- Home

- »

- Plastics, Polymers & Resins

- »

-

Specialty Carbon Black Market Size And Share Report, 2030GVR Report cover

![Specialty Carbon Black Market Size, Share & Trends Report]()

Specialty Carbon Black Market Size, Share & Trends Analysis Report By Grade (Conductive Polymers, Fiber Carbon Black, Food Contact Carbon Black), By Region (Asia Pacific, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-121-4

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Specialty Carbon Black Market Size & Trends

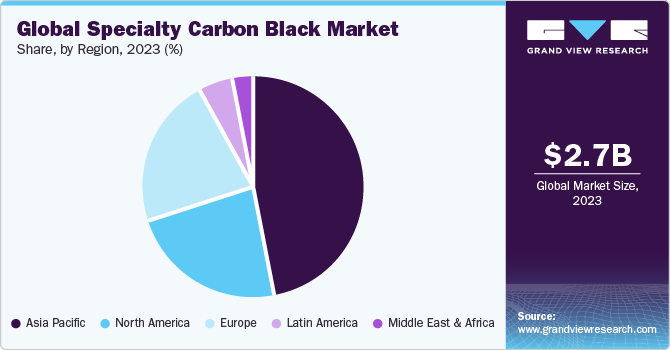

The global specialty carbon black market size was estimated at USD 2.74 billion in 2023 and is projected to grow at a CAGR of 10.2% from 2024 to 2030. This is attributed to the surging demand for the product as reinforcing agents, especially in tires. In addition, the growing utilization of the product in agriculture mulch film, stretch wrap, refuse sacks, and industrial bags is anticipated to contribute to the market growth in the near future.

Specialty carbon black is a highly versatile component for non-rubber applications. It imparts protection from UV degradation, color, electrical conductivity, and opacity. The selection of carbon black entirely depends on the requirements of the product. It is mainly used in key plastic segments including molding, film pipe, fiber, and cable.

Specialty carbon black dynamics are heavily dependent on applications such as non-tire rubber, electrostatic discharge, packaging, paints & coatings, and printing inks consumptions along with regulations formulated for manufacturing technologies and raw materials used. It provides enhanced viscosity, conductivity, UV protection and sharp color.

The carbon black production process emits a high amount of toxic GHG, which is not suitable for environment and health. Companies are investing in R&D activities to develop their manufacturing processes, which will reduce gas emissions within the permissible limit and improve the quality of their product.

Raw materials used in specialty carbon black include natural gas, acetylene, aromatic hydro-carbon oil, mineral/vegetable oil. Majorly, specialty carbon black is produced through five main processes including furnace black, channel process, lamp black, thermal black, and acetylene black process.

In all these processes, raw material differs from petroleum or coal oil to natural gas and acetylene gas. Specialty carbon black manufacture in North America is mainly reliant on natural gas, which is accessible at a comparatively low cost in that region. Fluctuation in crude oil prices is because of seasonal variations, supply-demand imbalances, and political instability.

Market Concentration & Characteristics

The market is concentrated, with a few companies accounting for a majority share of the global market. The market leaders are companies that have initially established a significant presence in the specialty carbon black industry. In their quest to develop products for niche applications, the companies have developed product formulations that are well-accepted and have established a significant geographical presence. With significant sales figures, they have cemented their position in the global market.

Emerging players in the market have integrated manufacturing and distribution along with a focus on product innovation. The companies have developed processes and formulated products to adopt the product differentiation strategy. These companies also work with end users to develop customized products.

Grade Insights

Based on grade, the food contact segment led the market with the largest revenue share of 30.7% in 2023. Increasing usage of packaging, films & sheets, and plastic molded goods in the food industry is anticipated to drive market growth over the forecast period. Food-grade products adhere to various requirements imposed by FDA, The European Plastics Regulation and Japan Hygienic Olefin & Styrene Plastics Association (JHOSPA). Specialty carbon blacks are used for packaging a diverse range of products and thus have extensive applications across several end-use industries, including food and agriculture industry.

Conductive carbon blacks are used for manufacturing cost-efficient electrically conductive plastic compounds. These electrically conductive plastics are used in various processing methods and final applications. They further possess superior properties such as low ash, metal, and grit content which makes them preferred choice for semi-conductive applications such as medium and high voltage cables.

