- Home

- »

- Healthcare IT

- »

-

Southeast Asia Telehealth Market Size & Share Report, 2030GVR Report cover

![Southeast Asia Telehealth Market Size, Share & Trends Report]()

Southeast Asia Telehealth Market Size, Share & Trends Analysis Report By Service Type (Remote Patient Monitoring, Real-time Interactions), By Delivery Mode, By Application, By Type, By End Use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-432-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Market Size & Trends

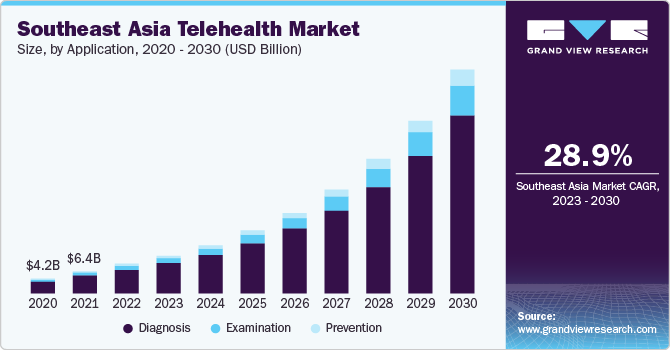

The Southeast Asia telehealth market size was valued at USD 8.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 28.9% from 2023 to 2030. Increasing penetration of the internet and the constant evolution of smartphones and tablets have made accessing telehealth services more convenient and are expected to contribute to the growing demand. Users are increasingly turning aware of the importance of monitoring health and fitness to control the incidence of chronic ailments and are using their smartphones to track the same. In addition, innovators are designing technologies to deliver quality care through various web and cloud-based platforms.

For instance, in April 2021, DOC2US, a telehealth provider in Malaysia, partnered with AIA Malaysia for providing virtual assistance through the AIA app. The AIA app users can use DOC2US services such as text messaging or video consultations with healthcare professionals. This partnership is expected to help DOC2US expand its consumer base. Telehealth services enhance access to healthcare through telephonic/video consultation and enable the communication between the healthcare provider and patients in remote locations, thereby eliminating the need to visit healthcare facilities and reducing unnecessary costs. For instance, in April 2021, Prudential Life Assurance Public Company Limited announced their partnership with MyDoc in order to launch telemedicine & online consultation services to Thai people on Pulse by Prudential app. This will allow Pulse users access to video consultations, obtaining electronic prescriptions and certifications.

The emergence of the Internet of Things(IoT) in healthcare with integrated analytics, advanced wearable devices, and strong mobile connectivity has significantly transformed the healthcare industry and has enabled efficient patient monitoring, optimizing prescriptions, and chronic disease management. For instance, in August 2022, Qmed Asia, a Malaysia-based startup launched Qmed GO, a telehealth kiosk that can serve as a mini-clinic for corporate employers as it is connected to medical IoT devices that can track 16 vital parameters. Furthermore, deep learning and artificial intelligence functionalities enhance the personalization of healthcare. These advanced techniques are incorporated in telehealth to assist the conclusive disposition of patients through remote analysis. For example, the Telehealth platform of Haldoc uses AI to provide its physicians with feedback on their performance and consultation and training for performance enhancement.

The Covid-19 pandemic has burdened global healthcare systems and is anticipated to drive the demand for telehealth services. Owing to lockdowns and movement restrictions, patients shifted their focus to telemedicine amidst the fear of contracting the virus by visiting the healthcare facility. Insurance companies and key players collaborated to provide a free consultation to their customers. Due to the pandemic-induced travel restrictions, several telehealth firms witnessed a surge in demand for their services. For instance, Haldoc recorded a ten-fold increase in the number of active users in 2020 in Indonesia.

