc.; Josey Baker Bread; Bread SRSLY; Morabito Baking Co. Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country-level and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global sourdough market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Type I

-

Type II

-

Type III

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Bread

-

Cookies

-

Cakes

-

Waffles

-

Pizza

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the sourdough market growth include rising consumer demand for healthier, tastier, and more natural baked products have renewed the success of conventional production over the years.

b. The global sourdough market size was estimated at USD 2.5 billion in 2019 and is expected to reach USD 2.7 billion in 2020.

b. The global sourdough market is expected to grow at a compound annual growth rate of 5.7% from 2019 to 2025 to reach USD 3.5 billion by 2025.

b. Europe dominated the sourdough market with a share of 30.3% in 2019. This is attributable to the increasing consumption of sourdough bread owing to it being a healthier alternative to regular bread.

b. Some key players operating in the sourdough market include Puratos; Boudin SF; Riverside Sourdough; Lallemand; Truckee Sourdough Company; Gold Coast Bakeries; Alpha Baking Co. Inc.; Josey Baker Bread; Bread SRSLY; and Morabito Baking Co. Inc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."