Increasing demand from end-use industries such as automotive, architecture and consumer goods is anticipated to fuel conductive carbon black demand in paints & coatings industry. A growing manufacturing sector coupled with strong economic growth is anticipated to drive conductive product consumption over the forecast period. Asia Pacific market is one of the largest manufacturers and consumers of polymers and is expected to fuel market growth over the next eight years.

Other grade segments include conductive and fiber. Increasing demand from other end-use industries, such as consumer goods, architecture, and automotive, is anticipated to drive conductive grade demand. The growing manufacturing sector is anticipated to drive conductive grade consumption during the forecast period.

Regional Insights

The specialty carbon black market in North America occupies a significantly large share of the global market. Economic recovery in the U.S. and expanding automotive and commercial building activities are likely to trigger product demand in molded plastics, paints & coatings, and wires & cables. There is a substantial demand for conductive and food grade products in North America concerning growth of packaging and polymer industries. The region is also expected to benefit from a rapidly expanding automotive industry, where these products are mainly utilized as sealants for gaskets, liners in automobile dashboards, arm liners, instrument panels and other components.

U.S. Specialty Carbon Black Market Trends

The specialty carbon black market in U.S. is anticipated to grow at the fastest CAGR during the forecast period. The U.S. is home to one of the largest automotive markets in the world. Major automakers have responded to new domestic cost advantages by shifting production from other countries to the U.S. A large consumer market, open investment policy, available infrastructure, a highly skilled workforce, and government incentives, have made the U.S. a premier hub for the auto industry. The U.S. market is expected to benefit from a revitalized automotive sector.

Asia Pacific Specialty Carbon Black Market Trends

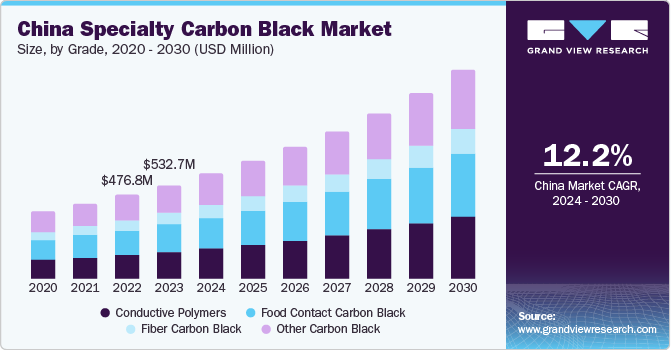

Asia Pacific dominated the specialty carbon black market with a revenue share of 47% in 2023. The growth in this region can be attributed to expanding end-use industries, and growing consumer interest in recyclable & sustainable, yet luxurious and comfortable products. Increasing high performance coatings demand from end-use industries such as marine, aerospace, decorative, wood, and industrial coatings is further expected to drive regional market growth over the forecast period. Growing demand for conductive polymers in applications, including, capacitors, textiles, actuators, batteries, solar cells, and sensors is expected to fuel regional market growth for conductive polymers and in turn benefit conductive grade. Moreover, the presence of developing countries, including India and China is anticipated to further drive the market growth, as consequence of the escalating industrial base in the Asia Pacific region.

The specialty carbon black market in India is estimated to witness a significant CAGR during the forecast period, due to the growth of textile industry along with rising automotive sales in the country. The market is marked by the presence of several large-scale players such as Birla Carbon Company, and Himadri. Increasing demand for food grade carbon black from packaged food industry is expected to further drive market growth over the forecast period. The growth of polymer industry coupled with increasing demand in automotive and construction sectors is anticipated to drive market growth in the country.

Europe Specialty Carbon Black Market Trends

The specialty carbon black market in Europe is anticipated to grow at the fastest CAGR during the forecast period. Europe emerged as the prominent market following North America. High demand from polymer industry is expected to drive demand in Europe. Recovery of automotive industry in the region in countries such as Germany, France, UK, and Russia are anticipated to boost market growth over the forecast period. Demand for specialty carbon black in paints & coatings and inks is expected to show increase in the near future.