Furthermore, to reduce strain on the overburdened healthcare systems regional governments announced initiatives to promote telehealth services. For instance, the government of Indonesia announced that patients with mild symptoms of COVID-19 should be treated via telehealth. Ministry of Information and Communications and Ministry of Health implemented a telemedicine program in Vietnam in April 2020, for virtual examination and treatment of COVID-19 patients. The increasing number of market players are venturing into the telemedicine space to cater to the growing demand. For instance, In April 2020, AIA Thailand launched Virtual COVID-19 Clinic in collaboration with SAMITIVEJ and True Digital Group, to provide free COVID-19 consultations.

The shortage of healthcare personnel is increasing across Southeast Asian countries and is positively influencing the demand for telemedicine services. According to World Health Organization (WHO), the number of medical doctors per 10,000 population were 9.28 in Thailand in 2020. Telemedicine services are helping in improving healthcare accessibility in remote and rural areas and curb increasing healthcare costs. Moreover, the growing geriatric population and increasing prevalence of chronic diseases in Southeast Asia are contributing to the growing demand for quality healthcare. According to the Department of Statistics Malaysia (DoSM), the country’s population aged 65 years or above has increased from 5% of the 27.5 million population in 2010 to 6.8% of the 32.4 million population in 2020. Lastly, the growing government support and initiatives are boosting the growth of the market for telehealth in Southeast Asia. For instance, in March 2019, the Thailand Public Health Ministry and the National Broadcasting and Telecommunications Commission (NBTC) introduced telemedicine programs in rural areas. Through this program, 32 hospitals were to be funded for setting up telemedicine equipment.

Furthermore, mergers and acquisitions, partnerships, and collaborative agreements are some of the crucial initiatives being undertaken by key players, which are expected to propel the growth of the market for telehealth in Southeast Asia. For instance, in July 2020, Oncoshot announced its partnership with MyDoc to provide access to second opinions to cancer patients, from leading oncologists. The company will direct its patients from within its network to Oncoshot’s specialist telemedicine platform, which offers remote medical advice through highly qualified oncologists as well as clinical trial matching solutions.

Service Type Insights

In 2022, the real-time interactions service type segment had a significant revenue share in the market for telehealth in Southeast Asia. Increasing preference towards telemedicine amongst providers and patients has contributed to the growth. For instance, in April 2023, DOC2US a digital health provider based in Malaysia announced the launch of DOC2HOME, its new subsidiary, a digital health platform aimed to provide home-based personalized healthcare services to residents and homeowners through technology. Furthermore, these services enable patients in remote locations to access healthcare services at affordable prices. The COVID-19 pandemic has further offered numerous opportunities for virtual care solutions, considering social distancing as the only existing solution capable of minimizing exposure.

On the other hand, the remote patient monitoring service type segment is anticipated to register significant growth rate during the forecast period owing to technology advancements in video conferencing systems and the development of digital infrastructure. The growing geriatric population coupled with the increasing prevalence of chronic diseases is expected to positively influence segment growth. For instance, according to United Nations Development Programme (UNDP), the percentage of people in Thailand having diabetes and aged above 18 has increased from 6.9% in 2009 to 9.5% in 2021. Furthermore, remote patient monitoring allows real-time monitoring, improves patient engagement, detects activity patterns, and reduces healthcare costs.

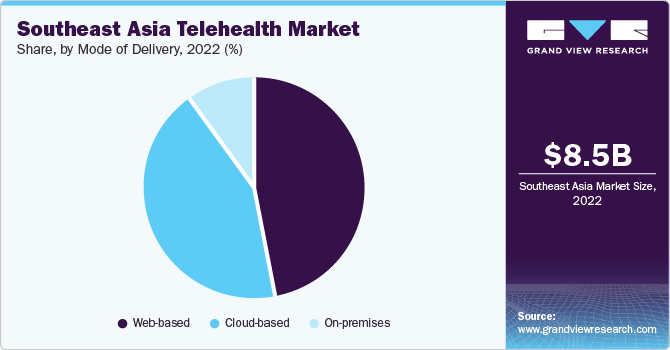

Delivery Mode Insights

In 2022, the web-based delivery mode segment dominated the market for telehealth in Southeast Asia and accounted for the largest revenue share of 47% owing to the availability of a large number of web-based telehealth platforms and growing usage rates of web-based platforms by patients and healthcare personnel. Penetration of the internet and the development of web-based applications has enhanced the accessibility of telemedicine services to patients in remote locations.