The specialty carbon black market in Germany is anticipated to grow at the fastest CAGR during the forecast period. The Germany market is driven by the growth of key end-use industries such as automotive and plastics industries. Increasing demand for molded parts for consumer goods along with growth of non-rubber automotive applications is anticipated to drive market growth in the country. Food emerged as the largest grade segment in German market, with high consumer demand for packaged and convenience food & beverages owing to busy lifestyles and changing consumer preferences. The growth of packaging industry is another key driving factor for food grade growth over the forecast period.

The UK specialty carbon black market is anticipated to grow at the fastest CAGR during the forecast period. Polyester fiber was the largest application segment in the UK fiber carbon black market, with rising demand for luxury apparels, mattresses, and other fiber products. The market in the country is largely mature and is driven by innovation and cost differentiation. Packaging also emerged as the prominent application segment in the food, with shift towards packaged food & beverages along with rising regulatory guidelines, which is further estimated to contribute to the market growth.

Latin America Specialty Carbon Black Market Trends

The specialty carbon black market in Latin America is anticipated to grow at the fastest CAGR during the forecast period. Latin America is expected to benefit from a rapidly expanding automotive industry, where these products are mainly utilized as non-rubber automotive components. Increasing consumer disposable income and rising living standard are also anticipated to foster demand for comfortable furniture and bedding, leading to an upsurge in fiber carbon black sales. In addition, increasing demand for food grade carbon black from packaged food industry is expected to further drive market growth over the forecast period.

The Brazil specialty carbon black market is driven by increasing demand from thermosetting application in end-use industries such as automotive, construction, consumer goods and blow-molded containers. The country is characterized by a rapidly growing industrial sector, which is expected to positively influence industry growth in the near future. Increasing specialty carbon black demand for semi-conductive cable compounds which is used for smoothness, conductivity and chemical cleanliness is anticipated to drive demand over the forecast period.

Middle East & Africa Specialty Carbon Black Market Trends

The specialty carbon black market in Middle East & Africa is anticipated to grow at the fastest CAGR during the forecast period. Increasing construction spending in emerging economies such as Saudi Arabia, Qatar, UAE, and Oman is anticipated to drive market growth in the Middle East & Africa (MEA) region. Rapid urbanization in these developing countries has shifted consumer preference towards packaged food & beverages, thus generating huge demand for fiber grade specialty carbon black. Increasing demand from thermoplastic molding for various applications in end-use industries such as consumer goods and automotive is further anticipated to boost market growth. The growth of the textile sector along with strong demand from packaged food industry is expected to drive market growth in the region.

The Saudi Arabia specialty carbon black market is expecting a surge in demand from the construction and automotive sector. Growth of industrial sector along with rising automotive sales is anticipated to drive industry growth in the country. In addition, rising packaged food consumption coupled with textile industry growth is further expected to boost demand over the forecast period.

Key Specialty Carbon Black Company Insights

The market competition is highly dependent upon the product mix, number of sellers and location. As the products are application specific the product mix of any market player is expected to have a profound impact. Companies are tailoring their product portfolio to gain leadership in a specific application. The strategy helps the companies to enjoy higher margins while adopting the product differentiation strategy. Companies such as Orion and Cabot Carbon are working on strategies to achieve product leadership.

The number of sellers is considerably low as the market is made up of manufacturers with specialty offerings. Another major distinctive factor about the market is the presence of large-scale carbon black manufacturers that have the geographical as well as the product expertise that they have developed over the years by being in the business. The competition terms in the market are majorly dictated by these companies and the rest of the companies try to exploit small pockets either by geographical expansion or new product development.

OMSK Carbon Group, Tokai Carbon Co. Ltd., Cabot Corporation, and Orion Engineered Carbons GmbH emerged as leaders in the market, while Atlas Organics Private Limited, Himadri Specialty Chemical Ltd, Phillips Carbon Black Limited, and Ralson are some of the emerging market participants in the global market.

-

OMSK Carbon Group is a Russian carbon black company with manufacturing locations in Omsk and Volgograd. The company’s product portfolio comprises both OMCARB special grades for paint and polymer applications, and commodity grades for rubber and tire product industries. The company produces 36 different grades of carbon black which include tread grades, carcass grades, low dispersion grades and specialty grades

-

Tokai Carbon Co. Ltd. is a Japanese carbon black manufacturer. The company operates through its seven business segments including graphite electrodes, carbon black, fine carbon, smelting and lining, furnaces, friction materials, and anode materials. The company operates through its carbon black production plants based in Ishinomaki, Shonan, Chita, Shiga, Hofu, Kyusyu Wakamatsu and Tanoura

-

Cabot Corporation is a specialty chemicals and performance materials company. It caters its products to various end-use industries including transportation, infrastructure, environment, and consumer under four segments including reinforcement materials, performance materials, advanced technologies, and purification solutions. The company product portfolio includes activated carbons, aerogel, carbon black for elastomers reinforcement, cesium formate brines, fine cesium chemicals, inkjet colorants and inks, graphene, master batches, fumed metal oxides, and specialty carbon blacks

Key Specialty Carbon Black Companies:

The following are the leading companies in the specialty carbon black market. These companies collectively hold the largest market share and dictate industry trends.

- Omsk Carbon Group

- Tokai Carbon Co., Ltd.

- Atlas Organics Private Limited

- Continental Carbon Company

- Birla Carbon

- Cabot Corporation

- International China Oak Investment Holdings Co., Ltd.

- Himadri Specialty Chemical Ltd

- Philips Carbon Black Limited

- Orion Engineered Carbons GmbH

- Ralson

Recent Developments

-

In January 2024,Birla Carbon announced Greenfield Expansions in the Asia Pacific region. The company shall expand its carbon black capacity by over 240 kilotons in the identified locations of India and Thailand

-

In November 2023, Cabot Corporation launched a novel product family “REPLASBLAK” with certified material. The company launched three products with this launch that are sold as its first certified black master-batch products as (ISCC PLUS) International Sustainability & Carbon Certification

-

In April 2023, Cabot Corporation acquired the solar farm in Chiba, Japan. The farm adjoins the Cabot Corporation’s carbon black production unit in Japan and will enable the company to export solar power as renewable energy in the country

Specialty Carbon Black Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.01 billion

Revenue forecast in 2030

USD 5.40 billion

Growth rate

CAGR of 10.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume in kilotons, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Russia; China; Japan; India; South Korea; Southeast Asia; Mexico; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Omsk Carbon Group; Tokai Carbon Co., Ltd.; Atlas Organics Private Limited; Continental Carbon Company; Birla Carbon; Cabot Corporation; International China Oak Investment Holdings Co., Ltd.; Himadri Specialty Chemical Ltd; Philips Carbon Black Limited; Orion Engineered Carbons GmbH; Ralson

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty Carbon Black Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specialty carbon black market report based on grade, and region.

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Conductive Polymers

-

Conductive Carbon Black

-

Paints & Coatings

-

Battery Electrodes

-

Printing Inks

-

Others

-

-

Fiber Carbon Black

-

Polyester Fiber

-

Pp Masterbatches

-

Nylon Textiles

-

Other Synthetic Fibers

-

-

Food Contact Carbon Black

-

Packaging

-

Film & Sheet

-

Consumer Molded Parts

-

Others

-

-

Other Carbon Black

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Southeast Asia

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global specialty carbon black market size was estimated at USD 2.74 billion in 2023 and is expected to reach USD 3.01 billion in 2024.

b. The global specialty carbon black market is expected to grow at a compound annual growth rate of 10.2% from 2024 to 2030 to reach USD 5.40 billion by 2030.

b. Asia Pacific dominated the specialty carbon black market with a share of 47.0% in 2023. This is attributable to increasing automotive sales along with rising polymer demand from the consumer goods industry is anticipated to drive regional market growth.

b. Some key players operating in the specialty carbon black market include Omsk Carbon Group, Tokai Carbon Co., Ltd., Atlas Organics Private Limited, Continental Carbon Company, Birla Carbon, Cabot Corporation, International China Oak Investment Holdings Co., Ltd., Himadri Specialty Chemical Ltd, Philips Carbon Black Limited, Orion Engineered Carbons GmbH and Ralson

b. Key factors that are driving the specialty carbon black market growth include increasing demand in non-rubber applications and increasing consumption of carbon black in lithium-ion batteries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."