The cloud-based delivery mode segment is anticipated to register the fastest CAGR of 29.7% over the forecast period owing to numerous benefits such as high bandwidth, easy accessibility, easy data recovery and storage, and better data privacy and security. Increasing incidences of security breaches in web-based and on-premise applications have led to a growth in demand for cloud-based applications.

Application Insights

In 2022, the diagnosis application segment dominated the market for telehealth in Southeast Asia and accounted for the largest revenue share of 80.48% owing to the increasing number of smartphone users, rapid penetration of the internet, and increasing deployment of telehealth services. Patients and providers are increasingly becoming aware of the benefits of telemedicine and this is expected to drive the segment growth. In addition, telemedicine services enable flexibility in scheduling for the healthcare providers and are driving the adoption of these services.

Furthermore, the prevention application segment is anticipated to register the fastest CAGR of 30.8% growth during the forecast period owing to the increasing awareness levels regarding the importance of health and fitness. Shortage of healthcare personnel, increasing healthcare costs, burdened facilities, and resources, and increasing prevalence of chronic diseases are driving the adoption of telemedicine services for earlier disease prevention. For instance, according to an article published by United Nations in November 2021, chronic diseases are the leading cause of death in Thailand, accounting for approximately 4,00,000 deaths annually.

Type Insights

In 2022, the tele-hospital type segment had significant revenue share in the market for telehealth in Southeast Asia owing to the constantly developing digital healthcare technologies, growing government support, increased healthcare IT expenditure. Additionally, the growing geriatric population increased health consciousness, and the rising demand for accessible and affordable healthcare services is driving the growth. The ongoing Covid-19 pandemic has overburdened hospital systems and therefore, the demand for telehealth and virtual services has increased.

On the other hand, the tele-home segment is anticipated to register significant growth during the forecast period due to enhanced affordability, accessibility, efficiency, and quality of care. Moreover, the growing number of smartphone users and improved internet connectivity is expected to drive the growth of this segment.

End Use Insights

In 2022, the providers segment had significant revenue share in the Southeast Asia telehealth market owing to the rising adoption of telemedicine platforms by healthcare practitioners to reduce the growing burden on healthcare facilities and resources. Increasing demand for reducing hospital admissions and improvements in hospital workflow is propelling the adoption of digital health technologies among healthcare providers, which, in turn, contributes toward market growth. Moreover, the rise in the number of partnerships and collaborations among various public and private healthcare organizations to drive the adoption and accessibility of telehealth services is further aiding segment growth.

For instance, in April 2021, GDEX Bhd announced its collaboration with DOC2US and Alpro Pharmacy, to provide easy medication delivery services by secure and real-time tracking of medication. On the other hand, the patients segment is anticipated to register significant growth during the forecast period owing to increasing tech-friendly users and active users on telemedicine platforms. Furthermore, telemedicine services have successfully overcome the communication gap between healthcare professionals and patients. Lastly, these services have enhanced healthcare accessibility and reduced patient healthcare expenditure.

Country Insights

Indonesia had significant revenue share of the market in 2022, owing to widespread adoption of telehealth services amidst the Covid-19 pandemic. Favorable government policies and initiatives are supporting the growth in Indonesia. In addition, increasing investments by private and public players in this field is boosting the market growth. For instance, in in April 2021, Halodoc, a healthcare startup based in Indonesia announced its successful fundraising of USD 80 million, which will be used to expand Halodoc’s services and technology-based solutions in the country.

Similarly, in November 2020, Alodokter announced successful fundraising from MDI Ventures. The funding is an extension of its previous USD 33.0 million Series C funding raised in October 2019. The company aims at utilizing the funding for scaling up its ability to deliver as per expectations of Indonesian users and enhancing its digital health platform to be more accessible, robust, and affordable. Moreover, the shortage of healthcare professionals in Indonesia and the growing demand for quality care is expected to positively impact the growth. For instance, according to the WHO, in 2021, medical doctors per 10,000 population were just 6.95 in Indonesia.

In addition, Indonesia is anticipated to register significant growth during the forecast period owing to the increasing deployment of telemedicine services, increasing prevalence of chronic diseases, and rising healthcare costs. Lastly, the presence of key players like Haldoc and Alodokter witnessed a significant hike in their telemedicine and teleconsultation services during the Covid-19 pandemic.

Key Companies & Market Share Insights

The companies are increasingly focusing on expanding their geographical reach and introducing newer, innovative solutions through various strategies, including partnerships, product launches, and collaborations, to support the end-users in adopting analytical solutions, deliver value-based care, combat the COVID-19 pandemic, and maintain a competitive edge in the market. For instance, in November 2021, Doctor Anywhere (DA) announced the acquisition of Doctor Raksa, a telemedicine platform in Thailand. This deal is expected to increase the regional dominance of Doctor Anywhere (DA). In April 2021, Pfizer collaborated with DoctorOnCall for launching a digital therapeutics platform that focuses on three key therapeutic areas: vaccination, smoking cessation, and heart health. In June 2020, OCBC Bank launched their telehealth platform Healthpass through their mobile app with an aim to address the healthcare requirements of the above 18 age Singapore residents by creating accessibility to more than 100 specialists and practitioners.

Key Southeast Asia Telehealth Companies:

- HALODOC

- HEYDOC INTERNATIONAL SDN. BHD.

- Grab

- MyDoc Pte. Ltd.

- Doctor Anywhere Pte Ltd.

- Teleme

- GOOD DOCTOR TECHNOLOGY (SINGAPOUR) PTE. LTD.

- DoctorOnCall

- Alodokter

- ClicknCare

Southeast Asia Telehealth Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.9 billion

Revenue forecast in 2030

USD 64.5 billion

Growth Rate

CAGR of 18.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, delivery mode, application, type, end use, country

Country scope

Indonesia; Thailand; Malaysia

Key companies profiled

HALODOC; HEYDOC INTERNATIONAL SDN. BHD.; Grab; MyDoc Pte. Ltd.; Doctor Anywhere Pte Ltd.; Teleme; GOOD DOCTOR TECHNOLOGY (SINGAPOUR) PTE. LTD.; DoctorOnCall; Alodokter; ClicknCare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southeast Asia Telehealth Market Report SegmentationThis report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the Southeast Asia telehealth market report on the basis of service type, delivery mode, application, type, end use, and country:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Remote Patient Monitoring

-

Real-Time Interactions

-

Store And Forward

-

Other Services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

Cloud-based

-

On-premises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Prevention

-

Examination

-

Diagnosis

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tele-hospital

-

Tele-home

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Providers

-

Payers

-

Patients

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Indonesia

-

Thailand

-

Malaysia

-

Frequently Asked Questions About This Report

b. The Southeast Asia telehealth market size was estimated at USD 8.5 billion in 2022 and is expected to reach USD 10.9 billion in 2023.

b. The Southeast Asia telehealth market is expected to grow at a compound annual growth rate of 28.9% from 2023 to 2030 to reach USD 64.5 billion by 2030.

b. Indonesia dominated the market and accounted for the largest revenue share of 25.8% in 2022, owing to widespread adoption of telehealth services amidst the ongoing Covid-19 pandemic.

b. Some key players operating in the Southeast Asia telehealth market include Halodoc; Doc2Us; GrabHealth(Grab); MyDoc Pte Ltd; Doctor Anywhere Pte Ltd; TeleMe; Good Doctor Technology (GDT); DoctorOnCall; Alodokter; ClicknCare.

b. Key factors that are driving the telehealth market growth include favorable government policies and the growing adoption of telehealth owing to the COVID-19 pandemic.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."